Infrastructure

Nearly

25 years

investing in

infrastructure

We take a comprehensive, global approach to the infrastructure landscape—sourcing a wide range of diversified opportunities across markets and sectors. By leveraging our extensive network of hard-to-access managers, as well as flexible implementation options, we seek to deliver differentiated deal flow and create lasting value for our clients.

$19B

AUM

~230

Infrastructure Investments1

3,000+

Investing Across the Infrastructure Landscape

Hover over each asset type to learn more.

Digital

- Data centers

- Towers

- Fiber

Energy Transition

- Renewable generation

- Natural gas

- Energy efficiency

Transportation

- Airports and FBOs

- Rail, toll roads, and bridges

- Sea terminals and shipping

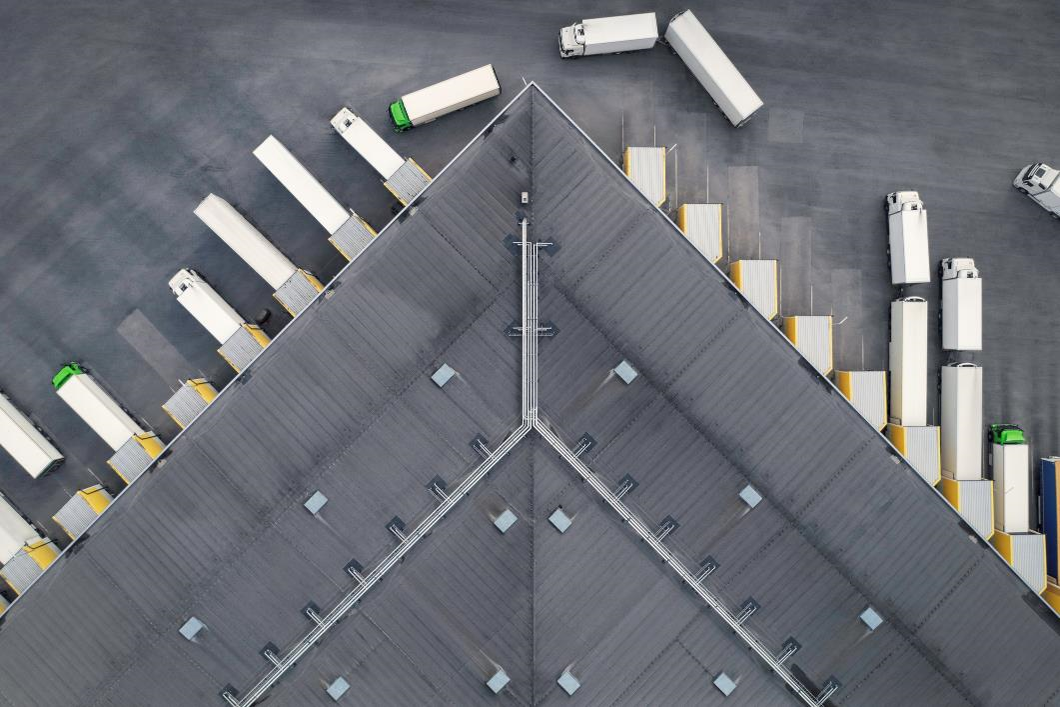

Supply Chain

- Warehouse / cold storage

- Land side shipping

- Fleet management / parking

Adjacencies

- Services (“asset-lite” infrastructure)

- Technology (“smart” infrastructure)

- Real Estate (housing, education, medical)

Digital

- Data centers

- Towers

- Fiber

Supply Chain

- Warehouse / cold storage

- Land side shipping

- Fleet management / parking

Energry Transition

- Renewable generation

- Natural gas

- Energy efficiency

Adjacencies

- Services (“asset-lite” infrastructure)

- Technology (“smart” infrastructure)

- Real Estate (housing, education, medical)

Transportation

- Airports and FBOs

- Rail, toll roads, and bridges

- Sea terminals and shipping

Why GCM Grosvenor For Infrastructure?

Proven Track Record

We have nearly 25 years of experience investing across geographies, sectors, and strategies, with deep transactional expertise.

Differentiated Deal Flow

Powered by our extensive network and platform connectivity, we access unique opportunities others cannot.

Trusted Partner

We have a seasoned team with sector depth and a strong reputation, making us a trusted partner worldwide.

How We Invest

Direct Investments

Investments made directly into businesses or securities, without an intermediary sponsor.

Co-Investments

Direct investments into businesses or securities alongside a sponsor.

Fund Investments

Allocations to managers’ multi-client funds, also known as primary investments.

Secondary Transactions

Purchased interests in existing funds, including traditional LP deals and the rapidly growing GP-led market segment.

Joint Ventures

Investments in early-stage managers or first-time funds, where we provide strategic capital in exchange for preferential terms and participation in manager economics.

Infrastructure Advantage Strategy

Our Infrastructure Advantage Strategy seeks to originate and execute infrastructure projects that leverage the inclusion of union labor as a contributing factor to enabling attractive risk adjusted returns.

Related News and Insights

Data as of December 31, 2025, unless otherwise noted.

1 Data as of December 31, 2024, updated annually.

Deal flow count methodology changed in 2013. As a result, deal flow count for years prior to 2013 are an approximate count.

Investments in alternatives are speculative and involve substantial risk, including market risks, credit risks, macroeconomic risks, liquidity risks, manager risks, counterparty risks, interest rate risks, and operational risks, and may result in the possible loss of your entire investment. No assurance can be given that any investment will achieve its objectives or avoid losses. The views expressed are for informational purposes only and are not intended to serve as a forecast, a guarantee of future results, investment recommendations, or an offer to buy or sell securities by GCM Grosvenor. The investment strategies mentioned are not personalized to your financial circumstances or investment objectives, and differences in account size, the timing of transactions and market conditions prevailing at the time of investment may lead to different results.

Unless apparent from context, all statements herein represent GCM Grosvenor’s opinion.