Discipline, Expansion, and Extraction: The Insurer’s Guide to Unlocking Value in Alternatives in 2024

Past performance is not necessarily indicative of future results. No assurance can be given that any investment will achieve its given objectives or avoid losses. Unless apparent from context, all statements herein represent GCM Grosvenor’s opinion.

Select risks include: market risks, credit risks, macroeconomic risks, liquidity risks, manager risks, counterparty risks, interest rate risks, and operational risks.

Introduction

Last year we correctly predicted that 2023 could be a challenging year for insurers investing in alternatives and that the volatility and turmoil could impact earnings, capital ratios, and investment policy limits. These challenges were met partially with retrenchment in commitments to new investments, opening the door to potentially negative ramifications such as gaps in vintage diversification. In this piece, we will build on our perspectives from last year and address what we believe are three key themes for insurance investors entering 2024: maintain investment discipline, expand the investment universe, and extract incremental value from capital and partners.

A Look Back at 2023

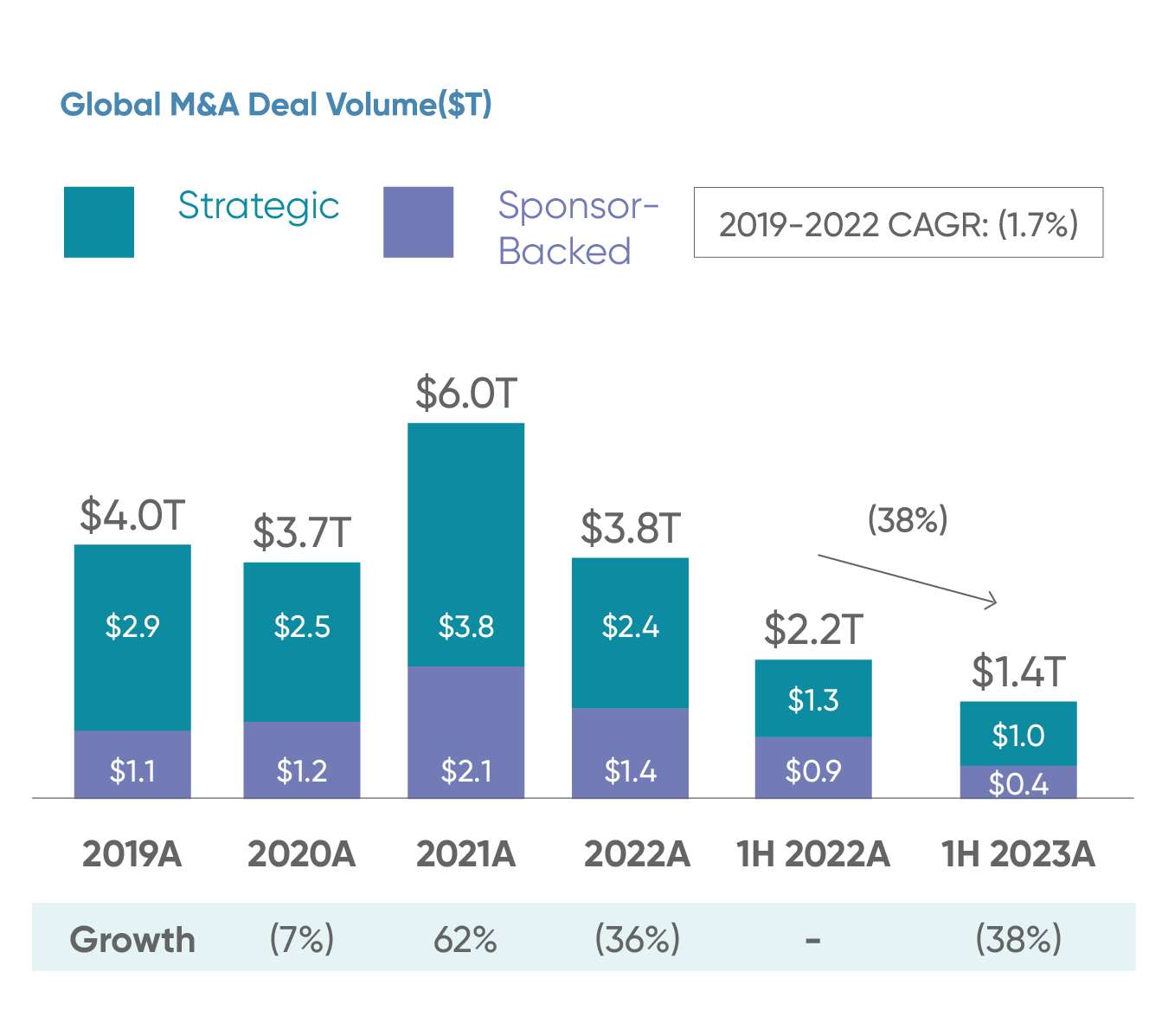

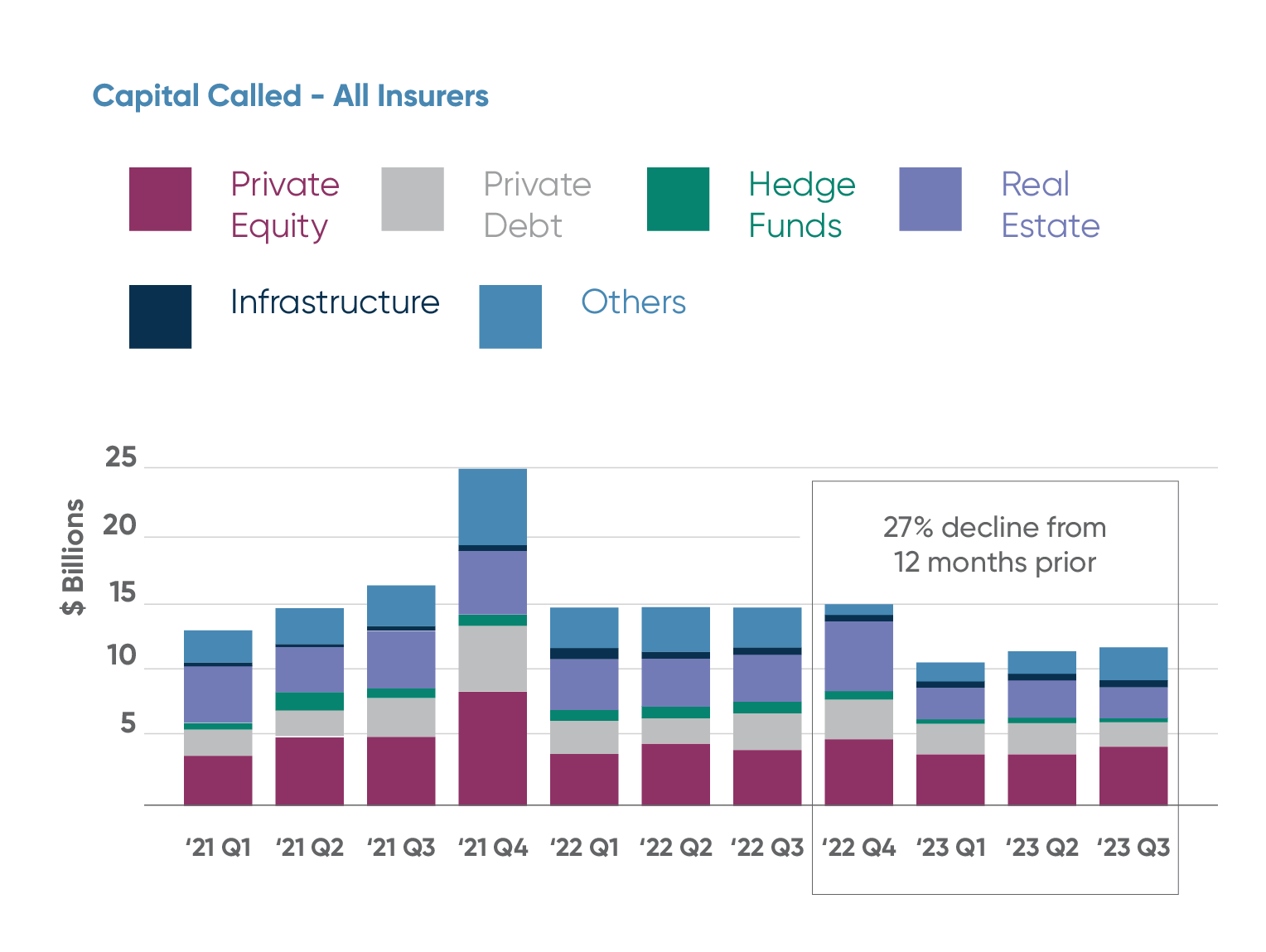

Private equity deal activity saw a significant decline in 2023 as compared to 2021 and 2022, resulting in lower capital calls on insurers’ balance sheets as illustrated in Figures 1 and 2 below. For the 12 months ending September 30, 2023, alternative capital called from insurers decreased by 27% compared to the 12 months prior.

Slowing market activity resulted in lower capital calls on Insurers' balance sheets

Source: Lazard Interim Secondary Market Report 2023.

Source: S&P Capital IQ Pro

Data as of September 30, 2023.

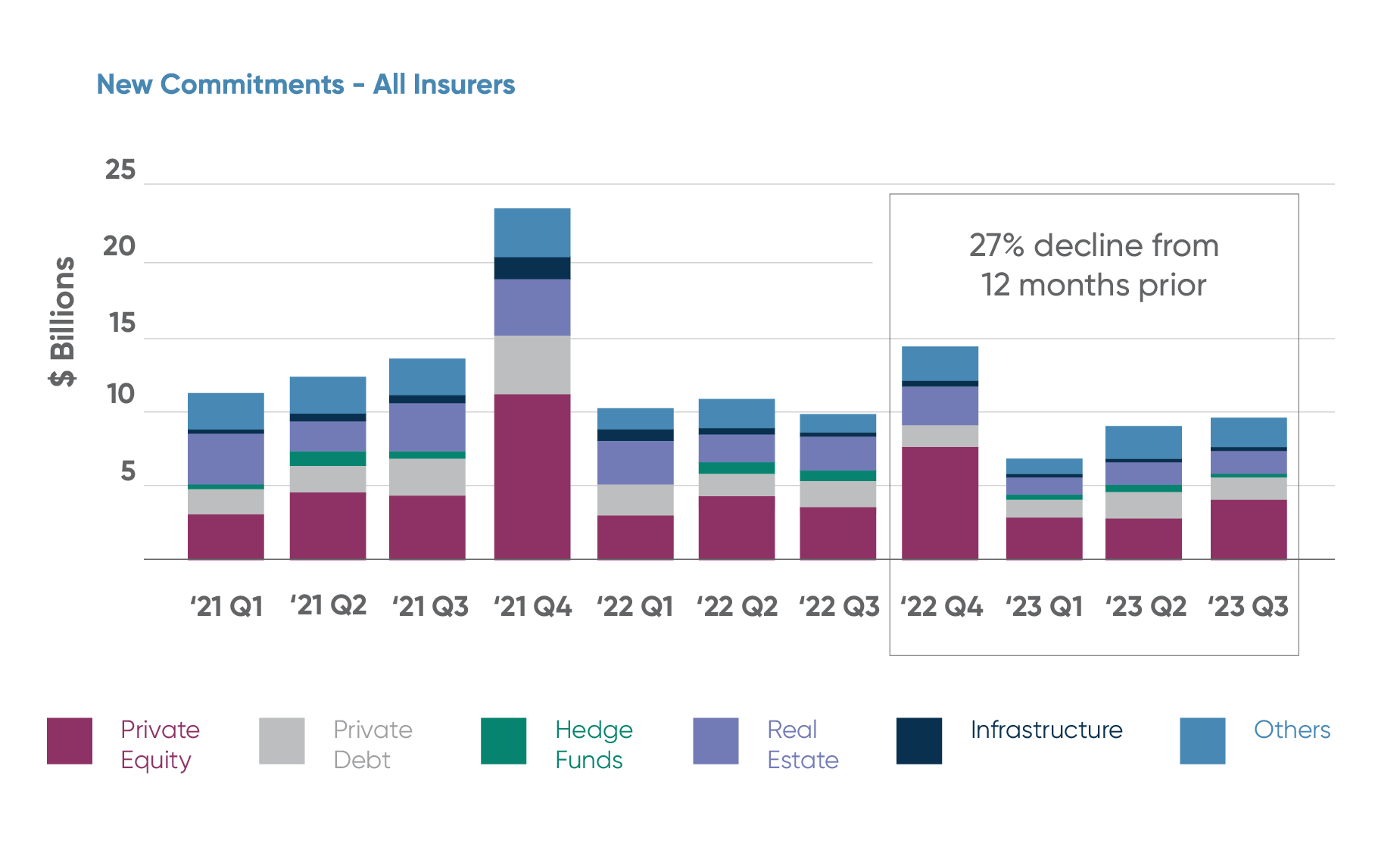

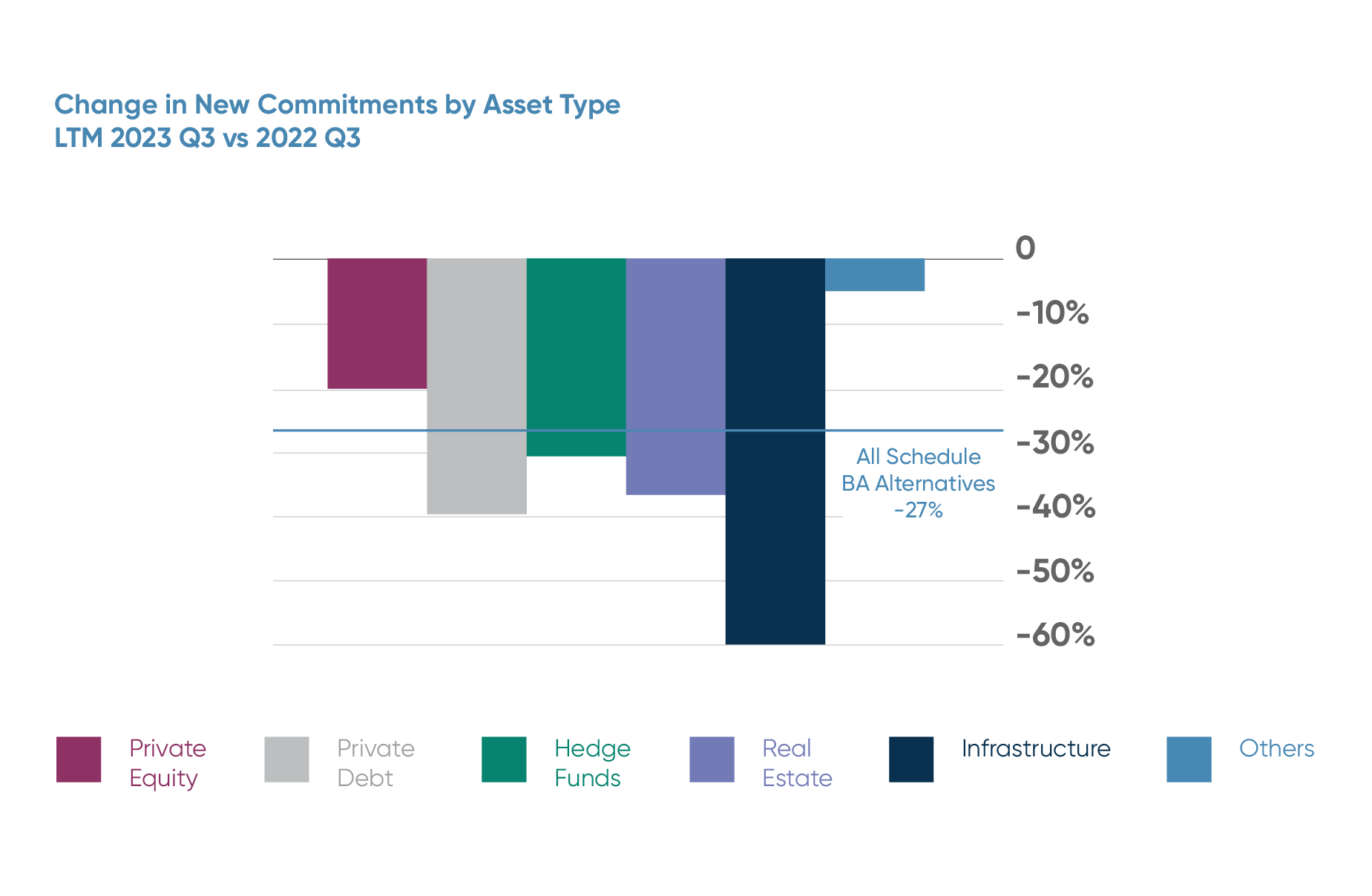

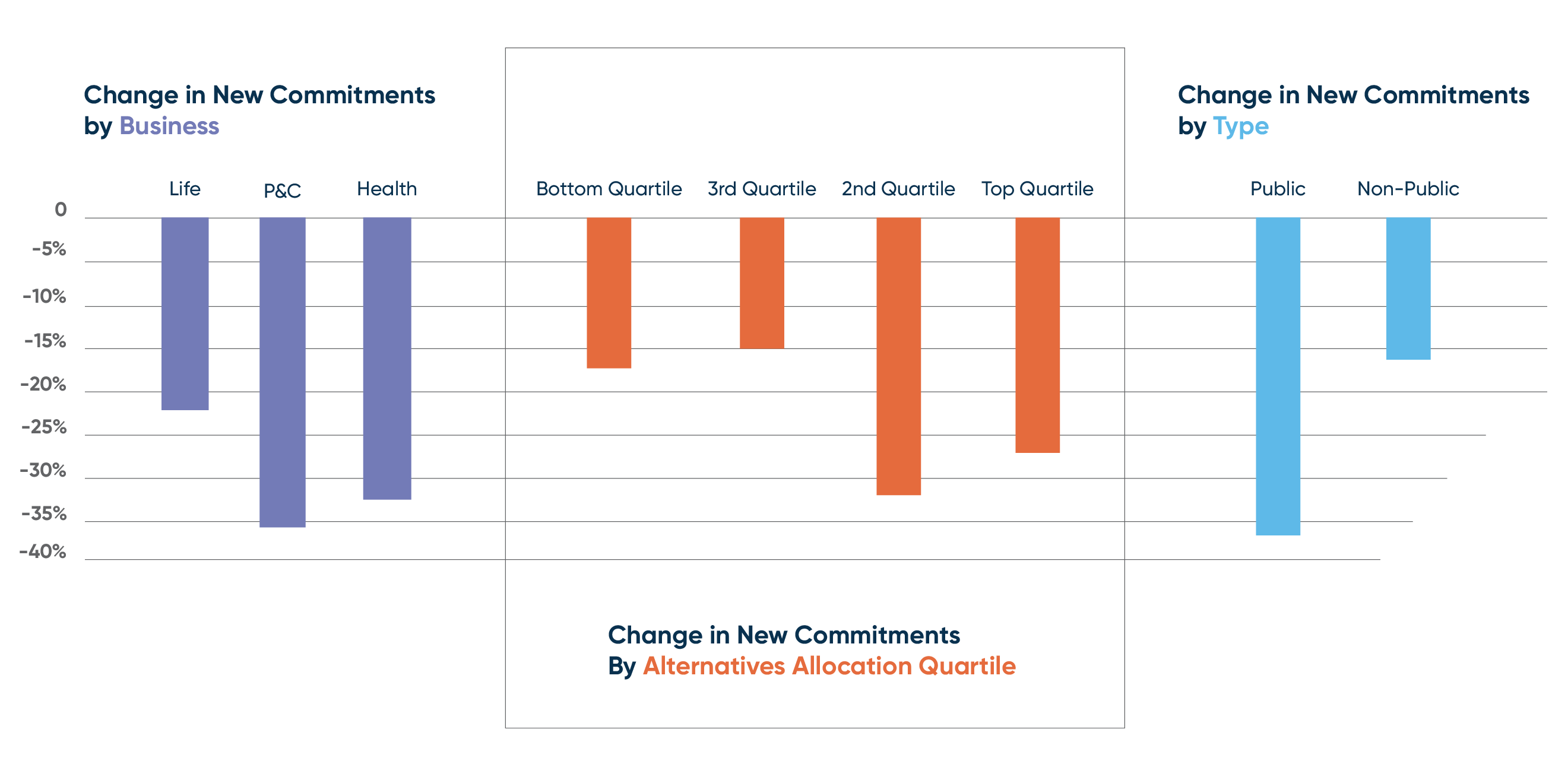

Unsurprisingly, the challenging market environment, slower distributions from existing investments, and balance sheet/capital constraints caused a decline in new commitments made by insurers in 2023, as illustrated in Figure 3. When comparing the 12 months ended September 30, 2023 to the prior year, there was a decline of 27% in aggregate commitments (the same rate as the decline in capital calls), and even more so across new commitments made in private credit, real estate, and infrastructure, as shown in Figure 4 below. Commitments to private equity also saw a decline, however it was less drastic than what was seen across other asset classes.

New commitments slowed down, particularly across private credit and real assets

Source: S&P Capital IQ Pro

Data as of September 30, 2023

Source: S&P Capital IQ Pro

Data as of September 30, 2023.

While the impacts of the 2023 market environment were felt by insurers across the board, property and casualty (P&C) and health insurers saw a greater reduction in new commitments compared to life insurers, perhaps due to their stronger preference for liquid assets and the larger percentage of their existing allocations to schedule BA alternatives for P&C insurers. Insurers with large existing allocations to schedule BA alternatives saw a higher reduction in new commitments due to a combination of several factors, including the slower return of capital to redeploy, pressure imposed on them by earnings volatility, and the denominator effect.

It is also worth noting that public companies slowed down their commitments significantly more than their non-public peers, possibly as a reaction to earnings sensitivity.

Some Insurers saw a more drastic decline in commitments than others.

Figure 5

Source: S&P Capital IQ Pro

Data as of September 30, 2023

Unlocking Value in Current Market Conditions

While current and forthcoming market conditions may present challenges for insurers investing in alternatives, it is our view that exciting opportunities to generate competitive risk-adjusted returns still exist. To best position themselves for success, we believe insurers should work with an experienced partner to implement the following three key themes: discipline, expansion, and extraction.

1. Maintain Discipline in Deployment

We continue to believe in the power of investing in alternatives consistently throughout market cycles to achieve long-term allocation objectives and to capitalize on vintage year diversification to help manage year-over-year returns variability. In addition, market dislocations often create investment opportunities that are unique to the moment.

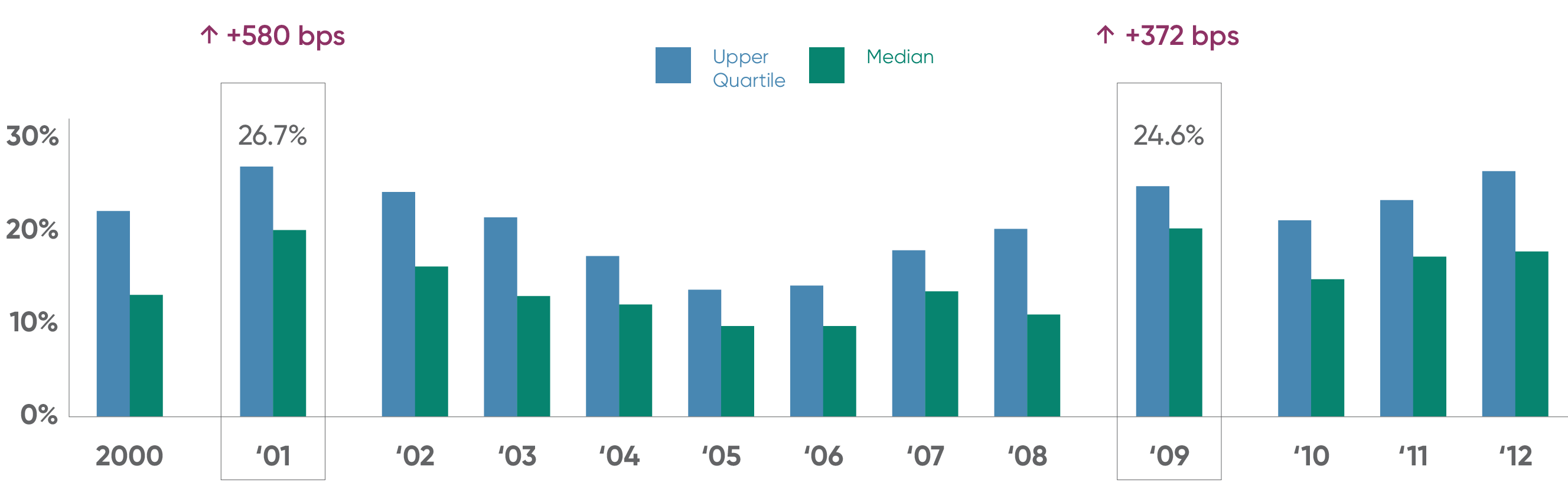

For example, many top quartile private equity managers have been successful in achieving high returns through prior recessionary periods (Dot.com Bubble and the Global Financial Crisis). As seen in Figure 6 below, missing out on the 2001 and 2009 vintages, which occurred during times of significant market dislocation, would mean sacrificing 580bps and 372bps of potential excess returns respectively over the 12-year average.

While this concept applies to all alternative asset classes, many investors are utilizing private equity co-investments in a targeted and systematic way to tactically build specific exposures that round out their portfolios and allow them to stay invested in more challenging environments.

Investing in periods of macro challenges has led to higher-than-average returns in vintages that are over 10 years old.

Net IRR - North American Buyout by Vintage Year

Figure 6

Source: Burgiss: Benchmarking data as of March 31, 2023.

Past performance is not necessarily indicative of future results. No assurance can be given that any investment will achieve its objectives or avoid losses. Unless apparent for context, all statements herein represent GCM Grosvenor’s opinion.

Read more about how co-investments can help maintain vintage year exposure when investment dollars are scarce.

2. Expansion of the Investment Universe

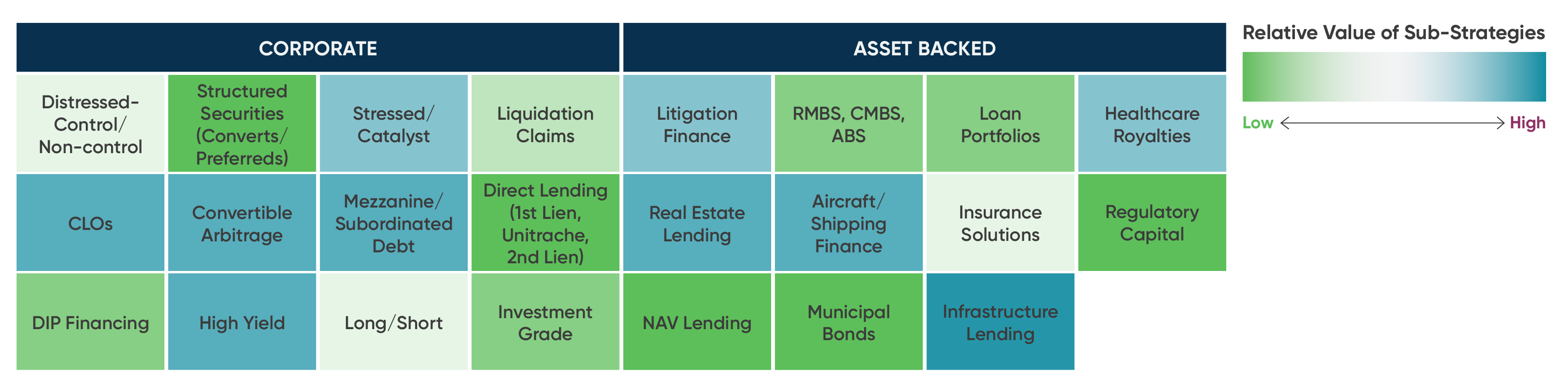

To maximize the potential of their alternative allocations, it is important for insurers to expand their investment universe by looking “outside the box” and sourcing investments in traditionally under allocated or less trafficked areas of the market, such as with small, emerging, and diverse investment managers, in middle-market buyouts, and in infrastructure GP-led secondaries. This year, we believe private credit will continue to offer significant opportunity provided the strategy is viewed through a sufficiently broad lens.

Private Credit

Last year we highlighted how insurers could look beyond the often-vanilla direct lending that is typical with most private credit investments and find situations that have complexity or opportunistic financings that lack traditional sources of financing. We believe this will continue to present a compelling opportunity for insurers throughout 2024.

A dynamic opportunity set

Figure 7

Select risks include: market risk, macroeconomic risk, liquidity risk, interest rate risk, and operational risk

For illustrative purposes only.

Past performance is not necessarily indicative of future results. No assurance can be given that any investment will achieve its objectives or avoid losses. Unless apparent for context, all statements herein represent GCM Grosvenor’s opinion.

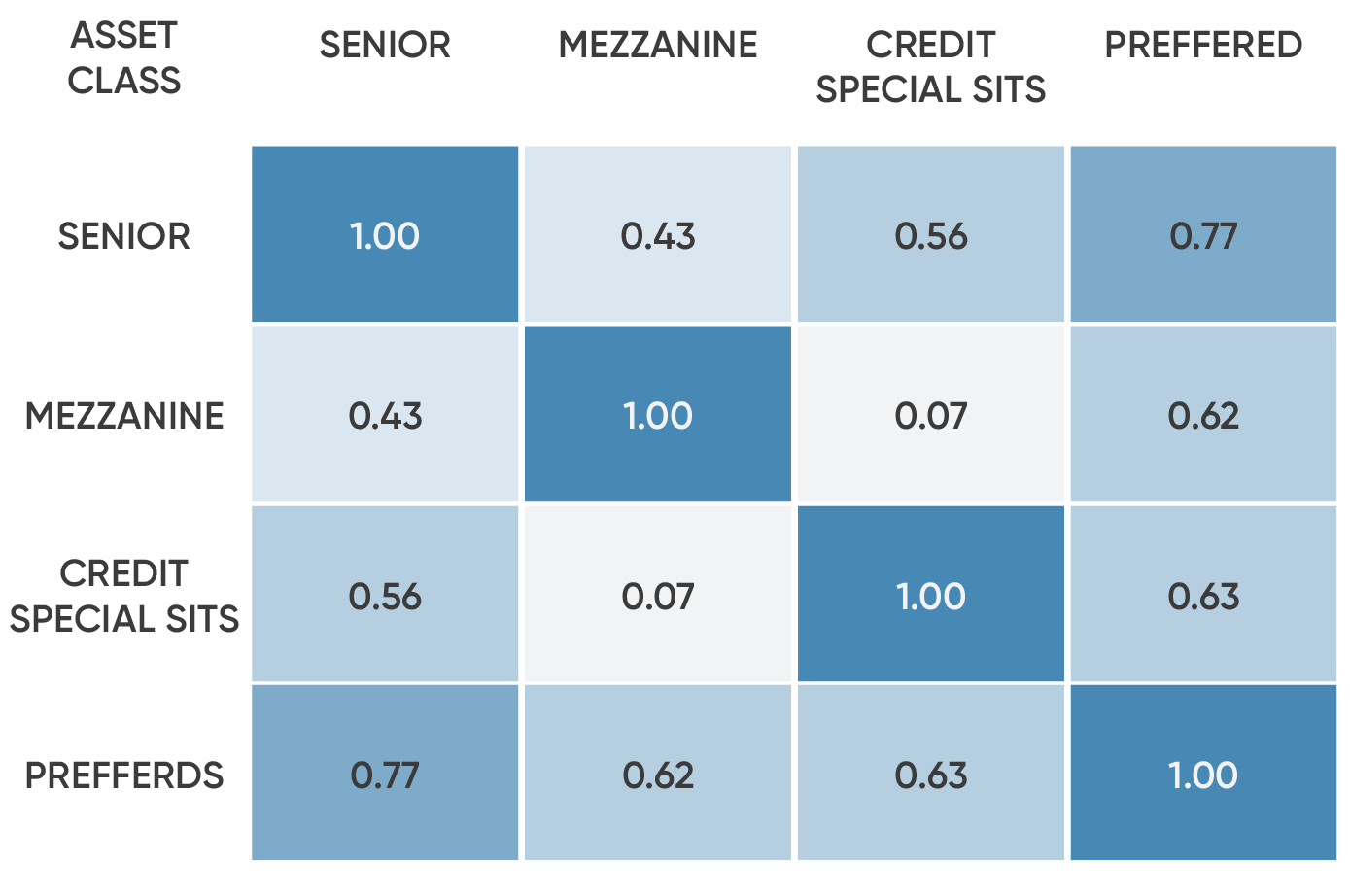

Extending beyond the direct lending market comes with diversification benefits as historical correlations between different sectors are low, as illustrated in Figure 8. By introducing other sectors, insurers can potentially create a private credit book that has higher returns, but lower volatility compared to a portfolio focused on direct lending.

The illustrative effect of diversification

Figure 8

For illustrative purposes only. No assurance can be given that any investment will achieve its objectives or avoid losses. Unless apparent from context, all statements herein represent GCM Grosvenor’s opinion. Past performance is not necessarily indicative of future results.

3. Extraction of Incremental Value

In addition to seeking attractive returns, it is especially important during challenging market environments that investors look for other ways to extract value from their investments. This can materialize in several forms such as lower fees, additional revenue sources, expanded sourcing channels, customization in investment themes and exposures, operational and capital efficiency, etc. Below, we explore several investment opportunities that can help allow insurers to extract incremental value from their investments in addition to seeking attractive risk-adjusted returns.

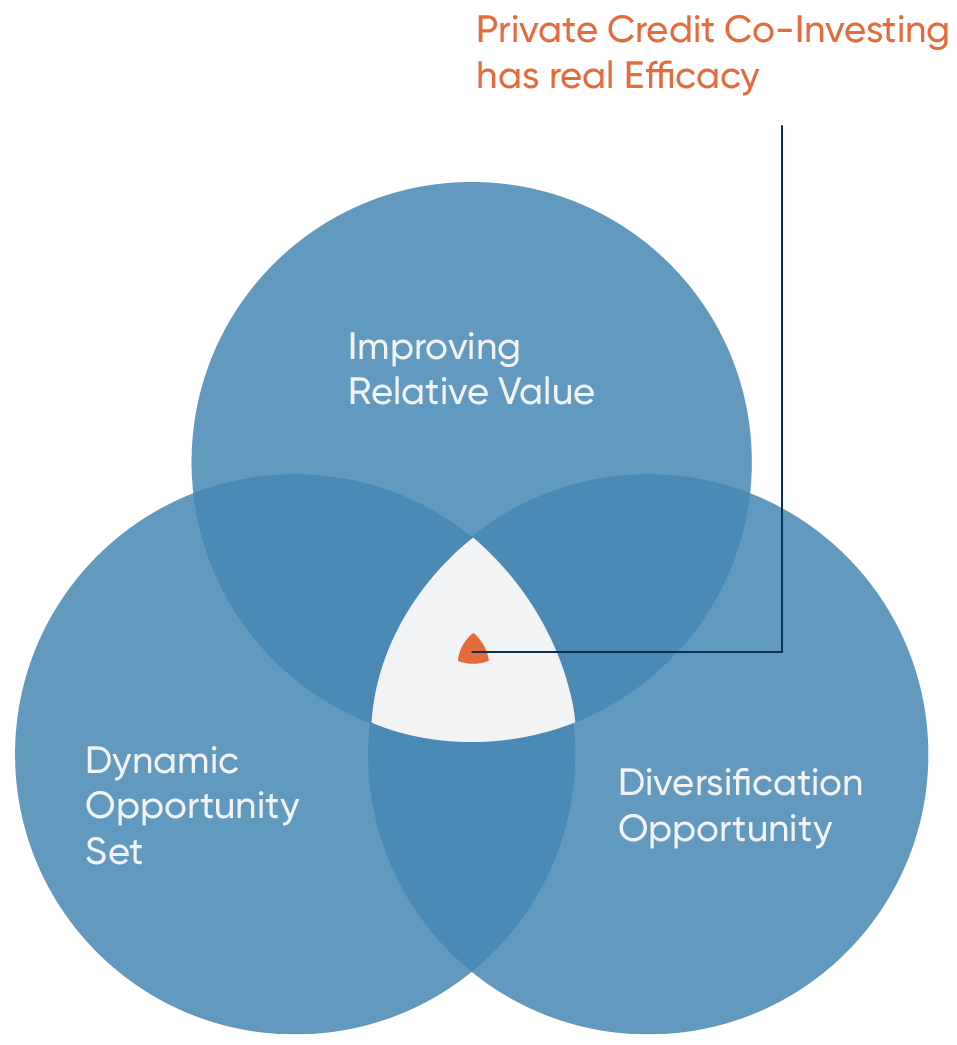

Credit Co-Investing

We believe an effective way for insurers to capitalize on the current opportunity set within private credit is through co-investments. Private credit co-investing not only provides the ability to capture the dynamic private credit opportunity set without a heavy operational burden, but it also provides empirical support for diversification benefits as well as the favorable economics associated with a reduced total layer of fees, which can lead to better risk-adjusted returns versus other private credit alternatives.

While we believe private credit co-investing presents a compelling opportunity for insurers, we recognize that there are implementation challenges that can make accessing these opportunities difficult. To unlock the full potential of credit co-investments, we believe insurers need a partner who has a robust deal sourcing platform, the internal execution capability to fully own the operational burden of co-investing, and the experience and ability to perform independent underwriting and make investment decisions.

Learn more about capturing co-investment opportunities in the private and alternative credit markets.

Figure 9

Select risks include: market risk, macroeconomic risk, liquidity risk, interest rate risk, and operational risk

For illustrative purposes only. No assurance can be given that any investment will achieve its objectives or avoid losses. Unless apparent from context, all statements herein represent GCM Grosvenor’s opinion. Past performance is not necessarily indicative of future results.

GP-Seeding

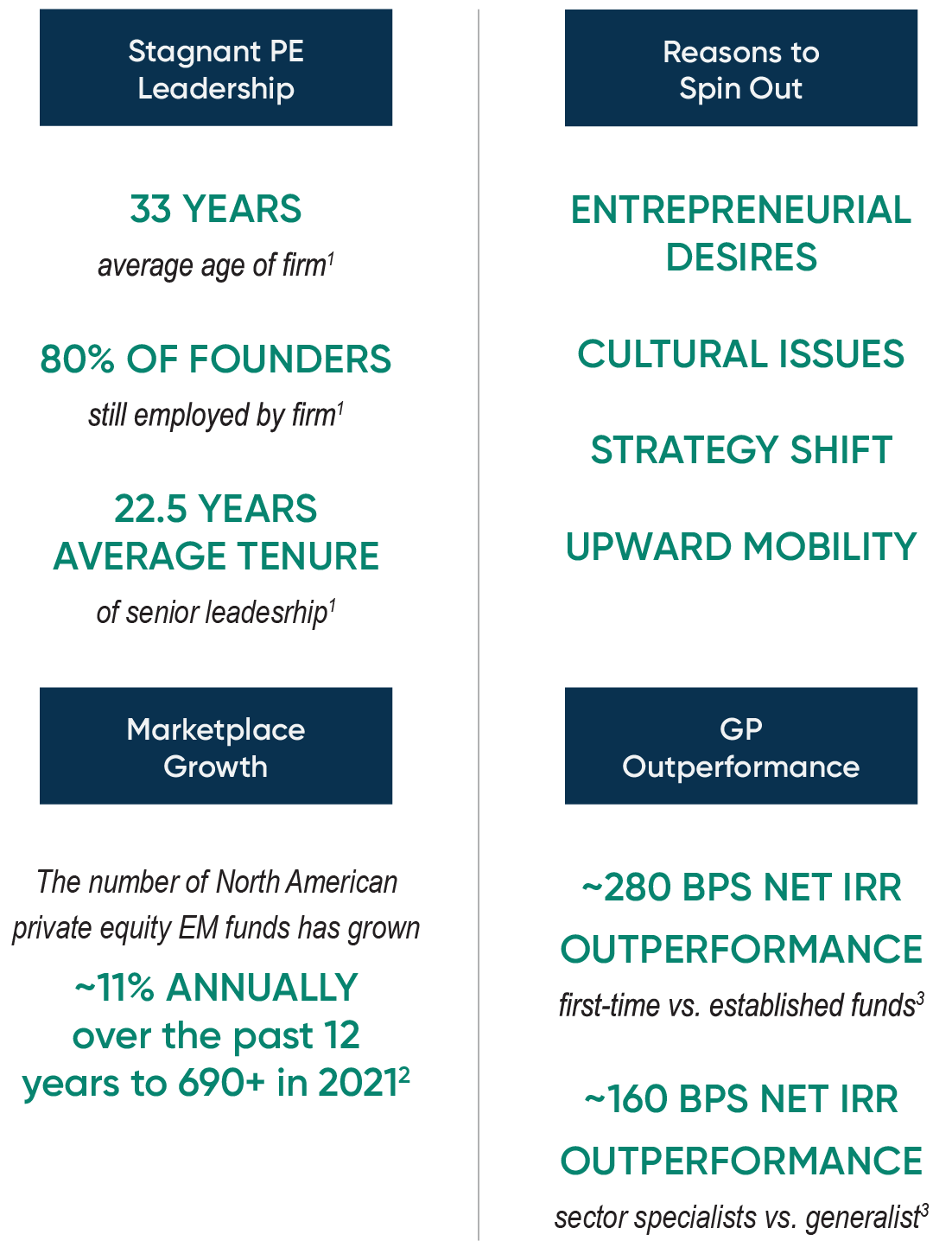

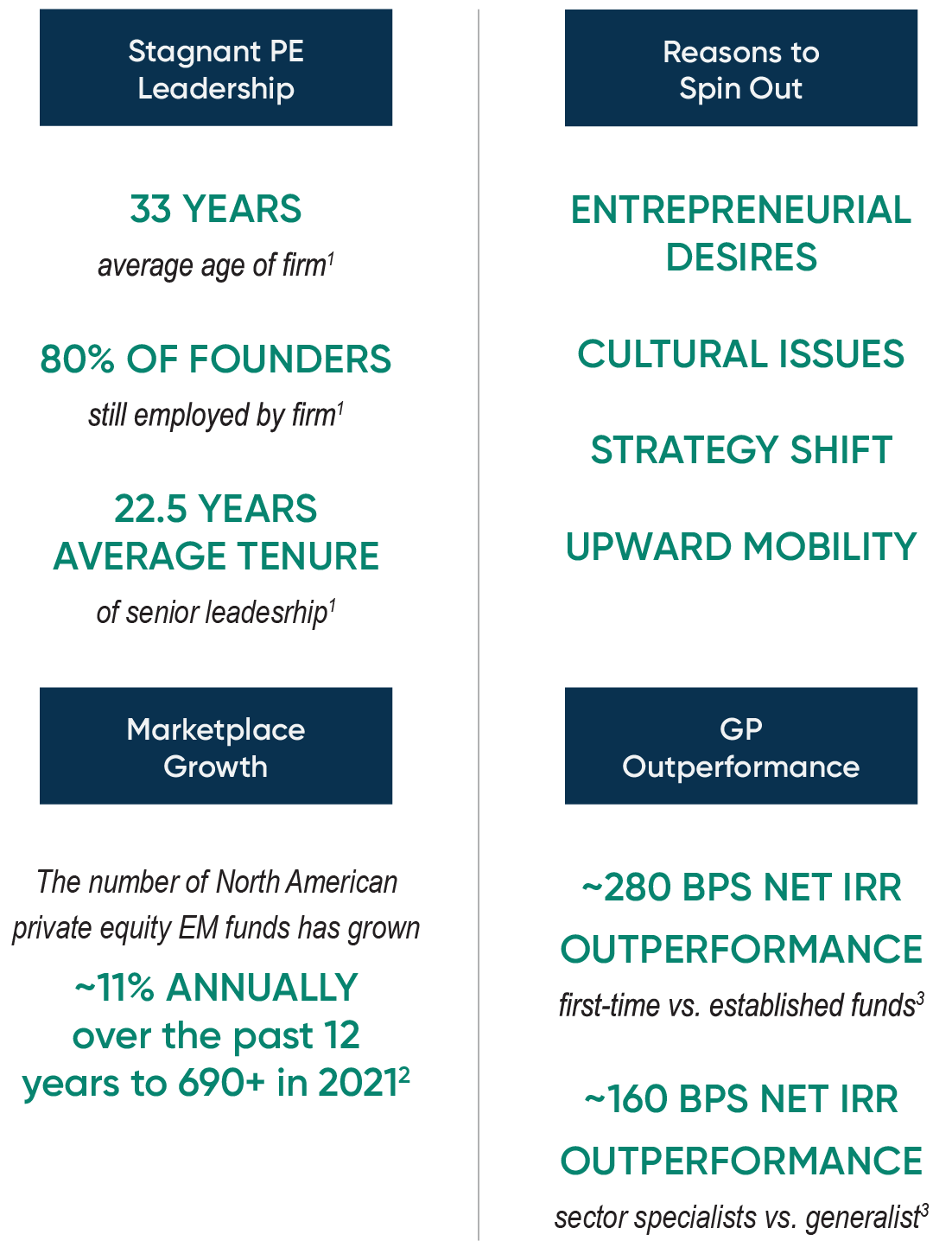

It is our belief that the current macroenvironment is an opportune moment for GP seeding, as each significant economic dislocation over the past 30 years has spurred extensive fund formation and the next great class of emerging managers. However, the highly challenging fundraising environment makes capital a scarce and precious resource. Combined with low and mid-market performance data, the current market, in our experience, is favorable for seed providers in a position to provide scale capital and operational support to experienced investors who are founding firms for the first time. In turn, this model can provide investors with a portfolio diversified across vintage years and an opportunity to participate as minority owners in cash flows across management fees, carried interest, and balance sheet investments over a long duration.

Read more about the rise of GP seeding as an institutional asset class.

Why GP seeding and why now?

Figure 10

1 Source: GCM Grosvenor analysis of publicly available information. Data as of May 2023.

2 Sources: Preqin (Data as of May 2023), Hedge Fund Research (Data as of May 2023), GCM Grosvenor proprietary databases (Data as of May 2023). Includes North American funds with vintages from 2010-2021.

3 Source: Preqin Pro. Data as of May 2023. Data represents Buyout funds with vintages from 2000-2019. First-time funds defined as first number fund (overall) and established funds defined as IV+ number fund (overall). Sector specialist defined as non-diversified focus for Core Industries.

For illustrative purposes only. No assurance can be given that any investment will achieve its objectives or avoid losses. Unless apparent from context, all statements herein represent GCM Grosvenor’s opinion. Past performance is not necessarily indicative of future results.

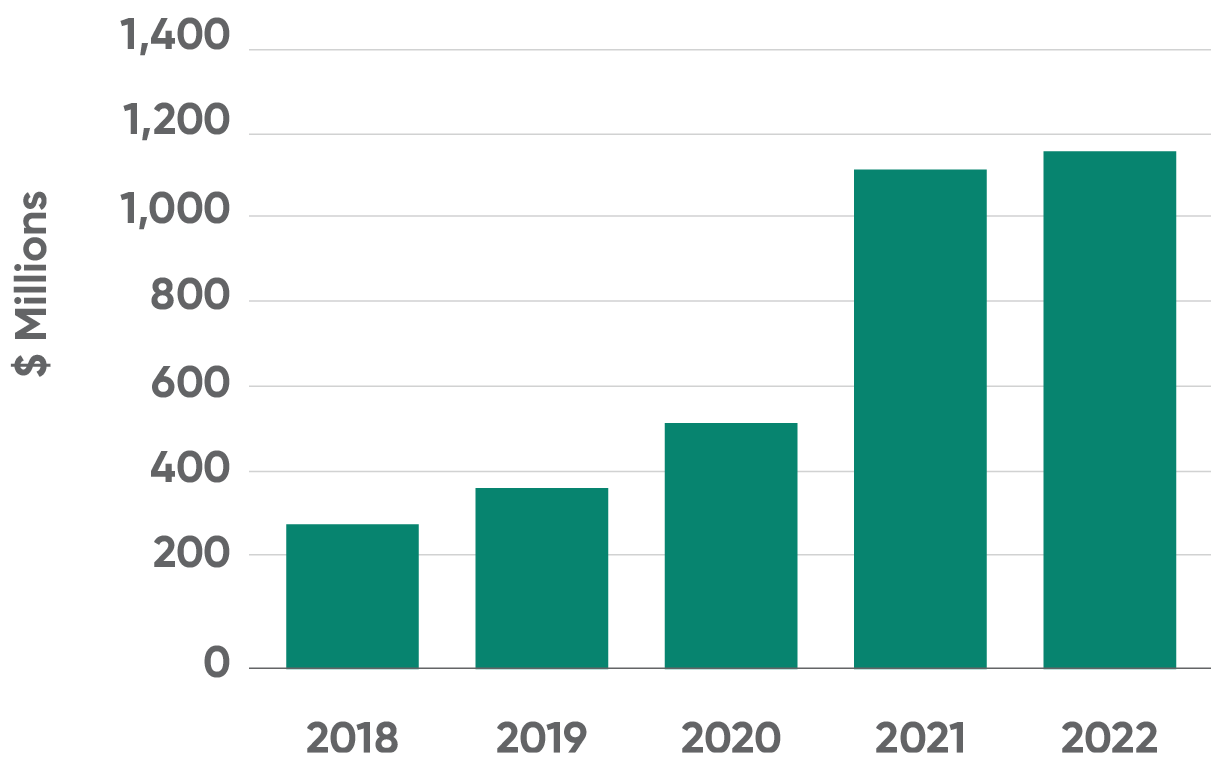

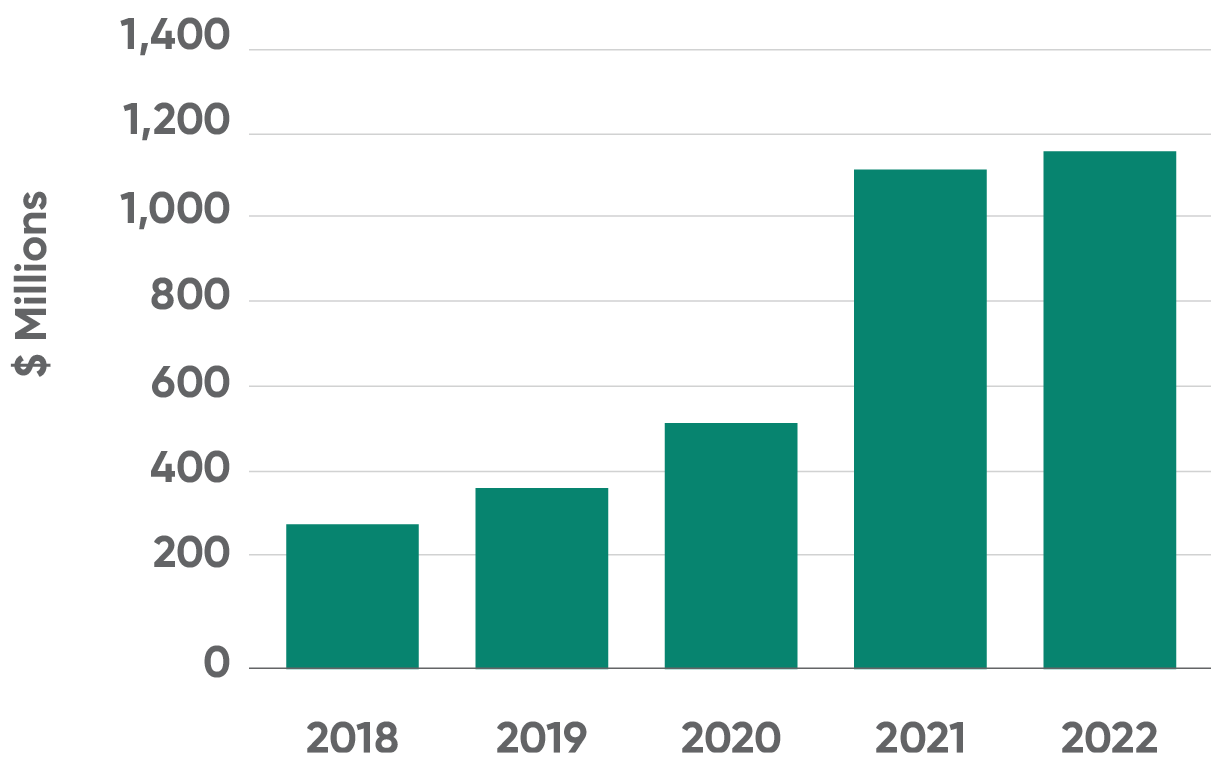

Insurers are beginning to see the value of GP seeding, as evidenced by their allocations to such strategies increasing at a CAGR of 41% over the past 5 years. We expect that their allocations will continue to increase over time.

Insurers GP Seeding Strategy Carrying Value

Figure 11

Source: S&P Capital IQ Pro

Data as of December 31, 2022

Structured Solutions

In addition to the two examples we explore above, insurers can also extract incremental value from their alternatives investments by utilizing structured solutions to access alternative investments more efficiently than they can by investing directly into such strategies. Structuring of alternative investments can play a critical role in their success and present insurers with ways to create capital, operational, and other efficiencies.

It is our belief that the current macroenvironment is an opportune moment for GP seeding, as each significant economic dislocation over the past 30 years has spurred extensive fund formation and the next great class of emerging managers. However, the highly challenging fundraising environment makes capital a scarce and precious resource. Combined with low and mid-market performance data, the current market, in our experience, is favorable for seed providers in a position to provide scale capital and operational support to experienced investors who are founding firms for the first time. In turn, this model can provide investors with a portfolio diversified across vintage years and an opportunity to participate as minority owners in cash flows across management fees, carried interest, and balance sheet investments over a long duration.

Read more about the rise of GP seeding as an institutional asset class.

Structured Solutions

In addition to the two examples we explore above, insurers can also extract incremental value from their alternatives investments by utilizing structured solutions to access alternative investments more efficiently than they can by investing directly into such strategies. Structuring of alternative investments can play a critical role in their success and present insurers with ways to create capital, operational, and other efficiencies.

Why GP seeding and why now?

Figure 10

1 Source: GCM Grosvenor analysis of publicly available information. Data as of May 2023.

2 Sources: Preqin (Data as of May 2023), Hedge Fund Research (Data as of May 2023), GCM Grosvenor proprietary databases (Data as of May 2023). Includes North American funds with vintages from 2010-2021.

3 Source: Preqin Pro. Data as of May 2023. Data represents Buyout funds with vintages from 2000-2019. First-time funds defined as first number fund (overall) and established funds defined as IV+ number fund (overall). Sector specialist defined as non-diversified focus for Core Industries.

For illustrative purposes only. No assurance can be given that any investment will achieve its objectives or avoid losses. Unless apparent from context, all statements herein represent GCM Grosvenor’s opinion. Past performance is not necessarily indicative of future results.

Insurers are beginning to see the value of GP seeding, as evidenced by their allocations to such strategies increasing at a CAGR of 41% over the past 5 years. We expect that their allocations will continue to increase over time.

Insurers GP Seeding Strategy Carrying Value

Figure 11

Source: S&P Capital IQ Pro

Data as of December 31, 2022

Conclusion

Regardless of the current macroeconomic landscape, we believe exciting alternative investment opportunities exist for insurers to unlock value and generate competitive risk-adjusted returns. To make the most of their alternative asset allocations, insurers should seek an experienced partner who can help them maintain discipline in deployment across vintage years, expand their investment universe to typically under allocated or less trafficked areas of the market, and utilize a variety of structures to extract incremental value from their investments.

To learn more, please reach out to our Insurance Solutions Team at [email protected].

RELATED NEWS AND INSIGHTS

Capturing Alternative Investment Opportunities: A Toolkit for Insurance Investors

As insurers navigate a dynamic investment landscape, GCM Grosvenor explores key trends shaping alternative allocations.

GCM Grosvenor Expands Insurance Solutions Group with the Hire of Joe Metzger as Managing Director

CHICAGO, Feb. 05, 2025 — GCM Grosvenor (Nasdaq: GCMG), a leading global alternative asset management solutions provider, is pleased to announce that Joe Metzger has joined the firm as a

Important Disclosures

For illustrative and discussion purposes only. No assurance can be given that any investment will achieve its objectives or avoid losses. The information and opinions expressed are as of the date set forth therein and may not be updated to reflect new information.

Investments in alternatives are speculative and involve substantial risk, including strategy risks, manager risks, market risks, and structural/ operational risks, and may result in the possible loss of your entire investment. The views expressed are for informational purposes only and are not intended to serve as a forecast, a guarantee of future results, investment recommendations, or an offer to buy or sell securities by GCM Grosvenor. All expressions of opinion are subject to change without notice in reaction to shifting market, economic, or political conditions. The investment strategies mentioned are not personalized to your financial circumstances or investment objectives, and differences in account size, the timing of transactions, and market conditions prevailing at the time of investment may lead to different results. Certain information included herein may have been provided by parties not affiliated with GCM Grosvenor. GCM Grosvenor has not independently verified such information and makes no representation or warranty as to its accuracy or completeness.

Data Sources

Certain information, including benchmarks, is obtained from The Burgiss Group (“Burgiss”), an independent subscription-based data provider, which calculates and publishes quarterly performance information from cash flows and valuations collected from of a sample of private equity firms worldwide. When applicable, the performance of GCM Grosvenor’s private equity, real estate, and infrastructure underlying investments are compared to that of its peers by asset type, geography, and vintage year as of the applicable valuation date. GCM Grosvenor’s Asset Class and Geography definitions may differ from those used by Burgiss. GCM Grosvenor has used its best efforts to match its Asset Class, Geography, and strategy definitions with the appropriate Burgiss data but material differences may exist. Benchmarks for certain investment types may not be available. GCM Grosvenor uploads data into its system one-time each quarter; however, the data service may continue to update its information thereafter. Therefore, information in GCM Grosvenor’s system may not always agree with the most current information available from the data service. Additional information is available upon request.