Structured Securities in Growth Equities: An Emerging Opportunity Set

In our latest post, we discuss how structured securities can be an attractive option for both investors and stressed growth companies looking to generate capital prior to an IPO.

Past performance is not necessarily indicative of future results. No assurance can be given that any investment will achieve its given objectives or avoid losses. Unless apparent from context, all statements herein represent GCM Grosvenor’s opinion.

Select risks include: market risk, macroeconomic risk, liquidity risk, interest rate risk, and operational risk. Additional risks that result in losses may be present.

The global spread of COVID-19 has impacted public health and capital markets in a significant, multifaceted, and ongoing manner. As the dislocation evolves, compelling opportunities emerged across assets, including credit, equities, and sub-segments of the private capital markets. We share how a flexible, multi-asset class approach seeks to capitalize on the current and future dislocations and deliver attractive risk-adjusted returns.

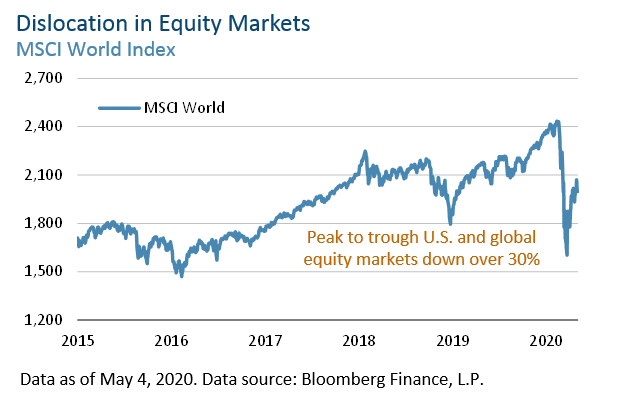

As the pandemic spread, health and economic fears contributed to a historic surge in volatility in the month of March and a sharp sell-off in equities markets. While central banks responded with unprecedented levels of stimulus, the continued effects of a prolonged “stay-at-home” economy remain unknown. As risk-aware investors, we viewed the initial rapid spread widening, decline in liquidity, and capital outflows across capital markets as a compelling opportunity, which continues to evolve with the market. While we believe it will be critical to remain flexible given the myriad opportunities across different pockets of the market, we in particular see four distinct multi-asset class opportunity sets covering the following liquid and illiquid strategies:

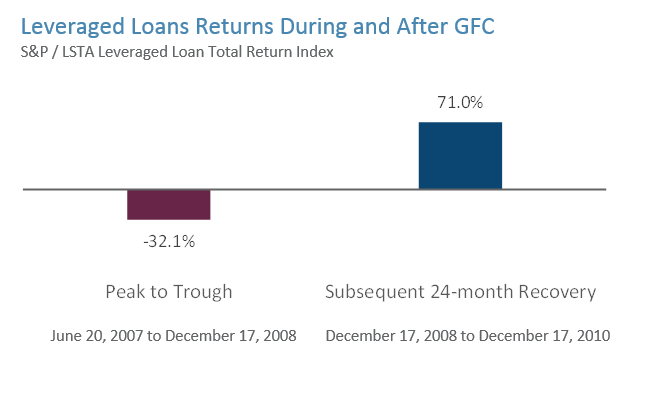

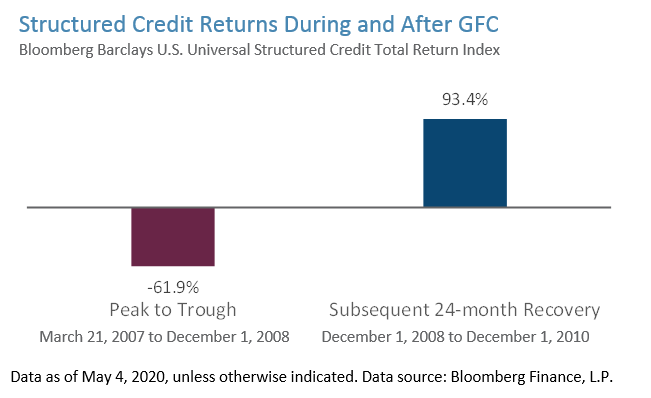

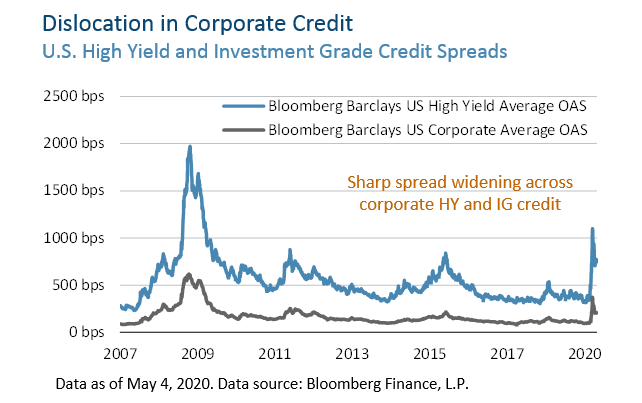

The speed and magnitude of the credit market’s dislocation and the resulting deleveraging observed were historically significant. As evidenced through the Global Financial Crisis (“GFC”) and its aftermath, returns have been generated in credit strategies following periods of market distress. Based on our analysis, we are seeing yield spreads and volatility levels signaling an opportunity to purchase credit investments at attractive prices – just like after the last financial crisis.

Attractive returns following periods of market stress

Past performance is not necessarily indicative of future results.

Past performance is not necessarily indicative of future results.

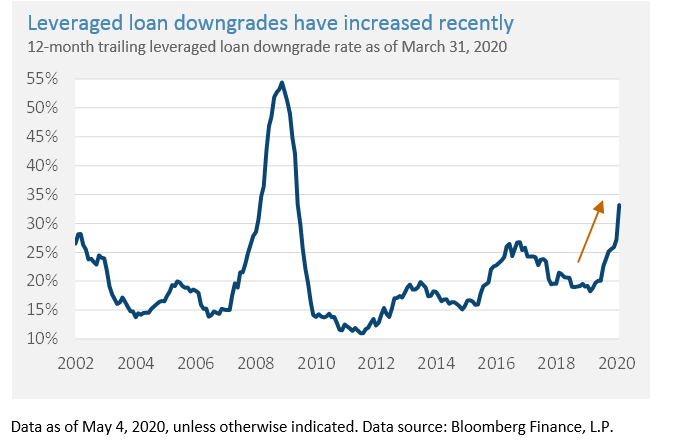

We believe corporate credit has been impaired by sellers overestimating the market impact of COVID-19 on operations of high-quality companies, creating potential opportunities for buyers with dry powder and stable platforms to seek higher returns at the top of the capital structure, especially as pandemic-induced corporate defaults begin to rise.

Past performance is not necessarily indicative of future results.

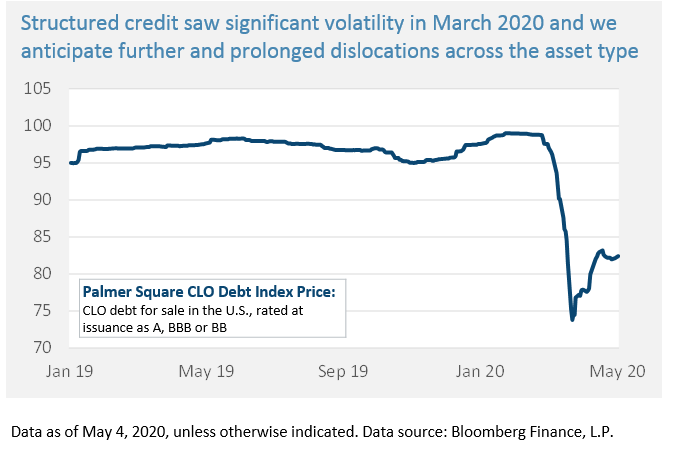

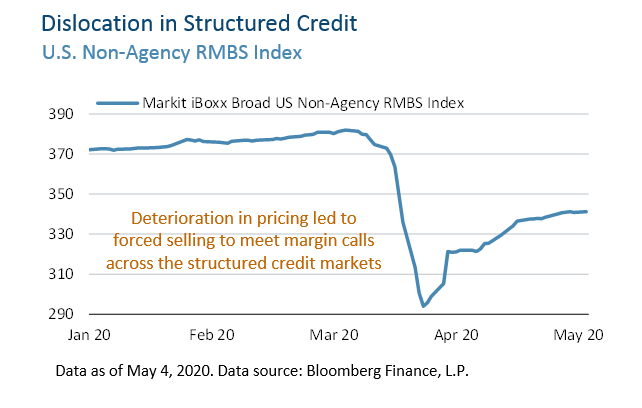

Across structured credit investments, a combination of forced sellers exiting investments in order to meet margin calls and investor redemptions caused assets to significantly reprice. The buying power of natural purchasers declined as NAVs and leverage declined in the system. This has created a dislocation that is broad-based across RMBS, CMBS, CLOs, consumer ABS and whole loan pools. We see this as an opportunity to use security selection and sponsor relationships to potentially generate alpha.

Past performance is not necessarily indicative of future results.

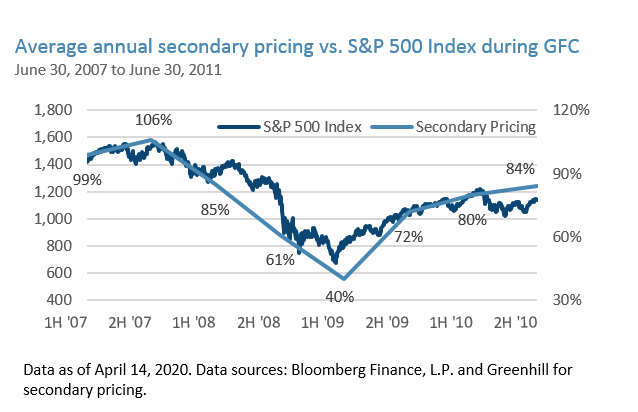

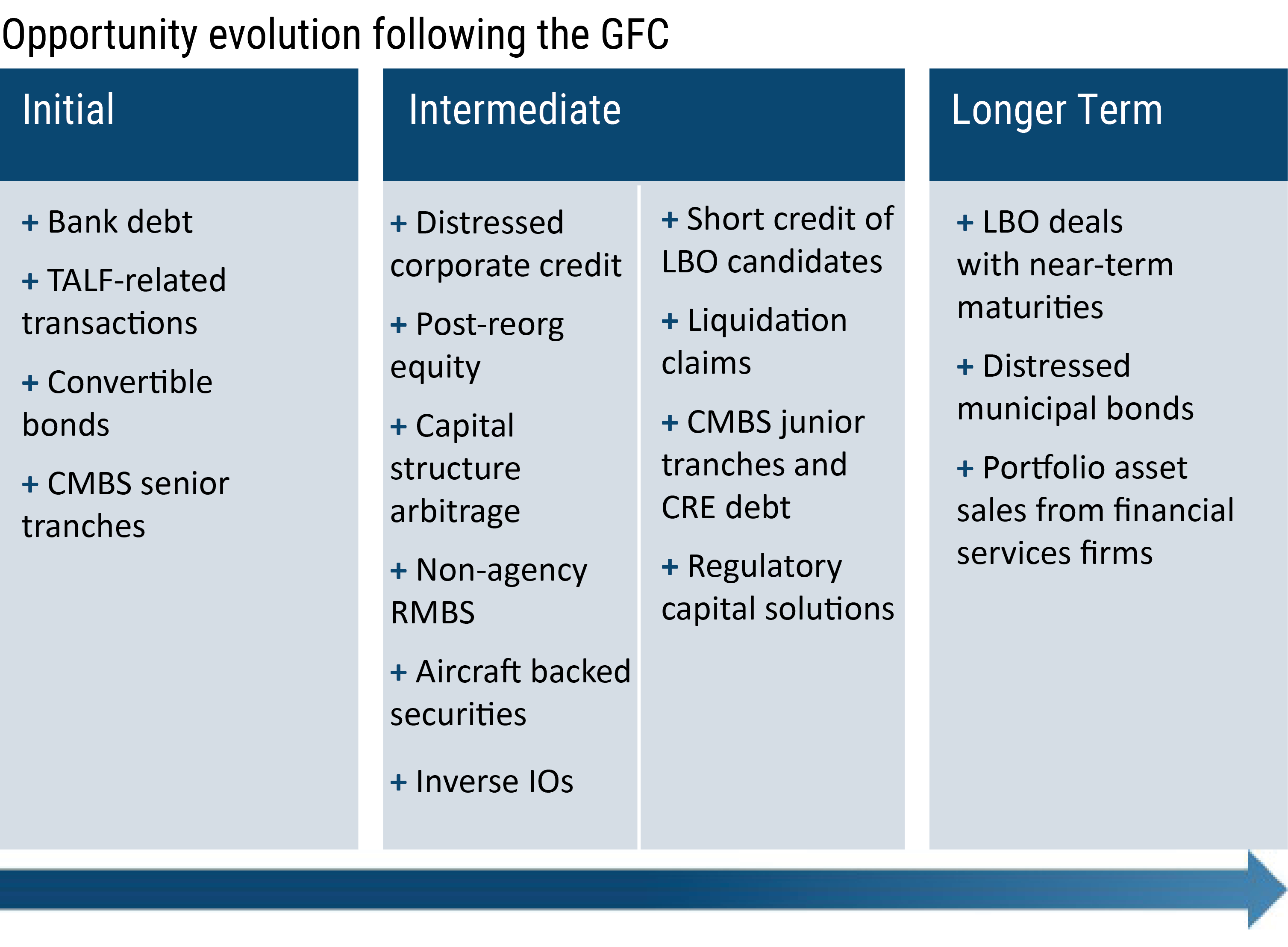

Similar to what we saw after the Global Financial Crisis (see below), we expect the current crisis will result in a return of deeply discounted private equity secondaries. The expected dislocation will speed up the traditional investment execution, leading to cycle opportunities (Read more in our recent post: Finding Opportunity in the Secondary Market Amid Dislocation). We believe structured secondary investments are an opportune way to facilitate quick liquidity transfers that may unlock these near-term opportunities. In later stages of economic recovery, opportunities typically take place in the form of hybrid debt investments. For instance, investments in the post-reorg equities of private companies emerging from bankruptcy with clear catalysts may be attractive.

Past performance is not necessarily indicative of future results.

While massive Fed intervention has propped up the broader equity market for the time being, we believe there is a tremendous and growing opportunity to invest in high-quality businesses with low liquidity concerns, modest financial leverage, and insulation from COVID-19 impact. Traditional equities’ volatility may enable attractive entry points to companies with lower long-term risk from the current economic downturn.

We believe the capital infusion to companies in defensive sectors that seek to limit the downside provide the opportunity to invest in assets through structures that we think are compelling.

While certain investment opportunities are similar to prior dislocations, niche strategies emerged as a result of the general market selloff and market response. This includes the government re-launching the TALF program to address a dislocation in the securitized market, along with significant forced selling in the SPAC market.

These opportunities are dynamic, given the ever-changing market, and we believe the right structure and flexibility provide the best way to navigate during this environment.

Past performance is not necessarily indicative of future results.

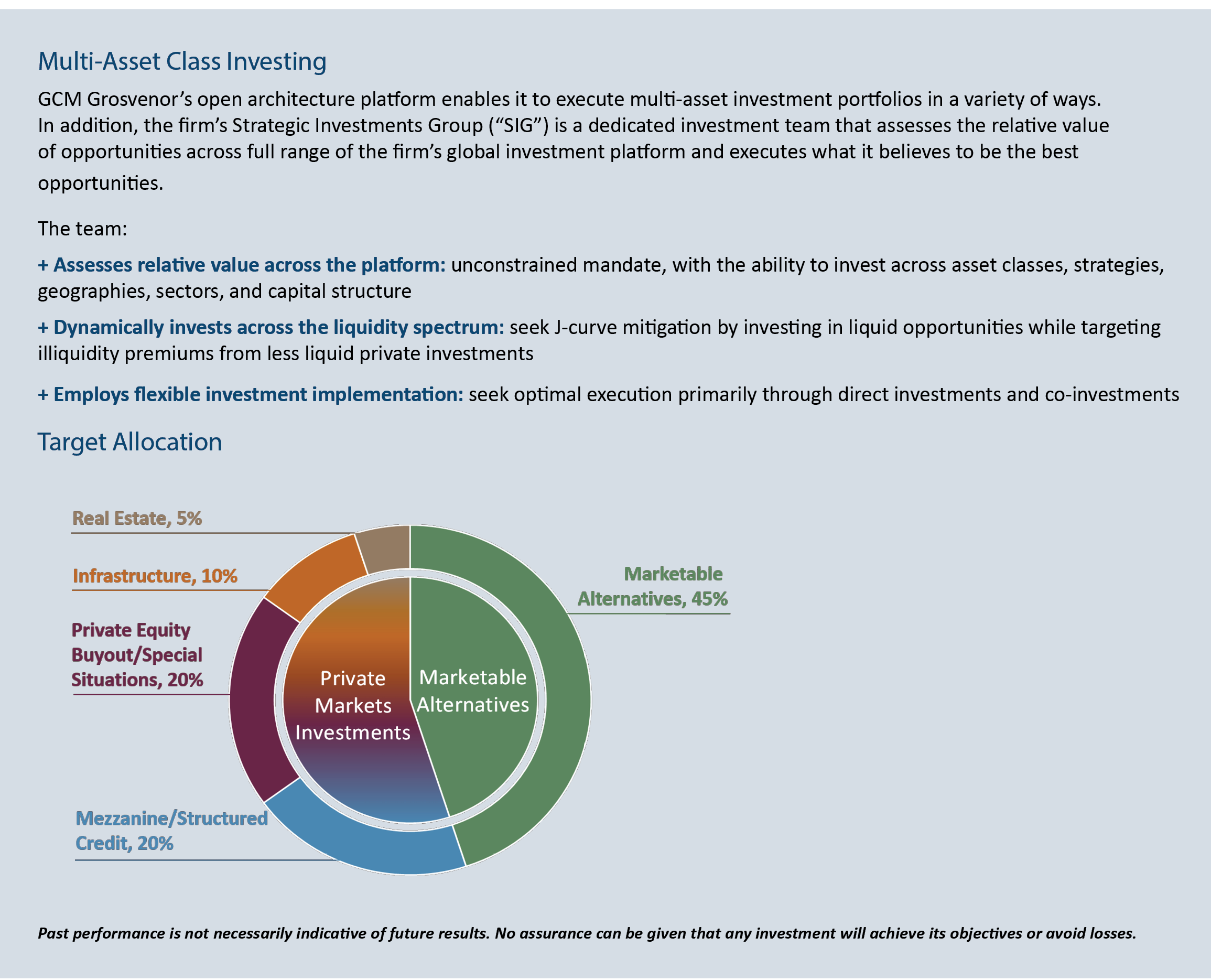

The ability to provide investors a single point of entry to capture the multitude, diversity, and fast-changing nature of the current opportunities has intuitive appeal. As we explain in our post Multi-Asset Investing: As Alternative Approach, a multi-asset strategy typically has an unconstrained mandate, allowing managers the freedom to invest capital more seamlessly and opportunistically in response to changes in the market. We believe this type of strategy best takes advantage of the full opportunity set, across sectors, industries, geographies, and positions in the capital structure, presented by the dislocation.

Amidst the current market dislocation and evolving opportunity set detailed above, a flexible, multi-asset strategy uniquely positions managers to survey the broad investable universe and deploy capital to opportunities like the ones we’re observing in credit, equity, and other sub-segments of the private capital markets. This flexible model is strengthened by the ability to deploy various implementation types, including direct investments, co-investments, and custom fund investments.

GCM Grosvenor’s open architecture, global alternative investment platform has 600+ quality manager relationships to source high conviction investment opportunities. The platform provides the team with broad coverage and extensive relationships across the alternative investments industry. Our market position enables us to effectively source over 2,400 deals annually and access high-quality market intelligence. The scale and depth of resources allows the team to source, underwrite, and structure differentiated direct investments, co-investments, and custom fund investments opportunities for our clients, which we have done successfully as part of our past and ongoing multi-asset class investment activities. We believe there are few firms with the requisite platform and capability to source from such a broad range of investment opportunities as well as execute in both liquid and illiquid markets.

The global investment and operations staff supports the investment professionals on the team throughout all stages of the investment and execution process. The team collaborates with investment professionals across the firm who help source ideas and offer specialized insight on managers and investments. Our deep and experienced team of operations professionals aid the efficient execution of investments. We believe the team can execute specialized opportunities by leveraging the firm’s legal, structuring, and operational capabilities. The team’s access to the significant resources on the GCM Grosvenor platform provides valuable efficiencies and speed to execution, which is critical within any tactical investment program.

We have an extensive history of managing multi-asset mandates for large, sophisticated institutional investors across the globe, including several mandates and funds specifically designed to take advantage of dislocations and stressed/distressed credit opportunities. For example, after the Global Financial Crisis our investment team navigated through opportunities that arose from the dislocations in the credit markets, capitalizing on GCM Grosvenor’s broad credit expertise.

Our deep senior team is experienced working through numerous crises and market cycles, which arms us with the strategies to help capitalize on market dislocations. We believe we are well-equipped with the requisite team, sourcing channels, underwriting, and execution capabilities to deliver attractive returns to investors.

In our latest post, we discuss how structured securities can be an attractive option for both investors and stressed growth companies looking to generate capital prior to an IPO.

We discuss the different ways investors can think about their allocations and compare case studies of how clients have categorized multi-asset investments.

Important Disclosures

Data source: Bloomberg Finance, L.P.

S&P. S&P and its third-party information providers do not accept liability for the information and the context from which it is drawn.

MSCI. MSCI makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used to create indices or financial products. This report is not approved or produced by MSCI.

Additional risks include: macroeconomic risk, liquidity risk, credit risk, customer retention, near term volatility, changes to permanent demand, risks related to the lack of a liquid, transparent market for secondary investments, performance risk, risks related to sourcing investments, regulatory risk, and supply chain disruption.

For illustrative and discussion purposes only. The information contained herein is based on information received from third-parties. GCM Grosvenor has not independently verified third-party information and makes no representation or warranty as to its accuracy or completeness. The information and opinions expressed are as of the date set forth therein and may not be updated to reflect new information.

Past performance is not necessarily indicative of future results. The views expressed are for informational purposes only and are not intended to serve as a forecast, a guarantee of future results, investment recommendations or an offer to buy or sell securities by GCM Grosvenor. All expressions of opinion are subject to change without notice in reaction to shifting market, economic, or political conditions. The investment strategies mentioned are not personalized to your financial circumstances or investment objectives, and differences in account size, the timing of transactions and market conditions prevailing at the time of investment may lead to different results. Certain information included herein may have been provided by parties not affiliated with GCM Grosvenor. GCM Grosvenor has not independently verified such information and makes no representation or warranty as to its accuracy or completeness.

GCM Investments UK LLP (GCMUK) has been made aware of fraudulent schemes targeting members of the public in the United Kingdom.

Unauthorised individuals are falsely claiming to represent GCMUK and are misusing the firm’s name and publicly available information in connection with fake investment opportunities.

These scams are sophisticated and deliberately misleading. They may involve the use of real GCMUK employee names and may imitate the tone, format, and branding of genuine GCMUK communications.

Please note:

GCMUK does not offer financial services or products to retail clients, either directly or through third parties. You can verify GCMUK’s regulatory status and permissions on the Financial Conduct Authority (FCA) Register at register.fca.org.uk.

If you are based in the UK and believe you have been contacted by a fraudster claiming to represent GCMUK, please take the following steps:

Investor Scam Alert

GCM Grosvenor L.P. and its affiliated entities (collectively, “GCMG”) have been made aware of fraudulent schemes currently targeting members of the public in Malaysia and Hong Kong, in which unauthorised individuals are falsely claiming to represent GCMG in connection with purported investment opportunities.

These fraudulent individuals are believed to be actively promoting false investment opportunities, often involving mobile applications, through the unauthorised use of GCMG’s name, brand, corporate logo, and other identifying materials. We have also received reports that these parties may be distributing fabricated business cards, hosting online webinars, creating WhatsApp groups, and arranging personal video calls to simulate legitimacy. These scams are sophisticated and deliberately misleading, frequently involving the use of real GCMG employee names and imitating the style, tone, and presentation of genuine GCMG communications.

GCMG has no presence, operations, or authorised representatives in Malaysia. GCMG does not offer any investment schemes, products, or mobile applications targeted at Malaysian investors, either directly or indirectly.

While GCMG maintains a legitimate presence and employs personnel in Hong Kong, these scams are entirely unauthorised and unrelated to any genuine activities conducted by GCMG or its employees in the region.

Position of GCMG

GCMG has neither authorised nor endorsed any such solicitations and takes this matter seriously. We have reported some of these incidents to the relevant regulatory and enforcement authorities in Malaysia, and are doing the same in Hong Kong, including notifying the Hong Kong Police and the appropriate financial regulators. GCMG will continue to assist with their investigations.

GCMG is actively monitoring these developments and reserves all rights to take legal action against any party found misusing its name, brand, or intellectual property.

While these reports currently centre on activity in Malaysia and Hong Kong, the methods used may be replicated in other jurisdictions. GCMG continues to monitor for similar risks globally.

Unauthorized individuals are impersonating Winston Chow in scams targeting investors, particularly in Malaysia. He does not solicit investments directly in Asia. If you are contacted by someone claiming to be him outside of official channels, please report it to local authorities.

For verification or further information, please contact: [email protected]

Investor Scam Alert

Unauthorized individuals are impersonating Winston Chow in scams targeting investors, particularly in Malaysia. He does not solicit investments directly in Asia. If you are contacted by someone claiming to be him outside of official channels, please report it to local authorities.

For verification or further information, please contact: [email protected]

We offer clients a broad range of tailored solutions across strategies, including multi-strategy, macro, relative value, long/short equity, quantitative strategies, and opportunistic credit. Levaraging our large scale and presence in the industry, we are able to offer clients preferntial exposure to hard-to-access managers and seek to obtain terms that can drive economic and structural advantages.