Overallocated to PE? How Co-Investments Can Help Maintain Vintage-Year Exposure When Investment Dollars Are Scarce

Past performance is not necessarily indicative of future results. No assurance can be given that any investment will achieve its given objectives or avoid losses. Unless apparent from context, all statements herein represent GCM Grosvenor’s opinion.

Select risks include: macroeconomic risk, sourcing risk, investment selection, portfolio diversification, management risk, execution of value creation plan, risks related to reliance on third parties, and risks related to the sale of investments.

INTRODUCTION

Many institutional investors are contending with an overallocation to private capital strategies relative to portfolio concentration targets. Yet, they may not want to pause new investments completely and disrupt long-term pacing objectives and potentially miss out on higher returning vintages. Co-investing in private equity is an effective and efficient way to maintain exposure when new investment dollars are scarce. We believe co-investing also presents unique opportunities in the current market. Working with a strategic partner like GCM Grosvenor can provide Limited Partners (“LPs”) with vital sourcing, underwriting and portfolio management resources to leverage their existing relationships to build diversified exposures.

Co-Investments Allow Investors to Maintain Vintage Exposures

Many LPs aim to diversify their private equity exposure across vintage years, because returns can vary significantly across vintages. Co-investments allow for more control over allocations and the ultimate impact of these exposures on Net Asset Value (NAV). Because co-investments have become more commonplace across private equity, LPs can utilize them in a targeted and systematic way to tactically build specific exposures that round out their portfolios and allow them to stay invested in more challenging environments.

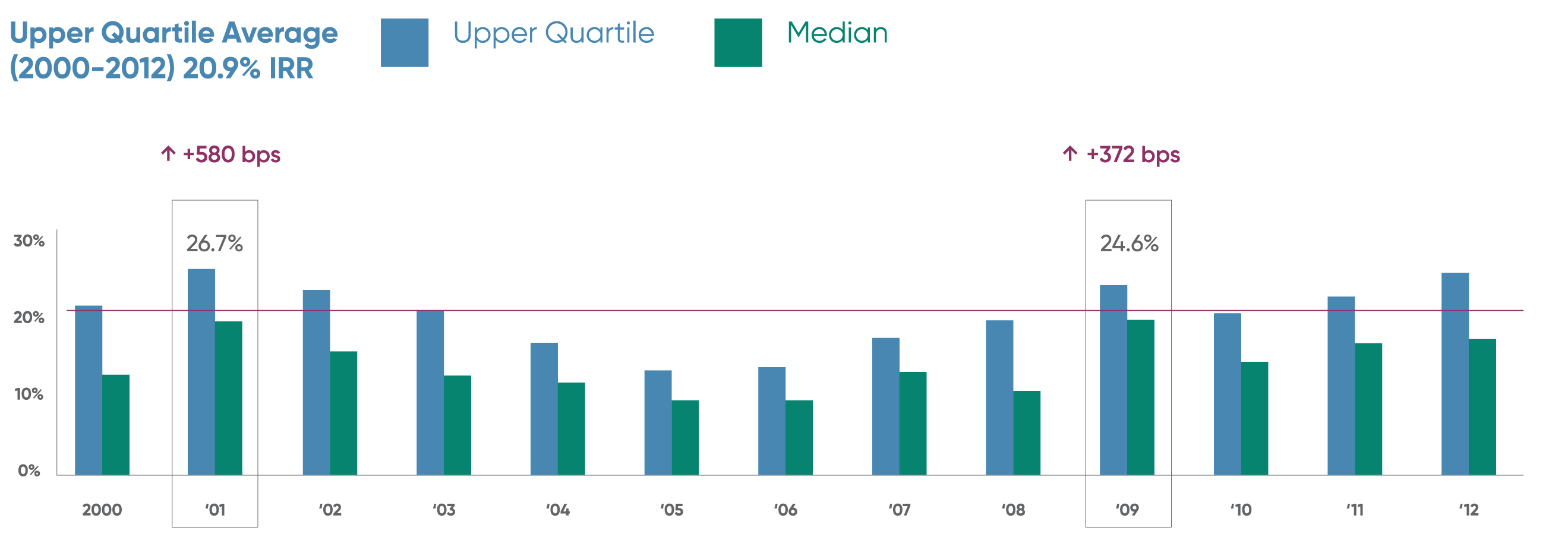

Investing in periods of macro challenges has led to higher-than-average returns in vintages that are over 10 years old.

Net IRR - North American Buyout by Vintage Year

Source: Burgiss: Benchmarking data as of March 31, 2023. Past performance is not necessarily indicative of future results. No assurance can be given that any investment will achieve its objectives or avoid losses. Unless apparent for context, all statements herein represent GCM Grosvenor’s opinion.

Increasing Supply of Co-Investments in Current Market Environment

Tighter credit conditions have opened a window of opportunity for co-investments in the current market. The resulting increase in equity requirements for buyouts has created a near-term capital gap that co-investments are well suited to fill. To compound this, many sponsors are finding fundraising more difficult than in prior years, and they are in greater need of co-investors to continue funding investment activity.

Co-Investments Can Also Bring Down Overall Cost

There’s also the important consideration of the cost of implementation. Typically, there aren’t any management fees or carried interest charged by the GP offering a co-invest opportunity to its LPs, resulting in a favorable structure compared to primary and secondary funds. Shifting allocation toward a lower-fee solution can bring down the blended cost of private equity, unlocking structural alpha at a compelling economic value to the LP.

Co-Investments Leverage the Value of Current GP Relationships

The value of relationships is well understood in the private capital world in an anecdotal sense, but it is rarely quantified. One way to value a GP relationship is to look at the opportunity cost of co-invest deal flow – opportunities that are often left on the “cutting room floor.” Building on an existing GP relationship through a co-investment program is more like thinking of that relationship as something that can be grown over time, compounding in value. A co-invest program could also help an LP build “brand equity” in the private capital community as trust is built over the course of many interactions and transactions.

The Essential Elements for Successful Co-Investments

Co-investments may have appealing qualities – but those attributes don’t mean they are easier to execute than other private investments. An LP who is serious about co-investing should consider a strategic partnership with a well-resourced and experienced co-investment team, akin to “renting” those resources rather than building them in-house.

Deal sourcing is the first essential element. In order to see ample flow of compelling opportunities, you have to ensure that you are seeing a large funnel of opportunities overall. Over our long tenure of co-investing, we have established our deal sourcing through a broad network of relationships across the GP community, in addition to our extensive roster of existing GPs.

Execution is another of the key factors. Co-investing requires a deal team with direct deal experience and the ability to execute transactions under tight timelines. This market is private equity on fast-forward; time frames are much shorter than primary deals. The legal and due diligence components have to be very effectively and efficiently run in that process as well.

Case Study: Pension Fund Uses a Strategic Partnership to Ramp NAV and Expand GP Relationships

A large public pension in the Southeast struggled with turnover on its investment team, which resulted in an inconsistent strategy toward private equity investing – i.e., an under-allocation and gaps in vintage years. It approached GCM Grosvenor looking for ways to ramp up its private equity allocation without taking on undue vintage-year risk. We devised a co-invest program with consistent annual deployment and ample diversification across a host of metrics. This design allowed us to make use of the client’s existing relationships while gaining new NAV immediately and building more diversification into their overall program. Additionally, the program raised the client’s profile with GPs as an interested and credible co-investment partner. Meanwhile, the co-investment structure helped control the cost of implementation while accomplishing other goals.

- Correct under-allocation faster than a primary fund commitment

- Diversify across vintage years, sponsors, sectors and value-creation strategies

- Raise profile across GP community as an interested and qualified co-investor

- Lower the blended cost of private equity exposure

GCM Grosvenor Is a Strategic Partner in Co-Investing

For institutional investors who are contending with concentrations or overallocations, but who do not want to pause active investments altogether, co-investing is a cost-effective and nimble option. We believe a strategic partnership with a co-invest platform like ours is an effective way to unlock structural alpha through co-investing, given the expertise and resources required to bring these strategies to fruition.

GCM Grosvenor has a successful history of being a strategic partner to LPs. Connect with us to learn about how our team partners with LPs to design co-invest programs that meet their specific needs.

RELATED NEWS AND INSIGHTS

Post-Election Market Shifts and the Rise of Co-Investment Opportunities

We examine how GCM Grosvenor has successfully identified and capitalized on private equity co-investment opportunities, even in a challenging market environment.

Clarifying the Misconceptions of Co-Investing

We debunk several common misconceptions related to co-investing in today’s market.

Important Disclosures

For illustrative and discussion purposes only. The information contained herein is based on information received from third parties. GCM Grosvenor has not independently verified third-party information and makes no representation or warranty as to its accuracy or completeness. The information and opinions expressed are as of the date set forth therein and may not be updated to reflect new information.

Investments in alternatives are speculative and involve substantial risk, including strategy risks, manager risks, market risks, and structural/operational risks, and may result in the possible loss of your entire investment. Past performance is not necessarily indicative of future results. The views expressed are for informational purposes only and are not intended to serve as a forecast, a guarantee of future results, investment recommendations or an offer to buy or sell securities by GCM Grosvenor. All expressions of opinion are subject to change without notice in reaction to shifting market, economic, or political conditions. The investment strategies mentioned are not personalized to your financial circumstances or investment objectives, and differences in account size, the timing of transactions and market conditions prevailing at the time of investment may lead to different results. Certain information included herein may have been provided parties not affiliated with GCM Grosvenor. GCM Grosvenor has not independently verified such information and makes no representation or warranty as to its accuracy or completeness.

Data sources:

Certain information, including benchmarks, is obtained from The Burgiss Group (“Burgiss”), an independent subscription-based data provider, which calculates and publishes quarterly performance information from cash flows and valuations collected from of a sample of private equity firms worldwide. When applicable, the performance of GCM Grosvenor’s private equity, real estate, and infrastructure underlying investments are compared to that of its peers by asset type, geography and vintage year as of the applicable valuation date. GCM Grosvenor’s Asset Class and Geography definitions may differ from those used by Burgiss. GCM Grosvenor has used its best efforts to match its Asset Class, Geography, and strategy definitions with the appropriate Burgiss data but material differences may exist. Benchmarks for certain investment types may not be available. GCM Grosvenor uploads data into its system one-time each quarter; however, the data service may continue to update its information thereafter. Therefore, information in GCM Grosvenor’s system may not always agree with the most current information available from the data service. Additional information is available upon request.