Goldman Sachs Healthcare Veteran Jo Natauri Sets up Invidia Capital

The Wall Street Journal Pro profiles our partnership with Invidia Capital Management.

Past performance is not necessarily indicative of future results. No assurance can be given that any investment will achieve its given objectives or avoid losses. Unless apparent from context, all statements herein represent GCM Grosvenor’s opinion.

For 15 years, GCM Grosvenor’s Small and Emerging Managers Conference has provided momentum to small, new, and diverse investment managers, helping them grow their capital base and build their businesses. We are proud the SEM Conference has contributed to the alternative asset management industry’s evolution by creating a forum for learning and providing the next generation of managers with access to leading institutional investors and consultants.

The 2021 conference continued its mission to advance the industry by providing a clear assessment of where it is today and identifying some of the forces driving change. Managers gained insights from top hedge fund and private markets managers, while investors and consultants heard from managers and learned how their allocations are making a positive impact. Below are some highlights.

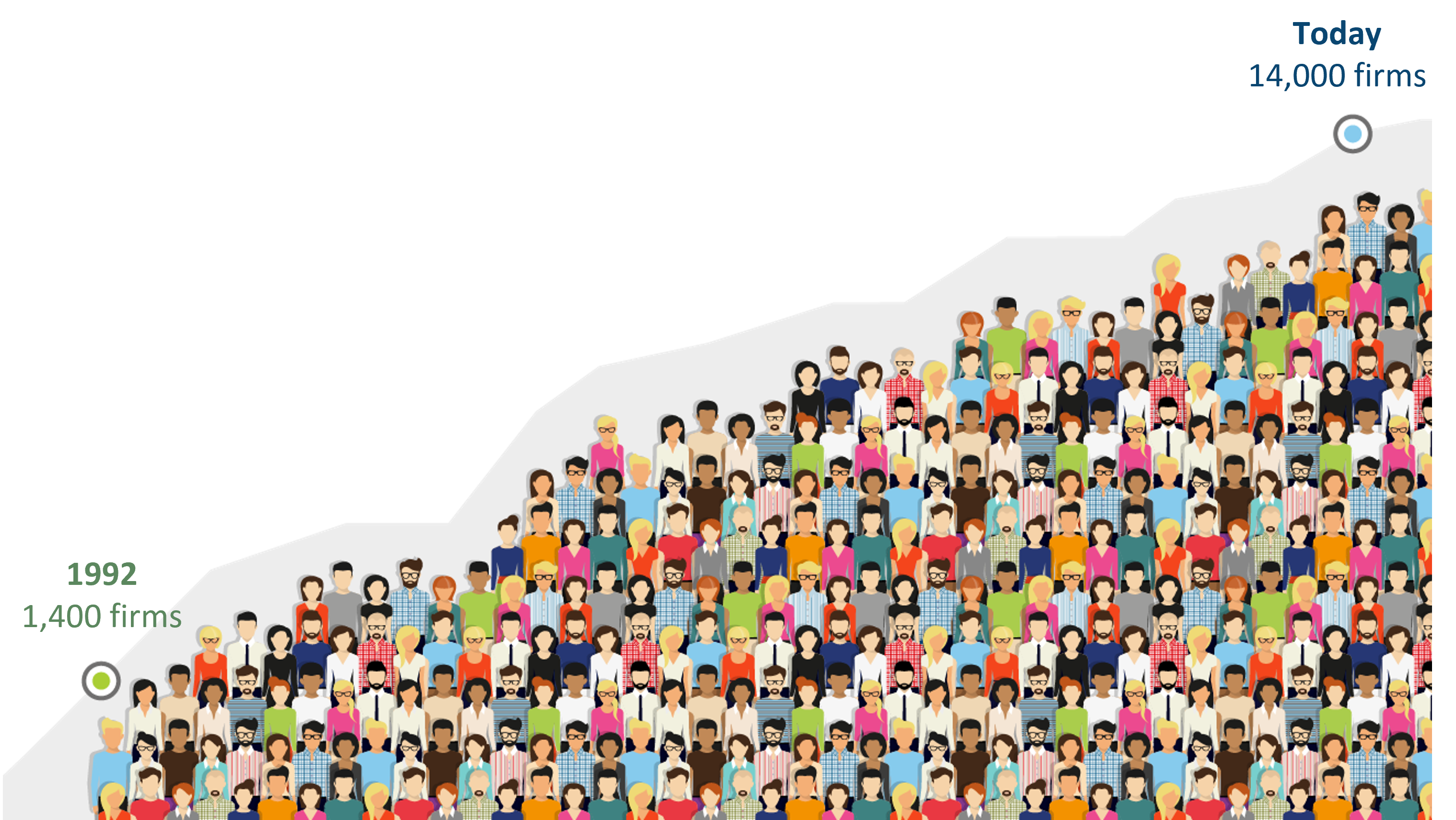

Since 1992, the universe of alternative investment managers has grown 10-fold, from around 1,400 to about 14,000.[1] This growth was largely driven by institutional investment, with pension plan capital in particular acting as a force multiplier. As investors increasingly allocated a greater share of their portfolio to alternatives, demand for investment managers increased exponentially. A need to deepen the pipeline of investment options ultimately drove the creation of the first “emerging manager” programs.

The emerging manager industry has evolved over time (and multiple “versions”) in a search to meet the needs of limited partners (LPs):

As emerging manager programs and their parent investors continue to enhance their focus on advancing diversity, equity, and inclusion in the industry, some plans are adopting a “Version 3.1” in which investments can be made alongside established managers to further DEI initiatives. This can be done through:

There remains much room for growth in the investment management industry, particularly regarding diversity, equity, and inclusion. Fortunately, due to the efforts of many LPs and GPs along with forward-thinking industry organizations and events like GCM Grosvenor’s Small and Emerging Managers Conference and Consortium, significant progress continues to be made.

According to GCM Grosvenor’s Peter Braffman, spinouts are the “engine of the alternatives universe.” For example, spinouts represented 65% of new real estate manager formation in the past three years. These firms’ founding professionals have “completed their apprenticeship” and apply the knowledge they learned in their careers to serve as stewards of capital, often in new and innovative ways. Spinout managers generally receive strong interest from institutional allocators, which tend to target managers who have left larger firms, given their established knowledge bases, relationships, and/or track records.

But given that it’s such a difficult business and usually takes years to turn a profit, why do individuals risk leaving a successful company to start their own firm? During discussions at the 2021 SEM Conference, Allan Jean-Baptiste of Ansa Capital, George Kase of Teleo Capital, and Leigh Sansone of Paceline Equity Partners gave a few insights into why they took the leap:

Allan Jean-Baptiste, Ansa Capital

George Kase, Teleo Capital

Leigh Sansone, Paceline Equity Partners

Whatever the reason, these managers agreed that before spinning out, it’s critical to cultivate and maintain relationships both within and outside the firm. Even if it takes a little longer to leave, it’s important to keep relationships strong, including partnering with interested LPs for fund or co-investing opportunities. At these early stages, GPs are well-served to work with LPs who recognize the GP is ready to be an investor, although they may not be ready to be a fiduciary.

To promote learning and development among emerging managers, each year a prominent hedge fund manager joins GCM Grosvenor’s David Richter at the SEM Conference for a one-on-one discussion to share their relevant experiences. This year, Steven Cohen from Point72 Asset Management shared his own experiences and lessons learned from 30 years of hedge fund investing.

Mr. Cohen acknowledged the industry is much tougher for new entrants than when he started. The sheer volume is greater, there are more and new sources of competition including “quant” investors, and information is shared much more quickly. Mr. Cohen also pointed out that alpha is harder to find today, and smaller firms without resources may be at a disadvantage, albeit a small one.

He does believe, however, there are common qualities that can help a new hedge fund manager enter this evolving industry. As Mr. Cohen related experiences from his own career, he shared how he kept pushing the envelope by putting cash flow back into the business, continuing to innovate, and hiring and developing talent. “I morphed the firm multiple times over 30 years. If I didn’t, I’d be out of business. I pride myself in innovating – and I’m still doing it today.”

The best ballplayers need coaches; people need feedback. I think that works.”

Internally developing talent is key. Mr. Cohen likened operating a hedge fund business to running a baseball team – in this case the New York Mets, which he owns. He said there are many similarities, including teamwork, talent management, the use of data and analytics, and creating a culture of accountability. “The best ballplayers need coaches; people need feedback. I think that works.”

But what makes a successful portfolio manager? Mr. Cohen believes it’s someone who focuses on what they’re good at and who can make money on both sides of the market. Beyond that, it’s someone who can build and manage a strong team and create a culture of learning, curiosity, and change. And from a personality perspective, they should be passionate about what they’re doing, not be afraid of risk, and be willing to put capital behind their thoughts. In describing these traits in himself, he says, “I can’t wait to get to work each day.”

The Wall Street Journal Pro profiles our partnership with Invidia Capital Management.

CHICAGO, Feb. 11, 2022 — GCM Grosvenor (Nasdaq: GCMG), a global alternative asset management solutions provider, announced today that it raised $1.5 billion for diverse manager investment mandates in 2021,

Important Disclosures

For illustrative and discussion purposes only.

No assurance can be given that any investment will achieve its objectives or avoid losses. Past performance is not necessarily indicative of future results.

The information and opinions expressed are as of the date set forth therein and may not be updated to reflect new information.

Investments in alternatives are speculative and involve substantial risk, including strategy risks, manager risks, market risks, and structural/operational risks, and may result in the possible loss of your entire investment. Past performance is not necessarily indicative of future results. The views expressed are for informational purposes only and are not intended to serve as a forecast, a guarantee of future results, investment recommendations or an offer to buy or sell securities by GCM Grosvenor. All expressions of opinion are subject to change without notice in reaction to shifting market, economic, or political conditions. The investment strategies mentioned are not personalized to your financial circumstances or investment objectives, and differences in account size, the timing of transactions and market conditions prevailing at the time of investment may lead to different results. Certain information included herein may have been provided parties not affiliated with GCM Grosvenor. GCM Grosvenor has not independently verified such information and makes no representation or warranty as to its accuracy or completeness.

[1] Source: GCM Grosvenor

GCM Investments UK LLP (GCMUK) has been made aware of fraudulent schemes targeting members of the public in the United Kingdom.

Unauthorised individuals are falsely claiming to represent GCMUK and are misusing the firm’s name and publicly available information in connection with fake investment opportunities.

These scams are sophisticated and deliberately misleading. They may involve the use of real GCMUK employee names and may imitate the tone, format, and branding of genuine GCMUK communications.

Please note:

GCMUK does not offer financial services or products to retail clients, either directly or through third parties. You can verify GCMUK’s regulatory status and permissions on the Financial Conduct Authority (FCA) Register at register.fca.org.uk.

If you are based in the UK and believe you have been contacted by a fraudster claiming to represent GCMUK, please take the following steps:

Investor Scam Alert

GCM Grosvenor L.P. and its affiliated entities (collectively, “GCMG”) have been made aware of fraudulent schemes currently targeting members of the public in Malaysia and Hong Kong, in which unauthorised individuals are falsely claiming to represent GCMG in connection with purported investment opportunities.

These fraudulent individuals are believed to be actively promoting false investment opportunities, often involving mobile applications, through the unauthorised use of GCMG’s name, brand, corporate logo, and other identifying materials. We have also received reports that these parties may be distributing fabricated business cards, hosting online webinars, creating WhatsApp groups, and arranging personal video calls to simulate legitimacy. These scams are sophisticated and deliberately misleading, frequently involving the use of real GCMG employee names and imitating the style, tone, and presentation of genuine GCMG communications.

GCMG has no presence, operations, or authorised representatives in Malaysia. GCMG does not offer any investment schemes, products, or mobile applications targeted at Malaysian investors, either directly or indirectly.

While GCMG maintains a legitimate presence and employs personnel in Hong Kong, these scams are entirely unauthorised and unrelated to any genuine activities conducted by GCMG or its employees in the region.

Position of GCMG

GCMG has neither authorised nor endorsed any such solicitations and takes this matter seriously. We have reported some of these incidents to the relevant regulatory and enforcement authorities in Malaysia, and are doing the same in Hong Kong, including notifying the Hong Kong Police and the appropriate financial regulators. GCMG will continue to assist with their investigations.

GCMG is actively monitoring these developments and reserves all rights to take legal action against any party found misusing its name, brand, or intellectual property.

While these reports currently centre on activity in Malaysia and Hong Kong, the methods used may be replicated in other jurisdictions. GCMG continues to monitor for similar risks globally.

Unauthorized individuals are impersonating Winston Chow in scams targeting investors, particularly in Malaysia. He does not solicit investments directly in Asia. If you are contacted by someone claiming to be him outside of official channels, please report it to local authorities.

For verification or further information, please contact: [email protected]

Investor Scam Alert

Unauthorized individuals are impersonating Winston Chow in scams targeting investors, particularly in Malaysia. He does not solicit investments directly in Asia. If you are contacted by someone claiming to be him outside of official channels, please report it to local authorities.

For verification or further information, please contact: [email protected]

We offer clients a broad range of tailored solutions across strategies, including multi-strategy, macro, relative value, long/short equity, quantitative strategies, and opportunistic credit. Levaraging our large scale and presence in the industry, we are able to offer clients preferntial exposure to hard-to-access managers and seek to obtain terms that can drive economic and structural advantages.