How Insurers Can Navigate Alternatives in 2023

Past performance is not necessarily indicative of future results. No assurance can be given that any investment will achieve its given objectives or avoid losses. Unless apparent from context, all statements herein represent GCM Grosvenor’s opinion.

Select risks include: market risks, credit risks, macroeconomic risks, liquidity risks, manager risks, counterparty risks, interest rate risks, and operational risks.

INTRODUCTION

As we anticipated, 2022 proved to be a volatile and challenging year for investors. Slowing economic growth, growing inflation concerns, rapidly shifting fiscal and monetary policy, and historically rapid valuation re-ratings challenged the beta trade across markets.

Looking ahead we believe economic activity could continue to slow in several geographies, including the U.S. and Europe, with recessions likely. We believe investors will find the most benefit in the first half of the year by focusing on alpha generation, but that the second half of the year may restart an equity growth cycle and could be a good time to reenter markets in terms of beta.

What Does This Mean for Insurers?

Insurers are not immune to the recent volatility and market turmoil. They have likely experienced impacts to their balance sheet as a result of current market conditions, which can lead to pressure on capital ratios due to the effects of mark-to-market. Lower asset prices may lead to losses for insurers and higher inflation may increase their liability payments and expenses. These factors can all combine for potential impacts across earnings volatility, capital ratios, investment policy limits and surplus positions, which can weigh on the investment planning process. As a result, many insurers are evaluating their investment priorities over the medium term and seeking out experienced partners to help them navigate, and capitalize on, current market dynamics.

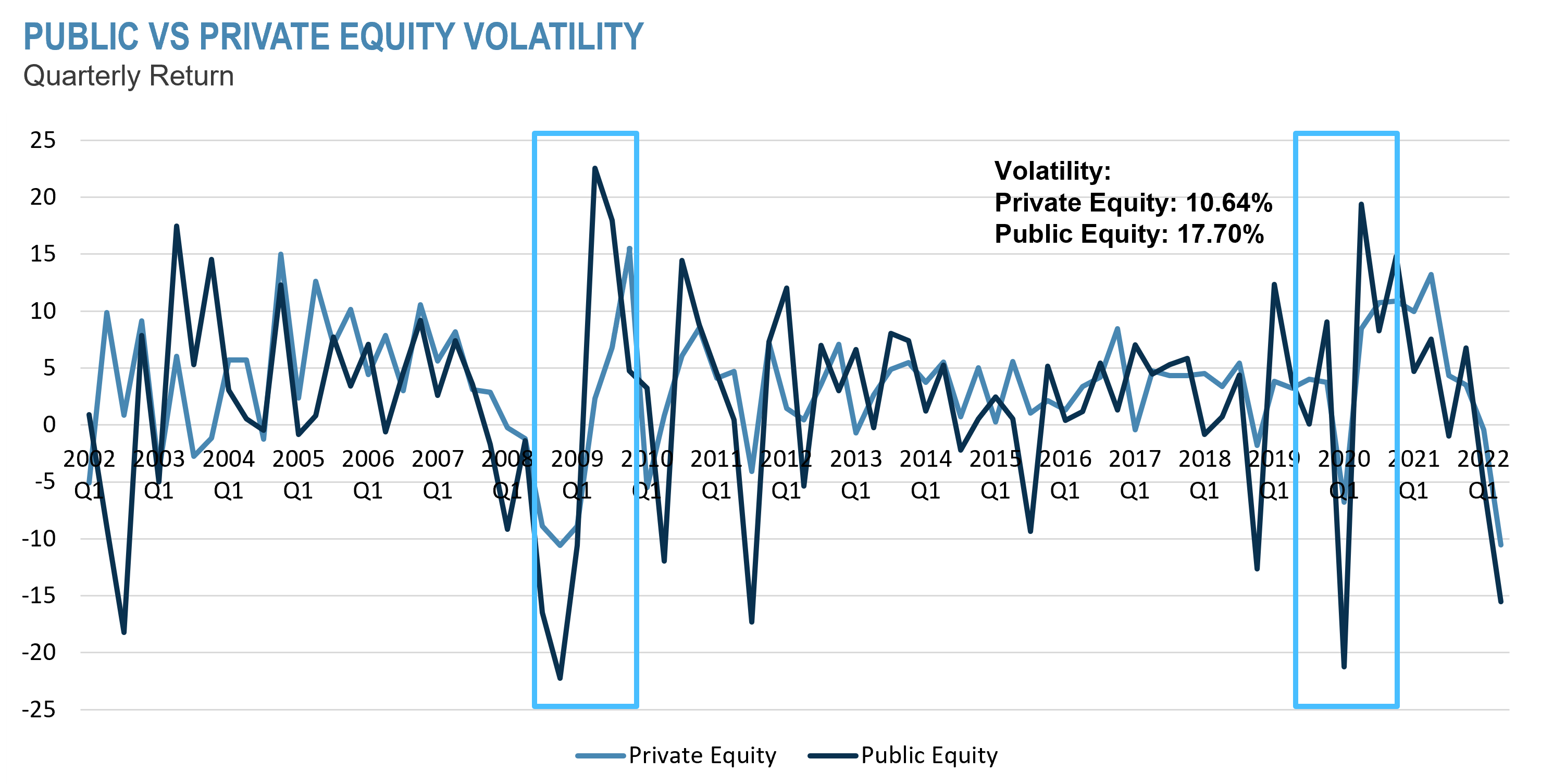

Private Markets Prove to Be Less Volatile

The good news is that the opportunity set within alternative investments for insurers continues to be strong. For example, private equity has shown reduced volatility as compared to public markets and can be an attractive option for insurers in search of relief from the current public market environment. As illustrated in Figure 1, private equity has seen nearly 7% less volatility as compared to public equity over the last 20 years. Importantly, during periods of macro challenges such as the Global Financial Crisis and the COVID-19 Pandemic, private equity saw an average of 17.5% volatility compared to 25.8% for public markets (one-year trailing volatility as of year-end 2009), and 14.7% versus 31.7% (one–year trailing volatility as of year-end 2020).

Figure 1

Sources: PitchBook, Data Inc. Rolling IRR by quarter for private equity.

MSCI ACWI. Total return for public equity.

Capitalizing on the Opportunity

We believe insurers can best capitalize on the alternatives opportunity set by focusing on certain key areas:

1. Taking advantage of dislocations and valuation opportunities

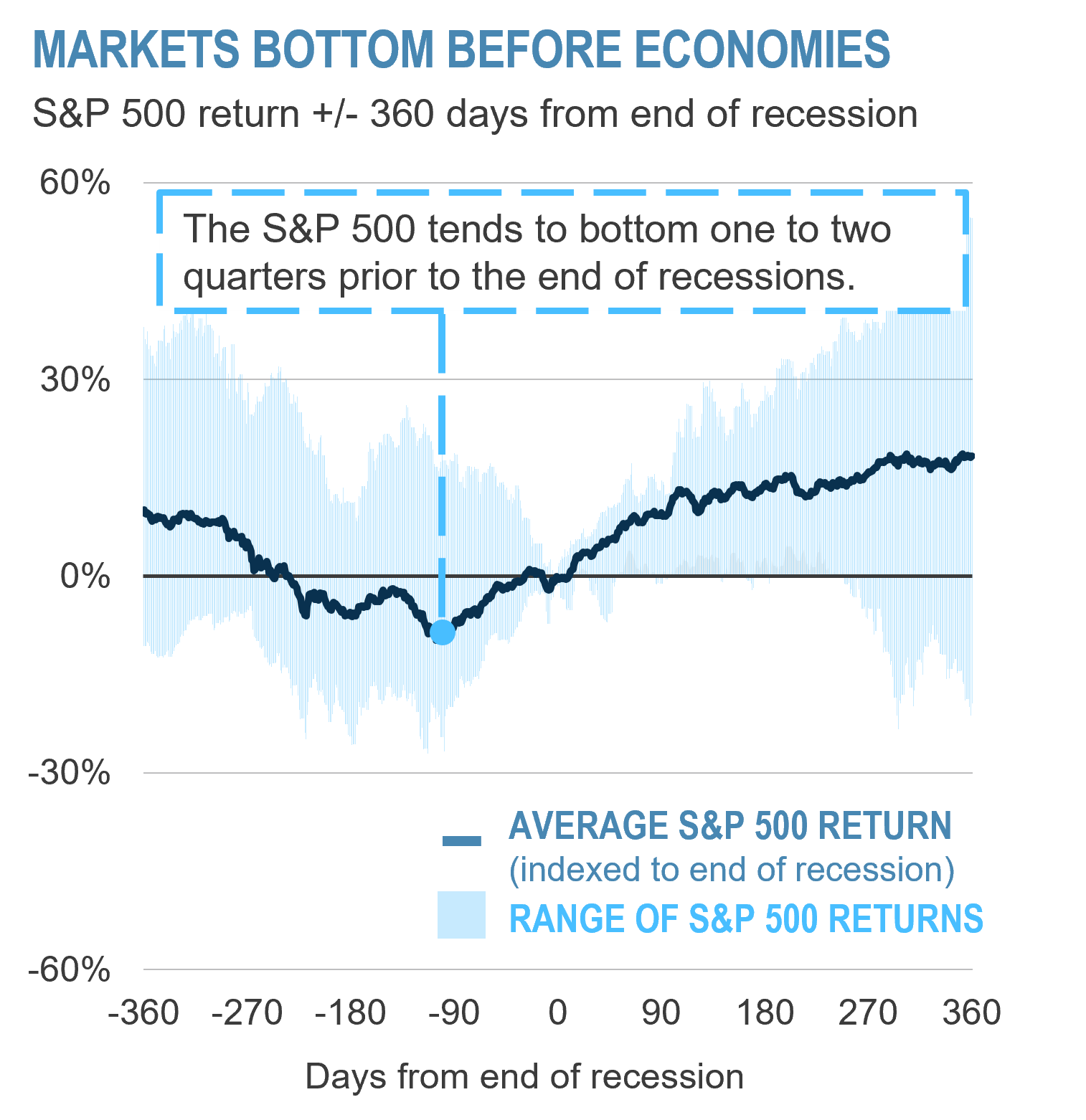

We believe there is power in investing in alternatives consistently throughout market cycles, as vintage year diversification can help manage year-over-year returns variability compared to trying to “time the market”. As Figure 2 illustrates, markets tend to begin their recovery anywhere from several months to a quarter before the end of a recession, signifying that investors who have been investing consistently throughout a cycle are more likely to see potential opportunity from regrowth than those who limit their activity until they see economic recovery begin.

Figure 2

Source: Bloomberg Finance L.P. Data as of December 31, 2022.

Unless apparent from context, all statements herein represent GCM Grosvenor’s opinion. Past performance is not necessarily indicative of future results. No assurance can be given that any investment will achieve its objectives or avoid losses

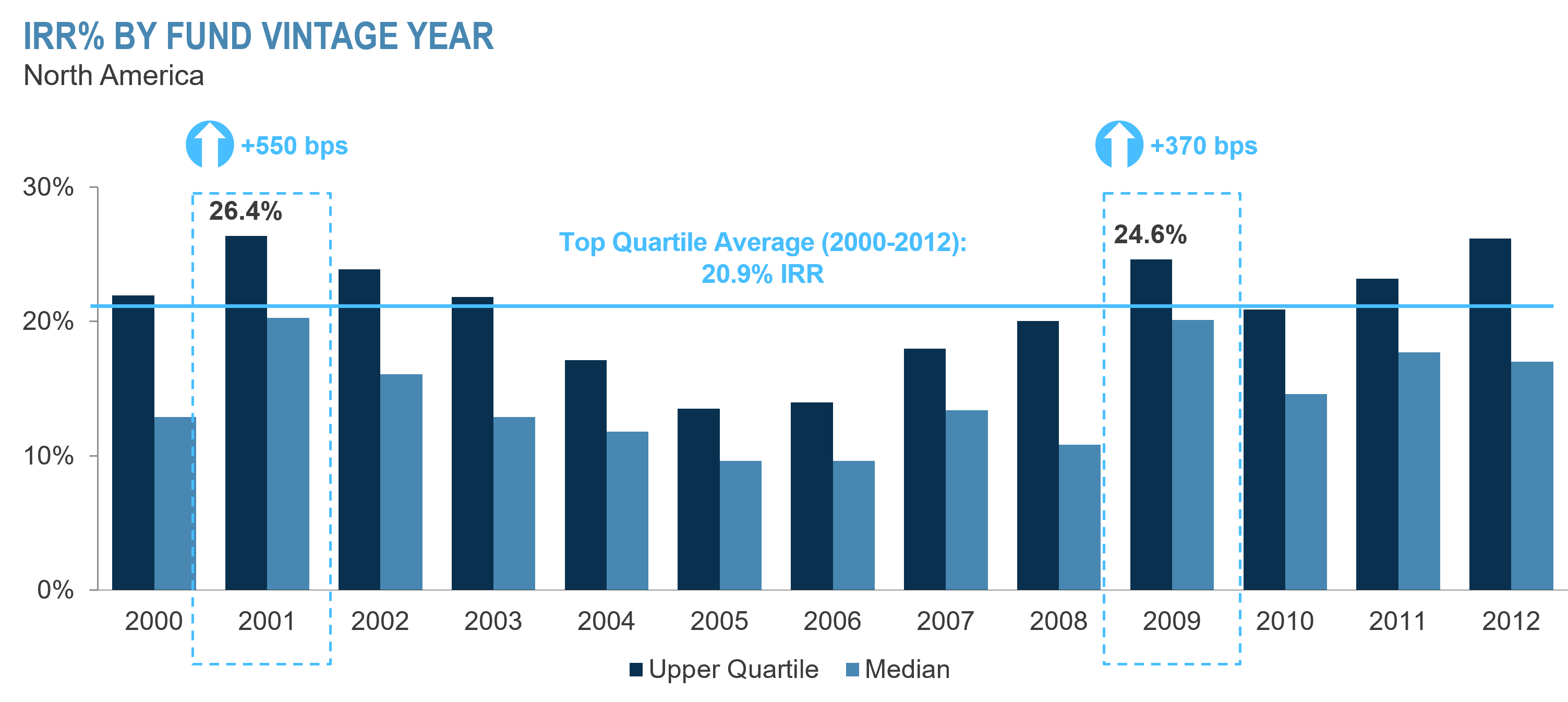

Figure 3

Source: BURGISS North American Buyout Track Record: Data as of September 30, 2022.

Past performance is not necessarily indicative of future results. No assurance can be given that any investment will achieve its objectives or avoid losses. Unless apparent from context, all statements herein represent GCM Grosvenor’s opinion.

In addition, market dislocations often create investment opportunities that are unique to the moment. Many seasoned alternatives investors have a track record of success in this regard. For example, many top quartile private equity managers have been successful in achieving high returns through prior recessionary periods (Dot.com Bubble and the Global Financial Crisis). As seen in Figure 3, missing out on the 2001 and 2009 vintages, which occurred during times of significant market dislocation, would mean sacrificing 550bps and 370bps of potential excess returns respectively over the 13-year average of 20.9% IRR.

2. Broadening their private markets portfolio

Diversification is an important component of any private portfolio, but can be especially important during times of macro uncertainty. Traditional investment strategies for insurers tend to focus on large buyout transactions in the private equity space and middle market senior loans in the private credit space. Over the years, these sectors are becoming more heavily trafficked and commoditized, which makes alpha generation and customization challenging.

Exploring alternatives beyond private equity large buyouts

To better explore the broad alternatives opportunity set, we believe insurers should seek ways to expand and diversify their portfolios, particularly in the areas of middle market buyouts, private credit opportunities beyond middle market loans, infrastructure, and real estate, which have the potential to provide better risk-adjusted returns, especially during times of macro uncertainty, when traditional sources of financing may become harder to obtain.

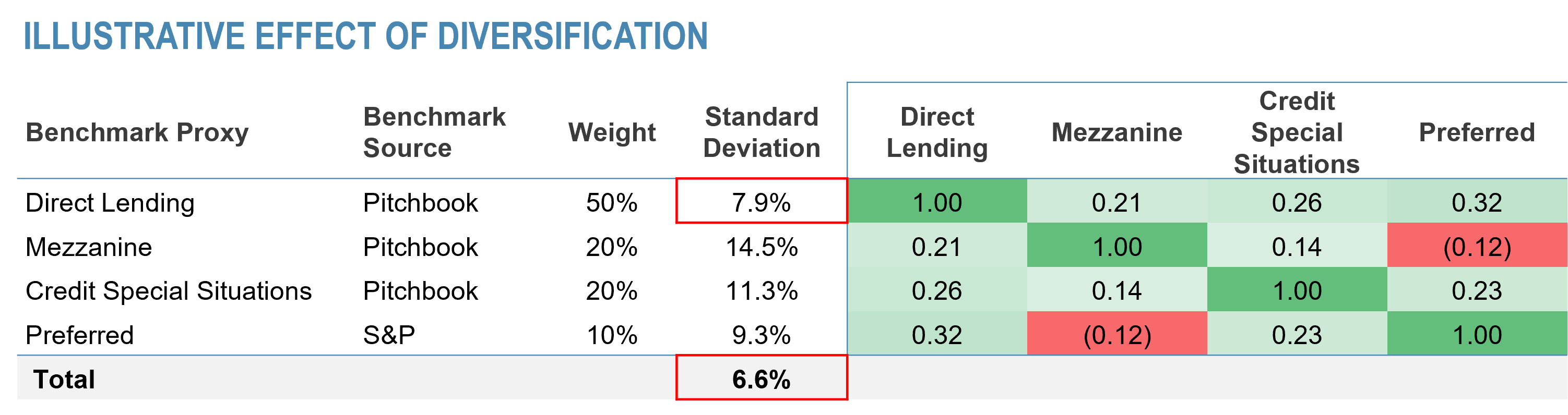

Figure 4

Source: PitchBook Data, Inc. benchmarks, quarterly rolling IRRs from 2013 Q1 to 2022 Q2.

S&P preferred stock index from 2013 to 2022.

Projected, Model, or Simulated Returns (“Projected Returns”) are hypothetical in nature and are shown for illustrative, information purposes only. See the Notes and Disclosures following this report for more information regarding Projected Returns. No assurance can be given that any investment will achieve its objectives or avoid losses. ACTUAL RESULTS EXPERIENCED BY CLIENTS MAY SIGNIFICANTLY VARY FROM THE PROJECTED RETURNS SHOW. PROJECTED RETURNS MAY NOT MATERIALIZE.

Extending beyond the direct lending market

Credit yields and spreads have widened and are now at or above historical averages. This creates a compelling opportunity for investing in credit and can provide insurers with the opportunity to generate high returns with less equity risk. While we have seen insurers increasing their allocations to private credit for several years, we believe now is a particularly good time to build exposure, and that the higher yield environment will likely accelerate the trend. The term “private credit” can be used broadly, but we particularly see opportunity today in situations beyond traditional direct lending that have complexity, or opportunistic financings that lack traditional sources of financing. Extending beyond the direct lending market also comes with additional diversification benefits as historical correlations between different sectors are low, as seen in Figure 4. By introducing other sectors, insurers can potentially create a private credit book that has higher returns, but lower volatility compared to a portfolio focused on direct lending.

3. Customizing portfolios and investment structures

Customization of alternative investment programs and portfolios through separate accounts has been increasingly growing in popularity among insurers. This additional level of flexibility can be especially beneficial during times of economic stress because it allows insurers to take advantage of structural alpha and other benefits by combining various implementation methods.

For example, through customized separate accounts insurers can utilize co-investments in seeking to reduce overall fees; they can also make direct investments to focus on a specific segment or strategy; or they can bring in new managers who they believe will outperform their peers in a particular market environment or add broader strategic value to the portfolio. The ability to flexibly combine these strategies can allow insurers to be best positioned to take advantage of attractive opportunities and not be constrained by the limitations of traditional models.

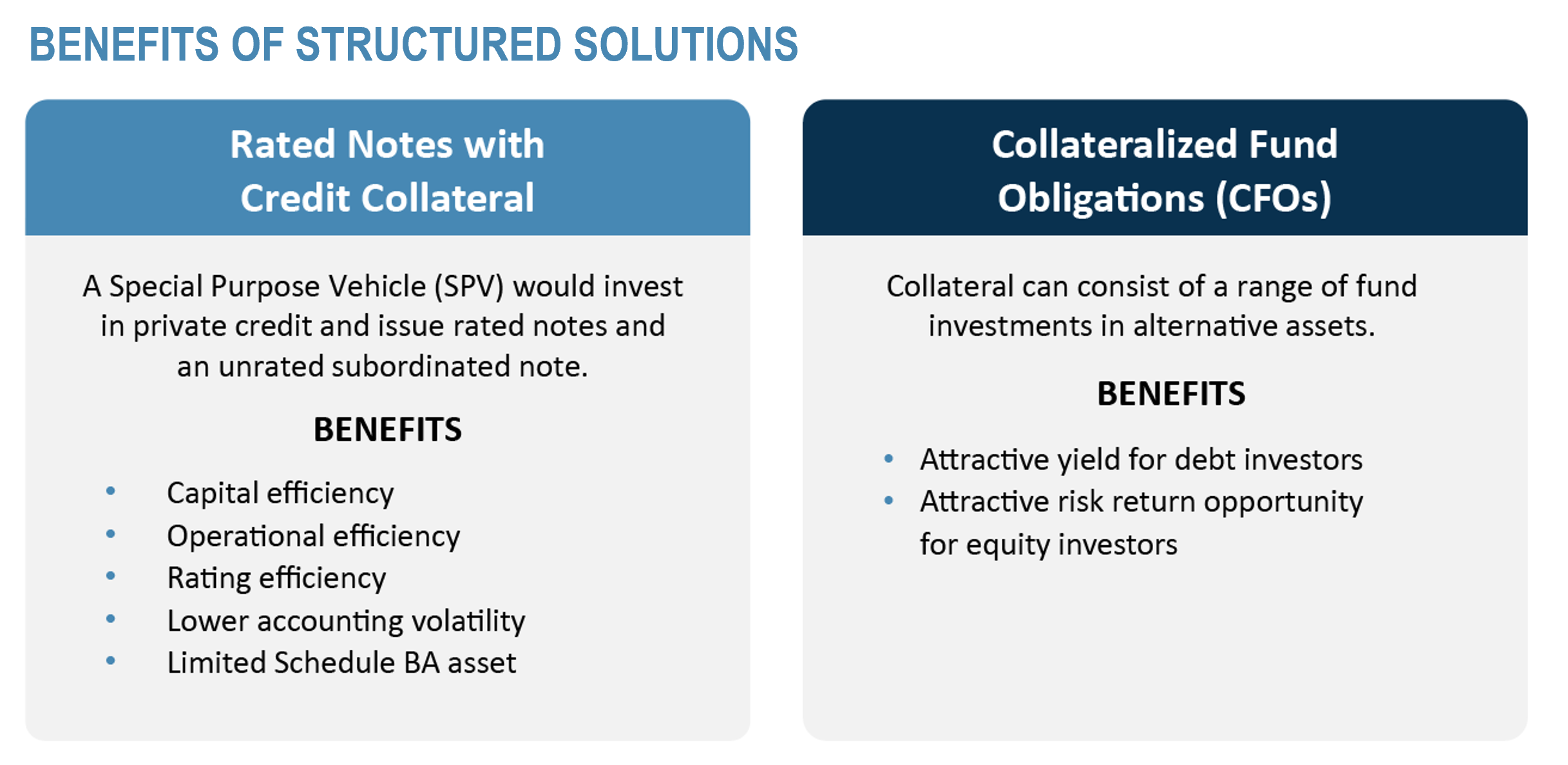

Another investment approach that has become increasingly popular among insurers, for good reason, is utilizing structured solutions. These vehicles often take the shape of collateralized fund obligations (CFOs) and rated credit feeders and can allow insurers to access alternative investments more efficiently than they otherwise could by investing directly in such strategies.

Learn more about structured solutions, including how to understand the current regulatory environment and plan for future changes, in Incorporating Alternatives into Insurance Portfolios Through Structured Solutions.

Figure 5

Select risks include: market risks, credit risks, macroeconomic risks, liquidity risks, manager risks, counterparty risks, interest rate risks, and operational risks. Past performance is not necessarily indicative of future results. No assurance can be given that any investment will achieve its objectives or avoid losses. Unless apparent from context, all statements herein represent GCM Grosvenor’s opinion.

4. Creating strategic objectives

With a growing number of insurers finding value in alternative investment strategies, we are seeing an increased focus on creating intentional and strategic objectives for private portfolios. For example, many insurers are looking to express their corporate values and goals through their investment strategy, often by investing in underlying companies who share similar goals such as ESG/Impact, diversity, or labor impact.

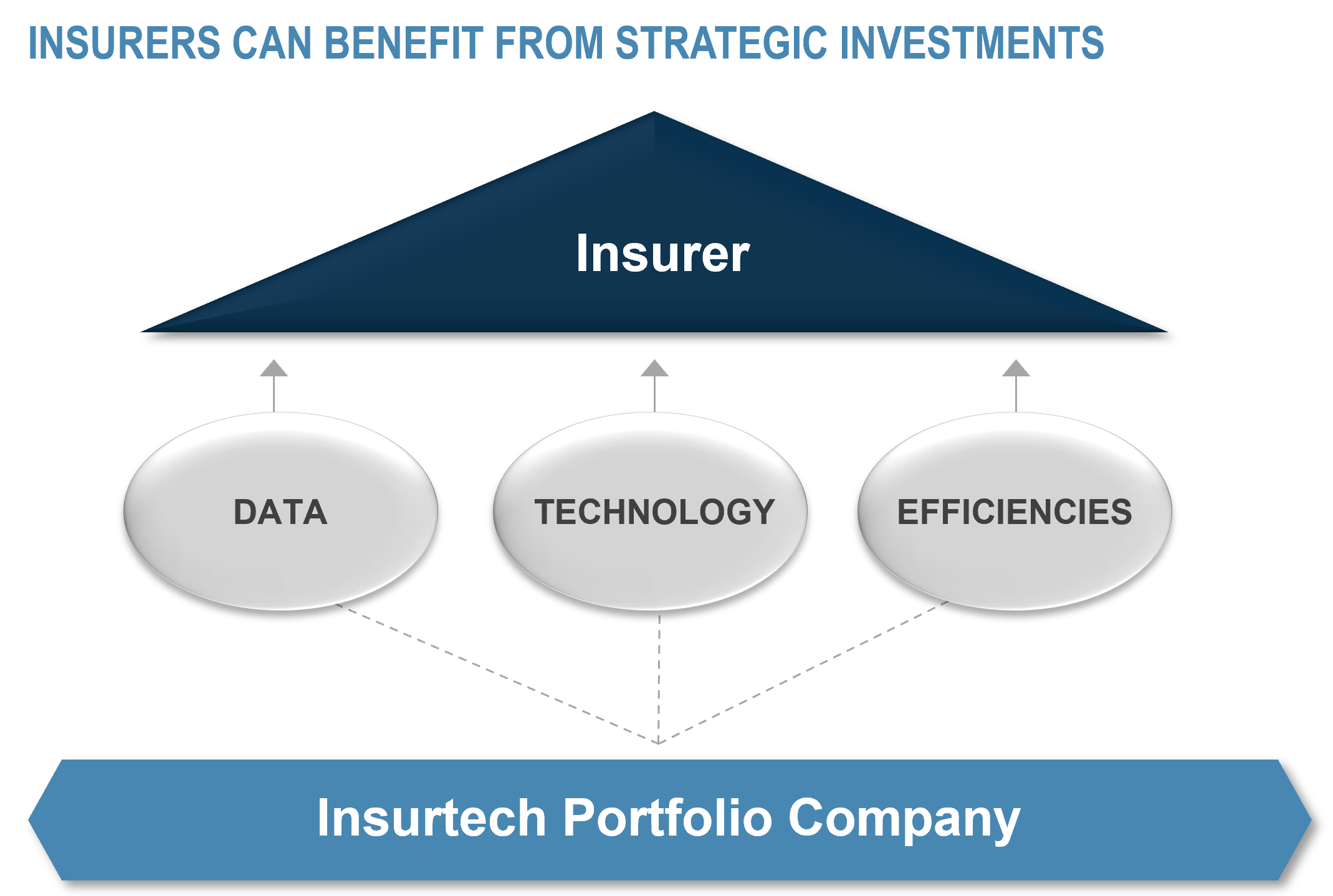

We have also seen a trend towards insurers who are looking to strategically invest in portfolio companies that are in related industries to benefit from a bigger footprint in the industry, generate synergy, and have more influence and control over their portfolio companies. In Figure 6, an insurer looks for investment opportunities in insurtech companies to strategically seek out potential advantages including the use of big data, technological developments, and other efficiencies that can help them grow their footprint in the space.

Figure 6

Illustrative example.

Closing

While 2023 may present some new and recurring challenges for the insurance community, we believe the opportunity in alternative investments is broad and strong, especially when approached with a thoughtful multi-year perspective alongside a focused partner like GCM Grosvenor. Historically, private markets have proven to be less volatile than their public counterparts, especially during times of economic stress such as the Global Financial Crisis and COVID-19 Pandemic. In several past instances we have seen such market dislocations lead to vintages that produce higher-than-average IRRs, further supporting the practice of consistently investing throughout market cycles. To take advantage of the current opportunity set, we believe insurers should seek out dislocation and valuation opportunities, broaden their private markets portfolio by looking beyond large market buyout transactions in the private equity space and middle market senior loans in the private credit space, seek out structural alpha by customizing portfolio and investment structures, and create strategic objectives that can allow them to invest more intentionally and with more impact.

RELATED NEWS AND INSIGHTS

Capturing Alternative Investment Opportunities: A Toolkit for Insurance Investors

As insurers navigate a dynamic investment landscape, GCM Grosvenor explores key trends shaping alternative allocations.

GCM Grosvenor Expands Insurance Solutions Group with the Hire of Joe Metzger as Managing Director

CHICAGO, Feb. 05, 2025 — GCM Grosvenor (Nasdaq: GCMG), a leading global alternative asset management solutions provider, is pleased to announce that Joe Metzger has joined the firm as a

Important Disclosures

For illustrative and discussion purposes only. The information contained herein is based on information received from third parties. GCM Grosvenor has not independently verified third-party information and makes no representation or warranty as to its accuracy or completeness. The information and opinions expressed are as of the date set forth therein and may not be updated to reflect new information.

Investments in alternatives are speculative and involve substantial risk, including market risks, credit risks, macroeconomic risks, liquidity risks, manager risks, counterparty risks, interest rate risks, and operational risks, and may result in the possible loss of your entire investment. Past performance is not necessarily indicative of future results. The views expressed are for informational purposes only and are not intended to serve as a forecast, a guarantee of future results, investment recommendations or an offer to buy or sell securities by GCM Grosvenor. All expressions of opinion are subject to change without notice in reaction to shifting market, economic, or political conditions. The investment strategies mentioned are not personalized to your financial circumstances or investment objectives, and differences in account size, the timing of transactions and market conditions prevailing at the time of investment may lead to different results. Certain information included herein may have been provided parties not affiliated with GCM Grosvenor. GCM Grosvenor has not independently verified such information and makes no representation or warranty as to its accuracy or completeness.

Projected Returns

Projected, Model, or Simulated returns (“Projected Returns”): Projected Returns are hypothetical in nature and are shown for illustrative, informational purposes only. It does not reflect the actual returns or risk profile of any GCM fund or strategy pursued by any GCM fund and does not guarantee future results.

Projected Returns are:

- based upon the firm’s view of the potential returns and risk parameters for a GCM fund or strategy pursued by a GCM fund;

- including information received from underlying investment sponsors (which has not been independently verified by GCM Grosvenor); and

- subject to numerous assumptions including, but not limited to, observed and historical market returns relevant to certain investments, an asset class, projected cash flows, projected future valuations of target assets and businesses, other relevant market dynamics (including interest rate and currency markets), anticipated contingencies, and regulatory issues. Changes in the assumptions will have an impact, perhaps materially so, on the Projected Returns.

Certain of the assumptions have been made for modeling purposes and are unlikely to be realized. No representation or warranty is made as to the reasonableness of the assumptions made or that all assumptions made have been stated or fully considered. Projected Returns may be shown before fees, transactions costs and taxes and do not account for the effects of inflation. Management fees, transaction costs, and potential expenses may not be considered and would reduce the Projected Returns. Actual results experienced by clients may vary significantly from the Projected Returns shown. Projected Returns May Not Materialize.

Data Sources

Certain information, including benchmarks, is obtained from The Burgiss Group (“Burgiss”), an independent subscription-based data provider, which calculates and publishes quarterly performance information from cash flows and valuations collected from of a sample of private equity firms worldwide. When applicable, the performance of GCM Grosvenor’s private equity, real estate, and infrastructure underlying investments are compared to that of its peers by asset type, geography and vintage year as of the applicable valuation date. GCM Grosvenor’s Asset Class and Geography definitions may differ from those used by Burgiss. GCM Grosvenor has used its best efforts to match its Asset Class, Geography, and strategy definitions with the appropriate Burgiss data, but material differences may exist. Benchmarks for certain investment types may not be available. GCM Grosvenor uploads data into its system one-time each quarter; however, the data service may continue to update its information thereafter. Therefore, information in GCM Grosvenor’s system may not always agree with the most current information available from the data service. Additional information is available upon request.

Bloomberg Finance L.P

MSCI ACWI Index

PitchBook Data, Inc.

S&P preferred stock index