Clarifying the Misconceptions of Co-Investing

We debunk several common misconceptions related to co-investing in today’s market.

Past performance is not necessarily indicative of future results. No assurance can be given that any investment will achieve its given objectives or avoid losses. Unless apparent from context, all statements herein represent GCM Grosvenor’s opinion.

Select risks include: macroeconomic risk, sourcing risk, investment selection, portfolio diversification, management risk, execution of value creation plan, risks related to reliance on third parties, and risks related to the sale of investments.

The private equity co-investment marketplace is growing and maturing, following trends in private equity overall, with more participants from both the capital supply (limited partner) and demand (sponsor) sides. Given the increasing size and evolution of this market, limited partners (LPs) have more ways to participate directly in transactions. With the right sourcing capabilities, LPs now have a wider range of choices for specific transactions and more access to sponsors to partner with on these deals.

We believe the maturing private equity co-investment marketplace is a good thing, on balance. Here, we offer our perspective on the changing opportunity set and investigate the benefits the maturing market offers us as co-investors. In an environment with more choice, selectivity arguably plays more of a role than in a market at a more nascent stage. And as we will discuss, manager research and selectivity is just as critical a part of this process as deal diligence.

The private equity co-investment landscape, much like the overall private equity ecosystem, is indisputably growing. In earlier days, co-investing was a one-off decision to bridge sponsor capital limits in specific circumstances. Now, sponsors have come to embrace co-investment capital as another financing source that they can tap when necessary. The arrangement is beneficial to all participants – to the private equity sponsors looking to secure additional equity financing for deals while furthering their relationship with LPs, and to the co-investors who benefit from strong investment opportunities at favorable economics.

Indeed, assets in completed co-investment deals have grown steadily. At the end of 2017, capital invested in co-investments was estimated at $60 billion and comprised about 20% of the private equity market, according to Cambridge Associates.1 At GCM Grosvenor, we have committed $3.4 billion of capital across approximately 150 buyout co-investments in the last 15 years.2

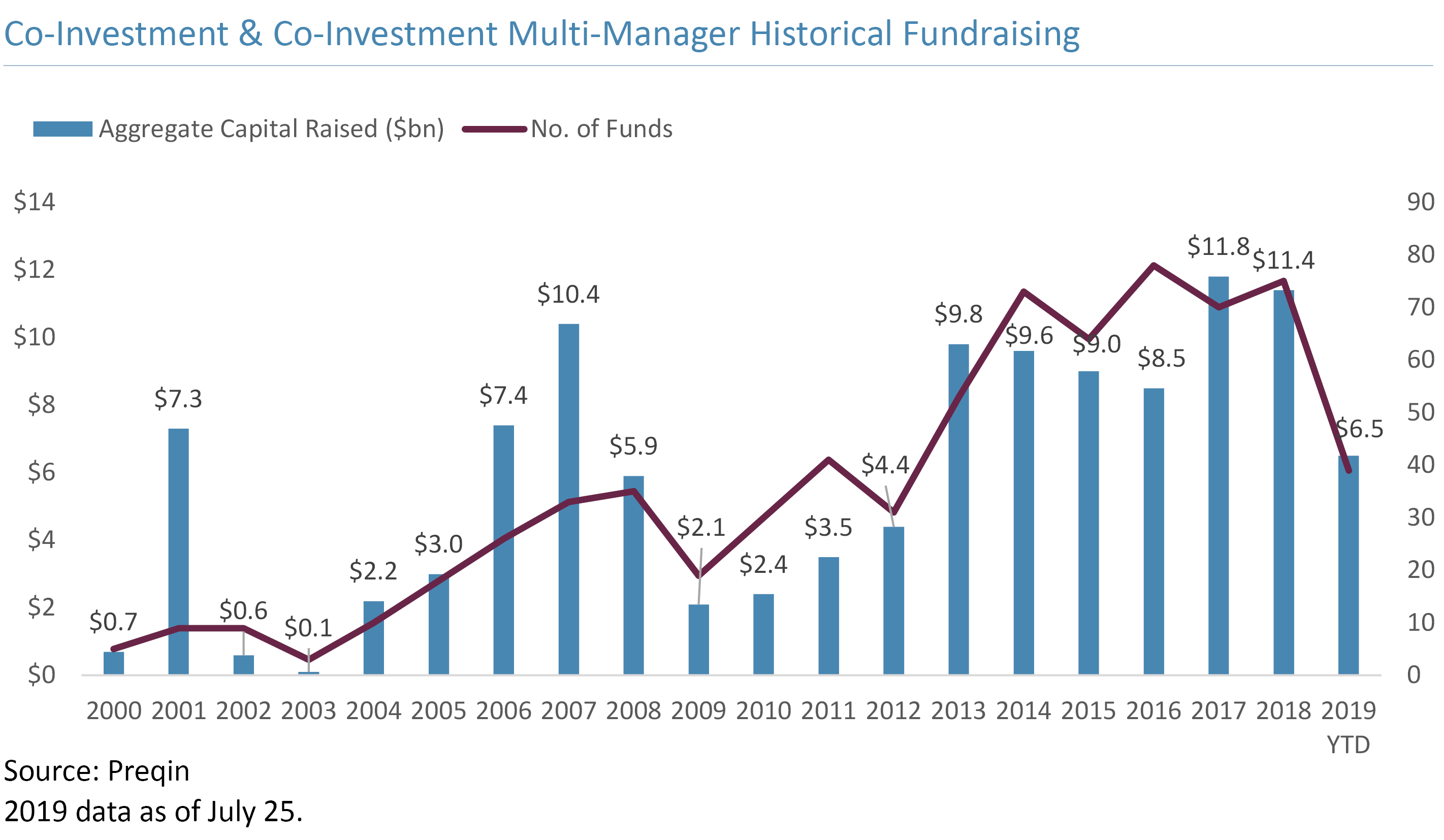

Fundraising volumes in recent years also demonstrate the growth of private equity co-investing, as the chart below shows. Along the way, the marketplace is also segmenting. Today there are niche co-investment pools for deal size, industry and growth stage.

The supply of capital is clearly one key driver of the increased activity. Institutional investors, on the whole, are aiming to allocate more to private equity as an asset class. Co-investing allows LPs to commit more capital alongside preferred sponsors and create targeted direct deal exposures for their portfolios. Additionally, the more appealing fee structure of co-investments, which often have no management fee or carried interest, is fueling demand from institutional investors.

By using co-investment in deals, sponsors benefit from the ability to retain control of a transaction, both pre- and post-closing. The wave of club deals in the years leading up to the 2009 financial crisis illustrated some of the difficulties that sponsors encountered when investing together in the same asset. Co-investors also benefit from a maturing co-investment market in a number of ways, including the following:

We believe co-investing with the right sponsors offers the same alpha potential as picking the right funds, from the LP’s perspective. For the past 20 years of private equity investing, upper-quartile managers have outperformed median managers by 820 basis points, according to Burgiss, thus illustrating the critical role manager selection can play in co-investing as well.

As the private equity co-investment market matures, it also offers more continuity. Today, our existing relationships with traditional sponsors (i.e., private equity managers who have a primary fund in which we are an LP) are the biggest source of co-investment opportunities and completed deals. In these relationships, we have the benefit of prior due diligence and a track record to the relationship, which allow us to keep our assessment of the sponsor – of their judgment, management style, and success – up-to-date and accurate. The sponsor also benefits from this continuity, as they can trust that co-investment partners have an established and transparent process for deal decisions, driving shared expectations.

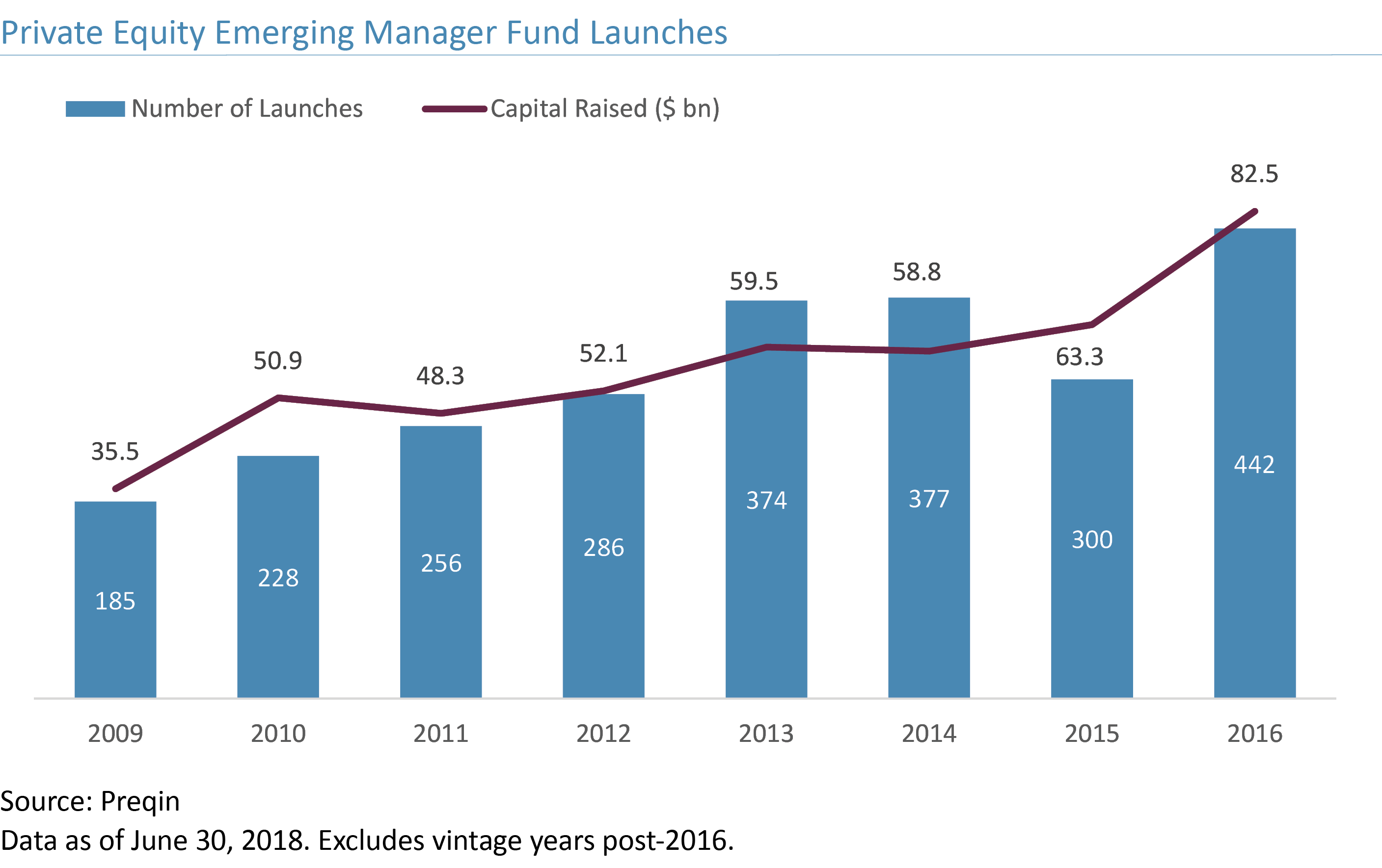

But to source as broad a funnel of deals as possible and try to capture the most alpha, we have to be open to executing co-investments not just with traditional sponsors, but with emerging managers and fundless sponsors as well. As the chart below illustrates, emerging managers are a growing share of the private equity market over the last decade.

Co-investing depends on trust, by design; co-investors have less control over portfolio companies than a traditional private equity investor would have. They tend to be minority investors, for instance, and they’re often the “taker” of deal terms. Manager research is therefore imperative. In our view, investors must be able to accurately assess the skill of their partners based on prior track records, deal experience, or whatever else they know of the manager’s judgment and access to promising opportunities.

Manager research and deal diligence are related endeavors, but the nature of the interaction depends on the manager type:

The maturing private equity co-investment market alters the dynamics of deals in some ways, but overall, these changes represent improvements for both sponsors and LPs. There are more ways for sponsors to utilize co-investors to get deals done, and more opportunities for LPs to participate in single-deal transactions to complement their primary fund investment strategies.

To operate successfully amid growing competition, we believe co-investors must have broad access to deals, and selection is a matter of both manager quality and individual deal potential. Diligence on both fronts is imperative. This philosophy positions private equity co-investors for continued success even in a more competitive environment.

We debunk several common misconceptions related to co-investing in today’s market.

In today’s market, many institutional investors are contending with overallocation to private capital strategies. Here, we discuss how co-investing can help them refrain from pausing new investments and maintain exposure to potentially high-performing vintages, even when investment dollars are scarce.

Select risks of co-investing include: macroeconomic risk, capital markets risk, credit risk, company risk, and liquidity risk. Additional risks that result in losses may be present.

Additional Notes

1. “Ready, Steady, Co-Invest,” Cambridge Associates, 2019.

2. As of March 31, 2019.

Important Disclosures

Burgiss Benchmark Data – Benchmark is obtained from The Burgiss Group, an independent subscription-based data provider, which calculates and publishes quarterly performance information from cash flows and valuations collected from of a sample of private equity firms worldwide. The performance of GCM Grosvenor’s underlying investments is compared to that of its peers by asset type, geography and vintage year as of the applicable valuation date. Benchmarks for certain investment types may not be available. GCM Grosvenor uploads data into our system one-time each quarter; however, the data service may continue to update its benchmarks thereafter. Therefore, benchmark information in GCM Grosvenor’s system may not always agree with the most current information available from the data service. Investments may be held indirectly through special purpose vehicles.

Investments in alternatives are speculative and involve substantial risk, including strategy risks, manager risks, market risks, and structural/operational risks, and may result in the possible loss of your entire investment. Past performance is not necessarily indicative of future results.The views expressed are for informational purposes only and are not intended to serve as a forecast, a guarantee of future results, investment recommendations or an offer to buy or sell securities by GCM Grosvenor. All expressions of opinion are subject to change without notice in reaction to shifting market, economic, or political conditions. The investment strategies mentioned are not personalized to your financial circumstances or investment objectives, and differences in account size, the timing of transactions and market conditions prevailing at the time of investment may lead to different results. Certain information included herein may have been provided by parties not affiliated with GCM Grosvenor. GCM Grosvenor has not independently verified such information and makes no representation or warranty as to its accuracy or completeness. GCM Grosvenor’s strategy definitions differ from those used by The Burgiss Group (“Burgiss”). GCM Grosvenor has used its best efforts to match each strategy with the appropriate Burgiss strategy but material differences may exist. Additional information is available upon request.

GCM Investments UK LLP (GCMUK) has been made aware of fraudulent schemes targeting members of the public in the United Kingdom.

Unauthorised individuals are falsely claiming to represent GCMUK and are misusing the firm’s name and publicly available information in connection with fake investment opportunities.

These scams are sophisticated and deliberately misleading. They may involve the use of real GCMUK employee names and may imitate the tone, format, and branding of genuine GCMUK communications.

Please note:

GCMUK does not offer financial services or products to retail clients, either directly or through third parties. You can verify GCMUK’s regulatory status and permissions on the Financial Conduct Authority (FCA) Register at register.fca.org.uk.

If you are based in the UK and believe you have been contacted by a fraudster claiming to represent GCMUK, please take the following steps:

Investor Scam Alert

GCM Grosvenor L.P. and its affiliated entities (collectively, “GCMG”) have been made aware of fraudulent schemes currently targeting members of the public in Malaysia and Hong Kong, in which unauthorised individuals are falsely claiming to represent GCMG in connection with purported investment opportunities.

These fraudulent individuals are believed to be actively promoting false investment opportunities, often involving mobile applications, through the unauthorised use of GCMG’s name, brand, corporate logo, and other identifying materials. We have also received reports that these parties may be distributing fabricated business cards, hosting online webinars, creating WhatsApp groups, and arranging personal video calls to simulate legitimacy. These scams are sophisticated and deliberately misleading, frequently involving the use of real GCMG employee names and imitating the style, tone, and presentation of genuine GCMG communications.

GCMG has no presence, operations, or authorised representatives in Malaysia. GCMG does not offer any investment schemes, products, or mobile applications targeted at Malaysian investors, either directly or indirectly.

While GCMG maintains a legitimate presence and employs personnel in Hong Kong, these scams are entirely unauthorised and unrelated to any genuine activities conducted by GCMG or its employees in the region.

Position of GCMG

GCMG has neither authorised nor endorsed any such solicitations and takes this matter seriously. We have reported some of these incidents to the relevant regulatory and enforcement authorities in Malaysia, and are doing the same in Hong Kong, including notifying the Hong Kong Police and the appropriate financial regulators. GCMG will continue to assist with their investigations.

GCMG is actively monitoring these developments and reserves all rights to take legal action against any party found misusing its name, brand, or intellectual property.

While these reports currently centre on activity in Malaysia and Hong Kong, the methods used may be replicated in other jurisdictions. GCMG continues to monitor for similar risks globally.

Unauthorized individuals are impersonating Winston Chow in scams targeting investors, particularly in Malaysia. He does not solicit investments directly in Asia. If you are contacted by someone claiming to be him outside of official channels, please report it to local authorities.

For verification or further information, please contact: [email protected]

Investor Scam Alert

Unauthorized individuals are impersonating Winston Chow in scams targeting investors, particularly in Malaysia. He does not solicit investments directly in Asia. If you are contacted by someone claiming to be him outside of official channels, please report it to local authorities.

For verification or further information, please contact: [email protected]

We offer clients a broad range of tailored solutions across strategies, including multi-strategy, macro, relative value, long/short equity, quantitative strategies, and opportunistic credit. Levaraging our large scale and presence in the industry, we are able to offer clients preferntial exposure to hard-to-access managers and seek to obtain terms that can drive economic and structural advantages.