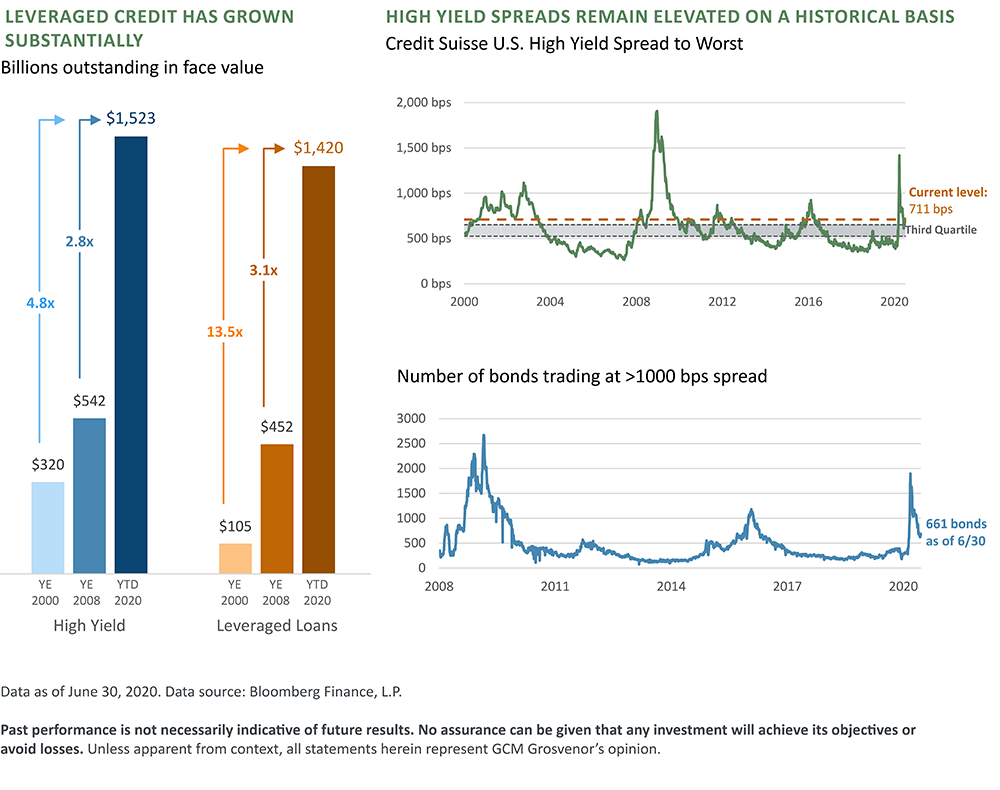

As anticipated corporate distress, defaults, and restructurings increase in the coming quarters, we expect the associated refinancing and “rescue funding” needs should create material opportunities for hedge funds with expertise in these strategies. Dislocated market conditions have caused the cost of capital to rise, particularly in complex situations. This will present an improved opportunity for hedge funds to act as lenders and financial intermediaries to stressed businesses and owners. Due to a large number of companies with significant cash needs, we believe hedge fund investors can be highly selective, with increased opportunities to negotiate equity-like returns with debt-like risk.

While we believe the current market environment is favorable for some opportunistic strategies, we are focused on the “middle of the barbell” consisting of hedge fund strategies designed to be “all-weather” and we seek to mitigate losses in declining and volatile market environments. We believe manager selection is particularly critical in constructing an attractive hedge fund program today. The elite hedge fund firms continue to attract deep talent and possess a sustainable “edge” in our view.

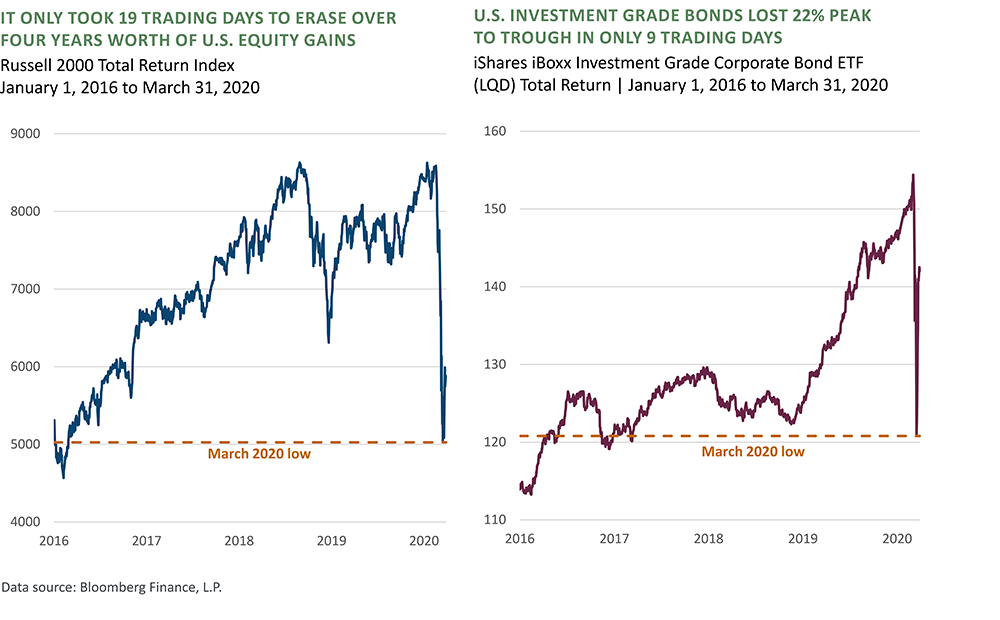

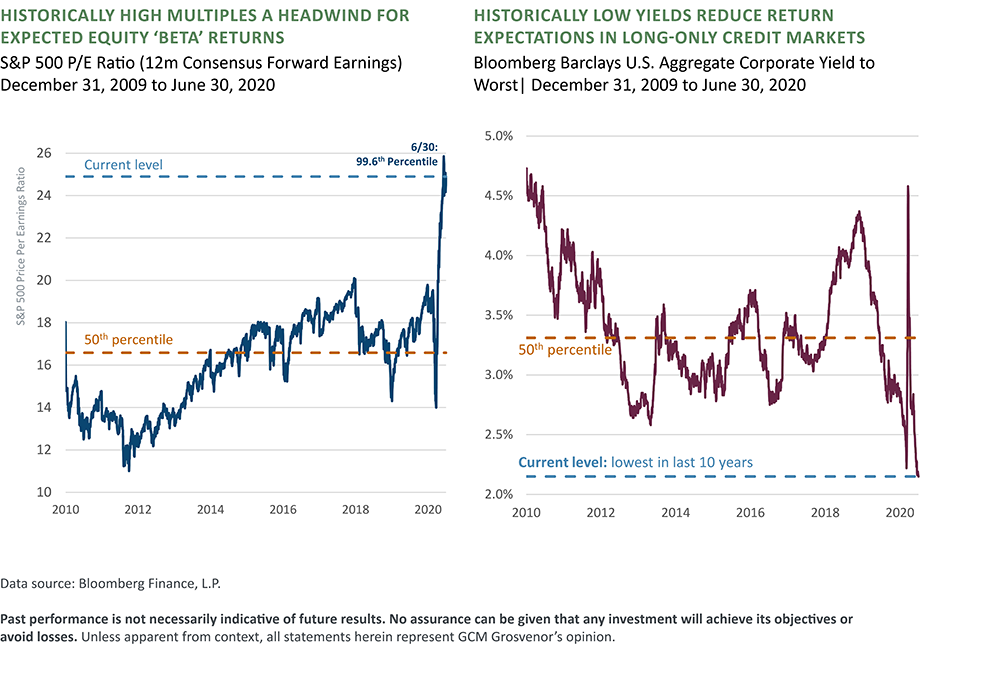

As many long-only fixed income investments have changed from diversifying sources of return to potentially “return-less risk” as yields reach historic lows, investors are considering shifting the strategic asset allocation of their portfolios. Therefore, we are having conversations about the value of increasing the allocations to absolute return strategies in our portfolios.

The COVID-19 pandemic is accelerating some market trends that had already taken root before the outbreak. Online shopping and e-commerce have been the most discussed, but others have accelerated, and the crisis will fuel more technology adoption and innovation. These trends are not only benefiting new innovators, but existing firms like Microsoft, where CEO Satya Nadella said in April, “In this era of remote everything, we have seen two years’ worth of digital transformation in two months.”

Against this backdrop, we believe there is an evolving and broad opportunity set across equity and credit for hedge fund managers. Within equity:

+ The Technology, Media, and Telecommunication (TMT) sector is at the forefront of innovation and enjoys robust secular growth independent of traditional economic cycles and GDP growth. At the micro-level, TMT is rich in businesses with advantages that include highly recurring revenues, scale/network effect advantages, and regulatory/innovation-driven barriers to competition.

The crisis is creating further TMT-specific opportunities, given the potential long-term shift in societal preferences towards tech-enabled offerings.

+ Healthcare is characterized by innovation, long-term growth, scientific and regulatory complexity, and persistent dispersion driven by idiosyncratic factors. Companies in clinical development have a continuous need to raise capital to fund the development of drugs prior to generating revenues. This creates opportunities for healthcare managers to invest in these companies at attractive prices.

The market dislocation created by COVID-19 has accelerated many companies’ capital needs and created better-priced entry points for managers.

+ COVID-19 dislocations have created a number of opportunities, including:

+ Long world-class companies with healthy businesses and deep moats, whose share prices were adversely impacted by indiscriminate selling and have not fully retraced

+ Long/short strategies: long companies in TMT, healthcare, and consumer spaces that stand to benefit from a post-COVID-19 world, and short companies that may never recover, or those with business models may not fit a post-crisis world

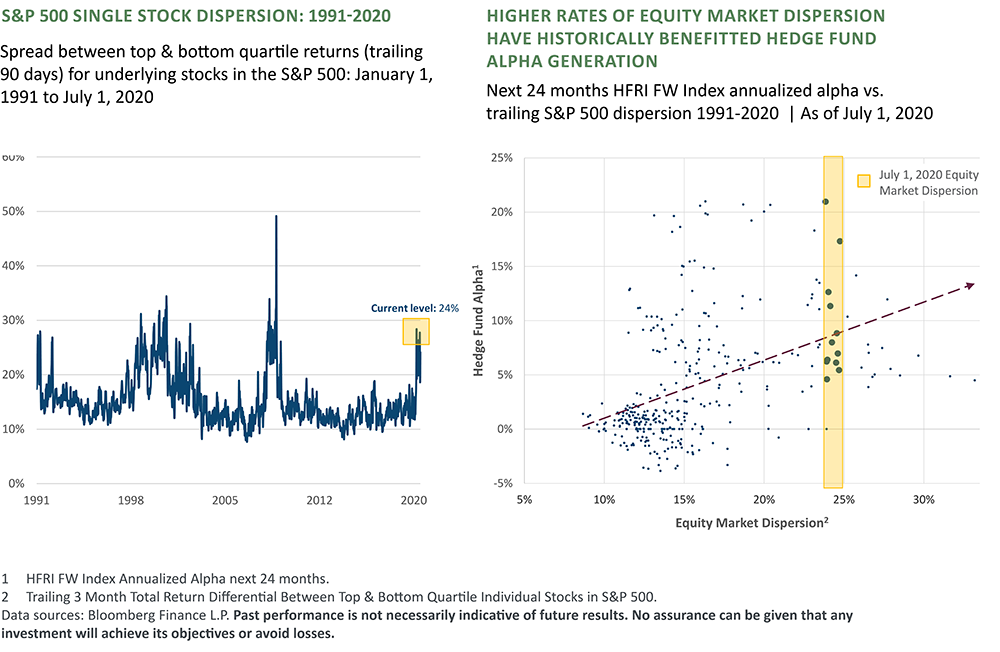

+ Short selling opportunities are attractive, given the increase in market activity among passive/index investors, quantitative strategies, and other short-term or non-fundamental investors. As these strategies account for a larger portion of trading activity, more securities diverge from managers’ estimates of intrinsic values, and the magnitude of these divergences increases. The potential returns available to short sellers that can identify and execute on these divergences have increased in recent years.

Within credit, dislocations arising from the pandemic are expected to drive opportunities not seen in over a decade. As mentioned above, we expect a large and growing opportunity to invest in high-quality businesses and assets that may offer “senior-like” risk at “equity-like” returns. The multi-sector and multi-class opportunity set could include securities spanning corporate credit, structured credit, distressed equity, and other sub-segments of the private capital markets.

We have defined three stages of the opportunity set in credit. With the aggressive and unprecedented policy response in the U.S., we believe we are currently in stage 2.

+ Stage 1: Liquidity and stressed dislocation – highly-rated corporates and structured credit opportunities created by forced sellers during periods of volatility. Purchasers seek equity-like returns generated by claims atop the capital structure (this opportunity has largely, but not completely, played out).

+ Stage 2: Effectuate balance sheet restructuring – privately negotiated transactions meant to stabilize balance sheets of high-quality businesses with over-levered balance sheets in the face of COVID-19-related economic slowdowns. These out-of-court “restructurings” seek to deleverage and extend the duration of a company’s liabilities while generating attractive risk/return opportunities for investors who can provide certainty of execution and scalable capital solutions.

+ Stage 3: Recovery opportunities – investing in a fulcrum security of a distressed, economically challenged issuer and participating in debt restructurings. The purchaser acquires control of businesses at a discount and helps strengthen the balance sheet and helps drive an operational turnaround.