1. Hedge funds data as of January 1, 2020. Private equity and real assets commitments as of September 30, 2019.

2. NAIC, “Examining the Returns,” 2019. Full report at http://naicpe.com/wp-content/uploads/2020/03/2019-NAIC-ExaminingTheResults-FINAL.pdf. Past performance is not necessarily indicative of future results. No assurance can be given that any investment will achieve its objectives or avoid losses.

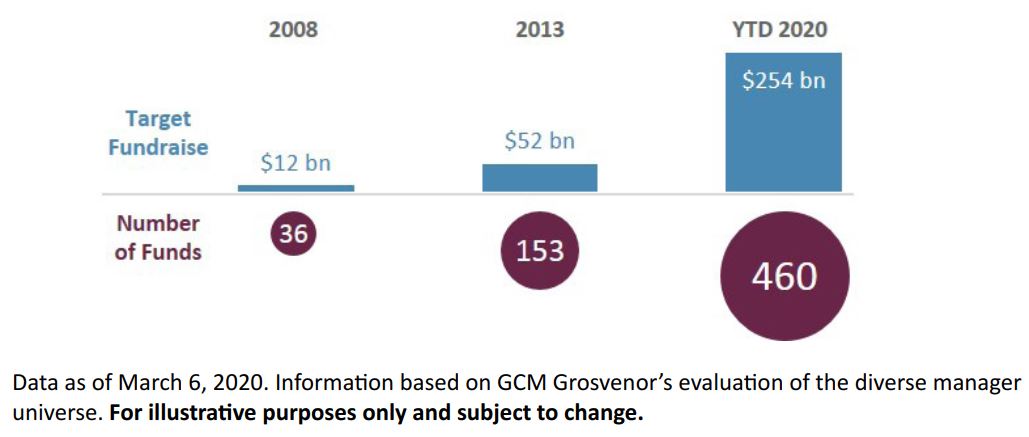

3. Diverse manager universe as of March 6, 2020. Fundraising data as of June 30, 2019.

4. Source: Preqin.

Important Disclosures

For illustrative and discussion purposes only.

No assurance can be given that any investment will achieve its objectives or avoid losses. Past performance is not necessarily indicative of future results.

The information and opinions expressed are as of the date set forth therein and may not be updated to reflect new information.

Past performance is not necessarily indicative of future results. No assurance can be given that any investment will achieve its objectives or avoid losses. Investments in alternatives are speculative and involve substantial risk, including strategy risks, manager risks, market risks, and structural/operational risks, and may result in the possible loss of your entire investment. The views expressed are for informational purposes only and are not intended to serve as a forecast, a guarantee of future results, investment recommendations, or an offer to buy or sell securities by GCM Grosvenor. All expressions of opinion are subject to change without notice in reaction to shifting market, economic, or political conditions. The investment strategies mentioned are not personalized to your financial circumstances or investment objectives, and differences in account size, the timing of transactions, and market conditions prevailing at the time of investment may lead to different results.