Past performance is not necessarily indicative of future results. No assurance can be given that any investment will achieve its given objectives or avoid losses. Unless apparent from context, all statements herein represent GCM Grosvenor’s opinion.

Select risks include: market risk, macroeconomic risk, manager risk, liquidity risk, interest rate risk, and operational risk.

INTRODUCTION

2022 was a challenging year for risk assets – global inflation and rapid tightening of central bank policy, combined with sudden geopolitical tension, sparked significant and widespread drawdowns in credit and equity markets. Here, we briefly review 2022 before exploring our expectations for 2023, including the potential opportunities that are emerging from the tumultuous past year in the market.

A Look Back at 2022

At the beginning of 2022 we highlighted four trends to our clients that we expected to influence the financial markets for the year.

- Slowing growth

- Expansionary fiscal and monetary policy reaching limits

- Growing inflation concerns

- Historically high valuations across public and private markets

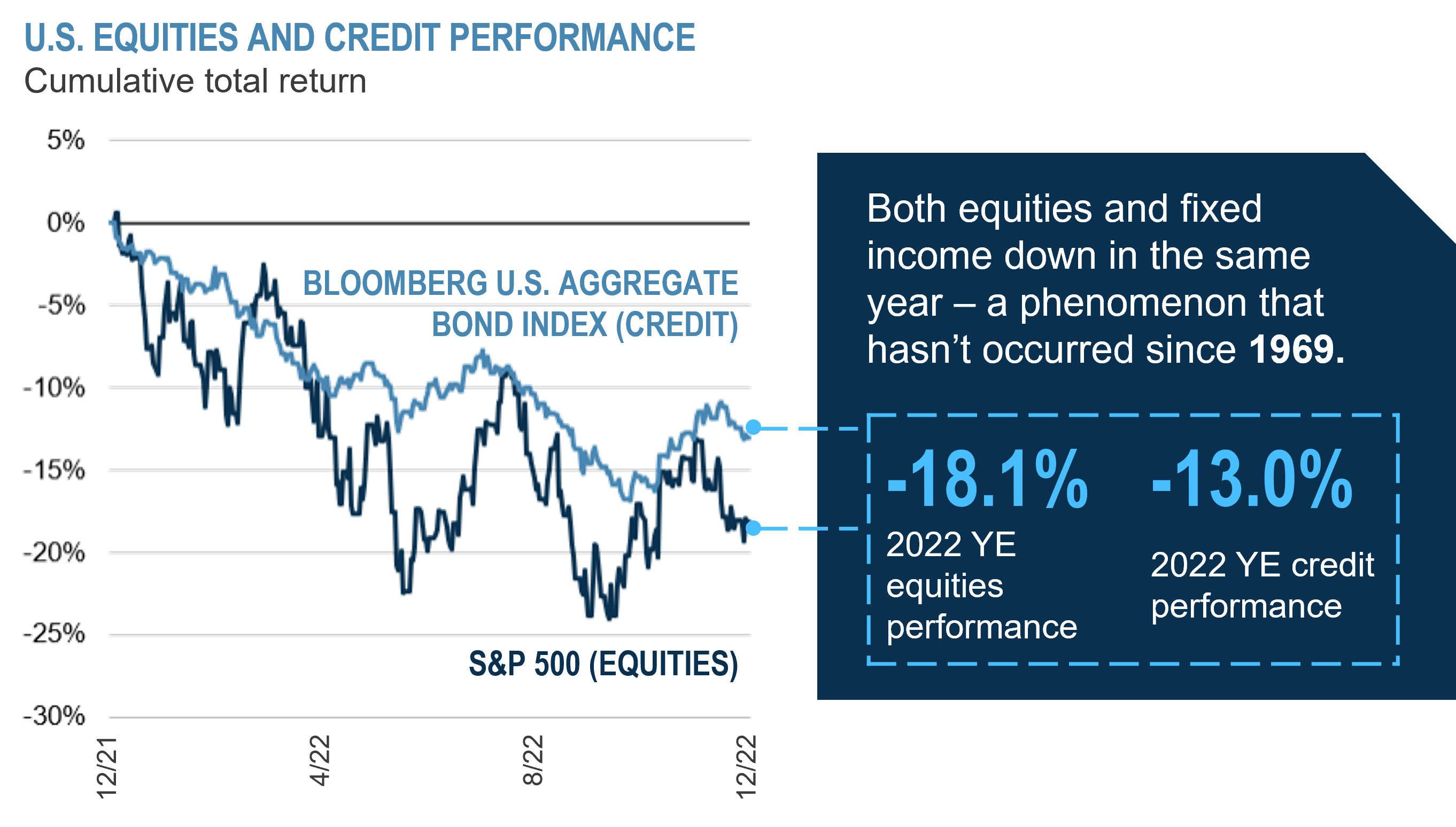

Unfortunately, in this case, our 2022 predictions came to fruition, making 2022 a highly challenging year for beta and risk assets generally. Equity and credit markets experienced double-digit drawdowns, making 2022 the first time both asset classes were down in the same year since the inflationary environment of 1969-1974. Consequently, investors did not experience the diversification benefits they have come to expect from the traditional 60/40 portfolio.

Source: Bloomberg Finance L.P. Data as of December 31, 2022.

Past performance is not necessarily indicative of future results. No assurance can be given that any investment will achieve its objectives or avoid losses.

Global Inflation and Central Bank Responses

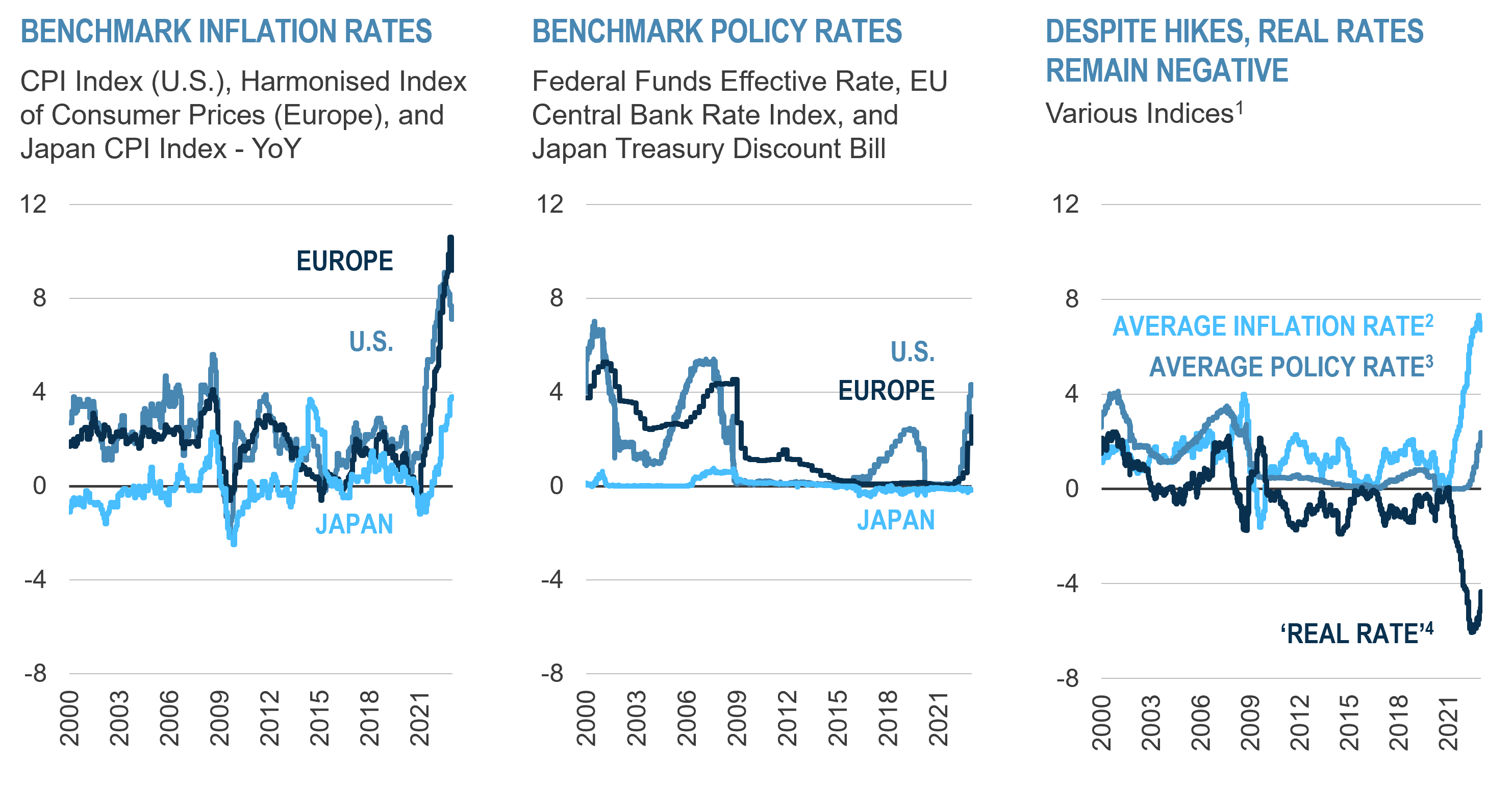

We believe central bank and policy adjustments are mostly but not all complete, and we anticipate their actions, including rate increases, to continue in the first half of 2023.

We do believe, however, that forward markets in both credit and equity have generally priced-in the forthcoming interest rate hikes, rising inflation, and other headwinds. Simply put, markets have repriced the cost of money.

But while the price of money has increased and markets have adjusted, looking ahead we believe markets have not yet fully priced-in the significant likelihood of an economic downturn or its potential severity, which represents a likely near-term headwind to sustained market appreciation.

(1) Includes the U.S., Europe, and Japan indices from the benchmark inflation rates and policy rates graphs. (2) Average inflation rate shows the average CPI across the U.S., Eurozone, and Japan. (3) The average policy rate across the U.S., Europe, and Japan. (4) ‘Real rates’ are defined as the difference between the average policy rate and the average inflation rate shown. Data source: Bloomberg Finance L.P. Data as of December 31, 2022. Past performance is not necessarily indicative of future results. No assurance can be given that any investment will achieve its objectives or avoid losses.

Slowing Growth and Recessionary Risks Across Regions

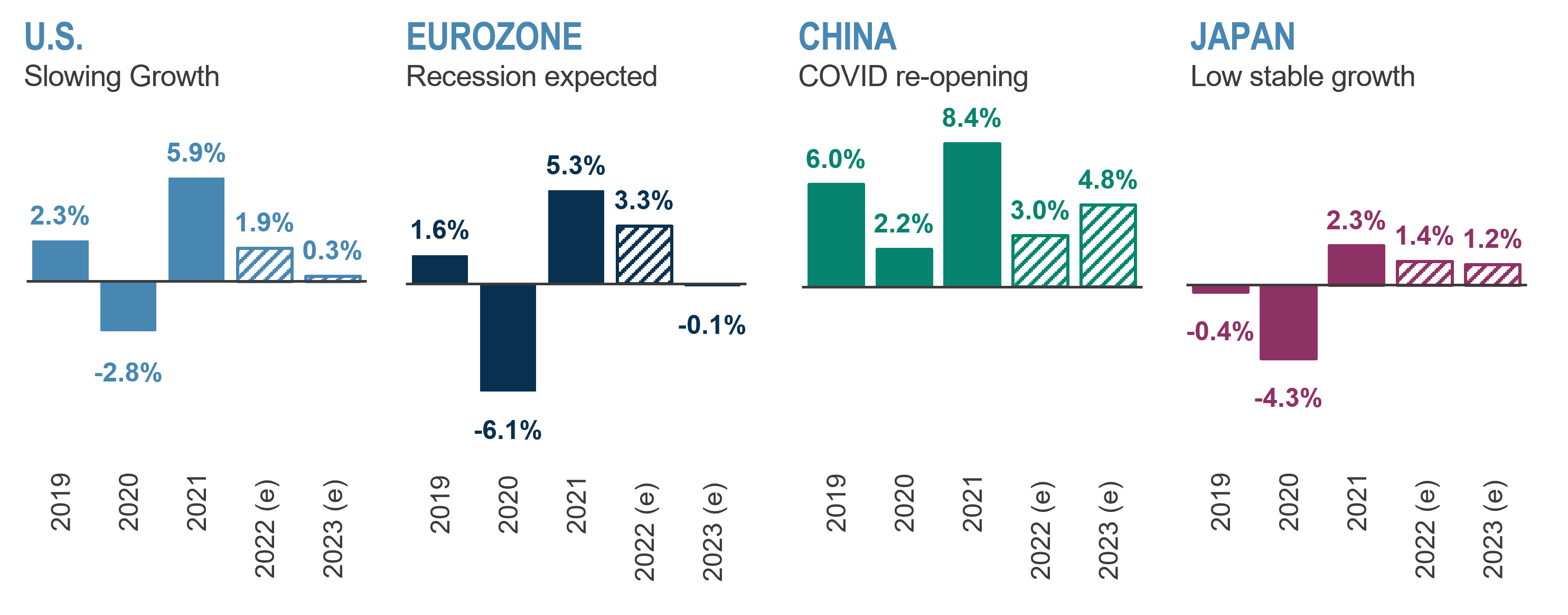

We anticipate interest rates will continue to rise throughout the year in the U.S. and Eurozone, which will likely spill over into slowing growth in these regions later in the year. While a technical recession may be avoidable, both regions are susceptible to a downturn at best.

Meanwhile, Japan lowered its probability of recession by foregoing rate increases in favor of currency devaluation. As a result, Japan may have avoided a significant downturn but at the cost of a weakened Yen.

Source for two charts above: Bloomberg Finance L.P. Data as of December 31, 2022.

China is only now reopening from mandated COVID-19 restrictions to what amounts to years of pent-up demand. As a result, we foresee China as being on a path of its own and anticipate increased growth in 2023 relative to 2022.

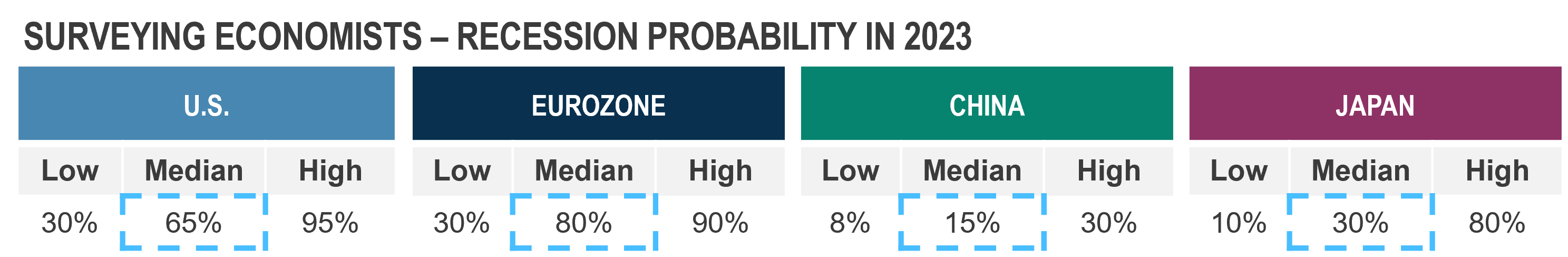

Not surprisingly, economists broadly agree with our expectations. When surveyed by Bloomberg, they collectively anticipate a higher chance for recession in U.S. and Eurozone vs. China and Japan. We do not foresee the U.S. and Eurozone avoiding recession, but instead believe the real question for the market to digest is the severity of the recession.

Markets and recessions

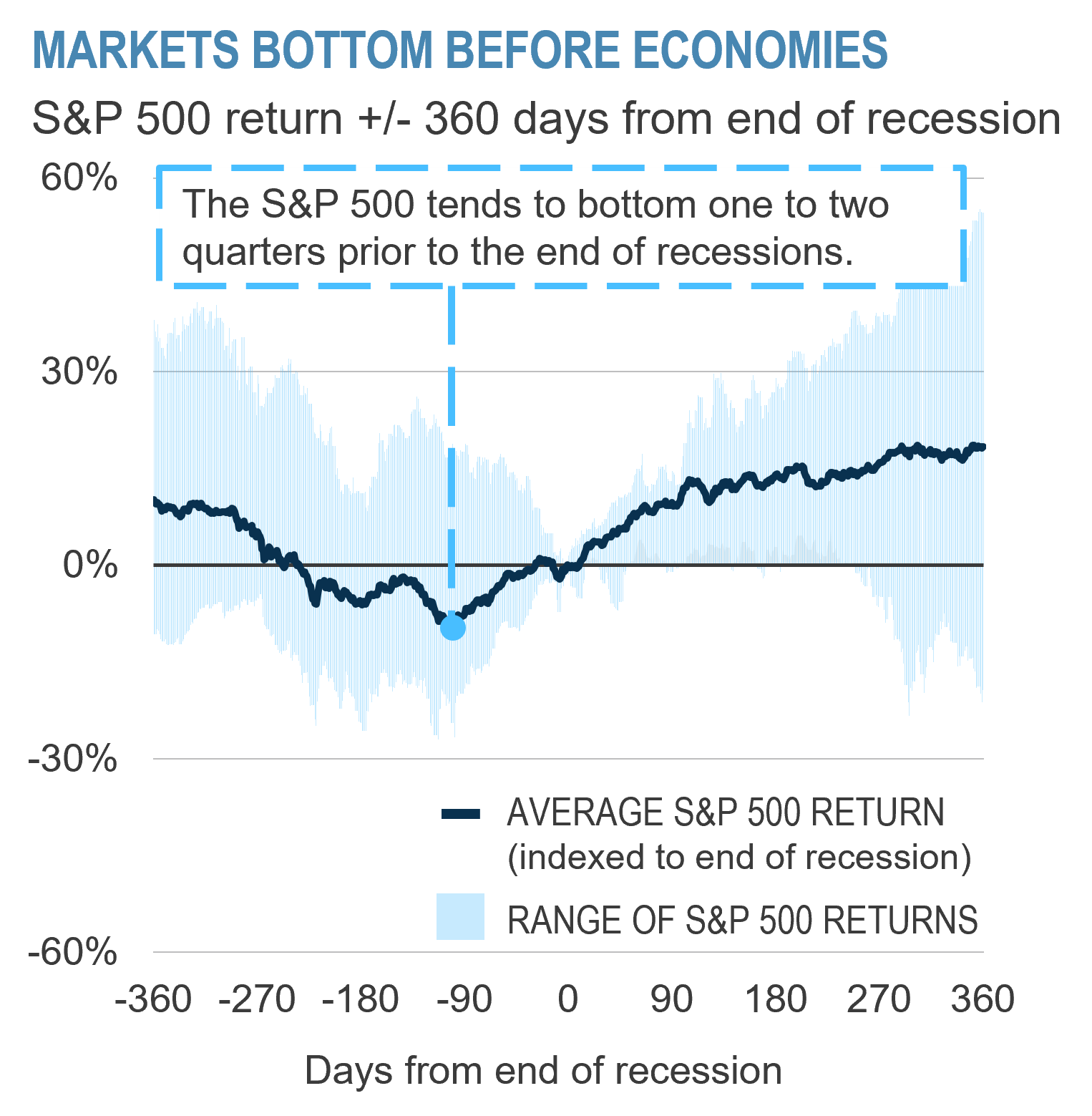

While we expect economies and markets to be challenged in the U.S. and Europe medium-term, it’s vital to keep in mind that equity markets typically bottom as many as two-to-three quarters before economic activity bottoms.

We can envision a scenario where markets bottom around the back half of 2023 before the beginning of new growth and a renewed value-creation cycle. At that point, we could foresee a potential opportunity to reenter markets with greater beta exposure across the board.

Recessions are determined the NBER on a quarterly basis. Source: Bloomberg Finance L.P. Data as of December 31, 2022. Past performance is not necessarily indicative of future results. No assurance can be given that any investment will achieve its objectives or avoid losses.

WHere are the opportunities today?

Given the continued challenges for beta in both the equity and credit markets, we maintain our focus on alpha generation across alternatives strategies.

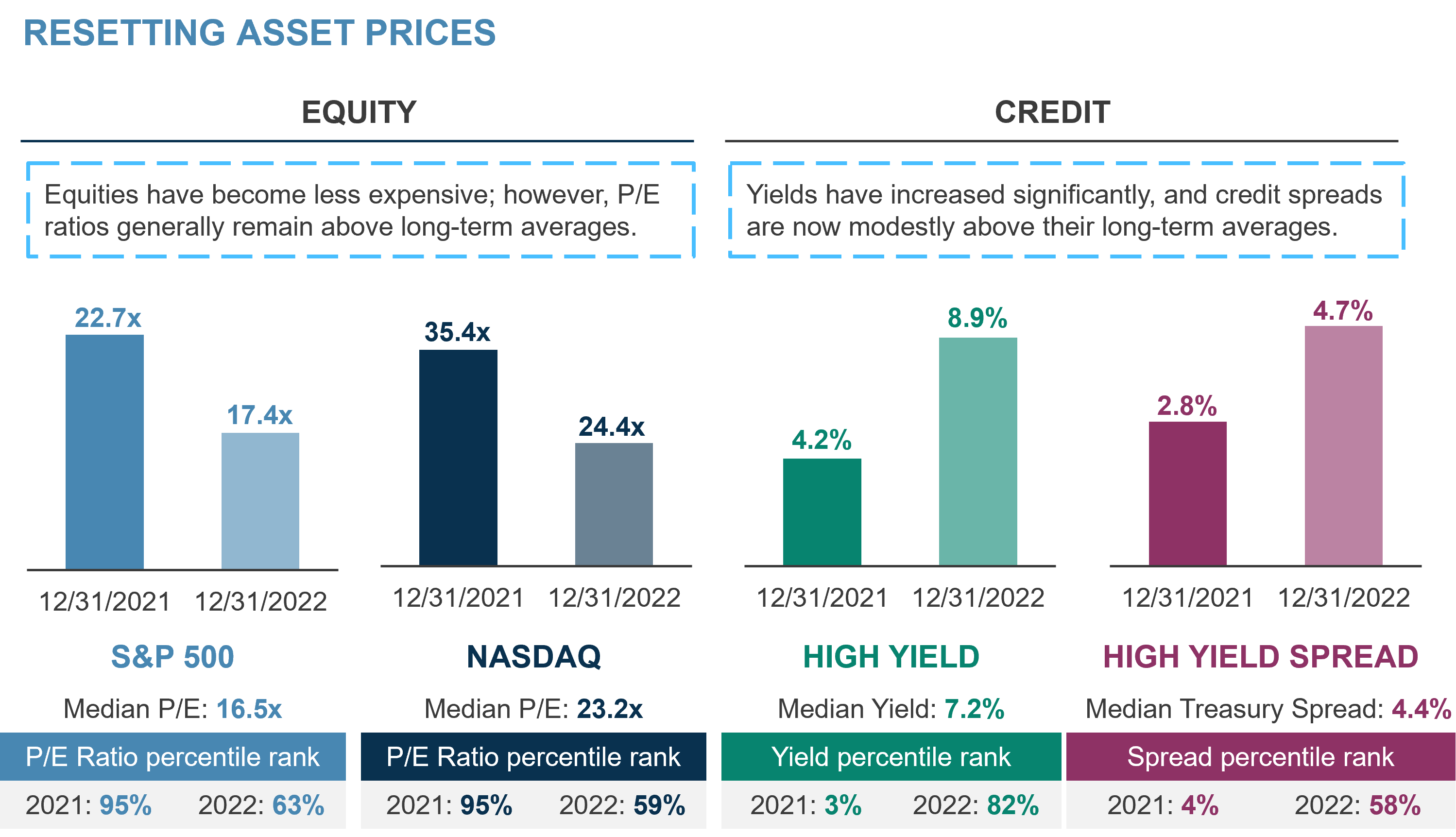

Today, we view credit to be particularly attractive. With base rates rising, recurring volatility and dislocations across markets, and the potential for economic stress in the near-term, we expect a robust and enduring opportunity set in credit across asset types and the liquidity spectrum. Thus, we think it’s wise to implement an opportunistic approach to credit exposure now, with both beta and alpha components.

Percentile ranks for all statistics shown are based on a 20-year look-back period. High yield statistics shown using the Bloomberg U.S. Corporate High Yield Bond Index as the reference index. Source: Bloomberg Finance L.P. Data as of December 31, 2022. Past performance is not necessarily indicative of future results. No assurance can be given that any investment will achieve its objectives or avoid losses.

We are also focusing our attention on real assets, which can offer potential inflation protection, stable yield, and long term growth for portfolios. In infrastructure, we’re excited by the growing secondaries market, which offers an opportunity to capture the aforementioned attributes with J-curve mitigation. In real estate, cap rate dislocation is offering once-in-a-decade attractive entry points to historically attractive sub-sectors.

While equities continue to face headwinds and, despite last year’s market contraction, valuations remain elevated relative to historical averages. To that end, we are focused for the near future on alpha generation and believe there are currently opportunities for equity alpha in a multi-portfolio manager approach to liquid markets, which can benefit from diversification, risk management, and careful portfolio construction. Further, we expect the equity climate may improve in second half of 2023 and into 2024 and are preparing our portfolios to take advantage of the alpha and beta when appropriate.

Finally, in private equity our approach is to continue to favor consistency of deployment across vintages and high levels of diversification – across asset classes, geographies, and investment types (primaries, secondaries and co-investments).

Looking Ahead

While we are approaching 2023 with cautious optimism, the greatest threat to investment performance in our view is the potential for policy error. The actions of central bank programs, as illustrated by the events of 2022, can have a meaningful impact on markets and the value of assets. Consequently, it will be crucial for central banks to balance short-term objectives, such as defeating inflation, with a long-term view in their efforts to avoid a prolonged economic downturn.

In general, however, we are optimistic. Coming out of 2023, we believe markets will enter into a new, productive growth cycle. Until then, we encourage careful and thoughtful participation in risk assets, particularly through an alternatives lens, which can create structural alpha “on top of” investment opportunities. We also remain nimble and flexible in our implementation such that we can capitalize on dislocations and find new opportunities as they arise.

At GCM Grosvenor, we believe our experience and global alternatives platform allow us to identify and capture current opportunities, but also remain patient so we are poised to take advantage of what we believe to be compelling investment opportunities that will arise when growth reignites later in the year and into 2024. We are a cycle-tested firm with experience since 1971, and we believe we will navigate this period of dislocation successfully as we have done in the past.

Looking further out, we believe investors a decade from now will remember 2022-23 not due to capital markets dislocation but instead as a watershed moment in transformative technological developments such as the birth of broadly accessible A.I. and the institutionalization of a wider spectrum of clean energy technology. Only time will tell, but from where we sit, we look forward enthusiastically.

RELATED NEWS AND INSIGHTS

Discipline, Expansion, and Extraction: The Insurer’s Guide to Unlocking Value in Alternatives in 2024

We build on our perspectives from last year and address what we believe are three key themes for insurance investors entering 2024: maintain investment discipline, expand the investment universe, and extract incremental value from capital and partners.

2023 Market Outlook

We explore our expectations for 2023 including the potential opportunities that are emerging from the tumultuous past year in the market.

Important Disclosures

For illustrative and discussion purposes only. The information contained herein is based on information received from third parties. GCM Grosvenor has not independently verified third-party information and makes no representation or warranty as to its accuracy or completeness. The information and opinions expressed are as of the date set forth therein and may not be updated to reflect new information.

Investments in alternatives are speculative and involve substantial risk, including market risks, credit risks, macroeconomic risks, liquidity risks, manager risks, counterparty risks, interest rate risks, and operational risks, and may result in the possible loss of your entire investment. Past performance is not necessarily indicative of future results. The views expressed are for informational purposes only and are not intended to serve as a forecast, a guarantee of future results, investment recommendations or an offer to buy or sell securities by GCM Grosvenor. All expressions of opinion are subject to change without notice in reaction to shifting market, economic, or political conditions. The investment strategies mentioned are not personalized to your financial circumstances or investment objectives, and differences in account size, the timing of transactions and market conditions prevailing at the time of investment may lead to different results. Certain information included herein may have been provided parties not affiliated with GCM Grosvenor. GCM Grosvenor has not independently verified such information and makes no representation or warranty as to its accuracy or completeness.