2024 Market Outlook: Can Alternatives Offer Investors a Path Towards Normalcy?

Past performance is not necessarily indicative of future results. No assurance can be given that any investment will achieve its given objectives or avoid losses. Unless apparent from context, all statements herein represent GCM Grosvenor’s opinion.

Select risks include: market risk, macroeconomic risk, manager risk, liquidity risk, interest rate risk, and operational risk.

Introduction

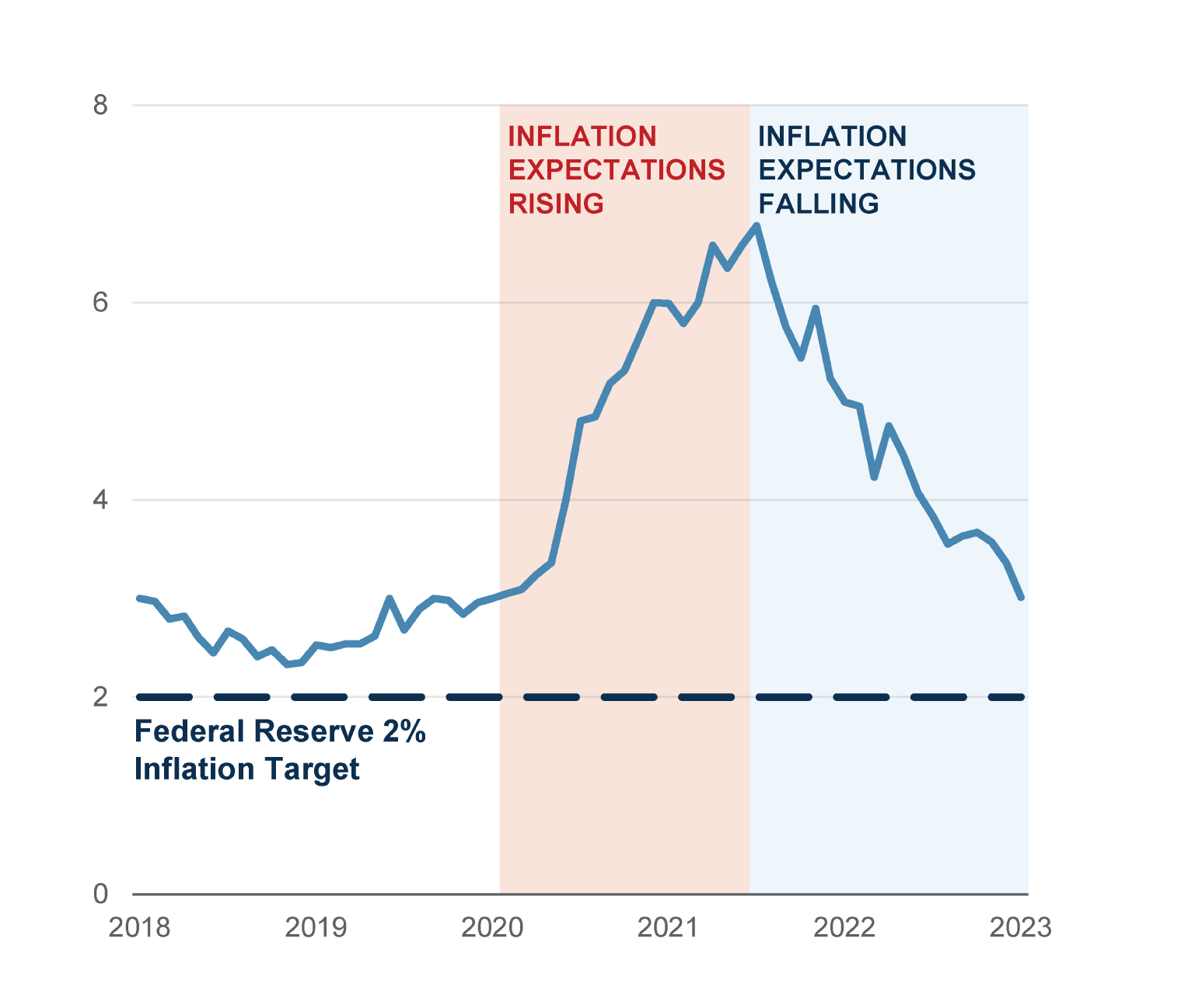

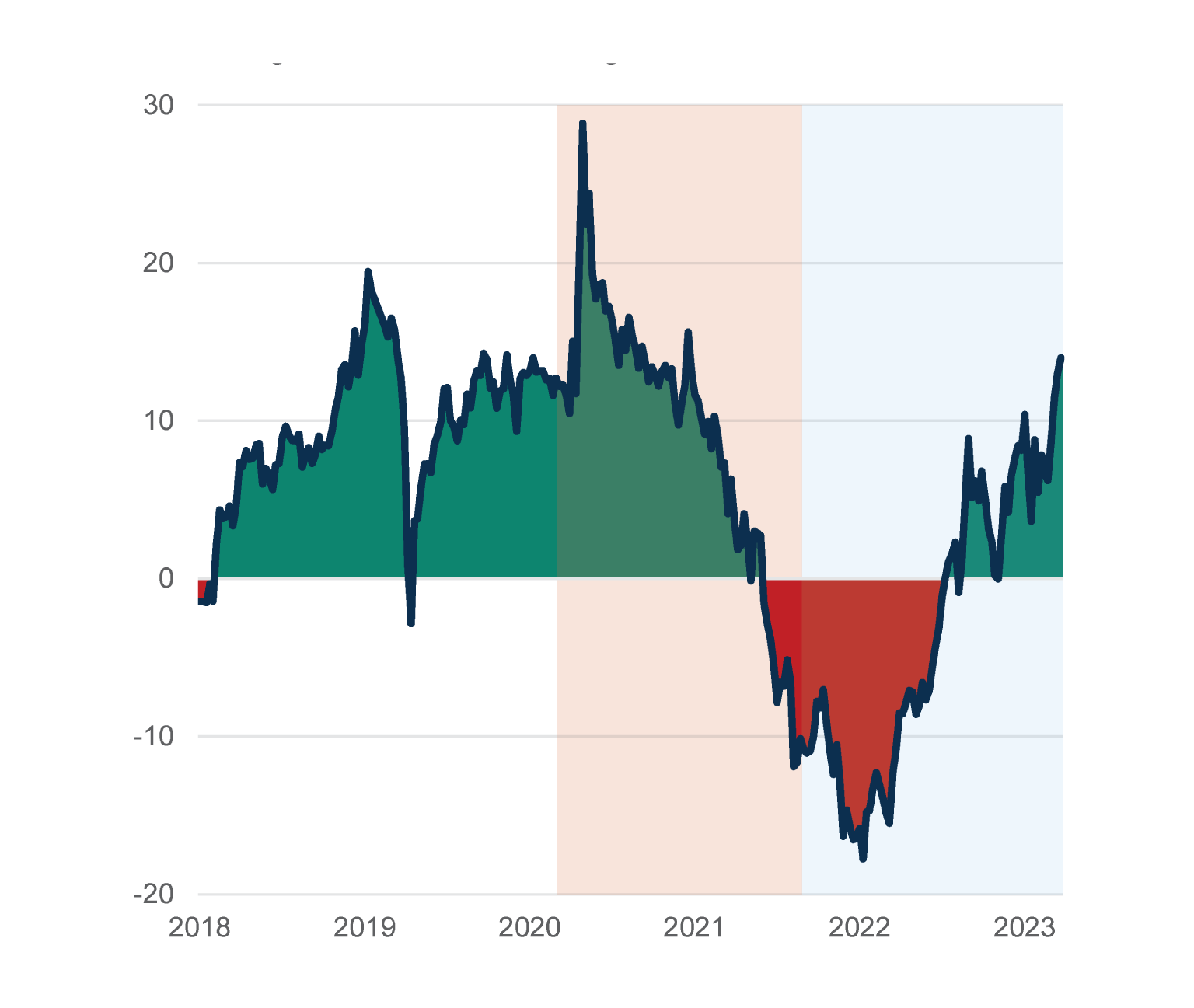

Last year we predicted that inflation would be a key economic driver for the economy in 2023 and that markets would improve in the second half of the year as investors gained clarity around rates. This played out as we expected, with a significant rally in Q4 2023 in global equity and bond markets. As Figure 1 illustrates, when inflation expectations were high there was negative performance across credit and equity markets, and when expectations fell the credit and equity markets rallied in unison.

Median U.S. Consumer Inflation Expectations (1yr fwd)

DROVE THE SHARE DECLINE AND SUBSEQUENT

REBOUND IN RISK ASSETS

Bloomberg U.S. 60/40 Trailing 12mo ROR

Figure 1

Data source: Bloomberg Finance, L.P. Data as of January 2, 2024.

Rising / falling inflation is defined as periods where the year ahead inflation expectations are above / below their levels 12mo’s prior and either the beginning or ending inflation expectation was in excess of 3%.

Inflation remains a key driver for the economy

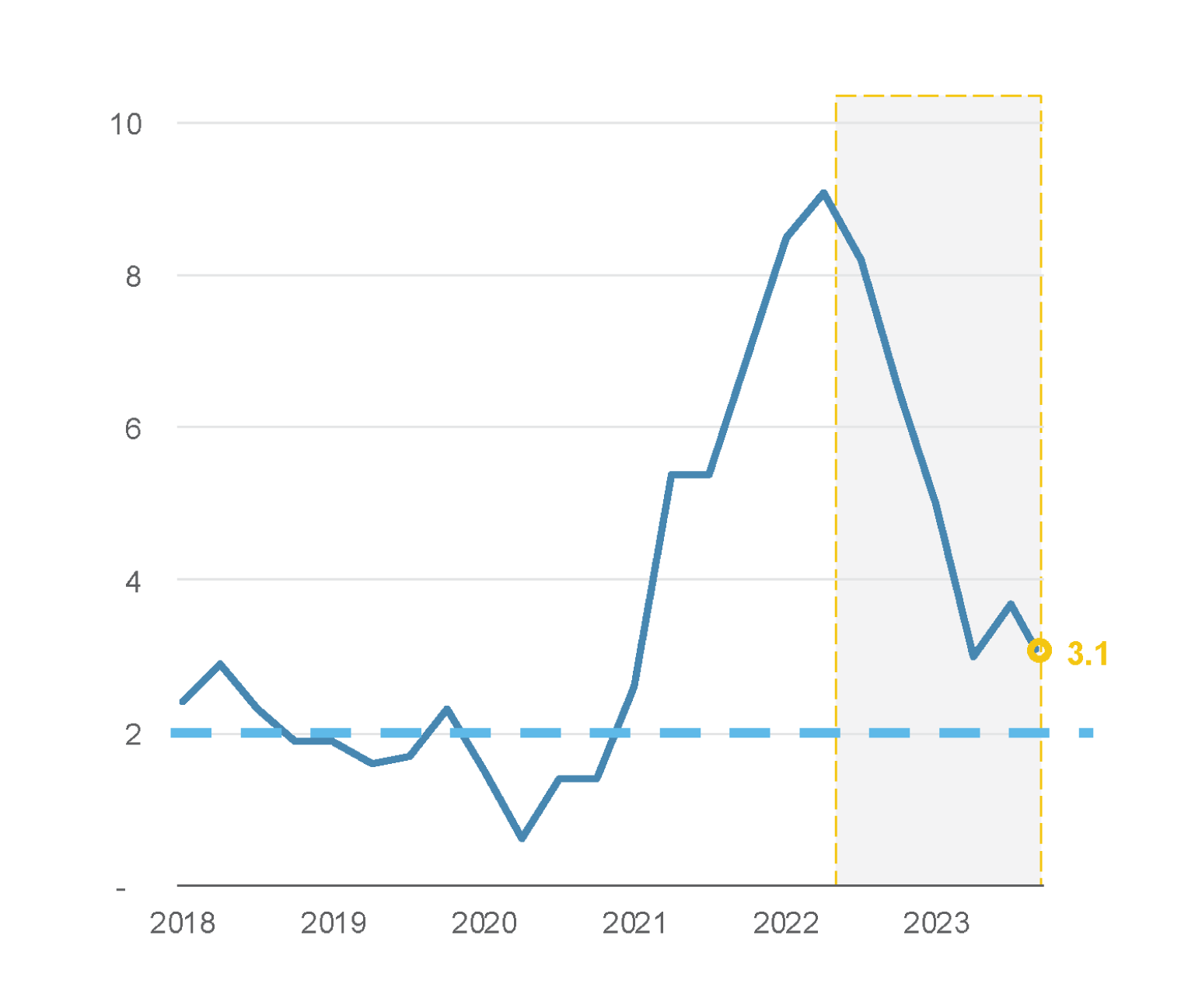

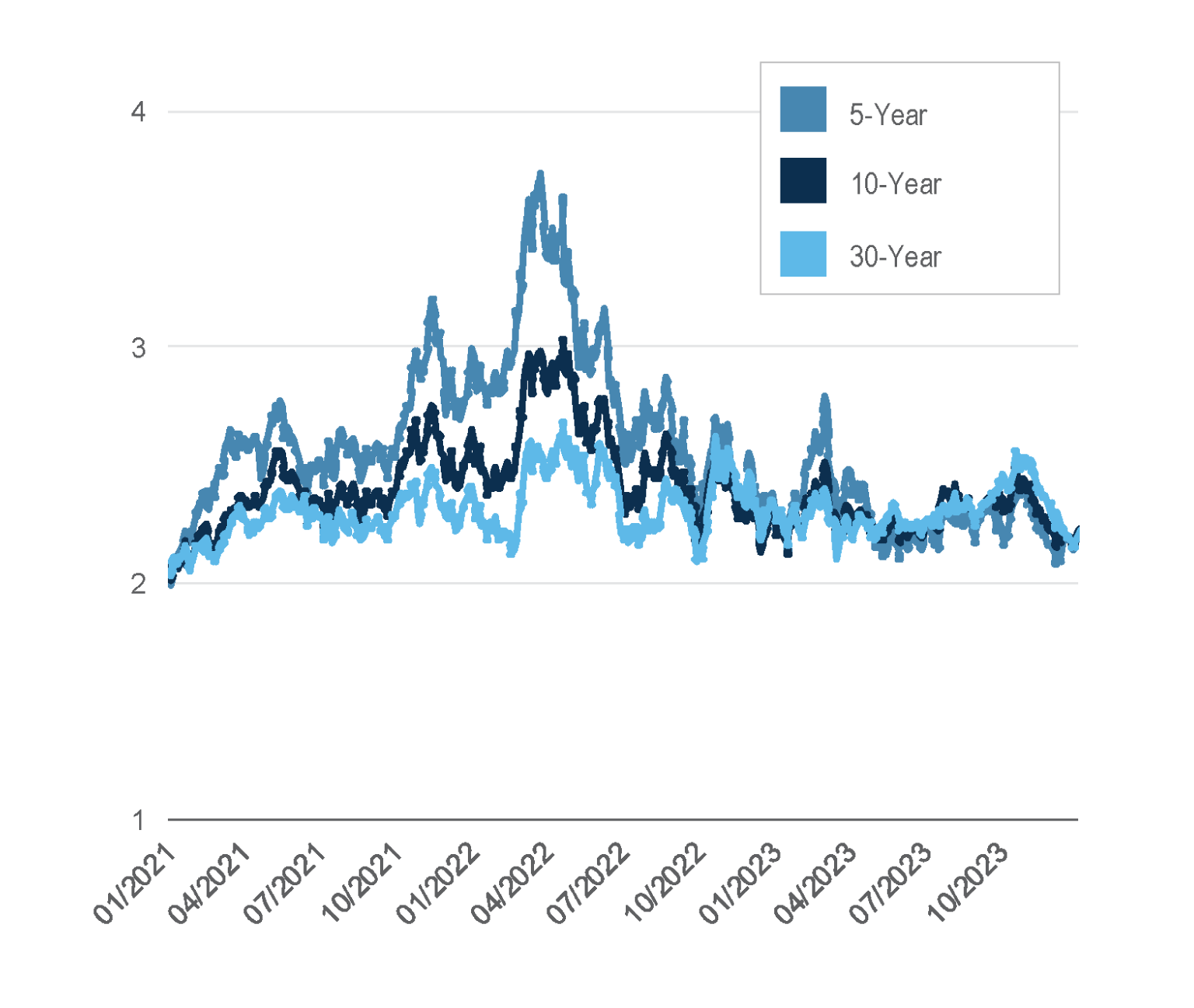

We believe inflation expectations are still the dominant force in driving markets in 2024, which leads to the natural question – is inflation under control? In Figure 2 we see inflation trending downward, with CPI declining drastically and breakeven inflation rates lowering after a spike in 2022.

INFLATION HAS COOLED SIGNIFICANTLY

FOLLOWING THE SURGE IN 2021-2022

CPI YoY % Change (2018-2023)

U.S. BREAKEVEN INFLATION RATES SPIKED THEN

CAME DOWN

Forward Implied Inflation Expectations

Figure 2

Data source: Bloomberg Finance, L.P. Data as of January 2, 2024.

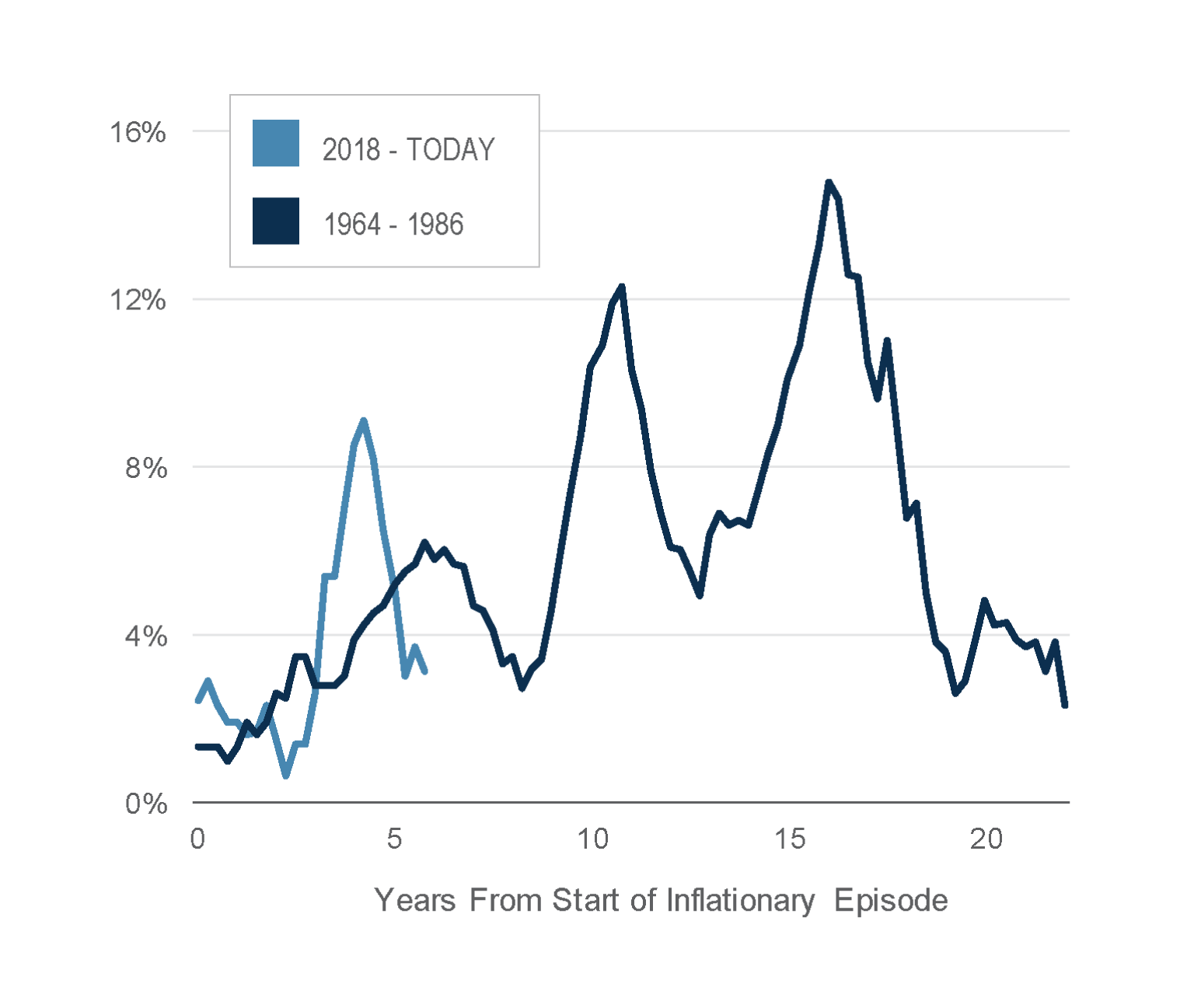

That said, history indicates that it is preemptive to declare victory. When looking at 1964-1986, the last period of a significant resurgence in inflation, year-over-year CPI seemed to be under control in the early phase of that cycle as well but then spiked again even higher.

INFLATION CONTINUED TO

RESURGE IN PREVIOUS CYCLES

CPI YoY Change (2018-2023 AND 1964-1986)

YEARS FROM START OF

INFLATIONARY EPISODE

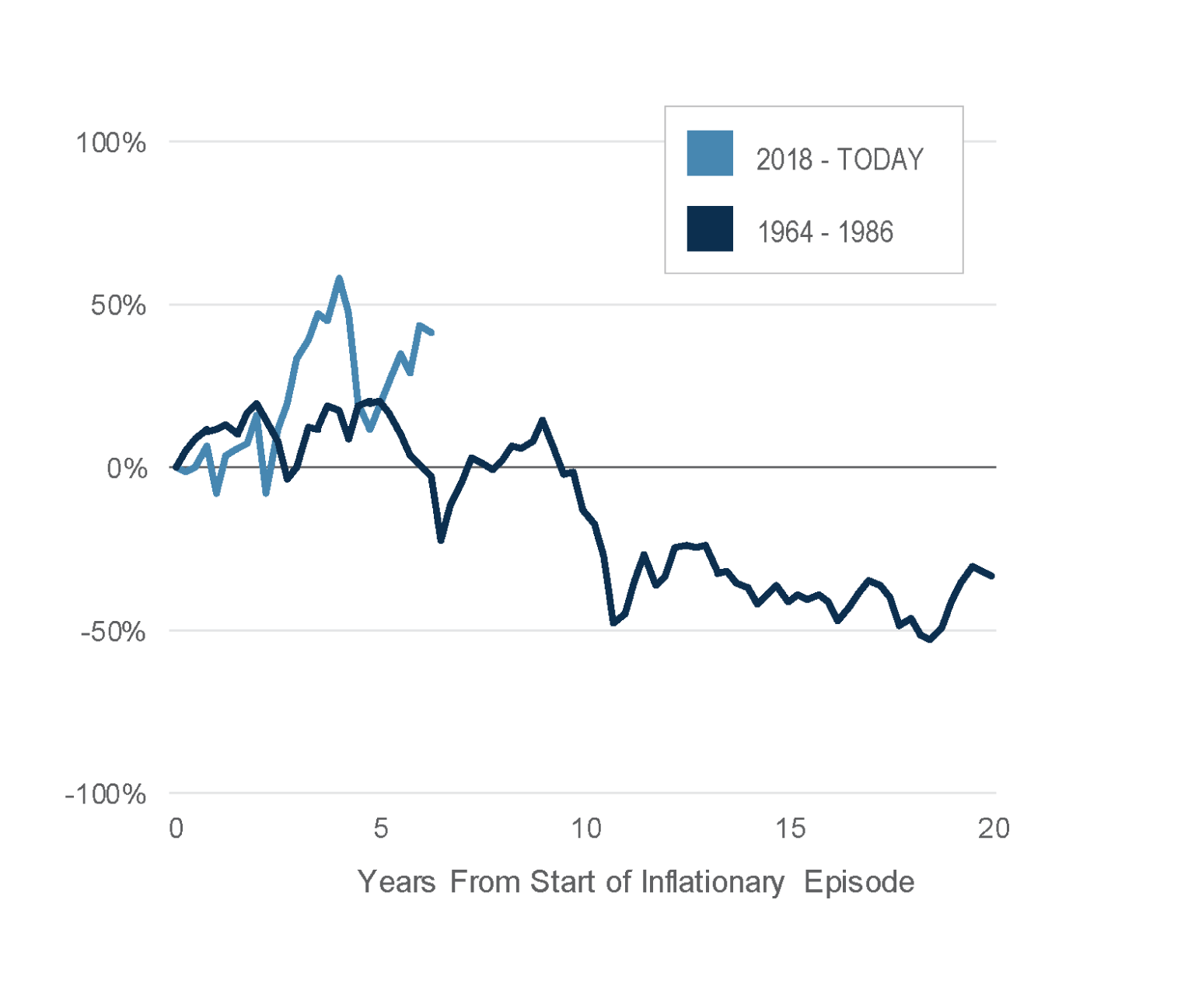

Inflation Adjusted S&P 500 Return (2018-2023 and 1964-1986)

Figure 3

Data source: Bloomberg Finance, L.P. Data as of January 2, 2024.

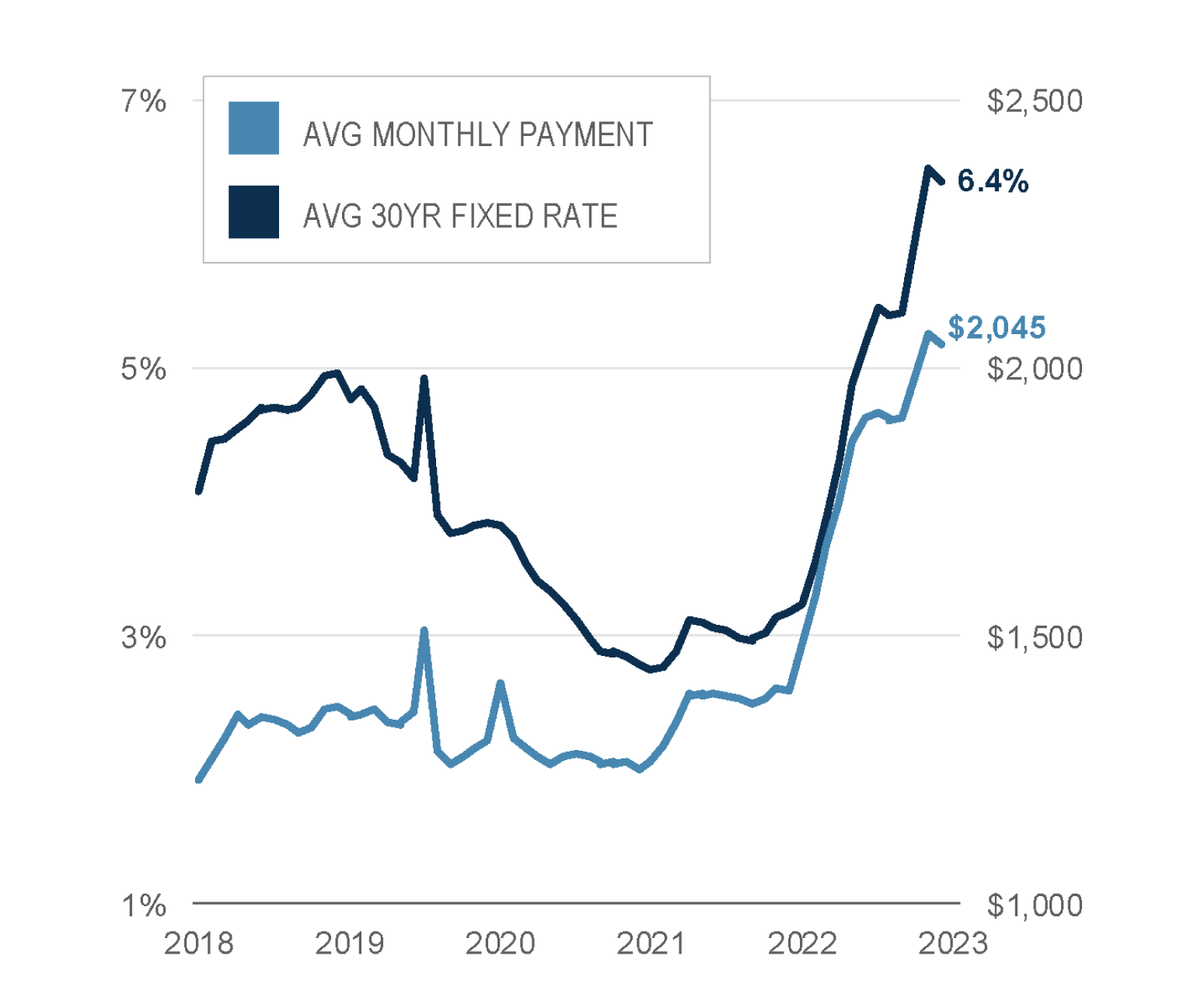

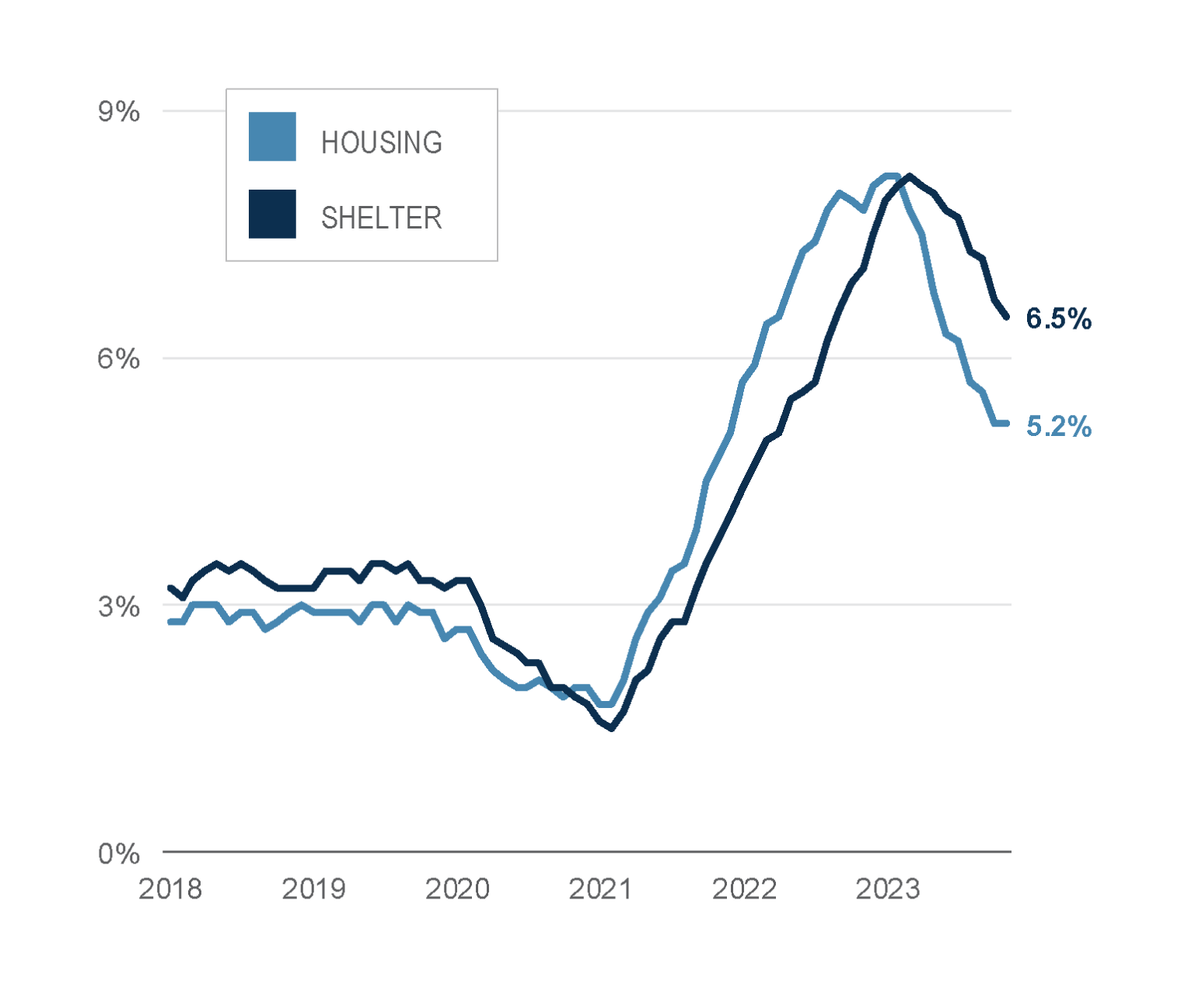

It is also important to note that there is a disconnect between the inflation being experienced and what is being reported. For many, their day-to-day cost of living has continued to increase, regardless of what headline inflation numbers are reporting. As illustrated in Figure 4, housing costs increased dramatically in recent years, well above the Fed’s target rate of 2%.

BUYING A HOME IS MORE

EXPENSIVE THAN EVER

Average Rate of a 30yr Fixed Rate Mortgage and Average

Payment on a New Mortgage Origination (2018-2023)

HOUSING AND SHELTERING COSTS HAVE NOT

MATCHED THE DECLINE OF HEADLINE CPI

Housing CPI and Shelter CPI YoY Change (2018-2023)

Figure 4

1 Data source: Consumer Financial Protection Bureau. Data as of December 2023.

2 Data source: Bureau of Labor Statistics. Data as of January 2023.

Because of the discrepancy between the inflation being reported and what people are feeling, we caution over-reliance on headline inflation numbers as an indicator of the health of the economy and will continue to keep in mind the cost pressures still facing consumers.

While we can’t predict exactly what will unfold throughout the rest of 2024, we believe it is prudent to keep a close eye on inflation and remember that we are not yet out of the woods.

Where was the recession?

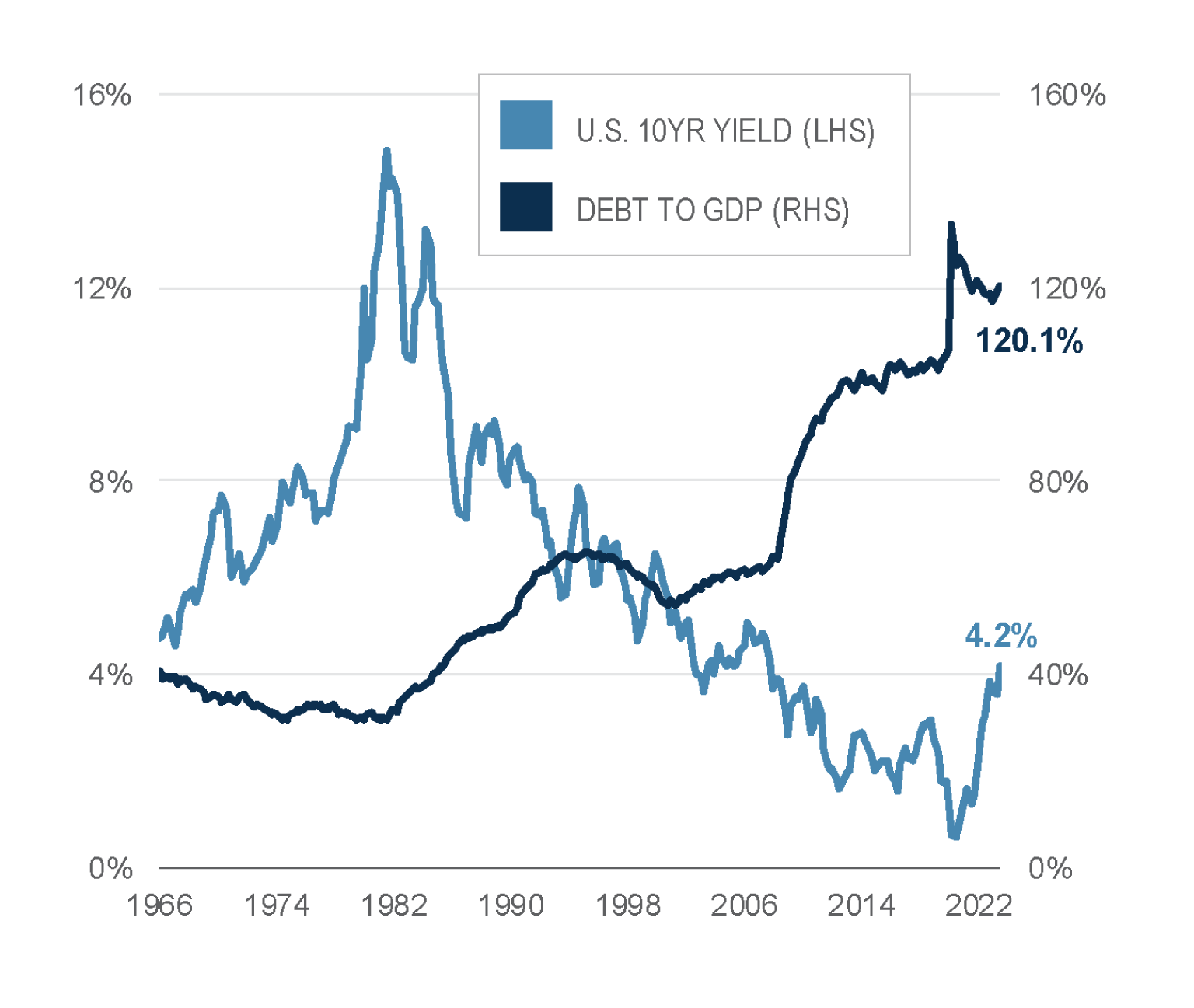

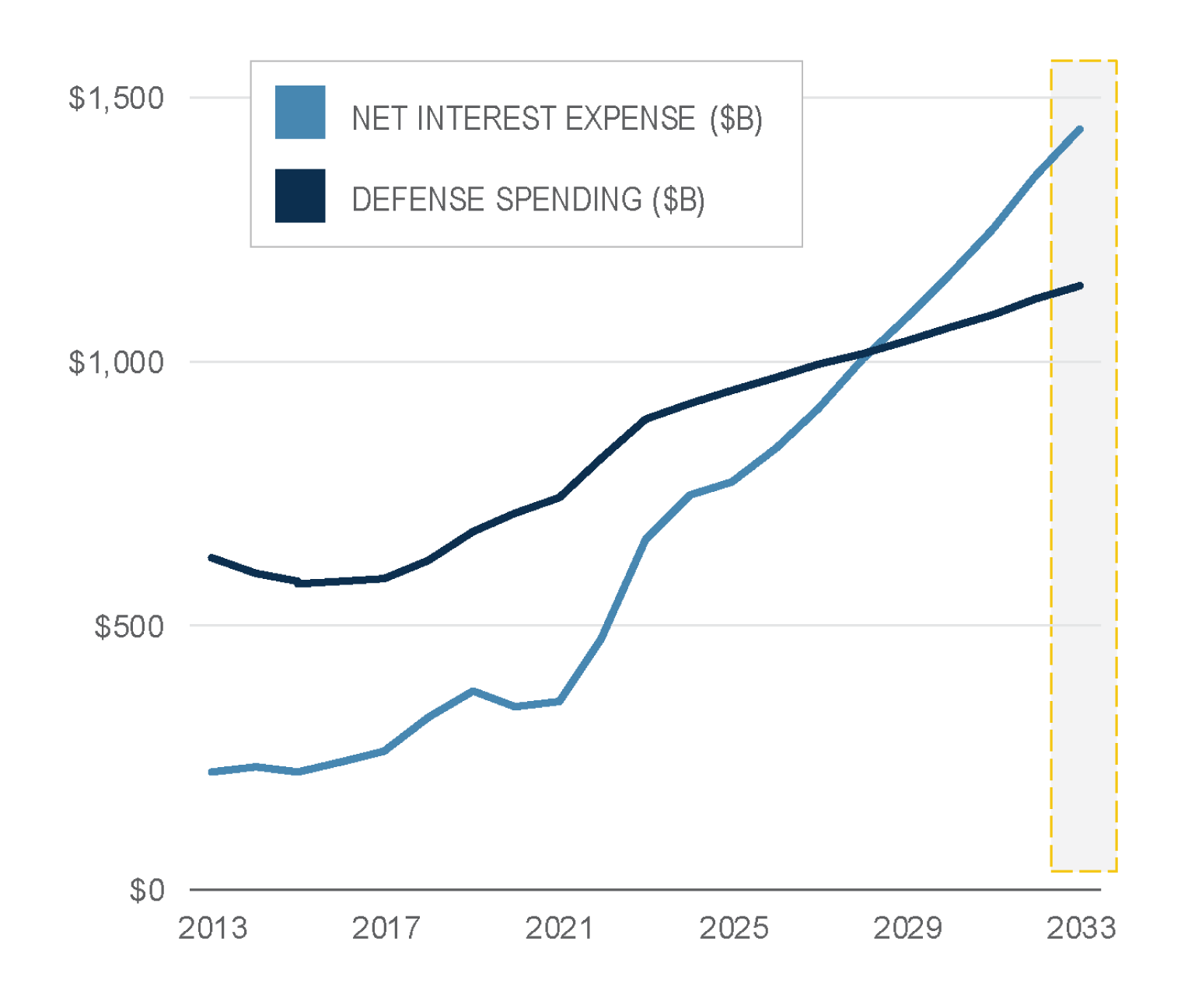

This time last year, the vast majority of economists predicted that we would see a recession in response to the Fed’s historic rate hikes. However, a large government spending deficit combined with a relatively strong labor market allowed the economy to continue to grow instead of contracting as predicted. But, we question whether these factors are sustainable. As shown in Figure 5, the cost of servicing the deficit is starting to exceed important components of national spending. The need to fund the deficit is also at the brink of crowding out other forms of government spending as well as potentially private capital investments. Hence, the interplay between economic growth and deficit spending will be one to watch carefully as we move through 2024.

PACE OF FEDERAL GOVERNMENT SPENDING

CONTINUES TO INCREASE DESPITE

INCREASING FUNDING COSTS

U.S. Debt to GDP vs 10 Year Treasury Yield

INTEREST COSTS ON U.S.

FEDERAL DEBT EXPECTED

TO EXCEED DEFENSE SPENDING THIS DECADE

U.S. Congressional Budget Office Actual (2013-2022)

and Forecast (2023-2033) Expenditures by Category

Figure 5

1 Data source: Federal Reserve Bank of St. Louis. Data as of July 1, 2023.

2 Data source: Congressional Budget Office. Data as of May 2023.

Finding opportunity in 2024

While we are taking a reasonably cautious stance on the macroeconomic outlook for the rest of 2024, we believe that the alternatives market can offer investors a path towards normalized investment activity. We believe alternatives will offer investors a wide range of opportunities to generate attractive risk-adjusted returns, assuming they stay disciplined in deploying capital alongside a partner with experience investing throughout market cycles.

This isn’t a market you can time...Let’s try to be creative to stay focused on an asset class that’s delivered really well for us over time."

Jon Levin, President, GCM Grosvenor

Hear from the experts

Watch the video below for a recap from our 2024 Annual Forum, where several senior members of our Investment Team discussed where they are seeking opportunities throughout the remainder of the year – particularly within private equity, private credit, and real assets.

Featured Speakers (in order of appearance)

Dianna Henrich

Frederick Pollock

Chief Investment Officer

Lee Brashear

Private Equity Investments

Brian Sullivan

Private Equity Investments

Peter Braffman

Real Estate Investments

Michael Kirchner

Elizabeth Browne

Sponsor Solutions Group

Matthew Rinklin

Infrastructure Investments

Steve McMillan

Absolute Return Strategies

David Richter

Absolute Return Strategies

Dianna Henrich

Frederick Pollock

Chief Investment Officer

Lee Brashear

Private Equity Investments

Brian Sullivan

Private Equity Investments

Peter Braffman

Real Estate Investments

Michael Kirchner

Elizabeth Browne

Sponsor Solutions Group

Matthew Rinklin

Infrastructure Investments

Steve McMillan

Absolute Return Strategies

David Richter

Absolute Return Strategies

Dianna Henrich

Frederick Pollock

Chief Investment Officer

Lee Brashear

Private Equity Investments

Brian Sullivan

Private Equity Investments

Peter Braffman

Real Estate Investments

Michael Kirchner

Elizabeth Browne

Sponsor Solutions Group

David Richter

Infrastructure Investments

Steve McMillan

Absolute Return Strategies

David Richter

Absolute Return Strategies

RELATED NEWS AND INSIGHTS

Capturing Alternative Investment Opportunities: A Toolkit for Insurance Investors

As insurers navigate a dynamic investment landscape, GCM Grosvenor explores key trends shaping alternative allocations.

2025 Market Outlook: Q&A with Fred Pollock, Chief Investment Officer

During GCM Grosvenor’s 2025 Annual Forum, Chief Investment Officer Fred Pollock shared insights into the opportunities and challenges shaping the upcoming year’s alternatives landscape. With inflation, interest rates, and geopolitical

Important Disclosures

For illustrative and discussion purposes only. No assurance can be given that any investment will achieve its objectives or avoid losses. The information and opinions expressed are as of the date set forth therein and may not be updated to reflect new information.

Investments in alternatives are speculative and involve substantial risk, including strategy risks, manager risks, market risks, and structural/ operational risks, and may result in the possible loss of your entire investment. The views expressed are for informational purposes only and are not intended to serve as a forecast, a guarantee of future results, investment recommendations, or an offer to buy or sell securities by GCM Grosvenor. All expressions of opinion are subject to change without notice in reaction to shifting market, economic, or political conditions. The investment strategies mentioned are not personalized to your financial circumstances or investment objectives, and differences in account size, the timing of transactions, and market conditions prevailing at the time of investment may lead to different results. Certain information included herein may have been provided by parties not affiliated with GCM Grosvenor. GCM Grosvenor has not independently verified such information and makes no representation or warranty as to its accuracy or completeness.