Our Impact

Nearly

40 years

investing in

credit

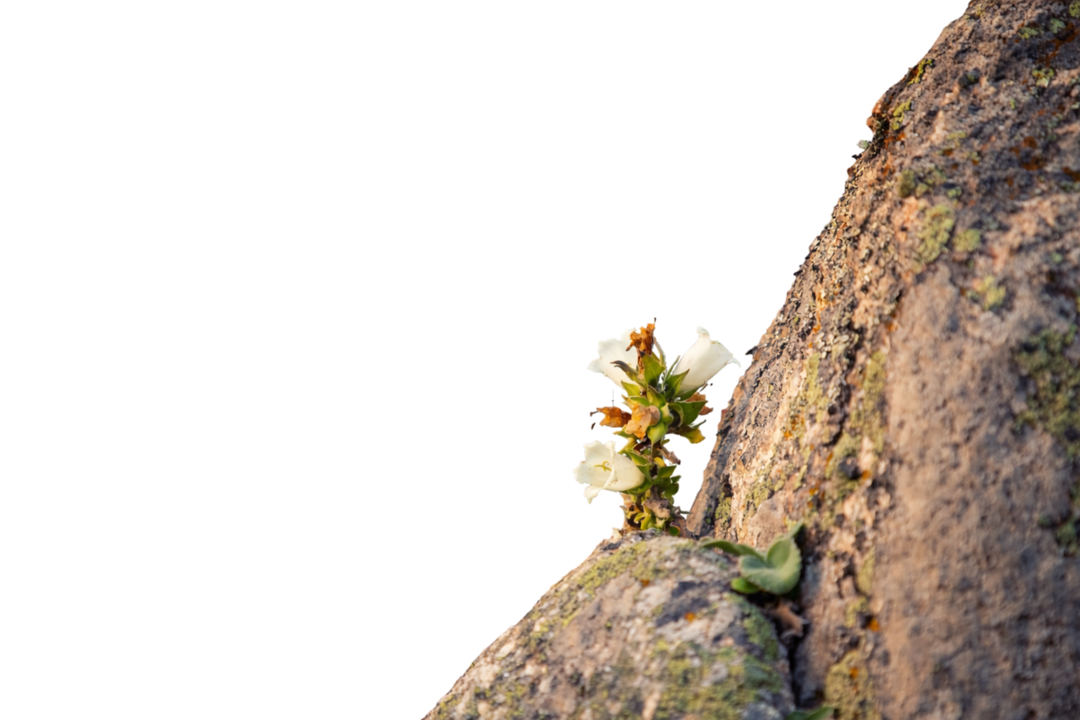

Making a difference, one action at a time.

We believe impact is about more than just investment performance. Through our responsible business practices, we strive to create meaningful change for our clients, our people, our communities, and the industry at large.

INVESTING RESPONSIBLY

Shaping the Future of Sustainable and Impact Investing

Our approach to sustainable and impact investing is guided by client choice, tailoring strategies to their unique priorities while seeking strong, risk-adjusted performance.

Community Engagement

Whether through hands-on volunteering, financial support, or serving as board members, our goal is always to make a meaningful impact in the communities where we live and work.

CORPORATE SUSTAINABILITY

We are a certified CarbonNeutral® Company under the CarbonNeutral Protocol®

We are dedicated to reducing our carbon footprint and adopting sustainable practices across all aspects of our business.

Industry Inclusivity

Our annual SEM Consortium conference strives to increase visibility for small and emerging managers and connect them with institutional investors and service providers.

Sustainability Committee

Our Sustainability Committee oversees all aspects of our Sustainable Investing and Impact Policy — the framework for how we apply sustainability and impact considerations regarding our business operations, investment strategy and implementation, and community engagement.

Elizabeth Browne

Sponsor Solutions Group

Lilly Farahnakian

Chief Compliance Officer

Jonathan Hirschtritt

Sustainability

Jessica Holsey

Private Equity Investments

Michael Kirchner

Investments

Scott Litman

Infrastructure Investments

Steve McMillan

Credit Investments

Burke J. Montgomery

General Counsel

Frederick Pollock

Chief Investment Officer

Jorge Ramirez

Labor and Government Strategies

David Richter

Absolute Return Strategies

Stacie Selinger

Head of Investor Relations

Bernard Yancovich

Private Equity Investments