Clarifying the Misconceptions of Co-Investing

We debunk several common misconceptions related to co-investing in today’s market.

Past performance is not necessarily indicative of future results. No assurance can be given that any investment will achieve its given objectives or avoid losses. Unless apparent from context, all statements herein represent GCM Grosvenor’s opinion.

Select risks include: market risk, macroeconomic risk, liquidity risk, interest rate risk, and operational risk

We recently wrote about the attractiveness of private credit co-investing and highlighted some of the elements to do it successfully. Today, we continue to view co-investing in private credit as a “silver bullet” of sorts, as it allows investors to both capitalize on broad trends in the private credit market while also providing access to attractive investment opportunities that can create real value for portfolios in 2023.

Here we spotlight three market trends that are currently creating opportunities in private credit and examine certain execution challenges that have precluded many investors from implementing credit co-investments. We also discuss why we believe GCM Grosvenor is well-suited to mitigate these challenges and can deliver the benefits of private credit co-investing to our clients, in ways that suit them best.

We have identified three market trends positively impacting private credit today. Our enthusiasm for private credit co-investing stems from our belief that it sits at the center of these trends:

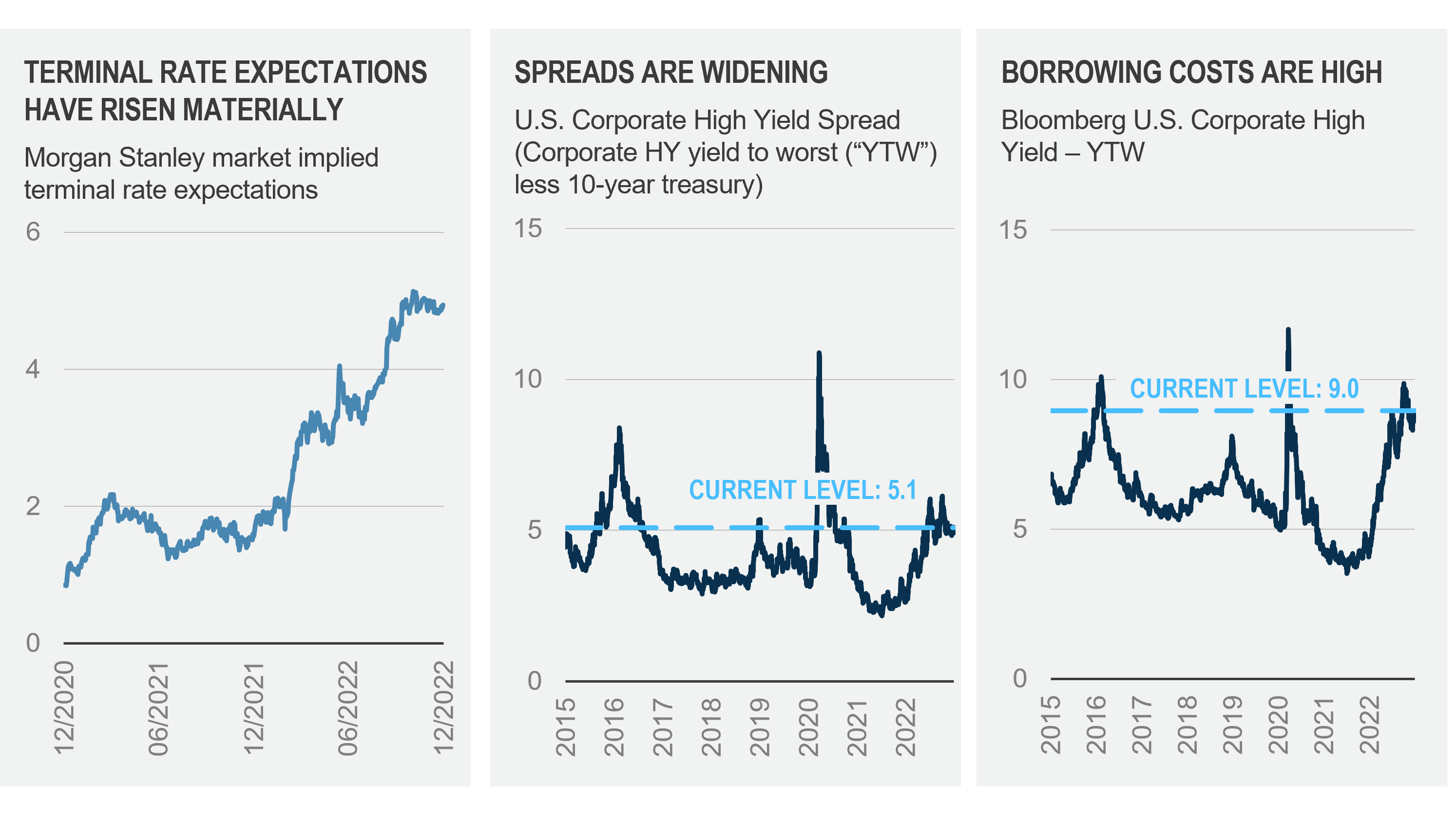

In private credit, there has been a meaningful shift in terms of expected return, and we are seeing some of the highest absolute returns in some time. As illustrated below, base rates have increased by 400 bps in the past year – a historic movement in both scale and speed. Meanwhile, spreads are widening at or above their historical averages, depending on the sub-sector, with the potential for further widening if economic conditions weaken.

The combination of rising base rates and widening spreads has led to significantly higher borrowing costs. Thus, we are starting to see stress in levered capital structures and in their ability to remain cash flowing, which can potentially lead to stressed/distressed opportunities as well.

The result for investors: 500-800 bps or more of incremental return potential across private credit opportunities compared to just a year ago. We are now seeing an attractive beta opportunity in private credit.

It follows that asset allocation discussions, long dominated by equity opportunities, are starting to shift toward private credit. Absolute returns in private credit, which range from 10%-20% per annum or more across sub-strategies, along with the contractual yield and seniority in the capital structure of these assets, are making it easier for investors to find a place for private credit in their portfolios.

Source: Bloomberg Finance L.P. Data as of December 31, 2022.

Diversification can be one of the easiest and most powerful ways to enhance returns while maintaining strong downside risk mitigation – in fact, diversification is often called the only “free lunch” in investing. But despite that, diversification has been slow to take hold in private credit1.

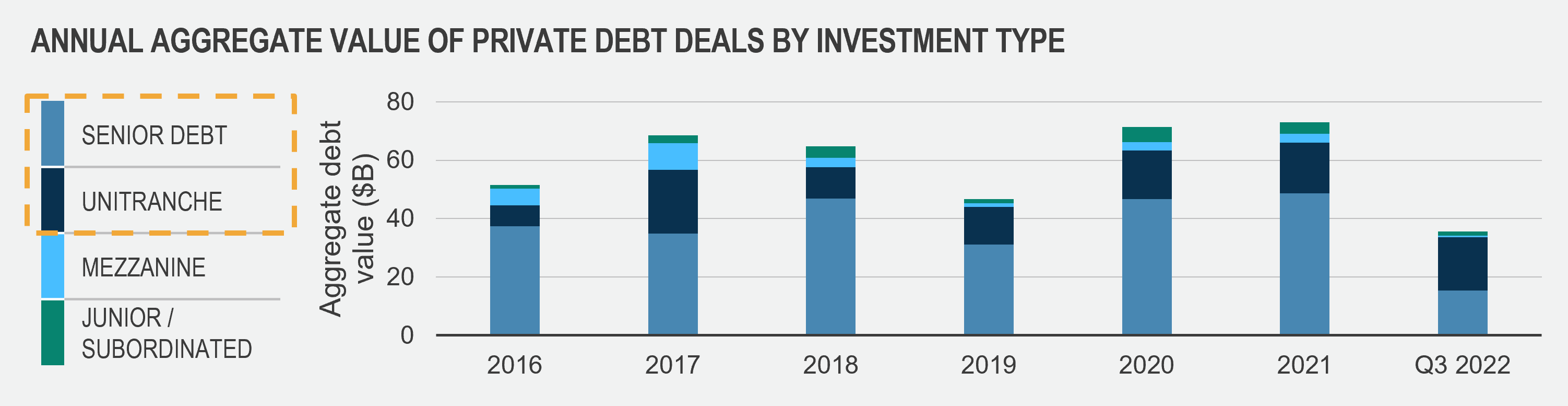

As illustrated below, most allocations in private credit recently have gone to traditional direct lending, and almost exclusively to the most senior part of capital structure: senior debt and first lien, or unitranche, deals. Those allocations allowed investors to diversify away from traditional investment grade and high yield exposures in seeking to earn excess return, at the cost of liquidity.

Source: Peqin Pro. Data as of September 30, 2022.

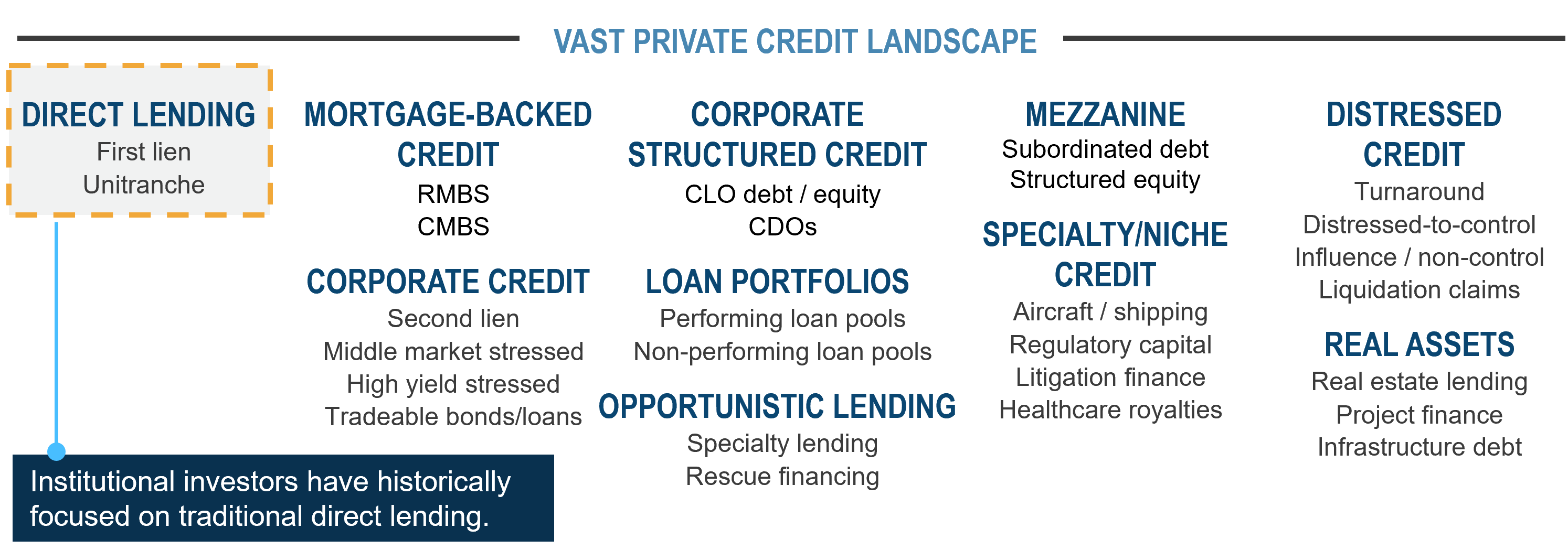

While this approach made sense, we still feel it is a half-measure in that it largely did not account for broader private credit opportunities in institutional portfolios. The private credit sector is vast and, importantly, sub-strategies within it are not perfectly correlated with one another. Thus, as an investor widens their exposures, there are substantial opportunities for diversification benefits in private credit.

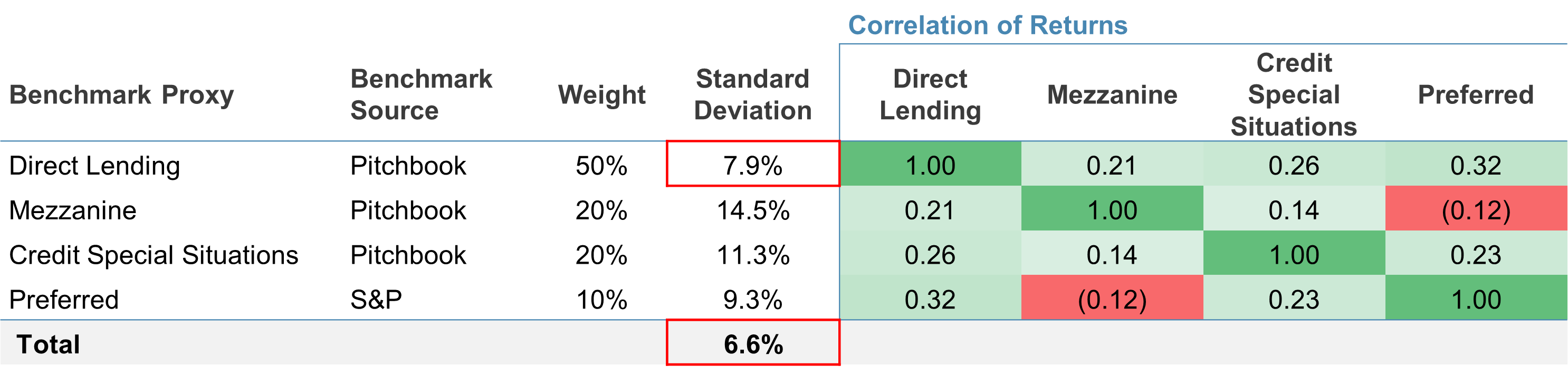

Thus, as an investor widens their exposures, there are substantial opportunities for diversification benefits in private credit. As illustrated below, historical correlations between different sectors are low, potentially providing lower volatility and correlation compared to a portfolio focused on direct lending.

The analysis (“Financial Analysis”) presented is hypothetical in nature and is shown for illustrative, informational purposes only. See the Notes and Disclosures following this report for additional information regarding the Financial Analysis. No assurance can be given that any investment will achieve its objectives or avoid losses. ACTUAL RESULTS EXPERIENCED BY CLIENTS MAY VARY SIGNIFICANTLY FROM THE FINANCIAL ANALYSIS SHOWN. THE POTENTIAL OUTCOMES OUTLINED IN THE FINANCIAL ANALYSIS MAY NOT MATERIALIZE.

The private credit opportunity set is fast-moving and difficult to predict over the long-term. This is due to a confluence of factors, but rate volatility and economic uncertainty are both key drivers. These and other drivers can combine to create a constantly shifting landscape of opportunities across sub-strategies.

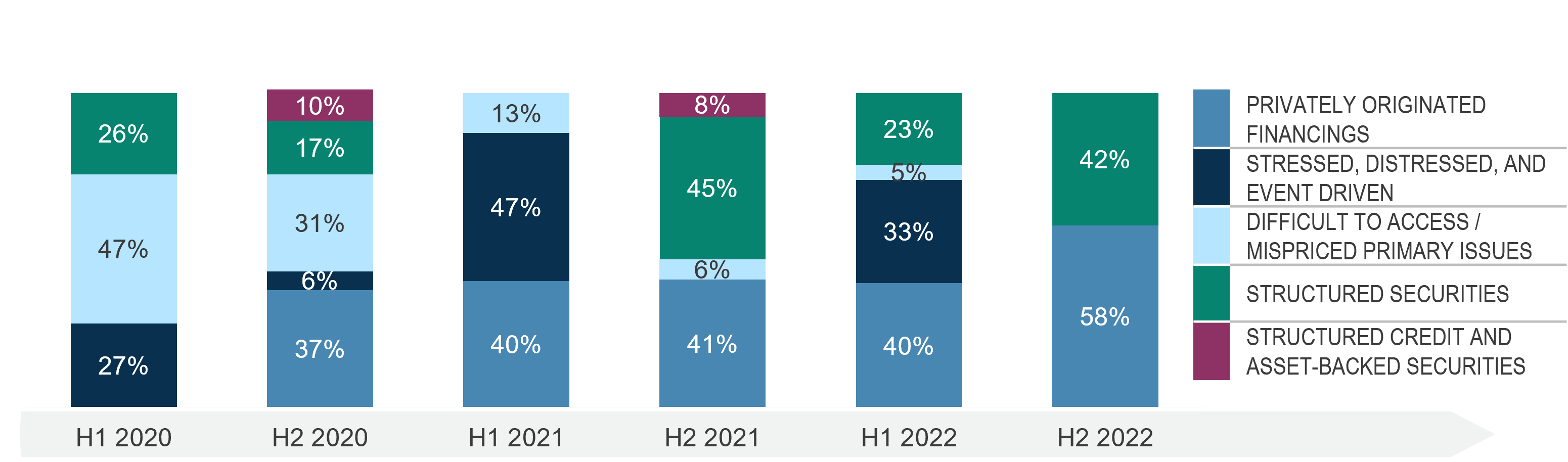

In the chart below, we show our private credit co-investing activities, which fluctuated greatly quarter-to-quarter across sub-strategies in the past 2.5 years. Given the current macro environment, we believe this trend will persist, and one could argue that the market could become even more dynamic, particularly if economic stress were to continue.

Data as of December 31, 2022 Graph only depicts credit investments in the Strategic Credit Strategy; non-credit transactions are not included.

In 2023, we believe private credit investors can achieve incremental return by capitalizing on increasing relative value, diversifying their private credit program across sub-strategies, and taking advantage of a dynamic opportunity set.

So, where’s the catch?

Private credit co-investing is difficult to implement – we believe it is much more difficult than in private equity or other asset classes. Thus, there are several challenges facing investors who wish to implement a program. Here, we highlight three.

While most investors wish to see a high volume of deals in their pipeline, it can be difficult to adequately cover the vast universe of private credit strategies and sub-strategies. As a result, blind spots may occur when assessing the opportunity set.

Of course, high quality deal flow is also critical. Investors must have the expertise to successfully identify the right opportunities and avoid adverse selection at the top of their deal-flow funnels. Failure to do so can lead to a “garbage-in garbage-out” effect if not effectively managed.

Investors in private equity co-investments often have the luxury of time for diligence and execution and frequently have access to deals that are pre-packaged in SPVs, and thus easier to access. Credit co-investing, on the other hand, can be quite burdensome operationally.

First, investors need to be familiar with many private credit asset types, including loans, bonds, structured securities, preferred securities, convertibles, and many more. Second, private credit has short timelines and there are no pre-packaged SPVs – meaning no ease of access for investors. Third, there are many unique legal, tax, and structuring components to the deals, which can easily extend beyond an investor’s area of expertise.

In private equity co-investing, most strategies are predicated on sizing-up existing positions and achieving structural alpha by blending-down economics. However, in private credit co-investing, while enhanced economics are certainly present, the primary motivation is seeking to create excess return and diversification in a portfolio.

Thus, it can be challenging for an investor to properly identify and select the most attractive deals from a broad opportunity set and assemble them into a diversified portfolio. Doing so requires a sound investment process and the ability to underwrite deals and do “real” credit work. It comes down to the investor synthesizing all the input and making an independent investment decision.

At GCM Grosvenor, we have been addressing the challenges and maximizing opportunities in private credit co-investing since the inception of our Strategic Investments Group eight years ago. Thus, we believe we can be strong partners for clients seeking the benefits this strategy offers.

We view the challenge of deal sourcing – in both volume and quality – as a competitive advantage because of our global investment platform. We have $74 billion deployed across more than 650 GP relationships, which produces high-volume and, importantly, high-quality deal flow. We see curated deal flow that goes beyond the marginal deals in the marketplace. Instead, we have curated relationships with managers selected by GCM Grosvenor professionals who are experts in their respective strategies.

All told, our team sees over 1,000 opportunities annually, and more than half of those are in private credit.

We also view operational execution as a competitive advantage. We addressed this challenge by building our own internal execution capability and fully removing the operational burden of co-investing from the GP. Thus, we are positioned to efficiently transact in any type of investment sourced by our team.

Today, we have a deep bench of operational resources. Our team includes tax and legal structuring professionals and middle- and back-office staff, we own our prime brokerage relationships, and have ISDAs in place with all counterparties2. In addition, our team members have trading skills across various product types.

The outcome: because of our resources and approach to execution, many General Partners view us as a good partner and easy to work with, which in turn generates more deal flow into the top of our funnel and creates a sort of virtuous cycle.

Finally, on deal selection, we have developed and continue to refine our investment process in seeking to deliver a high hit rate and achieve the desired returns. It begins with our experienced team, which is positioned to perform independent underwriting and ultimately make investment decisions. The team was hired from buy-side credit firms, hedge funds, private equity firms, and investment banks and have spent their whole careers doing direct deals.

By addressing the challenges in private credit co-investing, we believe we can provide clients with the benefits of enhanced returns by taking advantage of diversification opportunities and the dynamic opportunity set. We continue to form valuable partnerships with investors who are looking to grow and/or enhance their private credit exposure.

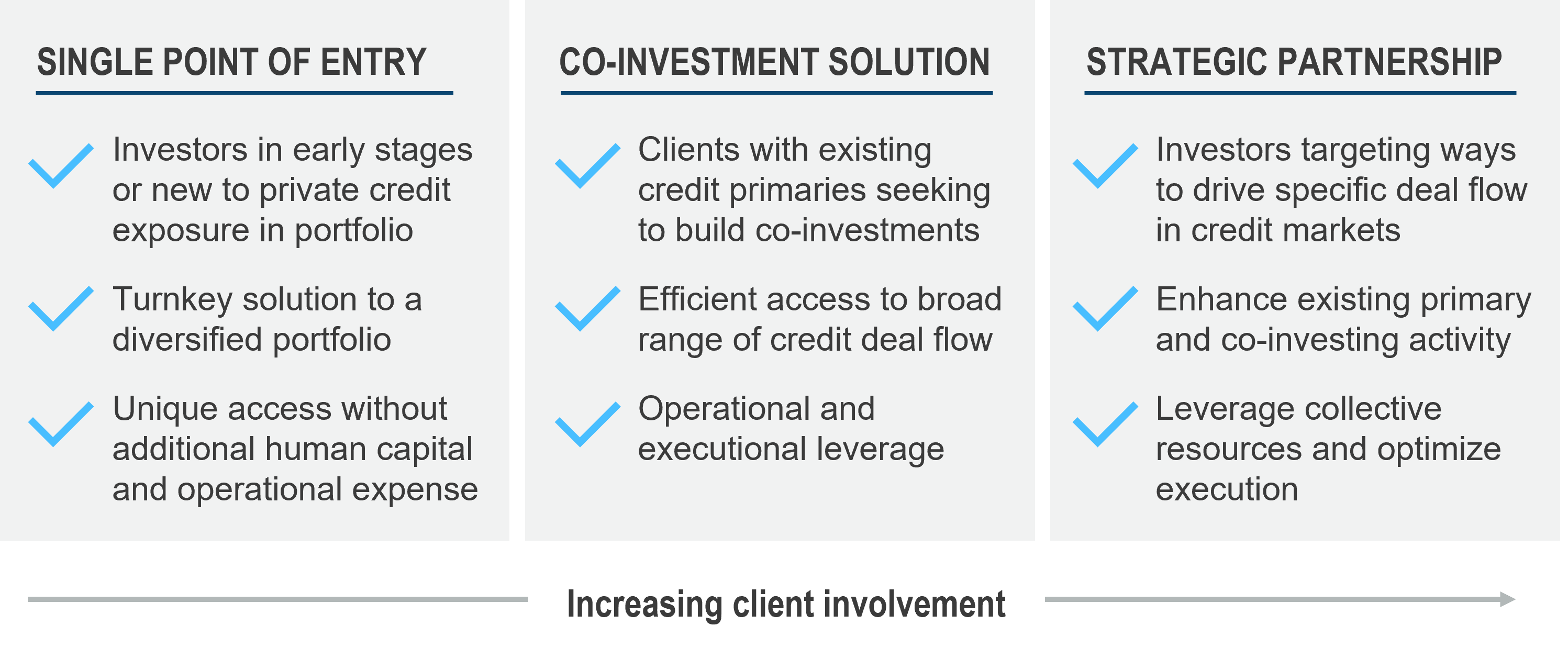

Today, our clients include a wide range of organization types with varying resources and objectives. Below is a snapshot of three ways we are working with clients to integrate private credit co-investing into their investment programs.

For illustrative purposes only.

Learn more about the GCM Grosvenor Strategic Investments Group.

We debunk several common misconceptions related to co-investing in today’s market.

In today’s market, many institutional investors are contending with overallocation to private capital strategies. Here, we discuss how co-investing can help them refrain from pausing new investments and maintain exposure to potentially high-performing vintages, even when investment dollars are scarce.

1Risk management, diversification, and due diligence processes seek to mitigate, but cannot eliminate risk, nor do they imply low risk.

2GCM Grosvenor does not provide legal or tax advice. You should seek advice based on your particular circumstances from your independent tax advisor and/or legal counsel.

Important Disclosures

For illustrative and discussion purposes only. The information contained herein is based on information received from third parties. GCM Grosvenor has not independently verified third-party information and makes no representation or warranty as to its accuracy or completeness. The information and opinions expressed are as of the date set forth therein and may not be updated to reflect new information.

Investments in alternatives are speculative and involve substantial risk, including market risks, credit risks, macroeconomic risks, liquidity risks, manager risks, counterparty risks, interest rate risks, and operational risks, and may result in the possible loss of your entire investment. Past performance is not necessarily indicative of future results. The views expressed are for informational purposes only and are not intended to serve as a forecast, a guarantee of future results, investment recommendations or an offer to buy or sell securities by GCM Grosvenor. All expressions of opinion are subject to change without notice in reaction to shifting market, economic, or political conditions. The investment strategies mentioned are not personalized to your financial circumstances or investment objectives, and differences in account size, the timing of transactions and market conditions prevailing at the time of investment may lead to different results. Certain information included herein may have been provided parties not affiliated with GCM Grosvenor. GCM Grosvenor has not independently verified such information and makes no representation or warranty as to its accuracy or completeness.

The analysis (“Financial Analysis”) presented is hypothetical in nature and is shown for illustrative, informational purposes only. It does not reflect the actual returns or risk profile of any GCM fund or strategy pursued by any GCM fund, and does not guarantee future results.

The Financial Analysis is subject to numerous assumptions including, but not limited to, observed and historical market returns relevant to certain investments, an asset class, projected cash flows, projected future valuations of target assets and businesses, other relevant market dynamics (including interest rate and currency markets), anticipated contingencies, and regulatory issues. Changes in the assumptions will have an impact, perhaps materially so, on the Financial Analysis.

Certain of the assumptions have been made for modeling purposes and are unlikely to be realized. No representation or warranty is made as to the reasonableness of the assumptions made or that all assumptions made have been stated or fully considered. Management fees, transaction costs, and potential expenses may not be considered and would affect the Financial Analysis. Actual results experienced by clients may vary significantly from the Financial Analysis shown. The Potential Outcomes Outlined In The Financial Analysis May Not Materialize.

GCM Investments UK LLP (GCMUK) has been made aware of fraudulent schemes targeting members of the public in the United Kingdom.

Unauthorised individuals are falsely claiming to represent GCMUK and are misusing the firm’s name and publicly available information in connection with fake investment opportunities.

These scams are sophisticated and deliberately misleading. They may involve the use of real GCMUK employee names and may imitate the tone, format, and branding of genuine GCMUK communications.

Please note:

GCMUK does not offer financial services or products to retail clients, either directly or through third parties. You can verify GCMUK’s regulatory status and permissions on the Financial Conduct Authority (FCA) Register at register.fca.org.uk.

If you are based in the UK and believe you have been contacted by a fraudster claiming to represent GCMUK, please take the following steps:

Investor Scam Alert

GCM Grosvenor L.P. and its affiliated entities (collectively, “GCMG”) have been made aware of fraudulent schemes currently targeting members of the public in Malaysia and Hong Kong, in which unauthorised individuals are falsely claiming to represent GCMG in connection with purported investment opportunities.

These fraudulent individuals are believed to be actively promoting false investment opportunities, often involving mobile applications, through the unauthorised use of GCMG’s name, brand, corporate logo, and other identifying materials. We have also received reports that these parties may be distributing fabricated business cards, hosting online webinars, creating WhatsApp groups, and arranging personal video calls to simulate legitimacy. These scams are sophisticated and deliberately misleading, frequently involving the use of real GCMG employee names and imitating the style, tone, and presentation of genuine GCMG communications.

GCMG has no presence, operations, or authorised representatives in Malaysia. GCMG does not offer any investment schemes, products, or mobile applications targeted at Malaysian investors, either directly or indirectly.

While GCMG maintains a legitimate presence and employs personnel in Hong Kong, these scams are entirely unauthorised and unrelated to any genuine activities conducted by GCMG or its employees in the region.

Position of GCMG

GCMG has neither authorised nor endorsed any such solicitations and takes this matter seriously. We have reported some of these incidents to the relevant regulatory and enforcement authorities in Malaysia, and are doing the same in Hong Kong, including notifying the Hong Kong Police and the appropriate financial regulators. GCMG will continue to assist with their investigations.

GCMG is actively monitoring these developments and reserves all rights to take legal action against any party found misusing its name, brand, or intellectual property.

While these reports currently centre on activity in Malaysia and Hong Kong, the methods used may be replicated in other jurisdictions. GCMG continues to monitor for similar risks globally.

Unauthorized individuals are impersonating Winston Chow in scams targeting investors, particularly in Malaysia. He does not solicit investments directly in Asia. If you are contacted by someone claiming to be him outside of official channels, please report it to local authorities.

For verification or further information, please contact: [email protected]

Investor Scam Alert

Unauthorized individuals are impersonating Winston Chow in scams targeting investors, particularly in Malaysia. He does not solicit investments directly in Asia. If you are contacted by someone claiming to be him outside of official channels, please report it to local authorities.

For verification or further information, please contact: [email protected]

We offer clients a broad range of tailored solutions across strategies, including multi-strategy, macro, relative value, long/short equity, quantitative strategies, and opportunistic credit. Levaraging our large scale and presence in the industry, we are able to offer clients preferntial exposure to hard-to-access managers and seek to obtain terms that can drive economic and structural advantages.