Unlocking Infrastructure’s Full Potential Through Co-Investing

This article explores how co-investing is shaping infrastructure portfolios across Europe, seeking to provide long-term value in critical sectors.

Past performance is not necessarily indicative of future results. No assurance can be given that any investment will achieve its given objectives or avoid losses. Unless apparent from context, all statements herein represent GCM Grosvenor’s opinion.

Over the past decade, the need for higher levels of infrastructure spending in developed nations has become increasingly apparent. Investment in infrastructure as a percentage of GDP has been on the decline in many countries. This “infrastructure gap” is well documented; studies have shown that, over the next two decades, developed nations will require a substantial investment in infrastructure to support and promote economic growth.1

In assessing the global need for new or improved infrastructure, and the enormous amount of capital required to fund these initiatives, we believe there is a compelling opportunity for private investors with a long-term horizon.

The market has become more established, with a larger amount of infrastructure assets in the hands of private investors than ever before. Advancing technologies (e.g., renewable energy, fiber optics), changing consumer behavior (e.g., the cloud, Internet of Things, etc.) and evolving revenue models (e.g., video on demand) have spurred new investment opportunities in infrastructure for private investors, including data centers, managed lanes and LNG. In addition, the ongoing global population migration from rural to urban communities is fueling modernization/urbanization trends and increasing pressure on municipal infrastructure around the world.

Looking back over the past decade, several notable developments have fundamentally altered the infrastructure landscape. In the wake of the Global Financial Crisis (which exacerbated longer term public funding imbalances), fiscal pressures caused many governments to further reduce infrastructure spending as a percentage of GDP. At the same time, regulatory capital requirements have increased, causing many banks to curtail their long-term financing activities. Due in part to the financial crisis, many investors began diversifying their portfolios by reducing exposure to traditional stocks and bonds while increasing allocations to alternative investments. Finally, persistently low global interest rates have spurred investors to seek alternative sources of yield with as low a risk profile as possible.

Thus, the current environment is one in which infrastructure projects have become more dependent upon the private sector for funding. Institutional investors and their consultants have embraced infrastructure as a distinct asset class they believe can generate attractive risk-adjusted returns and provide portfolio diversification benefits. Compared to many other asset classes, however, infrastructure is still in its relative infancy.

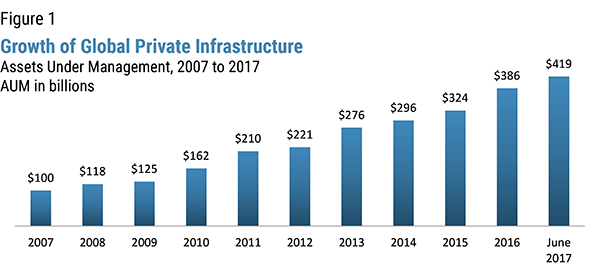

As shown in Figure 1, the global private infrastructure market has experienced robust growth since 2007.3 However, infrastructure continues to represent a relatively small portion of investors’ portfolios, and we believe there is substantial room for further growth.

A number of factors may account for this heightened interest. Despite the growing acceptance of infrastructure as an asset class, relative to private equity and real estate, fewer investors have historically made allocations to infrastructure. Furthermore, of those that have elected to make allocations, a large percentage of infrastructure investors remain below their targets.

Another factor driving this growth is the extraordinarily low level of interest rates since the Global Financial Crisis, which has caused many traditional fixed income investors to look elsewhere in search of long duration assets with enhanced cash yields.

Finally, infrastructure investors have generally been pleased with performance and have enjoyed record levels of distributions in recent years. In order to maintain or increase their exposure, investors have been redeploying these distributions, causing infrastructure managers to hold record levels of dry powder. As such, the demand for infrastructure is not surprising and, we believe, this trend will continue as investors move closer to target allocation levels and/or increase their current targets.

Infrastructure is not a homogenous asset class; there are a variety of assets with a broad spectrum of risk/return profiles. However, some characteristics are common to most infrastructure assets.

Infrastructure often represents an essential asset or the provision of an essential service. These assets may be characterized by high barriers to entry and frequently operate under a regulatory environment with some form of market power. Given the essential service nature of many infrastructure assets, they typically face somewhat inelastic demand and may be relatively insensitive to the general level of economic activity. As a result, they tend to be lowly correlated to other risk assets, making them efficient portfolio risk diversifiers.

Infrastructure assets typically have long duration, which appeals to a broad range of institutional investors, including pension funds, insurance companies and sovereign wealth funds that have long-term liability funding requirements. These assets are often characterized by relatively stable and predictable cash flows and, hence, are frequently viewed as proxies for fixed income investments.

However, unlike fixed income assets, infrastructure is generally positively correlated with inflation because infrastructure contracts commonly incorporate some type of inflation-linked provision. These assets may provide a hedge and mitigate downside risk in an inflationary environment.

We generally, though not exclusively, focus on the middle market as valuations tend to be lower and competition for assets is less intense. The industry has become increasingly concentrated with a small number of mega funds accounting for a larger percentage of overall fundraising. Dry powder held by the largest funds has been increasing for the past few years, while smaller funds have experienced a decline in these levels.7 As such, we believe that valuations will remain more attractive in the middle market, where mega funds are less active.

Importantly, we are opportunistic investors seeking to leverage our platform to identify the most compelling opportunities. Consequently, we are not beholden to co-investing exclusively with GPs as we have developed an extensive network of corporate sponsors, developers and construction companies who provide us with unique and difficult to source deal flow. From a sector perspective, some of our key areas of focus in the near term lie in power generation (conventional and renewable), communications infrastructure, social infrastructure and transportation. Finally, we believe the infrastructure debt market is becoming more interesting as banks continue to exit the sector given their increased capital requirements.

This article explores how co-investing is shaping infrastructure portfolios across Europe, seeking to provide long-term value in critical sectors.

New York, (January 28, 2025) —CION Investments (CION), a leading alternative investment solutions platform, and GCM Grosvenor, (NASDAQ: GCMG), a global alternative asset management solutions provider, are pleased to announce

Note: Infrastructure investments are exposed to risks associated with changes in the availability or price of inputs necessary, including but not limited to, electricity and fuel, for the operation and/or construction of infrastructure assets as well as events outside the control of the investor. The operation and maintenance of infrastructure assets involve various risks and is subject to substantial regulation and such operation and maintenance may be delegated to a third party unaffiliated with the investment and the failure of such third-party to perform its duties could have an adverse impact on the investment. Infrastructure projects are especially sensitive to government regulations and such regulations may add additional costs that would be indirectly borne, in part, by investors.

Sources:

1. A McKinsey study in 2016 estimated US$3.3 trillion needs to be invested each year to 2030 in order to support current growth rates. This represents a current annual shortfall of approximately $800 billion. McKinsey Global Institute “Bridging Global Infrastructure Gaps” June 2016.

2. Preqin. 2018 Preqin Global Infrastructure Report. p. 72.

3. Preqin P.12

4. Preqin. p. 80.

5. Preqin. p. 13.

6. Preqin. p. 69.

7. Preqin. p. 22. Dry powder held by mega funds (defined as >$2B in commitments) has increased each year since 2015 while dry powder held by funds <$1B in commitment dropped from 41% to 28% over the same time period.

Important Disclosures:

Past performance is not necessarily indicative of future results. No assurance can be given that any investment will achieve its objectives or avoid losses. Investments in alternatives are speculative and involve substantial risk, including strategy risks, manager risks, market risks, and structural/operational risks, and may result in the possible loss of your entire investment. Past performance is not necessarily indicative of future results. The views expressed are for informational purposes only and are not intended to serve as a forecast, a guarantee of future results, investment recommendations or an offer to buy or sell securities by GCM Grosvenor. All expressions of opinion are subject to change without notice in reaction to shifting market, economic, or political conditions. The investment strategies mentioned are not personalized to your financial circumstances or investment objectives, and differences in account size, the timing of transactions and market conditions prevailing at the time of investment may lead to different results. Certain information included herein may have been provided by parties not affiliated with GCM Grosvenor. GCM Grosvenor has not independently verified such information and makes no representation or warranty as to its accuracy or completeness.

GCM Investments UK LLP (GCMUK) has been made aware of fraudulent schemes targeting members of the public in the United Kingdom.

Unauthorised individuals are falsely claiming to represent GCMUK and are misusing the firm’s name and publicly available information in connection with fake investment opportunities.

These scams are sophisticated and deliberately misleading. They may involve the use of real GCMUK employee names and may imitate the tone, format, and branding of genuine GCMUK communications.

Please note:

GCMUK does not offer financial services or products to retail clients, either directly or through third parties. You can verify GCMUK’s regulatory status and permissions on the Financial Conduct Authority (FCA) Register at register.fca.org.uk.

If you are based in the UK and believe you have been contacted by a fraudster claiming to represent GCMUK, please take the following steps:

Investor Scam Alert

GCM Grosvenor L.P. and its affiliated entities (collectively, “GCMG”) have been made aware of fraudulent schemes currently targeting members of the public in Malaysia and Hong Kong, in which unauthorised individuals are falsely claiming to represent GCMG in connection with purported investment opportunities.

These fraudulent individuals are believed to be actively promoting false investment opportunities, often involving mobile applications, through the unauthorised use of GCMG’s name, brand, corporate logo, and other identifying materials. We have also received reports that these parties may be distributing fabricated business cards, hosting online webinars, creating WhatsApp groups, and arranging personal video calls to simulate legitimacy. These scams are sophisticated and deliberately misleading, frequently involving the use of real GCMG employee names and imitating the style, tone, and presentation of genuine GCMG communications.

GCMG has no presence, operations, or authorised representatives in Malaysia. GCMG does not offer any investment schemes, products, or mobile applications targeted at Malaysian investors, either directly or indirectly.

While GCMG maintains a legitimate presence and employs personnel in Hong Kong, these scams are entirely unauthorised and unrelated to any genuine activities conducted by GCMG or its employees in the region.

Position of GCMG

GCMG has neither authorised nor endorsed any such solicitations and takes this matter seriously. We have reported some of these incidents to the relevant regulatory and enforcement authorities in Malaysia, and are doing the same in Hong Kong, including notifying the Hong Kong Police and the appropriate financial regulators. GCMG will continue to assist with their investigations.

GCMG is actively monitoring these developments and reserves all rights to take legal action against any party found misusing its name, brand, or intellectual property.

While these reports currently centre on activity in Malaysia and Hong Kong, the methods used may be replicated in other jurisdictions. GCMG continues to monitor for similar risks globally.

Unauthorized individuals are impersonating Winston Chow in scams targeting investors, particularly in Malaysia. He does not solicit investments directly in Asia. If you are contacted by someone claiming to be him outside of official channels, please report it to local authorities.

For verification or further information, please contact: [email protected]

Investor Scam Alert

Unauthorized individuals are impersonating Winston Chow in scams targeting investors, particularly in Malaysia. He does not solicit investments directly in Asia. If you are contacted by someone claiming to be him outside of official channels, please report it to local authorities.

For verification or further information, please contact: [email protected]

We offer clients a broad range of tailored solutions across strategies, including multi-strategy, macro, relative value, long/short equity, quantitative strategies, and opportunistic credit. Levaraging our large scale and presence in the industry, we are able to offer clients preferntial exposure to hard-to-access managers and seek to obtain terms that can drive economic and structural advantages.