Past performance is not necessarily indicative of future results. No assurance can be given that any investment will achieve its given objectives or avoid losses. Unless apparent from context, all statements herein represent GCM Grosvenor’s opinion.

Select risks include: market risks, credit risks, macroeconomic risks, liquidity risks, manager risks, counterparty risks, interest rate risks, and operational risks.

Introduction

The diverse manager market is a thriving $1 trillion ecosystem of managers, investors, consultants, industry associations, and other stakeholders. While investors, managers, and consultants view an inclusive investment strategy as consistent with their pursuit of strong risk-adjusted returns, others are focused on narrowing the wealth gap and ensuring capital is being allocated equitably so talent is not overlooked.

There has been significant growth in the diverse managers market, and we expect the momentum to continue. Increasingly, LPs are taking note of the alpha created by diverse managers and are recognizing the growing opportunity set they provide. In addition, LPs have an increasing amount of information and resources at their fingertips, allowing for better decision-making. Meanwhile, the work of industry groups, regulators, and peers are providing market tailwinds and further incentivizing investors.

Significant growth and poised for more

As diverse managers grow and launch more funds, institutional investors are supporting the market’s growth with their allocations.

Diverse firms growing more than non-diverse

The diverse manager market is no longer a niche segment to be dabbled in. Instead, it is a growing collection of managers that should not be ignored. In private equity, we have seen the growth of women- and minority-owned private equity managers outpacing that of their non-diverse counterparts.

10-year growth (CAGR) in U.S.-based AUM among women- and minority-owned PE firms, 2011-20201

No Data Found

Growth among diverse manager funds

To add further evidence to this expansion, today GCM Grosvenor’s proprietary universe of diverse private equity managers is made up of more than 750 firms and over 1,000 funds. Since 2012, the number of funds we track has grown 10x and commitment dollars have grown nearly 12x.2

GCM Grosvenor universe of active diverse-managed private equity funds

The market can support further growth

Despite this growth, diverse private equity funds remain a small part of the private equity market. But we believe this disparity creates an “opportunity long, capital short” dynamic and there is a great deal of overlooked talent that can support more capacity and continued growth going forward.

Non-diverse, women-owned, and minority-owned U.S.-based private equity AUM3

No Data Found

Forward thinking LPs are leading by example

Many LPs recognize the opportunities that exist and are growing and evolving their diverse manager programs, some on a very large scale. For example:

- One large state teachers fund increased its emerging manager program target to $1 billion in total assets from $750 million.

- A U.S. corporation has invested over $1.5 billion with more than 25 diverse managers, and in 2020 buffered its own long-standing diversity and inclusion program.

- A $50+ billion state retirement system launched its emerging managers program in 2005 and it continues to evolve – the program is now on its fourth iteration.

We are also seeing LPs allocate to diverse managers as a larger share of their portfolios. For example, endowments and foundations continue to direct sizeable portions of their investments toward diverse managers. One recent survey showed that among 16 large university foundations, collectively with more than $200 billion in assets, an average of approximately 19% of those assets are allocated to diverse managers.4

ALPHA GENERATION IS A KEY GROWTH DRIVER

Diverse managers have outperformed benchmarks over time, and drivers go beyond fundraising.

A recent survey found that 58% of LPs said the societal events of 2020 influenced their thinking on diversity, equity, and inclusion in investing.5 But investing with diverse managers is not solely a social impact-driven strategy; LPs are seeking both positive social impact and strong returns. Studies have shown that diverse managers are in fact delivering those returns and have done so across market cycles.

In 2021, the National Association of Investment Companies (NAIC) looked at periods going back to 1998 and showed diverse private equity funds outperformed their non-diverse counterparts in several metrics. For example, the NAIC Private Equity Index produced higher net MOICs than the Burgiss Median Quartile in 83.3% of the vintage years studied.6

Diverse managers have demonstrated consistent outperformance

MOIC of NAIC Private Equity Index vs. Burgiss Median Quartile, by vintage year7

No Data Found

Positive performance also correlates with gender-diverse fund managers. As we highlighted earlier this year, research has shown that private equity and venture capital firms with gender-balanced senior teams delivered between 10 percent and 20 percent higher returns than teams with majority male or female leaders.8 A similar study of more than 20,000 publicly traded companies showed that increasing female leadership from zero to 30 percent correlated with a 15% jump in profitability.9

Differentiated drivers of performance

A common misconception among investors is that diverse managers are limited to venture capital firms. While it’s true the diverse manager market overall skews toward venture capital, we believe LPs have more opportunities to capture alpha than they think. Thus, we allocate to more middle- and lower-middle-market buyout managers than the overall market signifies.

GCM Grosvenor universe of private equity diverse managers

No Data Found

Universe data as of September 26, 2022. Allocation data as of October 2022. For illustrative purposes only and subject to change.

allocations

No Data Found

Beyond fund investing, we see opportunities for alpha generation through co-investing and investments in a diverse manager at the GP level.

First, diverse managers are growing their LP value proposition by offering co-investments, which provide LPs another differentiated source of alpha via potentially lower fees and better economics along with flexibility and control that LPs expect from co-investing.

LPs may also capture “structural” alpha in three ways that are distinct in their economic profiles and levels of involvement. First, an LP may choose to be an anchor investor, which can result in preferred economics and negotiated capacity rights in future funds. Or they may act as a seeding partner to a new or emerging GP. This often involves revenue sharing arrangements and, sometimes, preferred equity stakes, negotiated capacity, and co-investment rights. There is also the potential for the seeding LP to provide non-investment support to help the GP across a range of operational/infrastructure needs.

Meanwhile, some LPs are accessing more established diverse managers through investments directly in GPs. These investments, which can result in a share of long-term management and incentive fees, provide LPs the opportunity to pursue yet another differentiated source of alpha. Across private equity, GP stakes investments attracted over $20 billion in the fourth quarter of 2021,10 and diverse managers are increasingly participating in that trend.

GP spotlight

HarbourView Equity Partners is one of a kind – and one of many

HarbourView Equity Partners defines itself as “a multi-strategy, global investment firm focused on esoteric investment opportunities in the entertainment and media space.” But many see HarbourView as representative of the emergent talent in the diverse manager market – talent that is too often overlooked.

Leadership: The Firm is led by Founder and Managing Partner, Sherrese Clarke Soares. Sherrese is a two-time Founder and CEO with over 20 years’ experience in corporate finance, capital markets, investment banking, and private equity. She was recently named one of WSJ Pro’s female influencers shaping private equity’s future and, as a woman of color, Sherrese represents one of the most underbanked segments of the market.

The firm: Founded in 2021, HarbourView Equity Partners is a multi-strategy, global investment firm focused on esoteric investment opportunities in the entertainment and media space. The firm focuses on equity and equity related investment opportunities that are supported by several factors, including long duration revenue streams, resilience to broad economic downturns, and intellectual property. HarbourView is a long-term investor in content with an industrial platform built to protect, optimize, and enhance the legacy of premium IP. The firm’s initial investment strategy seeks to build a scaled diversified pool of long tenured, non-correlated investments focused on the exploitation of musical works across various income streams.

The approach to launch: When founding HarbourView, Sherrese focused on three areas: 1.) building a strong team, 2.) having the right technology in place and 3) securing a partner for launch of the first fund. She achieved all three, including the securing of up to $1 billion in seed capital from a prominent strategic partner, helping the firm achieve scale from the get-go.

HarbourView is an example of how smart emerging managers are taking a fresh approach to capital raising and getting their operational efficiencies organized from the outset. Appropriately, the firm’s tagline: “Content is Queen.”

Sherrese Clarke Soares at Consortium in 2022

This example is presented for illustrative purposes only, and is not intended to be representative of GCM Grosvenor funds, strategies or investments. Unless apparent from context, all statements herein represent GCM Grosvenor’s opinion. No assurance can be given that any investment will achieve its objectives or avoid losses.

More transparency is attracting more investors

Better information – and more ways to access it – is helping guide the judgement of institutional investors. Meanwhile, advisors are playing a crucial role by providing LPs with access to diverse managers and the expertise to implement investments.

Industry groups are educating, advocating, and connecting

Today, dozens of industry organizations are contributing to the advancement of diverse professionals and firms in asset management. Their objectives are in alignment with interested LPs, and they are providing information and resources that promote better decision-making. In short, these organizations are acting as the industry’s “connective tissue” in many ways:

- Create guidelines for best practices in diversity, equity, inclusion

- Provide research and performance data for diverse manager industry

- Educate and raise awareness with key decision makers at institutional investors

- Represent and act as a voice for various underrepresented groups including women, African American, Asian American and Pacific Islander, Hispanic and Latinx, and others

- Host industry events

- Publish articles

- Mentor and provide professional advancement opportunities

GCM Grosvenor’s representative industry partners

The market is working towards a standard definition of “diverse”

Recently we discussed how the lack of a standard definition of “diverse” can be a potential blind spot for the industry and may lead to missed opportunities or other negative outcomes. The good news: industry stakeholders agree that a universal definition will lead to better-informed LPs, a more efficient marketplace, and, ultimately, increased allocations.

There have been real steps in that direction. Spearheaded by the Diverse Asset Managers Initiative (DAMI) “Fiduciary Guide to Investing with Diverse Asset Managers and Firms,” multiple industry organizations are managing initiatives to help establish standards. In addition, LPs themselves are educating managers on their own definitions to promote transparency and a more focused roadmap to fundraising.

Advisors = access + expertise

There are numerous steps in the process for an LP seeking to launch or expand their diverse investment strategy. But once these steps have been taken and the LP is ready to invest, many find that they still lack access to managers and/or do not have the expertise to efficiently implement investments.

Thus, it is common for LPs to partner with an advisor that has the requisite experience, network, and access to deal flow to properly source and diligence managers and execute investments. The LP can benefit from working with an advisor in several ways:

- The advisor often acts as a fiduciary to help set up and manage a program that is commensurate with the LPs risk-return preferences, timeline, and other factors.

- The LP may have access to a range of implementation options such as fund investments, separately managed accounts, co-investing, or seed/anchor opportunities.

- An advisor can help mitigate risk through their ability to evaluate incomplete data. Since a large number of diverse managers are also early-stage, their lack of established track records, team, or infrastructure may create additional risks.

- The advisor, when acting as fiduciary on behalf of the LP, can leverage its deep GP relationships to access deal flow, capacity, or preferred terms. Or the advisor might be a “first call” from a GP seeking an anchor investor or seed partner, potentially capturing the associated economic benefits.

Tailwinds are supporting continued growth

Regulations, policies, and industry initiatives are expected to buffer the diverse manager industry, boost its appeal, and incentivize more LPs to allocate to diverse managers.

Many states, agencies, and plans themselves are rolling out initiatives designed to enact positive change and further investment. A few examples:

- The SEC’s Asset Management Advisory Committee issued a report in July 2021 in which it researched the state of diversity, published its findings, and made recommendations. The intent: to drive the industry toward more diverse and equitable actions through increased transparency and disclosure, manager selection process, and other investor practices.11

- In 2023, California public employees’ and teachers’ pension systems will be subject to annual reporting requirements for their diverse and emerging managers programs. These requirements are expected to help advance equity and diversity via the pension plans’ investments.12

- Meanwhile, institutional investors are aligning their efforts to increase diversity on corporate boards. The Northeast Investors’ Diversity Initiative is comprised of six state public retirement plans in the U.S. Northeast, while the Midwest Investors Diversity Initiative engages a coalition of institutional investors with a collective $820 billion in assets under management/advisement.

- In addition, the Massachusetts Pension Reserves Investment Management Board (MassPRIM) recently rolled out its FUTURE Initiative, with a goal of allocating at least 20% of plan assets to diverse and emerging managers,13and we have seen many other plans commit to similar policy targets.

LP spotlight

How one investor is taking a comprehensive approach

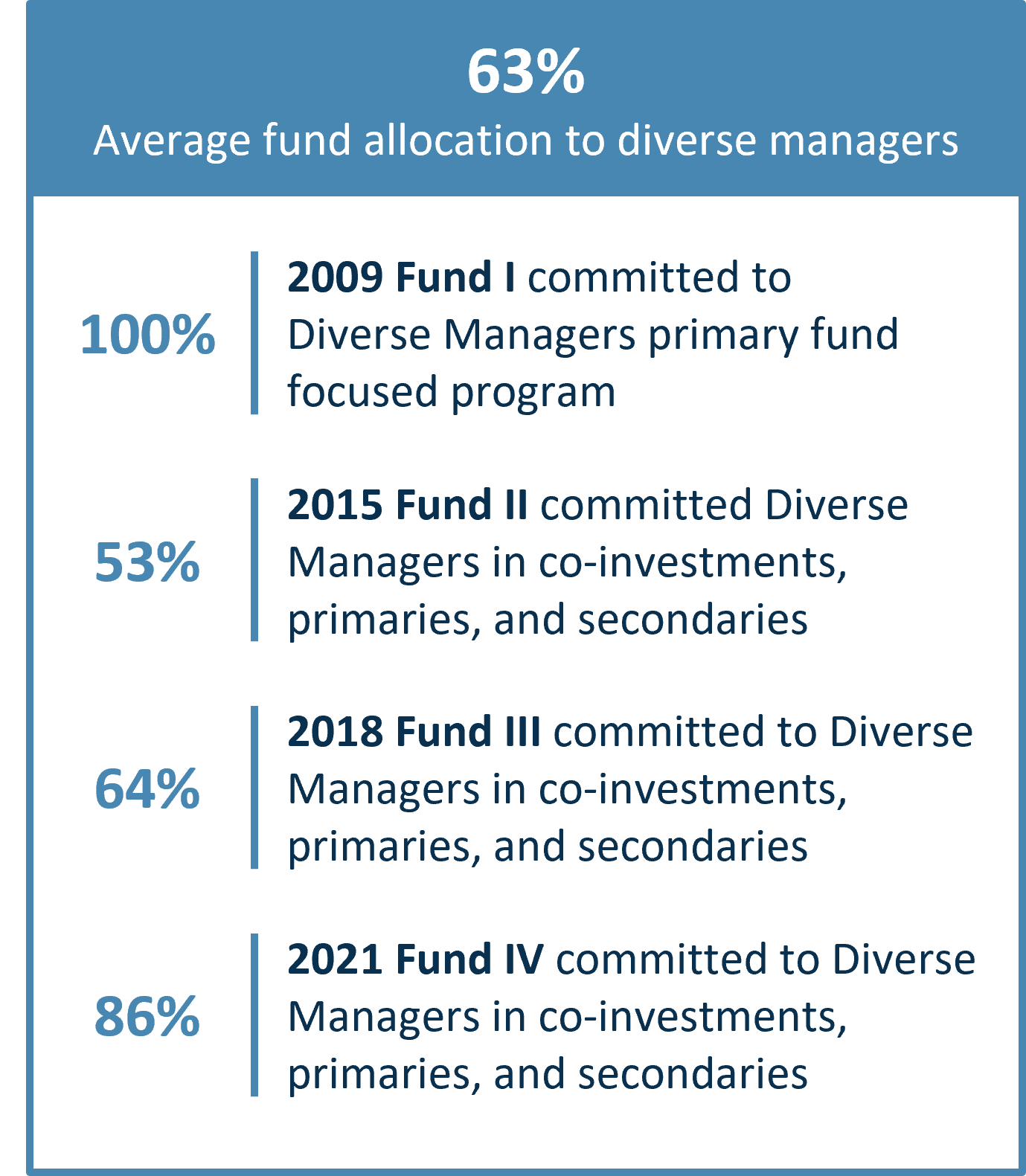

To illustrate how institutional investors can structure their diverse manager programs, we look at one industry leader who has taken a thorough approach to structure and pace their program. A large U.S. pension plan sought to incorporate investments by high-quality diverse investment managers. This was in keeping with their organization’s diversity, equity, and inclusion objectives and consistent with their belief that outperformance can be achieved via the differentiated experience and skills brought by managers considered outside the “mainstream.” Working with GCM Grosvenor, the plan launched its first diverse managers-focused private equity fund in 2009. It was 100% allocated to diverse managers and invested entirely in primary funds. For the next decade-plus, the plan expanded beyond primaries and allocated to middle-market buyout co-investments, as well as core middle-market primaries and secondaries. Across four funds, the plan committed over $220 million to more than 30 diverse managers across 40-plus investments. On average, each fund allocated 63% to diverse managers.14

Represents aggregate commitments of December 31, 2021.

In closing

The diverse manager market is growing, and we are encouraged by the abundance of talent being supported by the many activities of various stakeholders. At the same time, we understand the industry faces certain headwinds. Market volatility and the potential for a “denominator effect” may hinder the fundraising of diverse managers, particularly in private markets, as institutional investors take actions to rebalance their portfolios. In addition, during times of market stress, LPs may not be as keen to invest with early-stage managers, which includes many diverse managers. Instead, these LPs may invest with those they know or perhaps limit their allocations to more established diverse managers.

That said, we remain optimistic. We are encouraged that these and other issues remain front-of-mind among LPs and GPs and are being widely addressed, from industry conferences to conference rooms. We believe the industry’s growth, performance, and potential for more capacity, along with its transparency, abundance of information, and tailwinds will continue to support a vibrant marketplace, and we are proud to be a part of it.

The GCM Grosvenor Edge

GCM Grosvenor has been investing with diverse managers on behalf of clients for 20 years and today has over $12 billion in AUM with these managers. The firm’s diverse manager capabilities are supported by a robust investment platform, a dedicated team, a wide network of contacts, and broad proprietary sourcing capabilities.

GCM Grosvenor sits at the center of the industry and facilitates connections between managers, institutional investors, and consultants by hosting premier industry events including the Small and Emerging Managers Conference, Consortium, and ENGAGE.

Read more about GCM Grosvenor’s capabilities with small, emerging, and diverse managers here.

RELATED NEWS AND INSIGHTS

Goldman Sachs Healthcare Veteran Jo Natauri Sets up Invidia Capital

The Wall Street Journal Pro profiles

Excolere Equity Partners Announces Firm’s Launch and Strategic Investment from GCM Grosvenor

LOS ANGELES and CHICAGO, Oct. 25, 2023 — Excolere Equity Partners (“Excolere”), a leading buyout investor in the education and human capital management sectors, today announced a strategic partnership with

At GCM Grosvenor, we define diverse private equity managers as firms in which women or minority professionals account for at least 33% of firm economics. Our approach to investing with diverse managers has been consistent for over 15 years. We seek managers where diverse professionals are directly aligned longer-term with the growth, performance, and success of their firms.

Data Sources

All data and discussion assume US insurance companies

1 Source: Knight Foundation and Bella Research.

2 Includes all funds in GCM Grosvenor’s tracked universe, with funds in market through 2023.

3 Source: Source: Knight Foundation and Bella Research.

4 Source: Knight Foundation survey

5 Source: Aon.

6 Source: National Association of Investment Companies, “Examining the Returns,” 2021.

7 There were no NAIC member funds that reported performance for vintage years 1999, 2001-2004, or 2008. At the time of publication, only one vintage 2021 fund is included in the calculations

8 Source: International Finance Corporation, Oliver Wyman, and RockCreek. (2019). Moving Toward Gender Balance in Private Equity and Venture Capital.

9 Source: International Finance Corporation. (2020). Private Equity and Value Creation; A Fund Manager’s Guide to Gender-Smart Investing.

10 Source: Pitchbook. https://pitchbook.com/blog/what-is-gp-stakes-investing.

11 Source: SEC. https://www.sec.gov/files/spotlight/amac/amacreport-recommendations-diversity-inclusion-asset-managementindustry.pdf.

12 Source: Pensions & Investments. https://www.pionline.com/ frontlines/calpers-calstrs-start-reporting-emerging-or-diverse-assetmanagers.

13 Source: Pensions & Investments. https://www.pionline.com/ pension-funds/massprim-embraces-diverse-future.

14 Represents aggregate commitments of December 31, 2021.

Important Disclosures

For illustrative and discussion purposes only. The information contained herein is based on information received from third parties. GCM Grosvenor has not independently verified third-party information and makes no representation or warranty as to its accuracy or completeness. The information and opinions expressed are as of the date set forth therein and may not be updated to reflect new information.

Investments in alternatives are speculative and involve substantial risk, including market risks, credit risks, macroeconomic risks, liquidity risks, manager risks, counterparty risks, interest rate risks, and operational risks, and may result in the possible loss of your entire investment. Past performance is not necessarily indicative of future results. The views expressed are for informational purposes only and are not intended to serve as a forecast, a guarantee of future results, investment recommendations or an offer to buy or sell securities by GCM Grosvenor. All expressions of opinion are subject to change without notice in reaction to shifting market, economic, or political conditions. The investment strategies mentioned are not personalized to your financial circumstances or investment objectives, and differences in account size, the timing of transactions and market conditions prevailing at the time of investment may lead to different results. Certain information included herein may have been provided parties not affiliated with GCM Grosvenor. GCM Grosvenor has not independently verified such information and makes no representation or warranty as to its accuracy or completeness.