Unlocking Infrastructure’s Full Potential Through Co-Investing

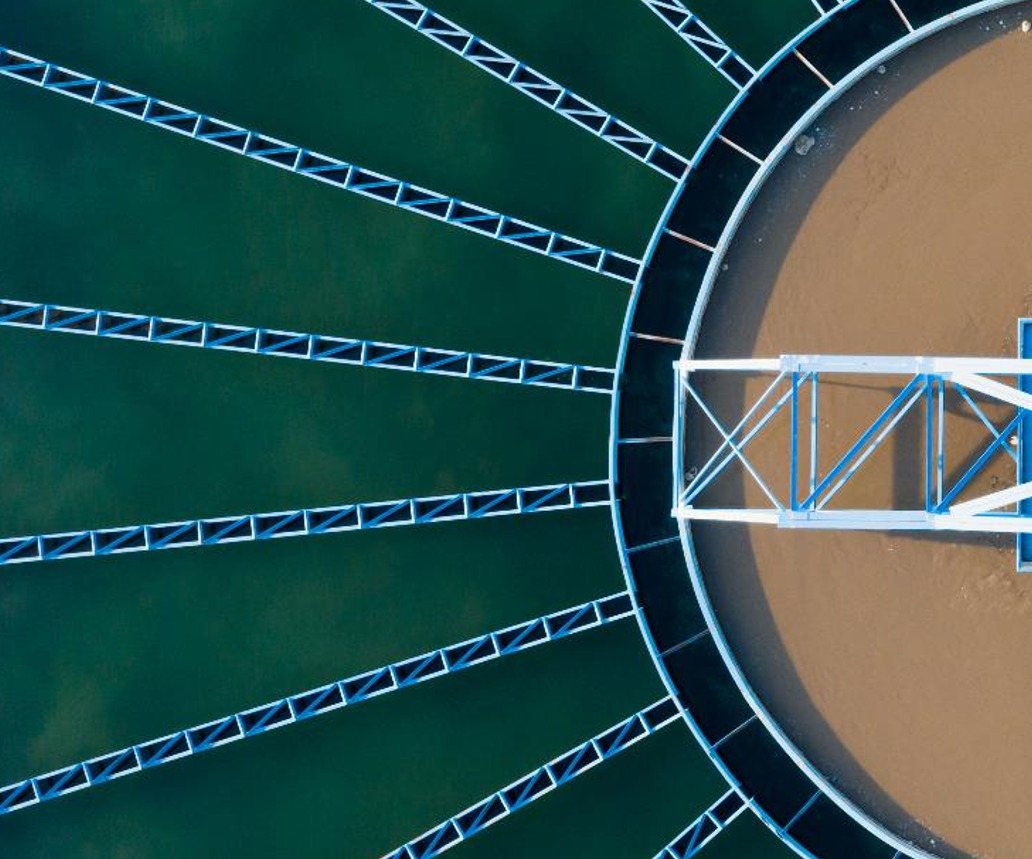

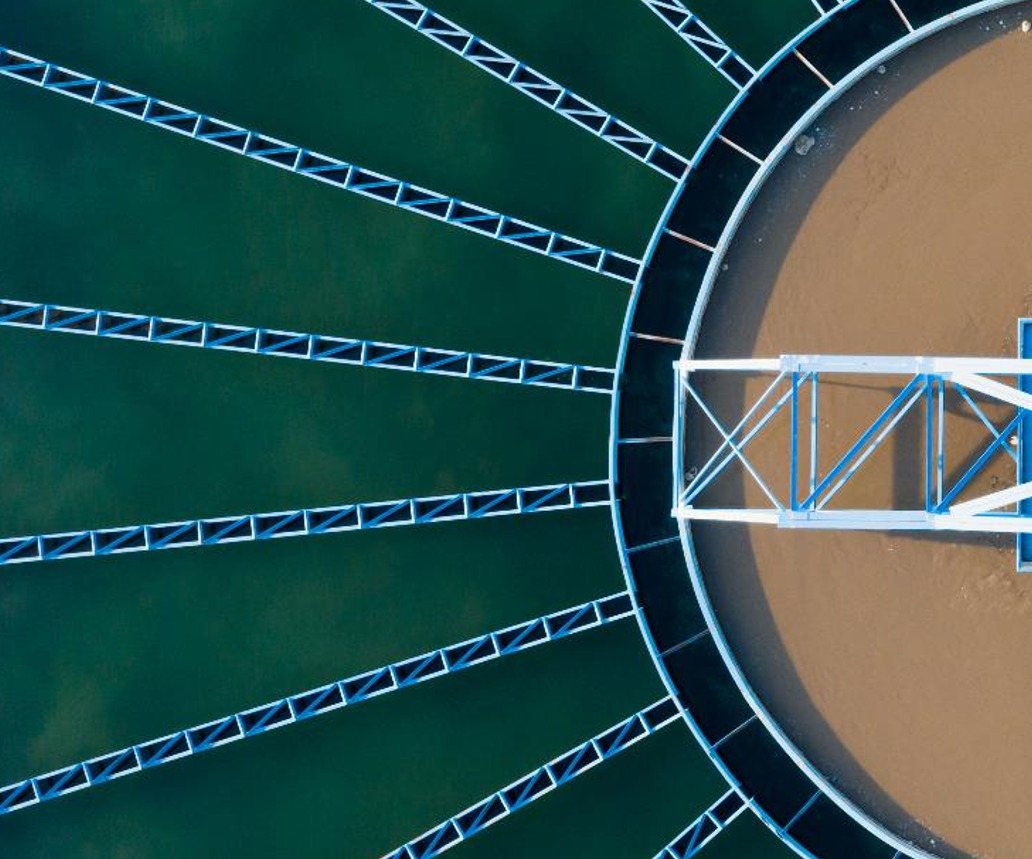

This article explores how co-investing is shaping infrastructure portfolios across Europe, seeking to provide long-term value in critical sectors.

No assurance can be given that any investment will achieve its given objectives or avoid losses. Unless apparent from context, all statements herein represent GCM Grosvenor’s opinion.

Select risks include: market risk, macroeconomic risk, liquidity risk, interest rate risk, and operational risk.

Once just a small part of the overall secondaries market, GP-led deals have grown in popularity in recent years and could account for up to $60 billion of annual infrastructure single asset secondary transaction volume in the next 3-5 years.

Here, Scott Litman, Managing Director, Infrastructure at GCM Grosvenor discusses how GP-led secondaries differ from traditional LP-led deals, and why we believe they present a compelling opportunity in the infrastructure space.

This article explores how co-investing is shaping infrastructure portfolios across Europe, seeking to provide long-term value in critical sectors.

New York, (January 28, 2025) —CION Investments (CION), a leading alternative investment solutions platform, and GCM Grosvenor, (NASDAQ: GCMG), a global alternative asset management solutions provider, are pleased to announce

Important Disclosures

For illustrative and discussion purposes only. The information contained herein is based on information received from third parties. GCM Grosvenor has not independently verified third-party information and makes no representation or warranty as to its accuracy or completeness. The information and opinions expressed are as of the date set forth therein and may not be updated to reflect new information.

Investments in alternatives are speculative and involve substantial risk, including market risks, credit risks, macroeconomic risks, liquidity risks, manager risks, counterparty risks, interest rate risks, and operational risks, and may result in the possible loss of your entire investment. Past performance is not necessarily indicative of future results. The views expressed are for informational purposes only and are not intended to serve as a forecast, a guarantee of future results, investment recommendations or an offer to buy or sell securities by GCM Grosvenor. All expressions of opinion are subject to change without notice in reaction to shifting market, economic, or political conditions. The investment strategies mentioned are not personalized to your financial circumstances or investment objectives, and differences in account size, the timing of transactions and market conditions prevailing at the time of investment may lead to different results. Certain information included herein may have been provided parties not affiliated with GCM Grosvenor. GCM Grosvenor has not independently verified such information and makes no representation or warranty as to its accuracy or completeness.

GCM Investments UK LLP (GCMUK) has been made aware of fraudulent schemes targeting members of the public in the United Kingdom.

Unauthorised individuals are falsely claiming to represent GCMUK and are misusing the firm’s name and publicly available information in connection with fake investment opportunities.

These scams are sophisticated and deliberately misleading. They may involve the use of real GCMUK employee names and may imitate the tone, format, and branding of genuine GCMUK communications.

Please note:

GCMUK does not offer financial services or products to retail clients, either directly or through third parties. You can verify GCMUK’s regulatory status and permissions on the Financial Conduct Authority (FCA) Register at register.fca.org.uk.

If you are based in the UK and believe you have been contacted by a fraudster claiming to represent GCMUK, please take the following steps:

Investor Scam Alert

GCM Grosvenor L.P. and its affiliated entities (collectively, “GCMG”) have been made aware of fraudulent schemes currently targeting members of the public in Malaysia and Hong Kong, in which unauthorised individuals are falsely claiming to represent GCMG in connection with purported investment opportunities.

These fraudulent individuals are believed to be actively promoting false investment opportunities, often involving mobile applications, through the unauthorised use of GCMG’s name, brand, corporate logo, and other identifying materials. We have also received reports that these parties may be distributing fabricated business cards, hosting online webinars, creating WhatsApp groups, and arranging personal video calls to simulate legitimacy. These scams are sophisticated and deliberately misleading, frequently involving the use of real GCMG employee names and imitating the style, tone, and presentation of genuine GCMG communications.

GCMG has no presence, operations, or authorised representatives in Malaysia. GCMG does not offer any investment schemes, products, or mobile applications targeted at Malaysian investors, either directly or indirectly.

While GCMG maintains a legitimate presence and employs personnel in Hong Kong, these scams are entirely unauthorised and unrelated to any genuine activities conducted by GCMG or its employees in the region.

Position of GCMG

GCMG has neither authorised nor endorsed any such solicitations and takes this matter seriously. We have reported some of these incidents to the relevant regulatory and enforcement authorities in Malaysia, and are doing the same in Hong Kong, including notifying the Hong Kong Police and the appropriate financial regulators. GCMG will continue to assist with their investigations.

GCMG is actively monitoring these developments and reserves all rights to take legal action against any party found misusing its name, brand, or intellectual property.

While these reports currently centre on activity in Malaysia and Hong Kong, the methods used may be replicated in other jurisdictions. GCMG continues to monitor for similar risks globally.

Unauthorized individuals are impersonating Winston Chow in scams targeting investors, particularly in Malaysia. He does not solicit investments directly in Asia. If you are contacted by someone claiming to be him outside of official channels, please report it to local authorities.

For verification or further information, please contact: [email protected]

Investor Scam Alert

Unauthorized individuals are impersonating Winston Chow in scams targeting investors, particularly in Malaysia. He does not solicit investments directly in Asia. If you are contacted by someone claiming to be him outside of official channels, please report it to local authorities.

For verification or further information, please contact: [email protected]

We offer clients a broad range of tailored solutions across strategies, including multi-strategy, macro, relative value, long/short equity, quantitative strategies, and opportunistic credit. Levaraging our large scale and presence in the industry, we are able to offer clients preferntial exposure to hard-to-access managers and seek to obtain terms that can drive economic and structural advantages.