Important Disclosures

Investments in alternatives are speculative and involve substantial risk, including strategy risks, manager risks, market risks, and structural/operational risks, and may result in the possible loss of your entire investment. Please review the disclaimer following this report.

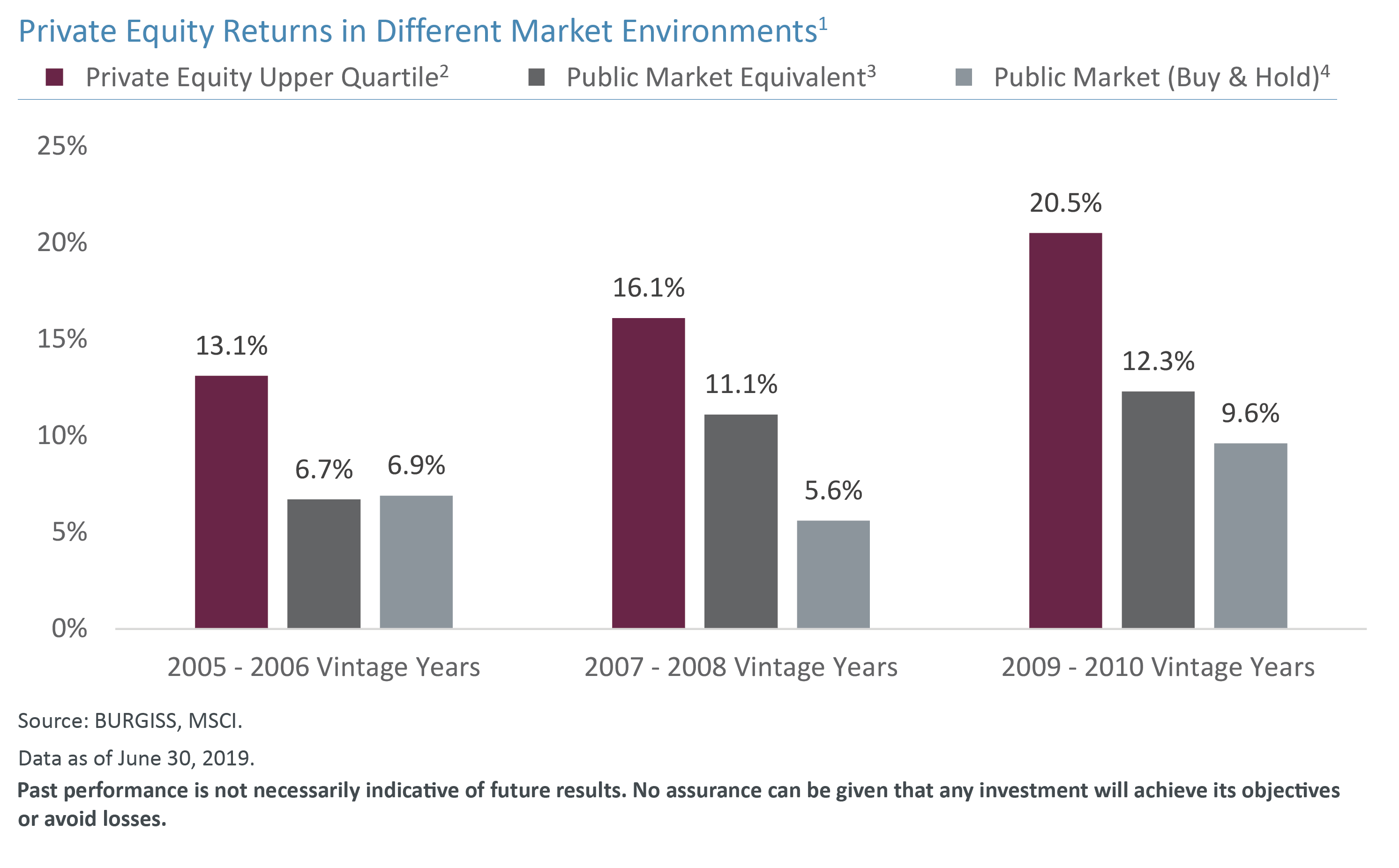

1 Burgiss data based on published 2Q 2019 benchmark data downloaded on October 4, 2019. MSCI makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used to create indices or financial products. This report is not approved or produced by MSCI. No assurance can be given that any investment will achieve its objectives or avoid losses. Past performance is not necessarily indicative of any future results.

2 “Private Equity Upper Quartile IRR” represents the upper quartile net IRR since inception through June 30, 2019 for all buyout funds in the Burgiss Manager Universe with vintage years 2005-2006, 2007-2008 and 2009-2010, respectively.

3 “Public Market Equivalent” returns reflect the MSCI World (TR) Index using the Long-Nickels methodology and were obtained from Burgiss.

4 “Public Market (Buy and Hold)” represents the annualized rate of return for the MSCI World (TR) Index (Ticker: GDDUWI) as of year-end of the first year of each time period through June 30, 2019.

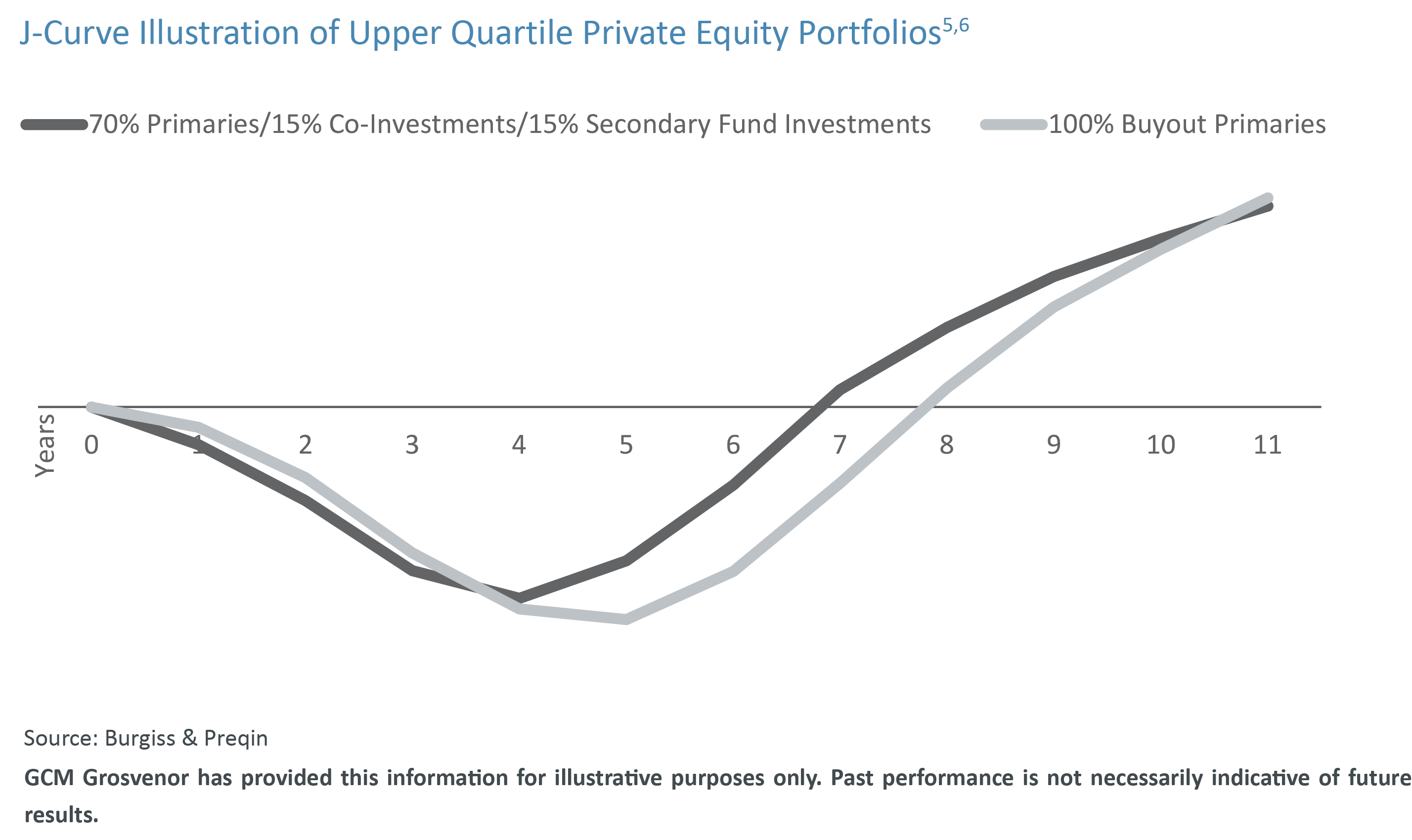

5 Illustrative portfolio consists of 52.5% primary buyout fund investments, 17.5% special situation primary fund investments, 15.0% co-investments and 15.0% secondary fund investments.

6 Private equity portfolios reflect upper quartile net multiple of invested capital for buyout funds, special situation funds, and private equity secondary fund portfolios with a vintage year of 2015 or prior as sourced from the Burgiss database. Burgiss data is based on published 2Q 2019 benchmark data downloaded on November 5, 2019. Additionally, the private equity portfolios reflect the upper quartile net multiple of invested capital for private equity co-investment portfolios with a vintage year of 2015 or prior as sourced from the Preqin database. Preqin data is based on latest available benchmark data downloaded on November 5, 2019.

The views expressed are for informational purposes only and are not intended to serve as a forecast, a guarantee of future results, investment recommendations or an offer to buy or sell securities by GCM Grosvenor. All expressions of opinion are subject to change without notice in reaction to shifting market, economic, or political conditions. The investment strategies mentioned are not personalized to your financial circumstances or investment objectives, and differences in account size, the timing of transactions and market conditions prevailing at the time of investment may lead to different results. Certain information included herein may have been provided by parties not affiliated with GCM Grosvenor. GCM Grosvenor has not independently verified such information and makes no representation or warranty as to its accuracy or completeness. GCM Grosvenor’s strategy definitions differ from those used by The Burgiss Group (“Burgiss”). GCM Grosvenor has used its best efforts to match each strategy with the appropriate Burgiss strategy but material differences may exist. Additional information is available upon request.