REVISITING 2024: a YEAR OF STABILITY AMIDST CAUTION

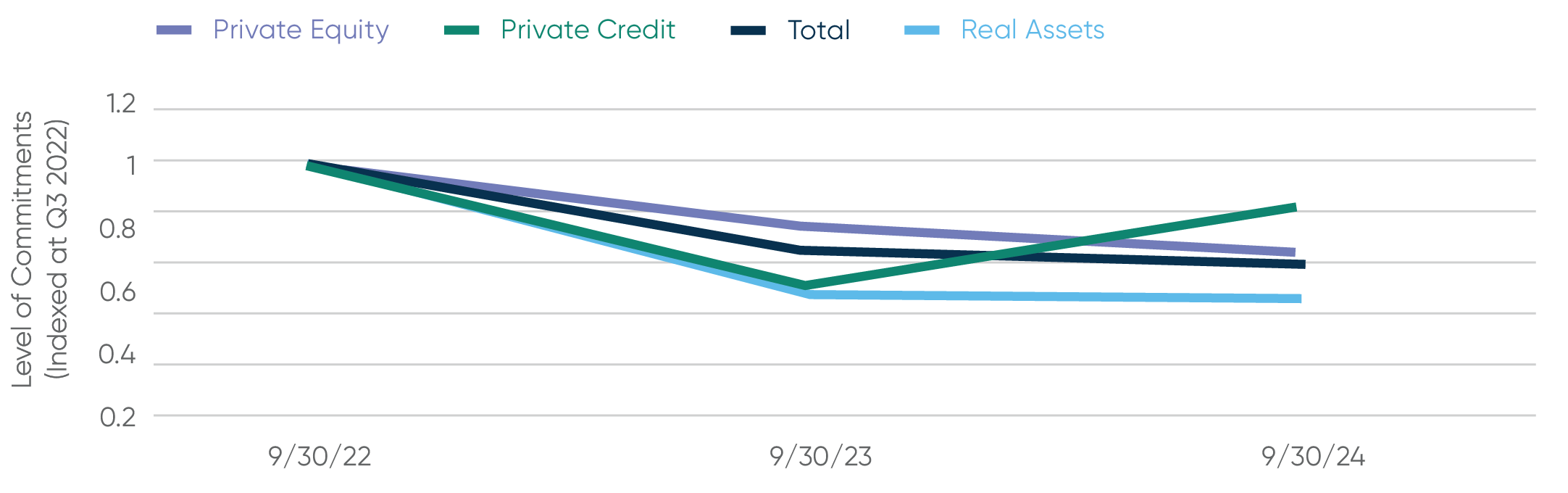

In our 2024 outlook (see: Discipline, Expansion, and Extraction: The Insurer’s Guide to Unlocking Value in Alternatives in 2024), we recognized a strategic recalibration in insurers’ alternative investment activities, reflecting a more measured pace of capital deployment with approximately a 30% reduction in capital calls and new commitments between Q3 2022 and Q3 2023. This shift presents an opportunity for insurers to refine their approach, and we highlighted three core considerations for optimizing risk asset strategies moving forward:

- Maintain investment discipline

- Expand the investment universe

- Extract incremental value

These considerations were tied together by a set of current and prospective economic factors:

- The notably rapid rise in rates and spreads had resulted in a large unrealized loss position.

- Higher interest rates and spreads offered compelling nominal yields across traditional fixed income asset classes.

- The distribution environment for private markets investments remained muted.

There has been no wholesale change to these economic factors as distributions remain low and interest rates hold steady amid positive employment and a stubborn inflationary environment. Accordingly, we are maintaining our core considerations from 2024 and commend our partners who acted on them for their foresight and commitment to long-term value creation. Whether it was clients accessing different sectors of private credit, participating in our GP seeding program, or implementing/expanding co-investment programs, we believe these will be highly impactful projects.

Regarding the broad behavior of insurance investors, overall commitments stabilized year over year.

Private equity commitments declined by 19% from 2022 to 2023, a 13% decline in 2024. Meanwhile, private credit experienced a resurgence in 2024, increasing by 42%, though commitments remain below the 2022 levels. Real assets appear to have stabilized after a 41% decline in commitments in 2023. Beneath the surface, we observed an uptick in infrastructure with a continued decline in real estate equity.

To put this into a dollar context, if insurers had maintained their 2022 pace of investing in alternatives over 2023 and 2024, they would have committed an incremental $29 billion across private equity, real estate, infrastructure, private credit, and other alternatives asset classes (approximately $1.2 billion per month).

We view this trend in declining commitments as primarily driven by temporary constraints rather than a persistent negative outlook on the opportunity set. As such, we look forward to discussing how GCM Grosvenor can partner with our insurance clients across a broad spectrum of risk assets and deployment strategies. While the pullback in commitments has been nontrivial, the insurance community is well positioned to implement and expand the alternatives allocation in what we view as a highly compelling market with attractive terms.

Commitments Stabilized in 2024

Source: S&P Capital IQ, Preqin as of 2023YE

Divergences Between Commitments to Private Credit and PEREI Strategies

Source: S&P Capital IQ, Preqin as of 2023YE

2025 Outlook: Seizing Opportunities Amid Macro Trends

It is worth noting that these insights are not exclusive to insurers and broader pricing opportunities and asset class evolution should be considered in forward-looking strategies. Opportunities in private equity, real estate and infrastructure are robust, and the maturation of private credit is offering opportunities to potentially enhance diversification, return potential, and economic terms.

Initiating or evolving private equity allocation

Looking across the real asset spectrum

Expanding the private credit toolkit

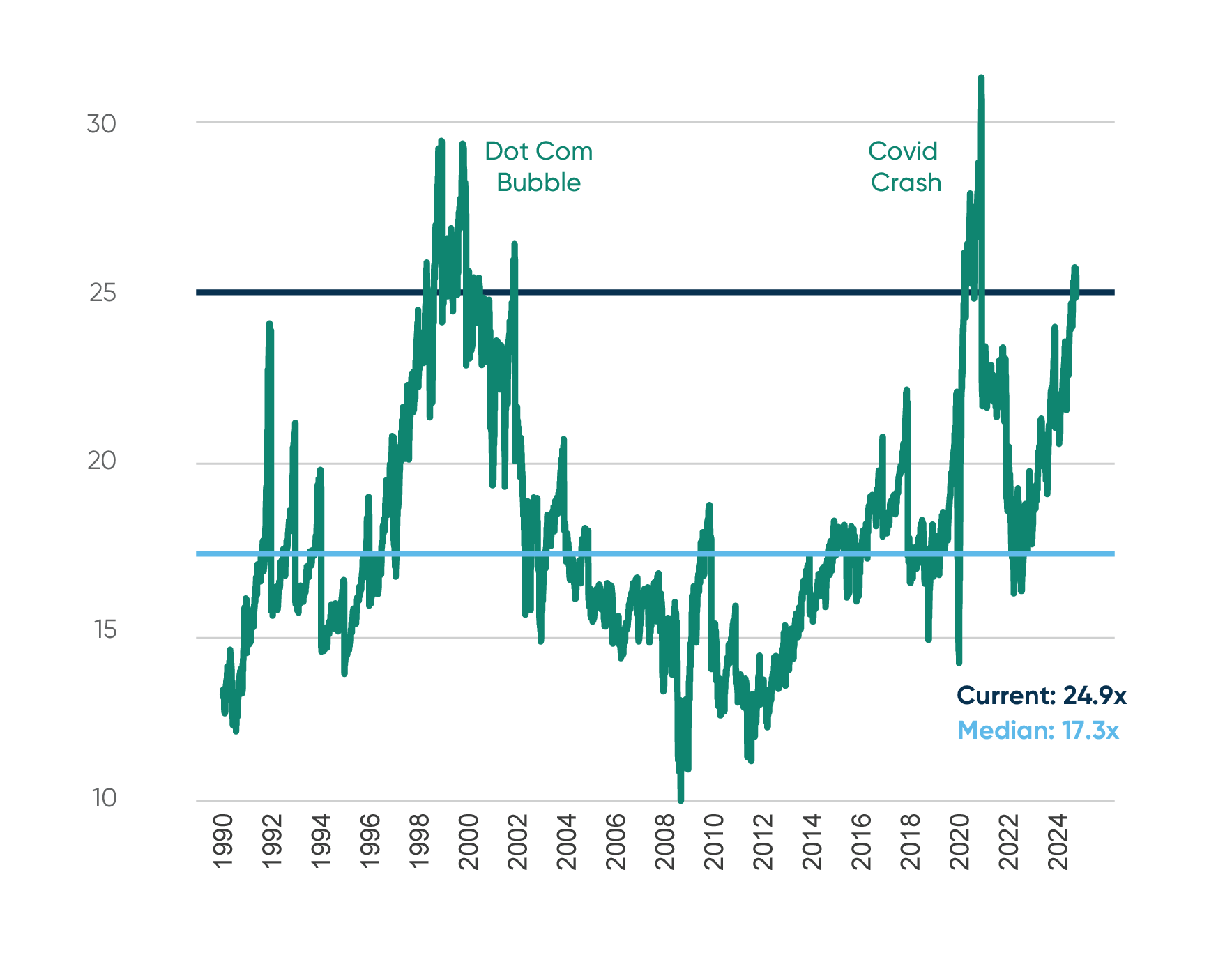

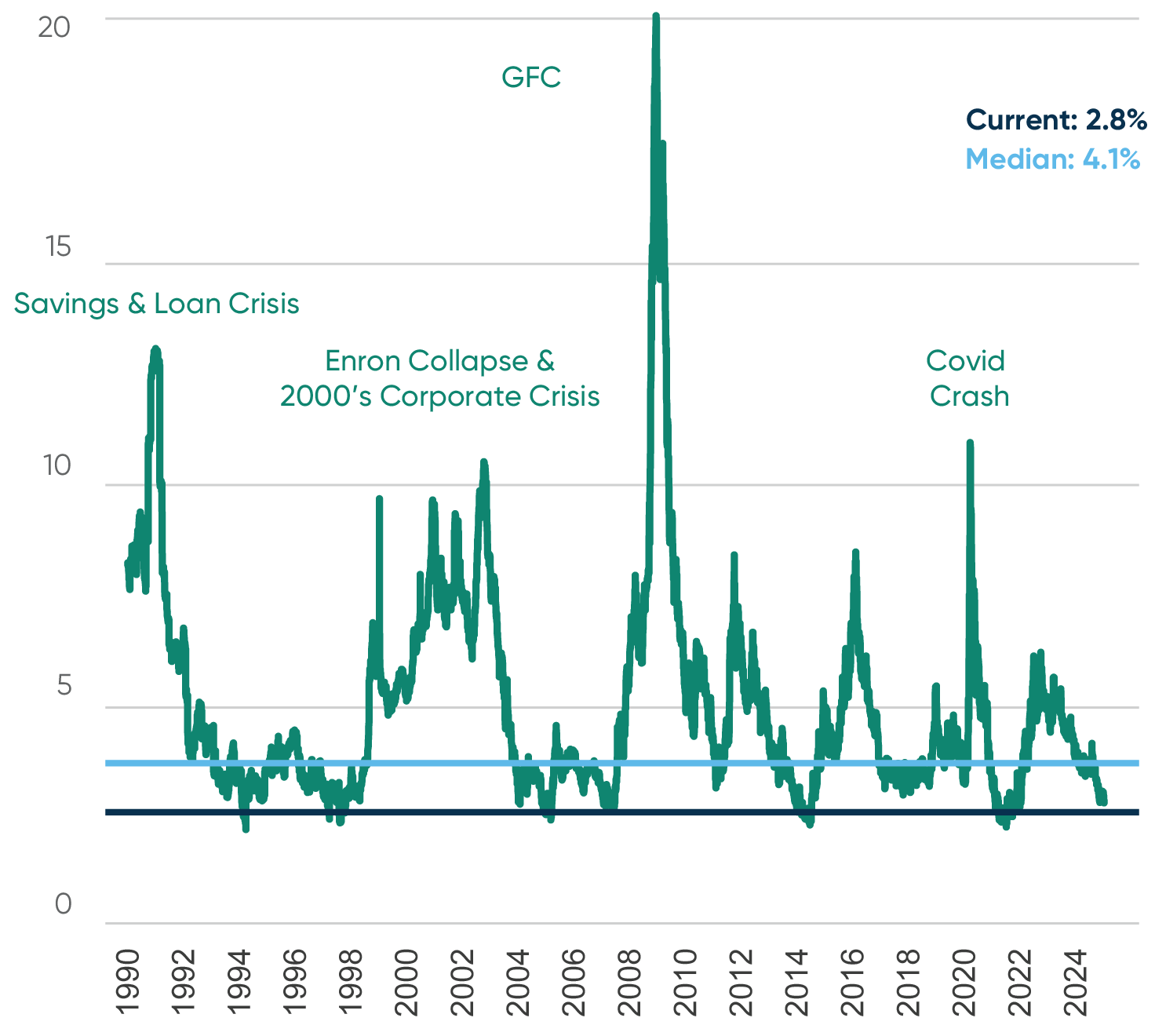

1. Public Market Valuations: The Case for a Rotation to Private Assets

Public markets, particularly U.S. equities, appear overvalued following back-to-back years of 25%+ returns. The S&P 500, even with the recent sell-off sparked by various concerns, is currently trading at high multiples, and credit spreads are historically tight—both factors indicating a less favorable risk-reward ratio for public market investments.

S&P 500 P/E Multiples

1990-2024

High Yield Spreads

1990-2024

Source: Bloomberg as of December 31, 2024.

Past performance is not necessarily indicative of future results.

This environment provides a strong case for insurers to move from public to private assets. Over the past decade, many insurers have shifted capital from core fixed-income portfolios to alternatives, increasing average alternative allocations from 3.9% in 2013 to 5.1% in 2023 (+30%). However, as shown below, a substantial subset of insurers remain effectively unexposed, highlighting a clear divide between those that have fully embraced private market strategies (“haves”) and those that have not (“have-nots”).

The table below summarizes the industry level allocation to each asset class as well as the percentage of insurers with virtually no allocation. For example, in the life industry, the allocation to private equity is 1.6%, yet half of all life insurers have less than a 0.1% allocation. Despite the noticeable overall growth, these figures reveal that many insurers are still on the sidelines, missing out on the potential diversification, yield, and long-term performance benefits that alternative investments can provide.

| Private Equity | Private Credit | Private Real Estate Equity | Infrastructure | |

|---|---|---|---|---|

| Life Allocation | 1.6% | 1.5% | 0.8% | 0.2% |

| Unallocated | 50% <0.1% | 50% <0.8% | 50% at 0% | 61% at 0% |

| P&C / Health Allocation | 1.8% | 1.6% | 1.6% | 0.2% |

| Unallocated | 50% <0.1% | 50% <0.4% | 59% at 0% | 73% at 0% |

Source: S&P Capital IQ, Preqin as of 2023 YE. Unallocated percentages are calculated on insurers with at least $1bn in assets.

Private credit includes Schedule D below-IG private credit and Schedule BA private credit investments.

GCM Grosvenor is well positioned to provide substantive insight into your alternatives portfolio relative to industry benchmarks and peer allocations. Our solutions are focused on initiating and evolving alternative portfolios to align with the clients’ goals and constraints.

Given the overvaluation in public equities and high-yield bonds, insurers lacking exposure to alternatives may find 2025 an ideal time to rebalance and seek to capitalize on the diversification and potentially higher returns offered by private assets. Private equity served as a core component of an alternatives portfolio and has historically offered attractive, long-term return potential. In our practice of working with insurers, we have engaged in an increasing number of conversations related to the activity and opportunity set in the private equity secondaries market. 2023 presented significant opportunities, and 2024 is on pace to break records for deal volume in the secondaries market (see: The Secondaries Surge: Reflections on 2024 and the Road Ahead for 2025).

Whether insurers are establishing a new private equity program or enhancing an existing one, they should consider a blend of primary, secondary, and co-investment strategies – each with distinct benefits for addressing specific portfolio objectives.

For insurers with established private equity programs, specialized opportunities within the asset class can enhance portfolio performance.

We believe middle market buyouts can offer strong value-creation potential in relatively under-penetrated segments.

- Small and emerging managers present compelling opportunities; early vintages and smaller firms can provide differentiated deal flow and have a track record of adding value to larger and more established funds.

- Co-investing is a powerful tool to expand allocations typically at favorable economics. However, many insurers are not taking advantage of this strategy, despite a robust opportunity set (see: Post-Election Market Shifts and the Rise of Co-Investment Opportunities).

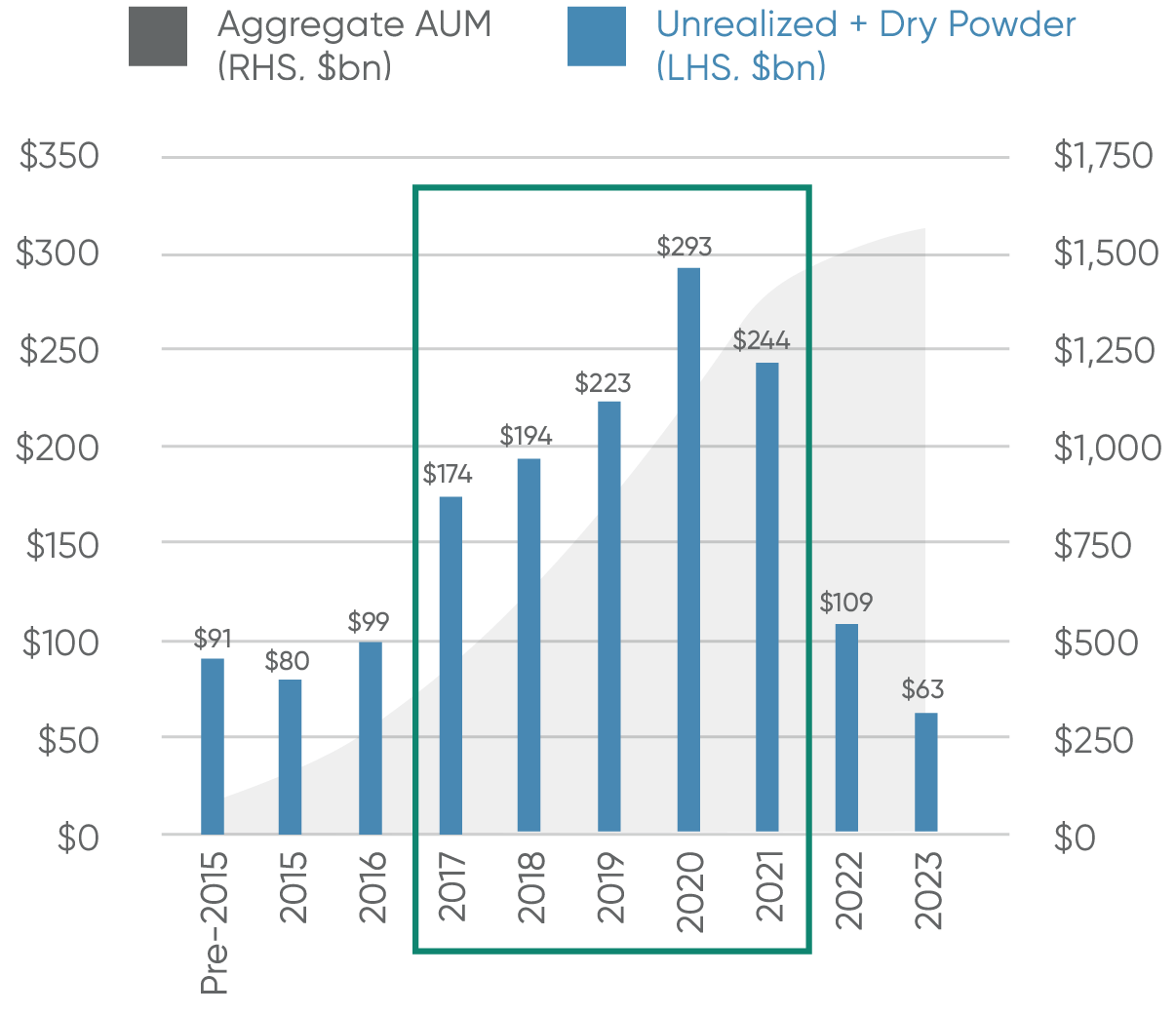

2. Deal Activity and Distribution: A Focus on Cash-Yielding Components and Secondaries Market Opportunities

Looking ahead, deal activity is expected to accelerate under a potentially more business-friendly administration. However, volumes may still fall short of the 2021 highs, making income generation a critical focus for insurers, particularly in an environment where distributions can be unpredictable.

Cash-yielding investments in private credit and real assets are especially well-suited for this landscape, offering potentially compelling yields and essential liquidity. Private credit, for example, can produce strong risk-adjusted returns, while infrastructure investments can provide stable, inflation-linked cash flows—both highly desirable features in times of distribution uncertainty.

Simultaneously, the credit secondaries market is emerging as an increasingly important avenue for insurers. With limited distributions, more investors are turning to secondaries to rebalance portfolios or access liquidity. This shift is creating unique opportunities, especially in private credit secondaries, where high-quality, cash-yielding portfolios can be acquired at a discount. These secondary transactions often involve seasoned private credit assets, sometimes with shorter durations, enhancing potential returns while maintaining a reliable income stream.

By combining a focus on stable cash yields with selective opportunities in the secondaries market, insurers can seek to position themselves to maximize returns in a capital-constrained environment.

Material Private Credit AUM Entering Harvest Period

Source: Preqin as of 2023YE

3. Macroeconomic Trends: Inflation, Interest Rates, and Their Impact on Private Credit and Real Assets

Inflationary pressures and fiscal policies will continue to define the investment landscape in 2025 (see: 2025 Market Outlook: Q&A with Fred Pollock, Chief Investment Officer). With inflation remaining above the Federal Reserve’s long-term target and interest rates expected to stay elevated, select private markets appear well-positioned to perform – offering insurers an opportunity to balance risk, return, and liquidity needs.

Private Credit

Private credit has demonstrated steady, attractive returns across various market cycles. Historical data underscores its ability to generate strong returns with comparatively low volatility, making it a compelling option for insurers seeking both income generation and risk mitigation. While direct lending has emerged as a key segment for insurers’ private credit portfolios, we believe the broader private credit market offers an even more compelling risk-adjusted profile, encompassing strategies such as asset-backed lending (e.g., NAV lending, structured products, and Synthetic Risk Transfer) and specialized corporate credit (e.g., DIP financing, structured securities such as convertibles and preferreds).

With interest rates remaining elevated and inflationary pressures persisting, private credit’s ability to potentially generate stable cash flows stands out. Coupled with its history of resilience through various economic cycles, it remains a key asset class for insurers aiming to navigate uncertain macro conditions. As insurers have resumed allocations to these opportunities in 2024, we strongly advocate for accessing the private credit landscape through co-investment programs to enhance market coverage on attractive economics terms (see: The Rise of Co-Investing in Private Credit).

Infrastructure

Infrastructure presents a compelling opportunity, particularly in sectors linked to digital infrastructure, renewables, and the energy transition, all estimated to expand amid global economic and technological shifts. These areas can offer inflation-linked returns and benefit from long-term structural tailwinds, making them especially appealing when inflation is high or uncertain.

Meanwhile, core infrastructure assets, such as toll roads, utilities, and essential real estate, have historically experienced rising yields alongside higher interest rates, further enhancing their risk-return profile.

Real Estate

Real estate has faced heightened skepticism in recent years due to pandemic-driven disruptions, evolving workplace dynamics, and broader structural shifts within the industry. However, property values have already declined by approximately 17% due to the rapid and substantial tightening cycle, potentially resetting valuations to levels that more than offset higher debt costs and lower leverage. Despite this initial market shock, we believe real estate is well-positioned to deliver attractive returns in the coming years.

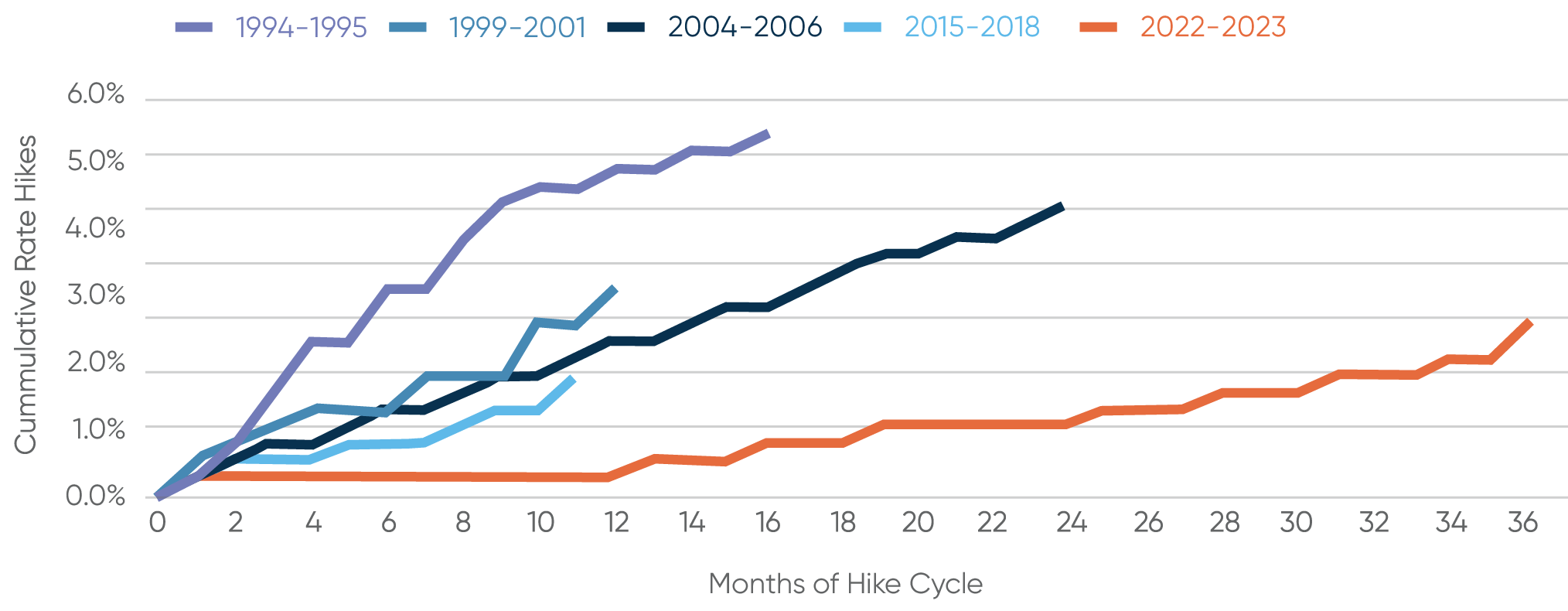

Historical Interest Rate Hike Cycles

3.9%

Average Annual Rate Increase

most recent cycle

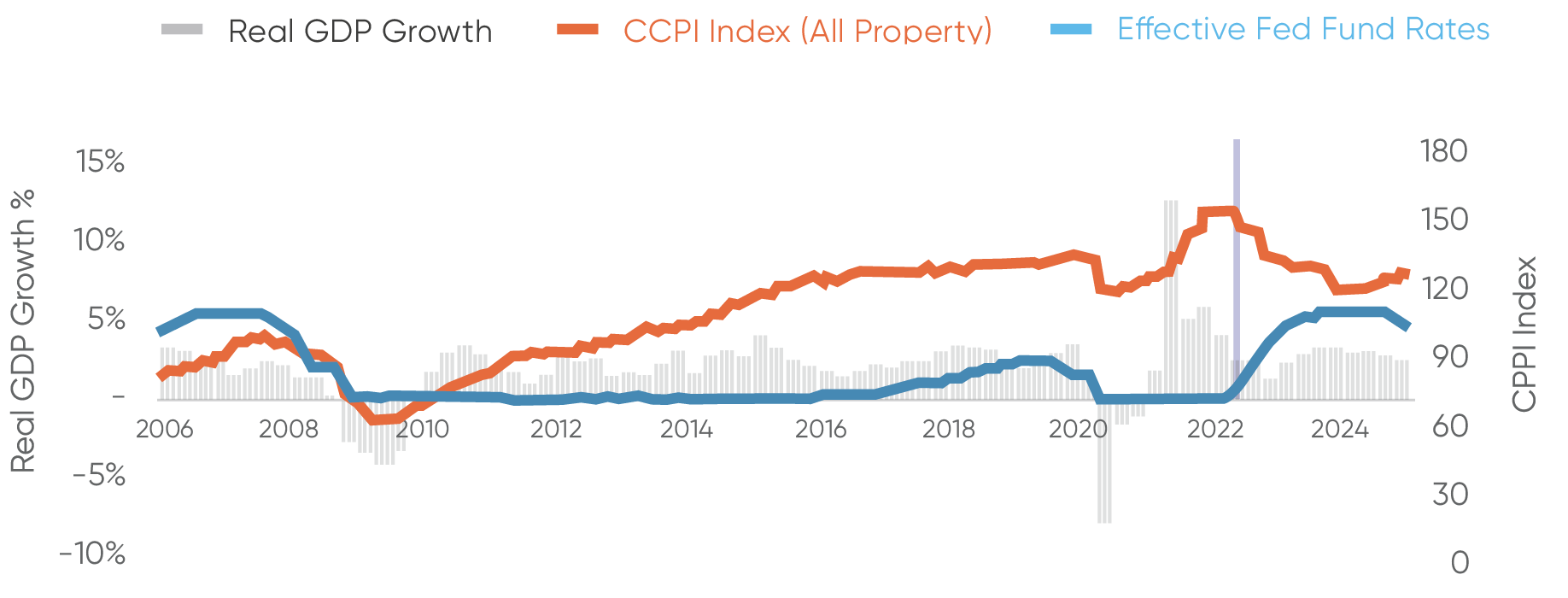

Interest Rates & Real GDP Growth VS. Property Value

17%

Decline in Property Values

since first rate hike or most recent cycle

Source: FRED Green Street. Unless apparent from context, all statements herein represent GCM Grosvenor’s opinion. No assurance can be given that any investment will achieve its objectives or avoid losses. Past performance is not indicative of future results.

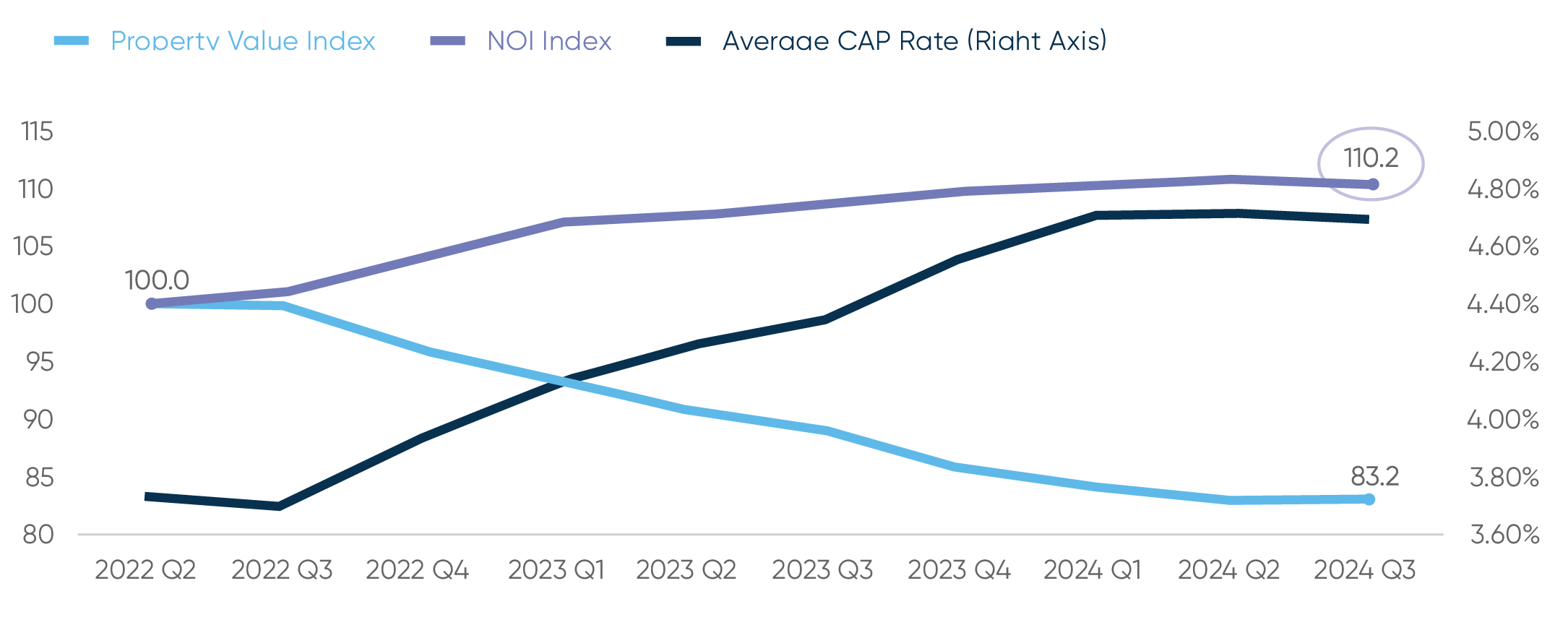

Although rising interest rates have repriced the market, core fundamentals remain strong. We have observed net operating income (NOI) growth at an annualized rate exceeding 4.0% since 2022. Our estimates indicate that recent valuation declines are sufficient to offset higher financing costs and lower loan-to-value (LTV) ratios, pushing levered IRRs close to or above the level seen before the rate hikes.

NOI & CAP VS. Property Values

4%+

NOI CAGR

Source: National Council of Real Estate Investment Fiduciaries NPI Trends Report as of 2024 YE

Within real estate, the benefits of diversification are especially evident in the middle market sector, defined as transactions under $50 million. These smaller deals represent over 95% of all U.S. real estate transactions, yet account for only about 60% of total dollar volume. In other words, fewer than 5% of transactions drive roughly 40% of total volume, suggesting an overrepresentation of larger deals and the potential for concentration risk.

Finally, it is worth noting that, for U.S. life insurers, Risk-Based Capital (RBC) charges for real estate were significantly reduced in 2021, enhancing the asset class’s capital efficiency.

Conclusion: Positioning for 2025 and Beyond

As insurers move through 2025, several key factors will continue to shape the alternatives landscape.

Elevated public market valuations highlight the risks of overexposure to traditional equities and high-yield credit, strengthening the case for increased allocations to private assets. Many insurers remain significantly underexposed, missing out on valuable diversification and return potential. With this in mind, 2025 may be the ideal time to rebalance, positioning private equity as a core component through strategies such as primaries, secondaries, and co-investments. Additionally, tapping into underpenetrated segments like middle market buyouts and emerging managers can enhance potential value creation.

While deal activity may rebound under a more business-friendly administration, it is unlikely to match 2021’s peak, making income generation a top priority amid unpredictable distributions. Private credit and real assets may offer strong yields. The secondaries market, especially in private credit, presents opportunities for insurers to acquire seasoned, cash-yielding assets – often at a discount.

Inflation remains stubborn, sustaining higher interest rates and contributing to ongoing uncertainty. In this environment, private credit stands out for its stable cash flows and potentially favorable risk-adjusted returns. Infrastructure can also offer resilience and inflation-hedging benefits. Meanwhile, despite market skepticism, real estate has seen valuations reset, and with solid fundamentals.

GCM Grosvenor provides insurers with tailored solutions to navigate the complexities of alternative investments, drawing on extensive experience across private credit, private equity, real estate, infrastructure, and absolute return strategies, enabling insurers to capture attractive opportunities while meeting the unique regulatory and strategic objectives of their balance sheets.