The Rise of GP Seeding as an Institutional Asset Class

Past performance is not necessarily indicative of future results. No assurance can be given that any investment will achieve its given objectives or avoid losses. Unless apparent from context, all statements herein represent GCM Grosvenor’s opinion.

Select risks include: macroeconomic risk, sourcing risk, investment selection, portfolio diversification, management risk, execution of value creation plan, risks related to reliance on third parties, and risks related to the sale of investments.

SUMMARY

As the sponsor solutions market has developed, institutional investors have been increasingly focused on maintaining long-term alignment with GPs and ensuring that minority investments serve to facilitate firm growth and success for the benefit of LPs. Against that backdrop, GP seeding is playing a role of growing importance and, we believe, establishing itself as a key asset class within the private equity industry.

Introduction

The rise of GP seeding and stakes strategies over the course of the last decade – part of the “sponsor solutions” investment class more broadly – has had a meaningful impact on the evolution of the private equity industry in a relatively short period of time. While sponsor solutions activity is relevant for both public and private markets asset managers across asset classes, this piece will focus on recent developments within the private equity industry, with an emphasis on GP seeding activity.

In recent years, institutional investors have increasingly recognized the value being created at the asset manager (or management company)-level rather than focusing exclusively on returns generated from limited partner and co-investment capital commitments. Seed and stakes investors recognize an opportunity to participate as minority owners in stable and predictable cash flows across management fees, carried interest, and balance sheet investments over a long duration. This trend is evident, with $60+ billion raised to date to acquire GP stakes of established private equity firms, with recent high-profile examples including Vista, Vistria, Clearlake, Dragoneer, TSG Consumer, Veritas, H.I.G., and L Catterton.

GP SEEDING DEFINED

GP seeding refers to minority investments in the management companies of emerging asset managers (often defined as Funds I-III), commonly structured as either a revenue share or common equity interest. Seed capital is typically comprised of a combination of anchor LP capital, co-investment capital, and occasionally working capital, in exchange for which a seed investor receives a minority interest in the given asset manager. The duration and structure of seed deals are highly idiosyncratic and negotiated relative to the bespoke nature of each GP, but often range from initial management company participation interests of 10-25% in today’s market. Unlike a typical anchor LP commitment, because seed investors participate at the management company-level, they may participate in management fees and/or carried interest from current and future funds and any other cash flows that accrue to the management company.

History and Evolution of GP Seeding

The history of GP seeding dates back multi-decades for single family offices, while institutional applications have largely developed over the last decade. In an institutional context, early iterations of GP seeding were often subscale and aggressively structured financing solutions whereby GPs were provided a relatively small quantum of capital in exchange for large percentage interests in the management company. This made it difficult for GPs to attract or retain high-quality teams and achieve long-term success. These early structures were often viewed by LPs as misaligned with LP interests and generated concerns around seeding as a proxy for adverse selection.

As the sponsor solutions market has evolved, sophisticated seed providers have developed solutions to provide thoughtfully structured scale capital as well as non-investment infrastructure support services to accelerate the growth and success of emerging asset managers while maintaining long-term alignment with LPs. This evolved GP seeding model has unlocked a desirable path for many successful emerging managers who seek a long-term strategic partner to accelerate growth. The right partner is especially sought after in the current market environment due to successive bouts of uncertainty from COVID-19, geopolitical tensions, and an interest rate/inflationary paradigm reset. Emerging managers often face significant headwinds for capital formation, with recent data showing that top-tier managers have spent an average of over two years raising their inaugural fund without significant working capital and operational support. This hampers their growth as it affects the firm’s opportunity to hire top talent and pursue attractive transactions.

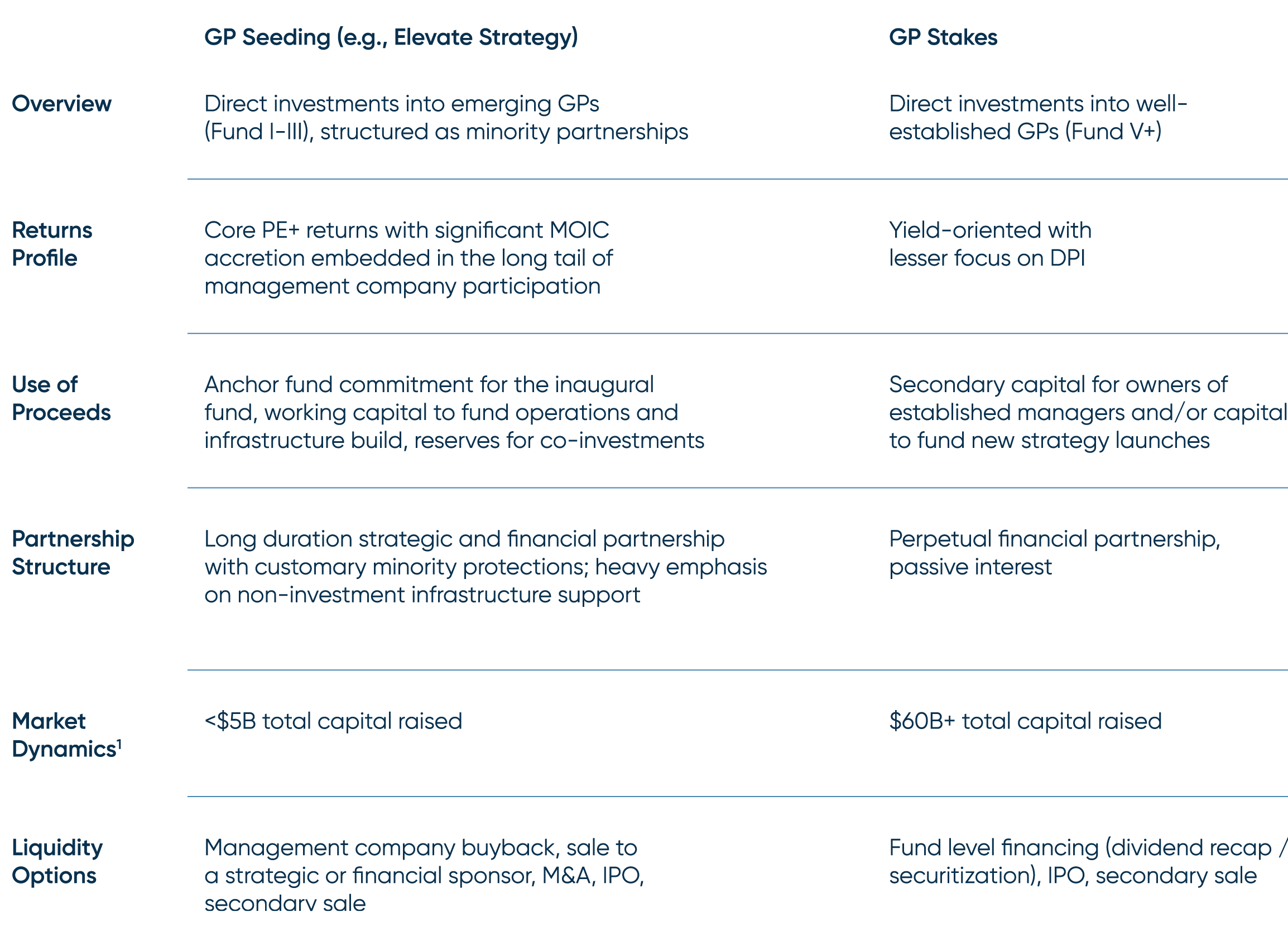

GP Seeding versus Stakes Investing

GP seeding is often mentioned alongside GP stakes investing. While both entail acquiring minority interests in the management companies of asset managers, stakes investing generally refers to a focus on more established firms (Fund IV+), with an established base of $2+ billion in AUM. In addition, seeding and staking are different in material respects including duration, return profile, use of proceeds, and opportunity set, among other key criteria.

COMPARISON OF GP SOLUTIONS

- Source: Market Research and PitchBook, “Analyst Note: The GP Staking Competitive Environment,” Q3 2020.

Current Market Dynamics for GP Seeding

We believe today’s macroenvironment is an opportune moment for GP seeding, as each significant economic dislocation over the past 30 years has spurred extensive fund formation and the next great class of emerging managers. However, the highly challenging fundraising environment makes capital a scarce and precious resource. Combined with low and mid-market performance data, the current market is favorable for seed providers in a position to provide scale capital and operational support to experienced investors who are founding firms for the first time.

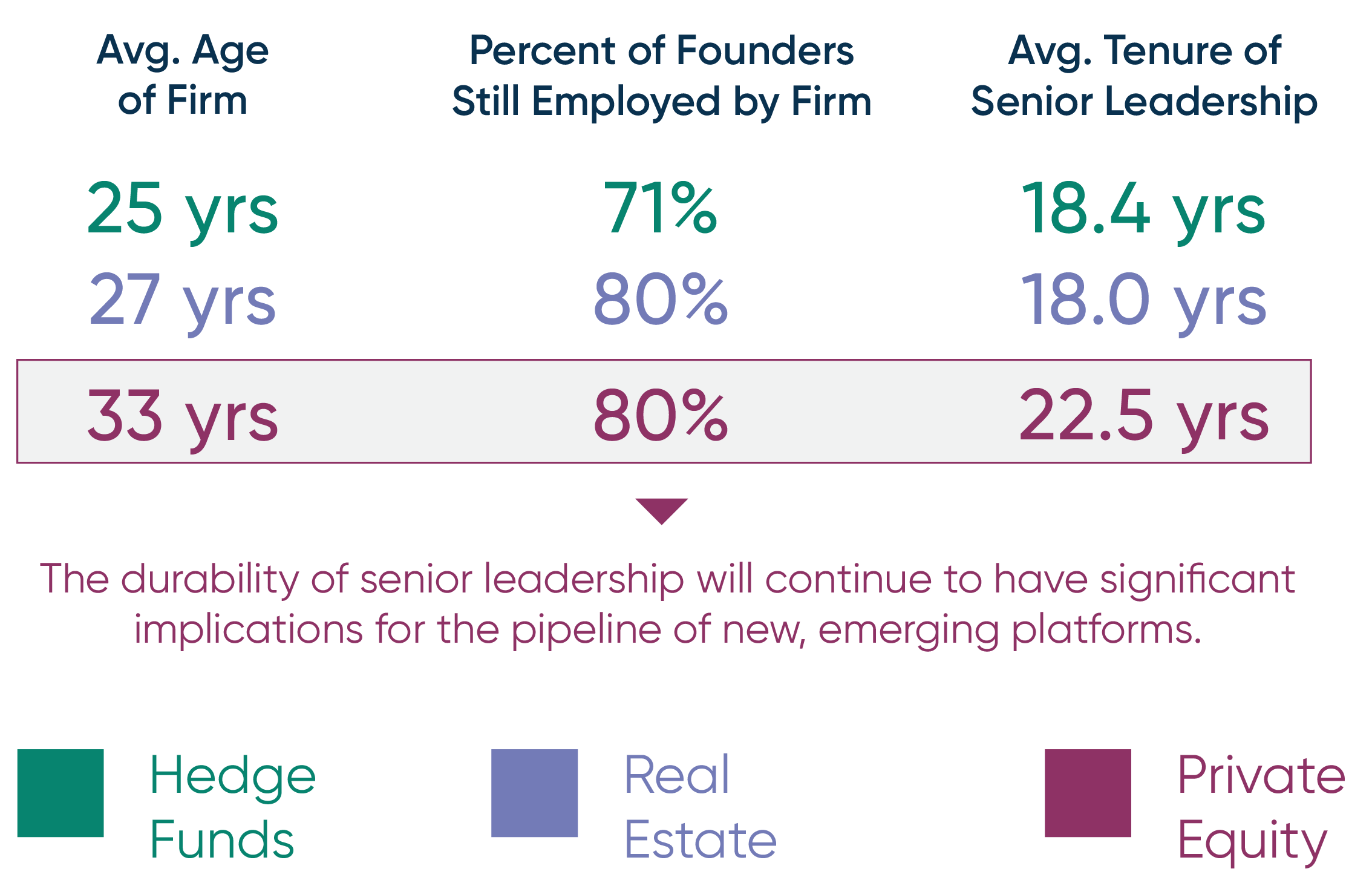

Beyond economic drivers, the maturation of the alternatives industry continues to support a proliferation of spinouts, as does a lack of succession planning at many top firms. Many of the most high-profile spinouts of the last few years have been the result of these factors. As a result, there are now numerous experienced, tenured teams seeking to scale their own firms, several of whom have partnered with institutional seed investors to launch.

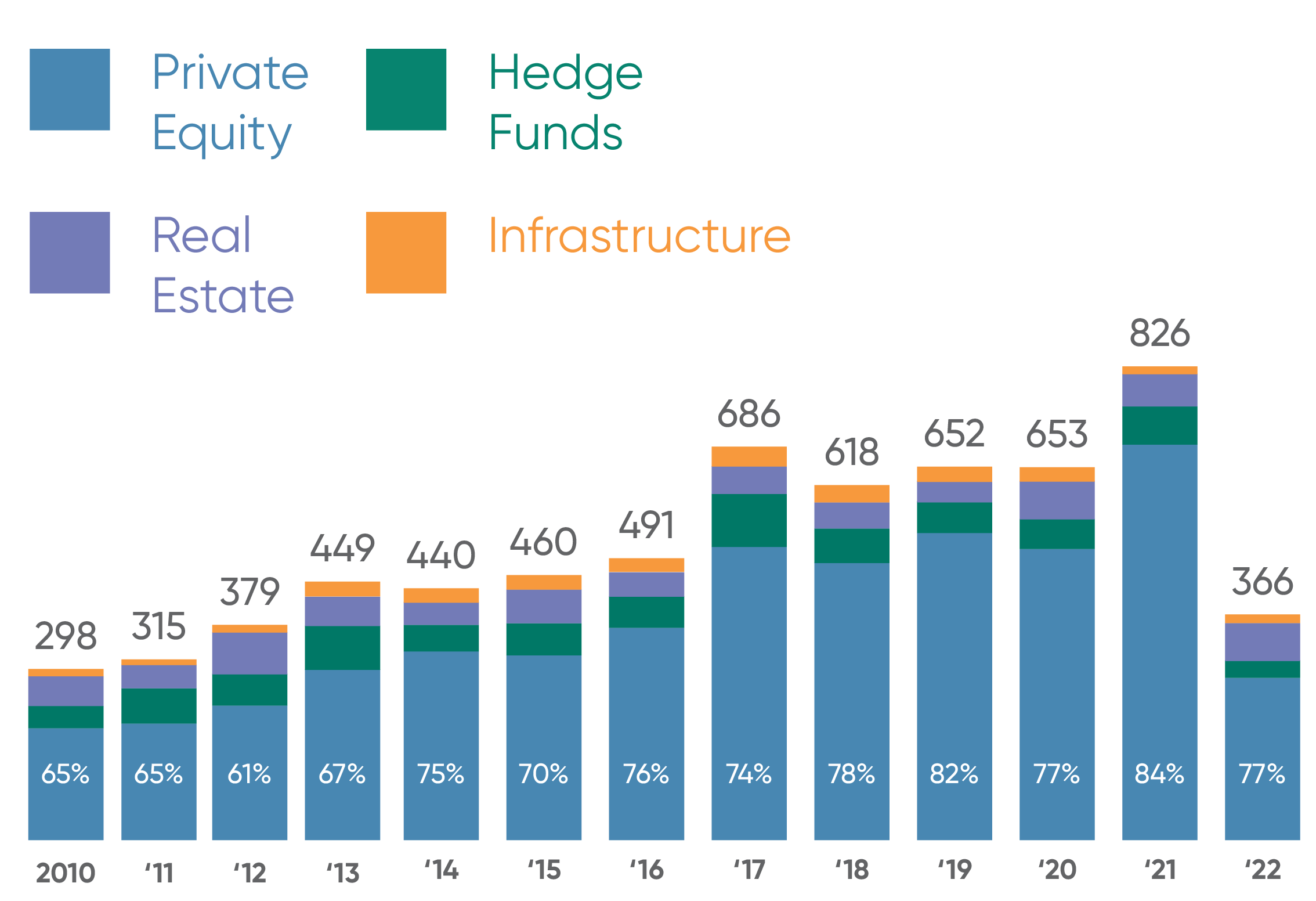

NUMBER OF EMERGING MANAGER FUNDS

RAISED BY VINTAGE YEAR 2

2. Data weighted by fund count.

Sources: Preqin (as of May 2023). Hedge Fund Research (as of May 2023), GCM Grosvenor proprietary databases (as of May 2023). Includes North American funds with vintages from 2010-2022.

SUCESSION PLANNING DYNAMICS

EXPERIENCE 3

3. Source: Data from senior leadership teams across the top 25 private equity, hedge fund, and real estate asset managers by AUM (as of May 2023).

Assessing Opportunity and Alignment in GP Seeding Structures

As the private equity industry matures and the largest firms continue to experience compression of returns, there is a need for a capital solution that supports and accelerates the success of experienced investors turned emerging GPs. In addition, under the right partnership model, seed investors can bring expertise to bear that fosters a GP’s institutionalization as a business.

For GPs, evolution in structuring seed investments means that they have an opportunity to gain the benefits of a scaled partner’s capital and resources, while maintaining a material portion of the upside from growing their business. Common reasons emerging managers pursue a seeding partnership include:

- Large commitment of capital at inception signals early momentum

- Access to co-investment capital to execute early deals at scale

- Access to working capital to support early hiring and operational build

- Access to free or low-cost support for capital formation and non-investment infrastructure advisory services across IT, legal, cybersecurity, finance operations, etc.

- Halo effect from institutional capital provides critical validation to the manager in a highly competitive market for capital and talent

For LPs, one of the most compelling cases for seeding is historical data that demonstrates outperformance of earlier fund vintages. Based on aggregated data for buyout funds, a Fund I net IRR outperforms established private equity funds by an average of ~280bps4. Therefore, investing in a first fund alongside a management company investment can offer LPs a doubly compelling return opportunity.

4. Sources: Preqin Pro as of May 2023. Data represents Buyout funds with vintages from 2000-2019. First-time funds defined as first number fund (overall), SEM funds defined as I-III number fund (overall), and established funds defined as IV+ number fund (overall). Sector specialist defined as non-diversified focus for Core Industries. Past performance is not necessarily indicative of future results. No assurance can be given that any investment will achieve its objectives or avoid losses.

CONCLUSION

The rise of GP seeding is a natural result of the maturation of the private equity industry. It represents an opportunity to support higher returns and new firm formation for the best investment talent while providing an opportunity for LPs to participate in the value being created as firms grow and evolve. Given the rapid evolution of the GP stakes market to date, we expect that GP seeding will follow a similar path in the coming years with more efficient markets and allocation of capital in the emerging manager end of the spectrum to follow.

RELATED NEWS AND INSIGHTS

How an $80B Asset Manager Seeds the Growth of New GP Talent

Elizabeth Browne dives deep into the area of GP seeding, explaining how it differs from traditional LP investing and its vital role in supporting emerging managers.

Real Estate Program Aims To Broaden Opportunity Set

Hear from our Head of Real Estate, Peter Braffman, and his counterpart at the New Jersey Division of Investment (NJDOI), Kevin Higgins, on how our real estate emerging manager partnership allows NJDOI to access investment opportunities previously unavailable to them due to their scale.

Important Disclosures

For illustrative and discussion purposes only. No assurance can be given that any investment will achieve its objectives or avoid losses. The information and opinions expressed are as of the date set forth therein and may not be updated to reflect new information.

Investments in alternatives are speculative and involve substantial risk, including strategy risks, manager risks, market risks, and structural/ operational risks, and may result in the possible loss of your entire investment. The views expressed are for informational purposes only and are not intended to serve as a forecast, a guarantee of future results, investment recommendations, or an offer to buy or sell securities by GCM Grosvenor. All expressions of opinion are subject to change without notice in reaction to shifting market, economic, or political conditions. The investment strategies mentioned are not personalized to your financial circumstances or investment objectives, and differences in account size, the timing of transactions, and market conditions prevailing at the time of investment may lead to different results. Certain information included herein may have been provided by parties not affiliated with GCM Grosvenor. GCM Grosvenor has not independently verified such information and makes no representation or warranty as to its accuracy or completeness.