Clarifying the Misconceptions of Co-Investing

We debunk several common misconceptions related to co-investing in today’s market.

Past performance is not necessarily indicative of future results. No assurance can be given that any investment will achieve its given objectives or avoid losses. Unless apparent from context, all statements herein represent GCM Grosvenor’s opinion.

Select risks include: macroeconomic risk, sourcing risk, investment selection, portfolio diversification, management risk, execution of value creation plan, risks related to reliance on third parties, and risks related to the sale of investments.

In the following, we address some of our clients’ most-often asked questions regarding buyout transactions and whether or not co-investing is the right approach given the current market environment.

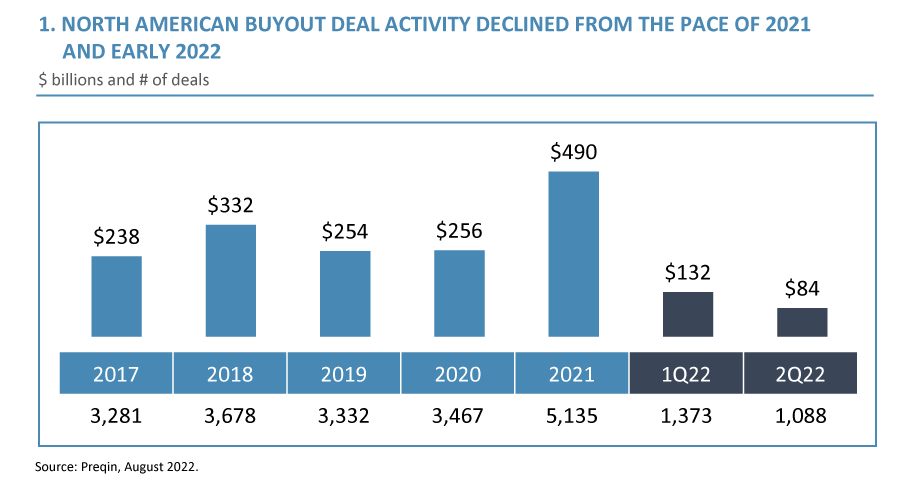

The first half of 2022 was the “tale of two quarters” in the North American buyouts market. Q1 saw robust deal activity with double-digit growth in the number of deals closed and an approximately 20% year-over-year increase in the amount invested, largely fueled by continued growth coming out of the pandemic. However, as the economy began feeling the impact of Russia’s invasion of Ukraine and widespread supply-driven inflation, deal activity paused in Q2 as markets turned and valuations recalibrated. Bid-ask spreads widened between elevated seller expectations and value-oriented buyer interest. Q2 witnessed a dramatic slowdown in the number of deals, a moderation in purchase price multiples, and an approximately 36% decline in invested dollars from Q11.

More recently, we have witnessed a return in deal activity across two general themes:

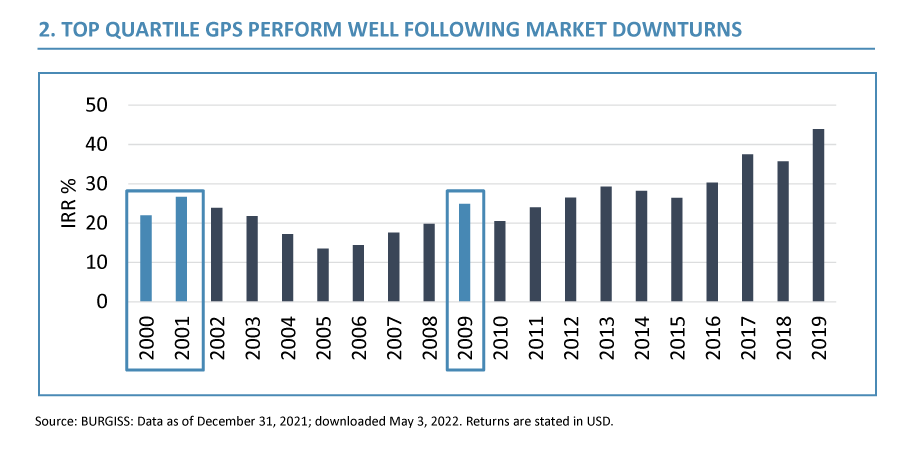

Yes, we believe that market dislocations often provide interesting investment opportunities to acquire high-quality assets at attractive valuations. Periods that follow historical market downturns, including the Dot-Com Bubble and Global Financial Crisis, have proven to be stronger returning vintages within private equity, especially for top quartile managers. According to Burgiss market data, North American top quartile GPs generated 26.7% and 23.9% IRRs in 2001 and 2002, respectively, which far exceeded the ensuing bull market years from 2003-2008. Similarly, the next high performing vintage year was 2009 at 24.9% – the period during and shortly after the Global Financial Crisis.

However, it is difficult for investors to “time the market” in private equity, especially given the time periods between commitment to a sponsor’s fund and when the money gets invested, and the longer-term holding periods of underlying companies. Therefore, a consistent pacing strategy with exposure across different vintage years has proven to be an effective strategy to provide investors with attractive risk-adjusted returns over time, versus trying to decide which vintage year may be better than others.

High-quality businesses in industries that have historically benefitted from strong secular tailwinds could help insulate investors from potential economic softness, including sectors like healthcare, food, technology, and education.

Companies with leading market positions can use their scale to manage through macro gyrations, giving them a natural competitive advantage. Additionally, investments where value creation is largely driven by “controllable” levers can be attractive since they are typically less reliant on external factors for return generation. These internally driven value creation levers can include cost rationalization, process improvement, geographic and/or product expansion, professionalization opportunities, as well as accretive M&A, and are often found in take-private transactions, corporate carve-outs, and family-owned businesses. In all scenarios, utilizing prudent levels of leverage can be paramount in providing businesses with financial flexibility to navigate any economic uncertainty.

By contrast, companies operating in more cyclical industries or whose customers can delay purchases could face greater demand risk, putting downward pressure on sales. From a supply standpoint, investors may want to avoid more labor-intensive businesses and those that are exposed to higher commodity and/or transportation costs given current market constraints. Lastly, companies with business models or capital projects that are more interest rate sensitive may face pressure given the Fed’s current tightening monetary policy.

Co-investing alongside top performing managers is an efficient and tactical way to access private equity opportunities in any market environment. As a co-investor, one can construct a diversified portfolio by choosing sectors and strategies that best suit current market conditions over time, as compared to traditional private equity managers who are beholden to one sector or strategy focus. That being said, co-investors can still benefit from the advantages of focused private equity strategies by partnering with sector specialists whose reputation, resources, and experience in specific industries provide superior access to unique opportunities. Co-investors can further leverage a sponsor’s expertise to execute on value creation strategies that have been historically proven to be effective across market cycles. Finally, private equity co-investing enables investors to build a well-diversified portfolio through a fee-advantaged structure to offer potentially superior net returns.

Learn more about why an increasingly volatile market environment can favor middle market co -investments.

The years following an economic downturn have proven to be some of the best performing private equity vintages as demonstrated after the Global Financial Crisis and Dot-Com Bubble. By co-investing alongside experienced sponsors and focusing on deals in industries that have historically benefited from strong secular tailwinds, companies with leading market positions, and investments where value creation is largely driven by “controllable” levers, private equity investors can be well positioned to take advantage of the opportunity set arising from current market volatility.

Learn about GCM Grosvenor’s private equity platform including our co-investment capabilities here.

We debunk several common misconceptions related to co-investing in today’s market.

In today’s market, many institutional investors are contending with overallocation to private capital strategies. Here, we discuss how co-investing can help them refrain from pausing new investments and maintain exposure to potentially high-performing vintages, even when investment dollars are scarce.

Important Disclosures

For illustrative and discussion purposes only.

No assurance can be given that any investment will achieve its objectives or avoid losses. Past performance is not necessarily indicative of future results.

The information and opinions expressed are as of the date set forth therein and may not be updated to reflect new information.

Investments in alternatives are speculative and involve substantial risk, including strategy risks, manager risks, market risks, and structural/operational risks, and may result in the possible loss of your entire investment. The views expressed are for informational purposes only and are not intended to serve as a forecast, a guarantee of future results, investment recommendations, or an offer to buy or sell securities by GCM Grosvenor. All expressions of opinion are subject to change without notice in reaction to shifting market, economic, or political conditions. The investment strategies mentioned are not personalized to your financial circumstances or investment objectives, and differences in account size, the timing of transactions, and market conditions prevailing at the time of investment may lead to different results. Certain information included herein may have been provided by parties not affiliated with GCM Grosvenor. GCM Grosvenor has not independently verified such information and makes no representation or warranty as to its accuracy or completeness.

Data sources:

Certain information, including benchmarks, is obtained from The Burgiss Group (“Burgiss”), an independent subscription-based data provider, which calculates and publishes quarterly performance information from cash flows and valuations collected from of a sample of private equity firms worldwide. When applicable, the performance of GCM Grosvenor’s private equity, real estate, and infrastructure underlying investments are compared to that of its peers by asset type, geography and vintage year as of the applicable valuation date. GCM Grosvenor’s Asset Class and Geography definitions may differ from those used by Burgiss. GCM Grosvenor has used its best efforts to match its Asset Class, Geography, and strategy definitions with the appropriate Burgiss data but material differences may exist. Benchmarks for certain investment types may not be available. GCM Grosvenor uploads data into its system one-time each quarter; however, the data service may continue to update its information thereafter. Therefore, information in GCM Grosvenor’s system may not always agree with the most current information available from the data service. Additional information is available upon request.

1 Source: Preqin 2022

GCM Investments UK LLP (“GCMUK”) has been made aware of fraudulent schemes targeting members of the public in Spain.

Unauthorised individuals are falsely claiming to represent GCMUK and are misusing the firm’s name and publicly available information in connection with fake investment opportunities.

These scams are sophisticated and deliberately misleading. They may involve the use of real GCMUK employee names and may imitate the tone, format, and branding of genuine GCMUK communications.

Please note:

GCMUK does not offer financial services or investment products to retail clients, either directly or through third parties. You can verify GCMUK’s regulatory status and permissions on the UK Financial Conduct Authority (FCA) Register at register.fca.org.uk

If you are based in Spain and believe you have been contacted by a fraudster claiming to represent GCMUK, please take the following steps:

You may also report online fraud to the Spanish National Police or Civil Guard via the computer crime reporting service at www.policia.es.

GCM Investments UK LLP (“GCMUK”) ha tenido conocimiento de estafas dirigidas al público en España.

Personas no autorizadas afirman falsamente representar a GCMUK y están haciendo un uso indebido del nombre de la empresa y de la información disponible públicamente en relación con oportunidades de inversión falsas.

Estas estafas son sofisticadas y deliberadamente engañosas. Pueden implicar el uso de nombres reales de empleados de GCMUK e imitar el tono, el formato y la marca de las comunicaciones auténticas de GCMUK.

Tenga en cuenta lo siguiente:

GCMUK no ofrece servicios financieros ni productos de inversión a clientes minoristas, ni directamente ni a través de terceros. Puede verificar el estado regulatorio y los permisos de GCMUK en el Registro de la Autoridad de Conducta Financiera del Reino Unido (FCA) en register.fca.org.uk

Si reside en España y cree que ha sido contactado por un estafador que dice representar a GCMUK, siga los siguientes pasos:

También puede denunciar el fraude online a la Policía Nacional o la Guardia Civil española a través del servicio de denuncia de delitos informáticos en www.policia.es.

GCM Investments UK LLP (“GCMUK”) has been made aware of fraudulent schemes targeting members of the public in France.

Unauthorised individuals are falsely claiming to represent GCMUK and are misusing the firm’s name and publicly available information in connection with fake investment opportunities.

These scams are sophisticated and deliberately misleading. They may involve the use of real GCMUK employee names and may imitate the tone, format, and branding of genuine GCMUK communications.

Please note:

GCMUK does not offer financial services or investment products to retail clients, either directly or through third parties. You can verify GCMUK’s regulatory status and permissions on the UK Financial Conduct Authority (FCA) Register at register.fca.org.uk.

If you are based in France and believe you have been contacted by a fraudster claiming to represent GCMUK, please take the following steps:

You may also report online scams through the French government’s Pharos platform at www.internet-signalement.gouv.fr.

GCM Investments UK LLP (“GCMUK”) a été informée de l’existence de stratagèmes frauduleux visant le grand public en France.

Des personnes non autorisées prétendent faussement représenter GCMUK et utilisent abusivement le nom de la société et des informations accessibles au public dans le cadre de fausses opportunités d’investissement.

Ces escroqueries sont sophistiquées et délibérément trompeuses. Elles peuvent impliquer l’utilisation des noms réels d’employés de GCMUK et imiter le ton, le format et l’image de marque des communications authentiques de GCMUK.

Remarque:

GCMUK n’offre pas de services financiers ni de produits d’investissement à des clients particuliers, que ce soit directement ou par l’intermédiaire de tiers. Vous pouvez vérifier le statut réglementaire et les autorisations de GCMUK dans le registre de la Financial Conduct Authority (FCA) du Royaume-Uni à l’adresse register.fca.org.uk.

Si vous êtes basé en France et pensez avoir été contacté par un fraudeur prétendant représenter GCMUK, veuillez suivre les étapes suivantes :

Vous pouvez également signaler les escroqueries en ligne via la plateforme Pharos du gouvernement français à l’adresse www.internet-signalement.gouv.fr.

ご注意

・当社代表取締役の駒田智彦(もしくはその秘書を名乗るもの)が、LINE等のSNSやメール等を通じて金融商品への投資をご案内・勧誘することはございません。

・不審なメールのリンク先には絶対にアクセスしないようご注意ください。

・GCM Grosvenorの日本法人であるGCMインベストメンツ株式会社は、Webページを開設しておりません。また、Instagram、LineといったSNSにおいても公式ページは開設しておりません。

GCM Investments UK LLP (GCMUK) has been made aware of fraudulent schemes targeting members of the public in the United Kingdom.

Unauthorised individuals are falsely claiming to represent GCMUK and are misusing the firm’s name and publicly available information in connection with fake investment opportunities.

These scams are sophisticated and deliberately misleading. They may involve the use of real GCMUK employee names and may imitate the tone, format, and branding of genuine GCMUK communications.

Please note:

GCMUK does not offer financial services or products to retail clients, either directly or through third parties. You can verify GCMUK’s regulatory status and permissions on the Financial Conduct Authority (FCA) Register at register.fca.org.uk.

If you are based in the UK and believe you have been contacted by a fraudster claiming to represent GCMUK, please take the following steps:

Investor Scam Alert

Unauthorized individuals are impersonating Winston Chow in scams targeting investors, particularly in Malaysia. He does not solicit investments directly in Asia. If you are contacted by someone claiming to be him outside of official channels, please report it to local authorities.

For verification or further information, please contact: [email protected]

Investor Scam Alert

GCM Grosvenor L.P. and its affiliated entities (collectively, “GCMG”) have been made aware of fraudulent schemes currently targeting members of the public in Malaysia and Hong Kong, in which unauthorised individuals are falsely claiming to represent GCMG in connection with purported investment opportunities.

These fraudulent individuals are believed to be actively promoting false investment opportunities, often involving mobile applications, through the unauthorised use of GCMG’s name, brand, corporate logo, and other identifying materials. We have also received reports that these parties may be distributing fabricated business cards, hosting online webinars, creating WhatsApp groups, and arranging personal video calls to simulate legitimacy. These scams are sophisticated and deliberately misleading, frequently involving the use of real GCMG employee names and imitating the style, tone, and presentation of genuine GCMG communications.

GCMG has no presence, operations, or authorised representatives in Malaysia. GCMG does not offer any investment schemes, products, or mobile applications targeted at Malaysian investors, either directly or indirectly.

While GCMG maintains a legitimate presence and employs personnel in Hong Kong, these scams are entirely unauthorised and unrelated to any genuine activities conducted by GCMG or its employees in the region.

Position of GCMG

GCMG has neither authorised nor endorsed any such solicitations and takes this matter seriously. We have reported some of these incidents to the relevant regulatory and enforcement authorities in Malaysia, and are doing the same in Hong Kong, including notifying the Hong Kong Police and the appropriate financial regulators. GCMG will continue to assist with their investigations.

GCMG is actively monitoring these developments and reserves all rights to take legal action against any party found misusing its name, brand, or intellectual property.

While these reports currently centre on activity in Malaysia and Hong Kong, the methods used may be replicated in other jurisdictions. GCMG continues to monitor for similar risks globally.

Unauthorized individuals are impersonating Winston Chow in scams targeting investors, particularly in Malaysia. He does not solicit investments directly in Asia. If you are contacted by someone claiming to be him outside of official channels, please report it to local authorities.

For verification or further information, please contact: [email protected]

We offer clients a broad range of tailored solutions across strategies, including multi-strategy, macro, relative value, long/short equity, quantitative strategies, and opportunistic credit. Levaraging our large scale and presence in the industry, we are able to offer clients preferntial exposure to hard-to-access managers and seek to obtain terms that can drive economic and structural advantages.