Structured Securities in Growth Equities: An Emerging Opportunity Set

In our latest post, we discuss how structured securities can be an attractive option for both investors and stressed growth companies looking to generate capital prior to an IPO.

Past performance is not necessarily indicative of future results. No assurance can be given that any investment will achieve its given objectives or avoid losses. Unless apparent from context, all statements herein represent GCM Grosvenor’s opinion.

Select risks include: market risk, macroeconomic risk, liquidity risk, interest rate risk, and operational risk.

We all gravitate naturally to category thinking – the urge to group “like” and separate “unlike.” The process is central to human intelligence. Yet, categories are not always the best solution to the problem of sorting and understanding inputs. Sometimes, categorizing works against us. We see such a phenomenon among alternative investments.

Alternative investments have rapidly gained traction within investment programs as sources of diversification and complementary income to traditional asset classes. As institutional investors adopted “alts,” they also embraced new classifications for these investment types, sorting them into categories of hedge funds, private equity, alternative credit, infrastructure, and real estate.

For asset allocation purposes, categories are highly effective. By identifying the long-term characteristics of individual asset classes, institutional investors can allocate to help optimize their specific goals – minimizing loss, managing volatility, maximizing return, or diversifying income, according to their priority.

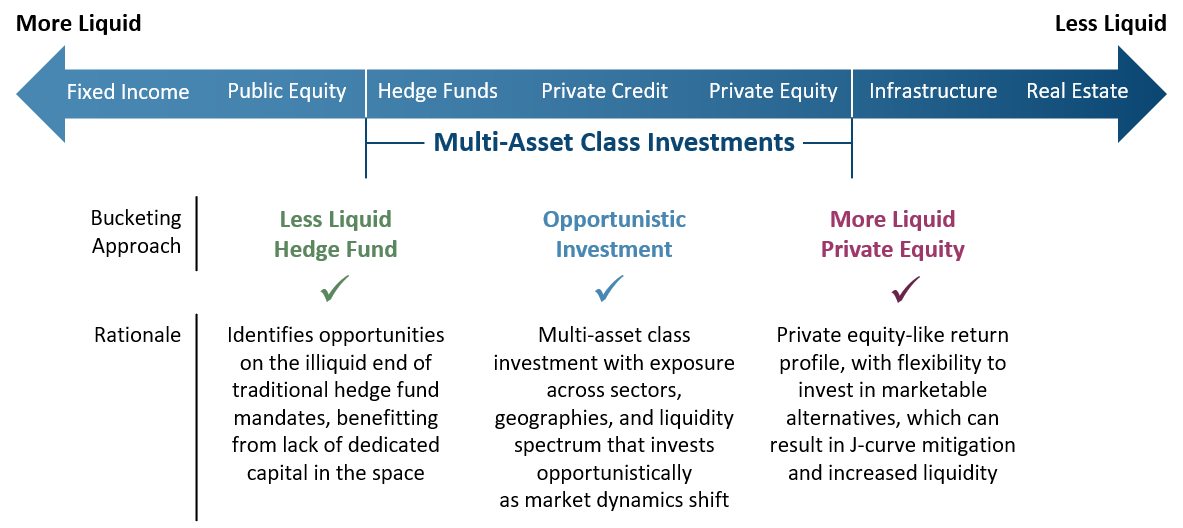

But that allocation-optimizing system does not work quite as perfectly when a category encompasses a varied range of characteristics, as happens in multi-asset investing. Facing a category that is harder to pinpoint in terms of characteristics, some institutional investors lump multi-asset strategies in an “opportunistic” bucket, while others avoid them altogether.

While the institutional investor might struggle to see the fit for strategies outside the usual asset class categories, portfolio managers face a different problem – asset class categories can block opportunities.

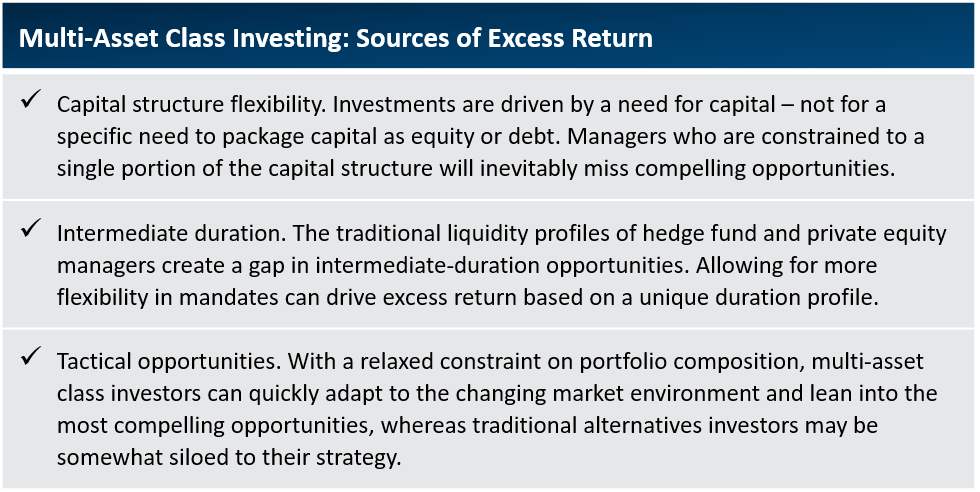

When strict category lines are applied in investing, compelling opportunities are inevitably left on the table. Or to put it another way, when strategies are unconstrained from traditional boundaries, they can seek to generate excess returns.

Managers with flexible mandates can access unique sources of return by pursuing opportunities that strict-mandate managers cannot, in three key areas.

First, investors who employ a multi-asset class approach have flexibility with respect to position in the capital structure. For example, an investment may be more attractively structured as a debt offering or hybrid security as opposed to an equity stake. The ability to capture opportunities such as these is a key advantage in the marketplace.

In addition, flexibility with respect to an investment’s duration can also be advantageous. Because of the liquidity profiles of hedge funds and private equity funds, investments that fit into a more intermediate-duration profile can often be challenging to execute. A multi-asset class mandate can capture these opportunities. Likewise for short-term investment opportunities created by market dislocations that are often overlooked by managers who can only consider long-term, illiquid opportunities.

Finally, an investor utilizing a multi-asset approach to portfolio construction may be more tactical and can quickly adapt to changing market environments. A flexible mandate relaxes constraints on exposures, security types, strategies, and other factors to allow a manager to better adapt and access opportunities.

It is true that multi-asset strategies can be harder to categorize. Still, it is possible to assess the profile of such strategies. While they may not follow the usual asset class delineations, they are typically managed with limits and boundaries. Those limits just take a different shape – targets. Because each investment decision can be modeled for its specific characteristics, the portfolio as a whole can be managed to targeted measures, whether that’s volatility, loss-limit targets, concentration limits, etc.

Many institutions who have embraced the multi-asset approach have created opportunistic buckets within their portfolios to take advantage of this exposure profile. Liquidity profiles of multi-asset programs tend to fall between hedge funds and private equity. Therefore, other approaches frequent among institutional investors are to model these strategies as either a less-liquid hedge fund or a more-liquid private equity allocation. Regardless of classification, the intention of multi-asset investing remains to be unconstrained and agile in accessing alternative investments.

We believe multi-asset class investing is best achieved through a co-investing and direct investing approach that leverages our key competitive advantage in the marketplace: our platform. Our Strategic Investments Group is built to leverage this advantageous position in the industry through:

The GCM Grosvenor multi-asset approach leverages our competitive advantages in seeking to deliver excess returns for clients.

The advantages of multi-asset investing in alternatives are not limited to a specific macroeconomic environment. Indeed, the changing cycle from one environment to the next is one of the dynamics that drives the opportunity set for multi-asset investing. We see multi-asset strategies as a strong option for institutional investors whose alternative asset allocation covers the traditional categories but lacks the flexibility to capitalize on the opportunities summarized here.

In our latest post, we discuss how structured securities can be an attractive option for both investors and stressed growth companies looking to generate capital prior to an IPO.

We discuss the different ways investors can think about their allocations and compare case studies of how clients have categorized multi-asset investments.

Important Disclosures

For illustrative and discussion purposes only.

No assurance can be given that any investment will achieve its objectives or avoid losses. Past performance is not necessarily indicative of future results.

The information and opinions expressed are as of the date set forth therein and may not be updated to reflect new information.

Investments in alternatives are speculative and involve substantial risk, including strategy risks, manager risks, market risks, and structural/operational risks, and may result in the possible loss of your entire investment. The views expressed are for informational purposes only and are not intended to serve as a forecast, a guarantee of future results, investment recommendations, or an offer to buy or sell securities by GCM Grosvenor. All expressions of opinion are subject to change without notice in reaction to shifting market, economic, or political conditions. The investment strategies mentioned are not personalized to your financial circumstances or investment objectives, and differences in account size, the timing of transactions, and market conditions prevailing at the time of investment may lead to different results. Certain information included herein may have been provided by parties not affiliated with GCM Grosvenor. GCM Grosvenor has not independently verified such information and makes no representation or warranty as to its accuracy or completeness.

GCM Investments UK LLP (GCMUK) has been made aware of fraudulent schemes targeting members of the public in the United Kingdom.

Unauthorised individuals are falsely claiming to represent GCMUK and are misusing the firm’s name and publicly available information in connection with fake investment opportunities.

These scams are sophisticated and deliberately misleading. They may involve the use of real GCMUK employee names and may imitate the tone, format, and branding of genuine GCMUK communications.

Please note:

GCMUK does not offer financial services or products to retail clients, either directly or through third parties. You can verify GCMUK’s regulatory status and permissions on the Financial Conduct Authority (FCA) Register at register.fca.org.uk.

If you are based in the UK and believe you have been contacted by a fraudster claiming to represent GCMUK, please take the following steps:

Investor Scam Alert

GCM Grosvenor L.P. and its affiliated entities (collectively, “GCMG”) have been made aware of fraudulent schemes currently targeting members of the public in Malaysia and Hong Kong, in which unauthorised individuals are falsely claiming to represent GCMG in connection with purported investment opportunities.

These fraudulent individuals are believed to be actively promoting false investment opportunities, often involving mobile applications, through the unauthorised use of GCMG’s name, brand, corporate logo, and other identifying materials. We have also received reports that these parties may be distributing fabricated business cards, hosting online webinars, creating WhatsApp groups, and arranging personal video calls to simulate legitimacy. These scams are sophisticated and deliberately misleading, frequently involving the use of real GCMG employee names and imitating the style, tone, and presentation of genuine GCMG communications.

GCMG has no presence, operations, or authorised representatives in Malaysia. GCMG does not offer any investment schemes, products, or mobile applications targeted at Malaysian investors, either directly or indirectly.

While GCMG maintains a legitimate presence and employs personnel in Hong Kong, these scams are entirely unauthorised and unrelated to any genuine activities conducted by GCMG or its employees in the region.

Position of GCMG

GCMG has neither authorised nor endorsed any such solicitations and takes this matter seriously. We have reported some of these incidents to the relevant regulatory and enforcement authorities in Malaysia, and are doing the same in Hong Kong, including notifying the Hong Kong Police and the appropriate financial regulators. GCMG will continue to assist with their investigations.

GCMG is actively monitoring these developments and reserves all rights to take legal action against any party found misusing its name, brand, or intellectual property.

While these reports currently centre on activity in Malaysia and Hong Kong, the methods used may be replicated in other jurisdictions. GCMG continues to monitor for similar risks globally.

Unauthorized individuals are impersonating Winston Chow in scams targeting investors, particularly in Malaysia. He does not solicit investments directly in Asia. If you are contacted by someone claiming to be him outside of official channels, please report it to local authorities.

For verification or further information, please contact: [email protected]

Investor Scam Alert

Unauthorized individuals are impersonating Winston Chow in scams targeting investors, particularly in Malaysia. He does not solicit investments directly in Asia. If you are contacted by someone claiming to be him outside of official channels, please report it to local authorities.

For verification or further information, please contact: [email protected]

We offer clients a broad range of tailored solutions across strategies, including multi-strategy, macro, relative value, long/short equity, quantitative strategies, and opportunistic credit. Levaraging our large scale and presence in the industry, we are able to offer clients preferntial exposure to hard-to-access managers and seek to obtain terms that can drive economic and structural advantages.