Have Your Cake and Eat it Too: Unlocking the Value of Middle Market Co-Investments

- May 24, 2023

- Co-Investments

Past performance is not necessarily indicative of future results. No assurance can be given that any investment will achieve its given objectives or avoid losses. Unless apparent from context, all statements herein represent GCM Grosvenor’s opinion.

Select risks include: macroeconomic risk, sourcing risk, investment selection, portfolio diversification, management risk, execution of value creation plan, risks related to reliance on third parties, and risks related to the sale of investments.

INTRODUCTION

While it is no secret that market volatility and an economic downturn have created a challenging deal making environment for investors, we believe compelling opportunities continue to exist in the middle market. Not only has deal volume held up relatively well amid a general slowdown but, with ~10x the number of investible opportunities compared to large buyouts1, the middle market often offers investors lower purchase price multiples and the ability to employ a more conservative capital structure. These smaller underlying company sizes can also offer the ability for the right sponsors to create value that will have a meaningful impact on returns versus what is possible when investing in larger companies.

Given that the middle market can present opportunities to both buy value as well as create it, the natural question is which approach is preferable? The answer, we believe, is both. We seek to target middle market co-investments that offer both attractive purchase prices and multiple value creation levers that can drive returns. Below we explore two segments of the market in which we believe there is a particular opportunity to “have your cake and eat it too” by both buying at an attractive entry price as well as partnering with the right sponsor to drive value creation. These two segments are family-owned businesses and public-to-private transactions.

In both family-owned businesses and public-to-private transactions, the companies at stake are usually fundamentally good businesses. But, because of the ownership dynamics, there are often cost savings opportunities to increase EBITDA margins and the ability to use cash flow to invest in future growth.

Family-Owned Businesses

Family-owned companies typically allow for broad professionalization opportunities across all areas of the business, including augmenting the management team. Many of these companies have never made an acquisition before, so partnering with the right sponsor can also unlock new avenues for growth and profitability.

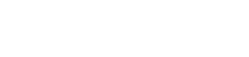

The below deal spotlight showcases one of our recent investments in a family-owned business that presented value creation opportunities through both margin and growth initiatives and resulted in significant return generation.

No assurance can be given that any investment will achieve its objectives or avoid losses. Past performance is not necessarily indicative of future results. Unless apparent from context, all statements herein represent GCM Grosvenor’s opinion. For illustrative purposes only.

Public-to-Private Transactions

Especially in the wake of broader market declines, such as what we are experiencing today, public companies or corporate carve-outs of non-core business units often offer attractive purchase prices to potential buyers. They can also provide opportunities to invest in larger scale growth initiatives when their focus is redirected away from shorter term quarterly earnings.

In this deal spotlight, we explore a recent investment that presented value creation opportunities through cost savings initiatives, management changes, and revenue expansion and resulted in margin expansion and a debt recapitalization that produced a subsequent distribution to shareholders of ~50% of invested capital.

No assurance can be given that any investment will achieve its objectives or avoid losses. Past performance is not necessarily indicative of future results. Unless apparent from context, all statements herein represent GCM Grosvenor’s opinion. For illustrative purposes only.

The Importance of Partner Selection

Middle market buyouts can offer compelling return potential but are more challenging to execute on your own. Pursuing middle market buyouts through a co-investment vehicle can be a cost-effective way to obtain exposure and achieve diversification. To be best positioned for success, investors need access to partners with the right expertise to not only source high-quality deals, but also to effectively diligence and structure investments and portfolios that offer comprehensive diversification. They also need to work with a partner who has access to top-tier sponsors that will be best positioned to identify and take advantage of value creation opportunities and have the expertise to do so in a cost efficient and timely manner.

GCM Grosvenor has been focused on middle market investing alongside sponsors for over 23 years, and we have a nearly 20-year track record of buyout co-investing that is part of our broader ~$30 billion private equity platform2. Learn more about our private equity and co-investment platforms here.

RELATED NEWS AND INSIGHTS

Have Your Cake and Eat it Too: Unlocking the Value of Middle Market Co-Investments

We explore two segments of the market in which we believe there is a particular opportunity to “have your cake and eat it too” by both buying at an attractive entry price as well as partnering with the right sponsor to drive value creation. These two segments are family-owned businesses and public-to-private transactions.

Widening the Lens of Private Credit Through Co-Investing

Here we spotlight three market trends that are currently creating opportunities in private credit and examine certain execution challenges that have precluded many investors from implementing credit co-investments. We also discuss why we believe GCM Grosvenor is well-suited to mitigate these challenges and deliver the benefits of private credit co-investing to our clients, in ways that suit them best.

1 Source: BURGISS: Data as of March 31, 2022; downloaded August 3, 2022. U.S. MMBO: Funds less than $3 billion; U.S. Large BO: Funds over $3 billion. Analysis consists of 2000 – 2013 vintage funds.

2 Data as of December 31, 2022.

Important Disclosures

For illustrative and discussion purposes only. The information contained herein is based on information received from third parties. GCM Grosvenor has not independently verified third-party information and makes no representation or warranty as to its accuracy or completeness. The information and opinions expressed are as of the date set forth therein and may not be updated to reflect new information.

Investments in alternatives are speculative and involve substantial risk, including strategy risks, manager risks, market risks, and structural/operational risks, and may result in the possible loss of your entire investment. Past performance is not necessarily indicative of future results. The views expressed are for informational purposes only and are not intended to serve as a forecast, a guarantee of future results, investment recommendations or an offer to buy or sell securities by GCM Grosvenor. All expressions of opinion are subject to change without notice in reaction to shifting market, economic, or political conditions. The investment strategies mentioned are not personalized to your financial circumstances or investment objectives, and differences in account size, the timing of transactions and market conditions prevailing at the time of investment may lead to different results. Certain information included herein may have been provided parties not affiliated with GCM Grosvenor. GCM Grosvenor has not independently verified such information and makes no representation or warranty as to its accuracy or completeness.