Business Operations

We leverage technology to create efficiencies in accounting, treasury, and investment operations processes and increase workplace productivity.

Click on each solution to learn more.

Client Experience

We utilize proprietary and third-party platforms to increase transparency and understanding through robust reporting and analytics tools.

Click on each solution to learn more.

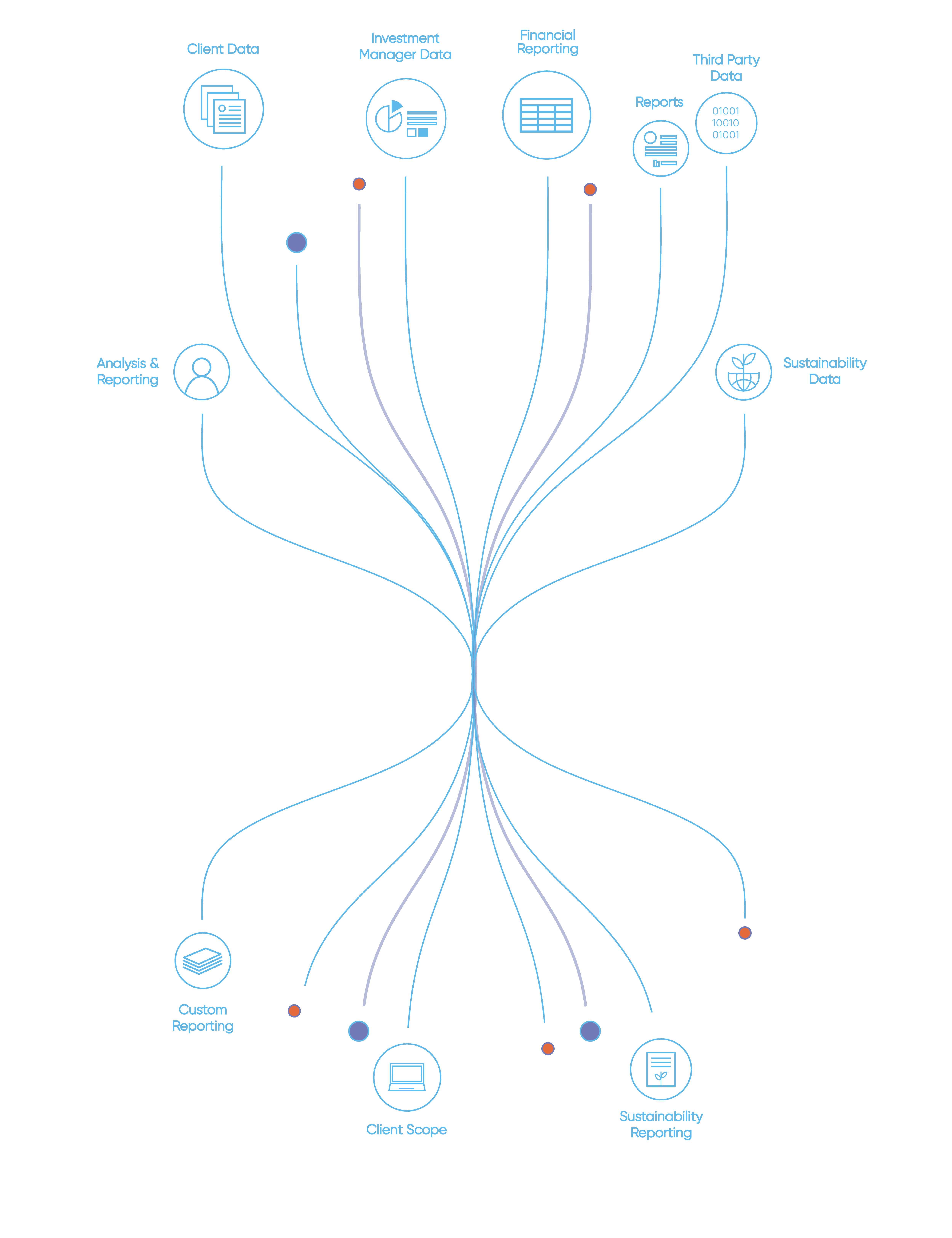

Data and Analytics

Through decades of investing across the alternatives landscape, we have built an unparalleled data universe spanning both public and private markets. This serves as the foundation for our ability to deliver transparency, enhance decision making, and drive efficiency for our clients and our business.

Proprietary Data Fabric

Our data fabric facilitates and governs how we move data around the organization and democratize access for citizen developers, business users, technologists, and, most importantly, our clients.

Reporting and

Transparency

We believe transparency is critical to our clients’ success. We have created unique technology solutions which empower our clients with seamless access to their data and user-friendly analytics solutions.

So, we built it.

Introducing ClientScope - our proprietary, web-based experience that will facilitate client interactions throughout the entire lifecycle, from onboarding through retirement.

So, we built it.

Introducing ClientScope - our proprietary, web-based experience that will facilitate client interactions throughout the entire lifecycle, from onboarding through retirement.

Strategic Partners

To meet the demands of our clients and staff, we have partnered with world-class cloud platforms for data storage and analysis along with preferred data and technology solutions providers, including:

As their first client, we partnered with Exchangelodge to create a revolutionary way to process and validate data received from third-party administrators. Click here to read more about our partnership with Exchangelodge.

We leverage iLEVEL and their Managed Data Services to streamline Private Markets data collection, portfolio monitoring, analytics, valuation, and reporting.

We use Arria’s Natural Language Generation platform to create narrative summaries of quarterly client and fund performance from raw data and utilize them in our standard client reporting packages.

All of our private markets deal information is stored within Intapp DealCloud, which is tightly integrated within our proprietary data fabric. It is the starting point of most of our deal-centric workflows and creates efficiencies across the firm.

Microsoft is one of our two public cloud infrastructure providers on which much of our data and our proprietary applications reside.

Amazon Web Services (AWS) is one of our two public cloud infrastructure providers. Many of our self-hosted third-party applications reside on AWS infrastructure.

Reporting21, now a part of Cority (2022), is our sustainability data collection and reporting platform. As one of their first enterprise clients in the US, we have worked together to pioneer data collection and automated sustainability and impact reporting within the alternatives industry.

We utilize index data, research data, and benchmark data from MSCI to support our internal and client-facing analytics capabilities. MSCI is one of our many 3rd party data providers.

Our ARS investments, portfolio management, and risk team members use AlternativeSoft to seamlessly integrate data sources such as Bloomberg, Morningstar, Albourne, HFR, EurekaHedge, HFM, Preqin, Refinitiv, and more for efficient screening and analysis.

We are using technology to drive scalability and efficiency in our business

Exchangelodge

Automating business processes to increase efficiency and leverage from 3rd party administrator relationships

Exchangelodge

Automating business processes to increase efficiency and leverage from 3rd party administrator relationships.

The Challenge

We have long partnered with fund administrators to provide accounting and related services to our absolute return strategies clients. Without an efficient to review and oversee the data produced by the various administrators, we found ourselves preparing parallel books and records for all portfolios and relying on legacy technology that limited our ability to scale.

The Solution

By introducing automation to the validation and oversight of core accounting data via Exchangelodge, we were able to optimize our workflow. Instead of running a parallel data review process, we implemented an exception-driven oversight process, solely focusing on the problematic data. The solution supports three key areas: dataflow automation, data interrogation and cleansing, and process control.

The Results

- 400%+ increase in process efficiency from one accountant handling 12 portfolios to now handling 50+ portfolios

- 33% of related operational staff reallocated to higher-value tasks due to termination of previous operating model

- 20+ vital databases integrated via automated, real-time processes

- 50+ business rules and validations for every valuation

- 0 accounting entries are booked by our team for approximately 100 portfolios, transferring low value, time intensive work to the fund administrator

Canoe

Eliminating manual document processing and data entry to drive organizational scale

Canoe Case Study

Eliminating manual document processing and data entry to drive organizational scale.

The Challenge

On behalf of our clients, we receive 30,000+ unique PDF documents from investment managers representing quarterly statements and cash flow notices. Many of these documents need to be manually downloaded from different sources, which is an extensive and time-consuming process. Additionally, the lack of standardization across documents makes it challenging to automate processing and manual processing is resource-intensive and not scalable.

The Solution

By leveraging Machine Learning (ML) and Artificial Intelligence (AI) via Canoe, we are able to automatically retrieve documents from various sources, efficiently review them, and automatically extract relevant data points. This creates a scalable solution and allows us to reallocate our human resources to other priorities.

The Results

- ~30% of quarterly statements are automatically booked straight through to our general ledger without human interaction

- We are positioned to reallocate ~20% of the team to other priorities

We are

democratizing

technological

transformation by

empowering

our full workforce

to innovate.

3rd ANNUAL HACKATHON | 100 participants and mentors from across the organization joined forces to work creatively on automation, AI, and employee engagement. Winners were voted on by members of the firm’s leadership team and several projects will be put into production for firmwide use.

INNOVATION DAYS | We host department-wide Innovation Days where individual teams dedicate a full workday towards using technology to create process efficiencies or solutions to day-to-day problems.

CITIZEN DEVELOPER PROGRAM

2022

Program Inception

200+

Program Graduates

4

Cohorts taught per year

Our Citizen Developer program aims to accelerate the pace at which we can drive change and scalability by empowering more individuals around the firm to learn and utilize new technologies. The program includes proprietary curriculum that is generated and facilitated by members of our in-house Technology Team and is offered to beginner, intermediate, and advanced citizen developers.

Security and

Business Continuity

Keeping data secure and minimizing risk on behalf of our clients is a top priority and key component of our corporate governance

Related News and Insights

Exchangelodge Expands Technology Partnership with GCM Grosvenor

PITTSBURGH AND CHICAGO, November 1, 2022 — Exchangelodge, a financial technology company that automates private markets data workflows, today announced an expansion of its strategic technology partnership with GCM Grosvenor …

Exchangelodge Expands Technology Partnership with GCM Grosvenor Read More »

GCM Grosvenor and Canoe Intelligence Announce New Technology Partnership to Drive Organizational Scale

CHICAGO and NEW YORK, June 13, 2022 — Canoe Intelligence (“Canoe”), a financial technology company powering alternative investment intelligence and GCM Grosvenor (Nasdaq: GCMG), a global alternative asset management solutions …

Data as of December 31, 2023 unless otherwise noted.

Tracked manager data as of January 1, 2023.

Representative list of service providers subject to change. Inclusion does not constitute endorsement by GCM Grosvenor or service provider.