Secondaries: An Oasis in a Desert of Illiquidity

We delve into the economic factors driving the staggering growth of the secondary market.

Past performance is not necessarily indicative of future results. No assurance can be given that any investment will achieve its given objectives or avoid losses. Unless apparent from context, all statements herein represent GCM Grosvenor’s opinion.

Select risks include: risks related to the lack of a liquid, transparent market for secondary investments, performance risk, and risks related to sourcing investments.

The global pandemic has touched every company, investment, and market, but in different ways. Here, we offer our perspectives on the current state of the secondary market and share ways to potentially capitalize on this once-in-a-cycle secondary opportunity.

We are in a unique position in the current market. We believe we will see a wave of secondaries opportunities driven by both limited partner sellers and GP-led situations."

Brian Sullivan, Managing Director, Private Equity Investments

As the scope of the global coronavirus pandemic became widespread in late February, public markets tumbled. Domestic large-cap indexes were down around 20% for the first quarter, while small-cap indexes averaged closer to down 30%. Private investments could suffer a similar decline, possibly even greater, depending on the specific assets and leverage involved. The continued global shutdown has continued into the second quarter, resulting in a more significant impact on operating performance. Second-quarter valuations of private equity holdings could continue the downward trend and come in lower than Q1 2020 marks in many cases.

We can characterize the market backdrop in the second quarter coming out of the first quarter’s severe dislocation with a few broad strokes:

+ Large bid/ask spreads for asset transactions

+ Broad-based need for liquidity across both GPs and LPs

+ Increased structured solutions amid atypical markets

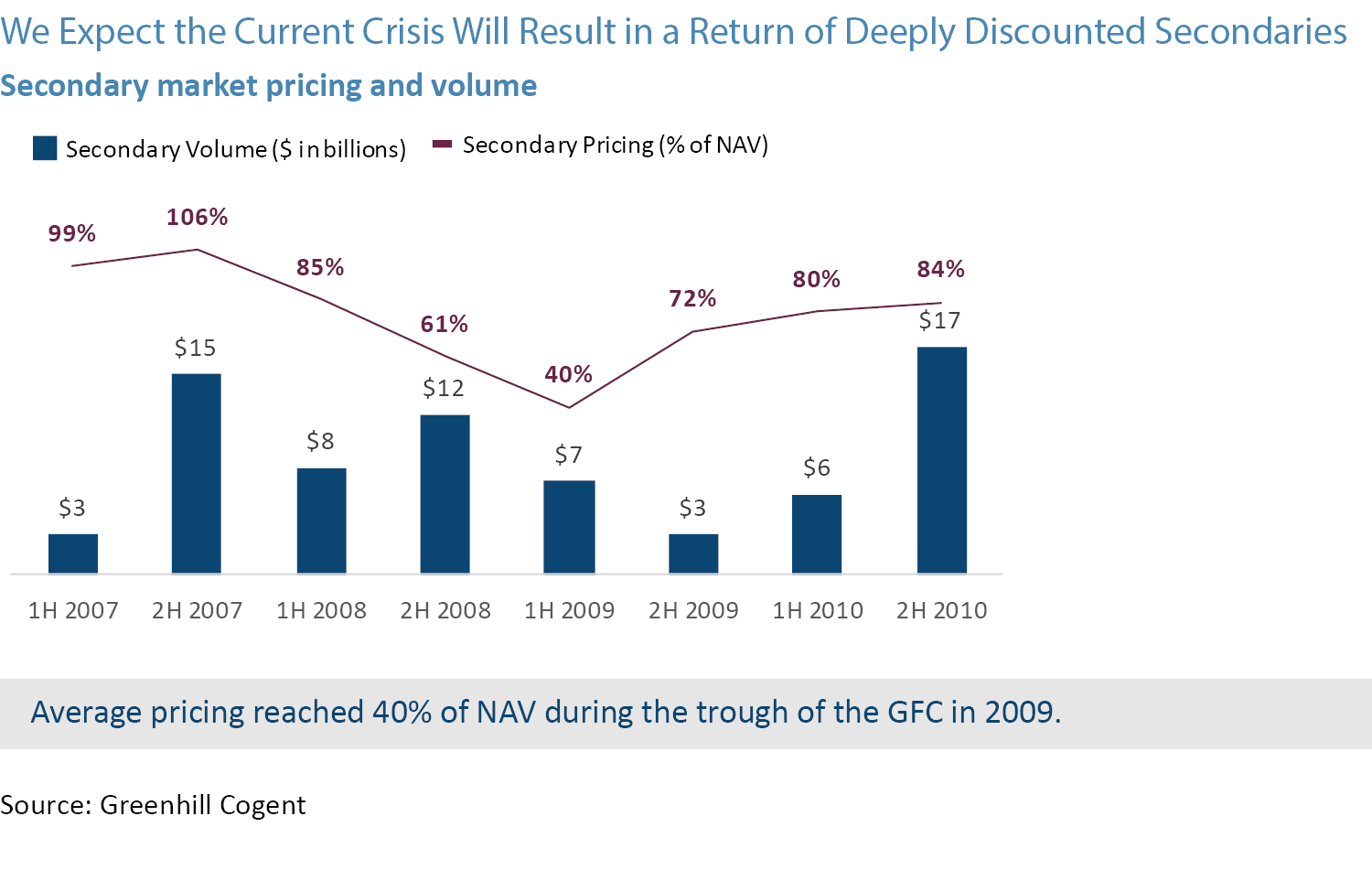

Following the decline of asset values, a significant bid/ask spread lingers across the secondary marketplace in the interim period before or until GPs revalue their portfolios. Published year-end 2019 valuations are outdated. A seller would have to accept a 20%-40%+ discount to transact just to account for the public market movements, terms that are optically grim, even if they are economically accurate (and could generate immediate liquidity). We expect bid/ask spreads to narrow once the decline in valuations, operational performance, and outlook are reflected in PE valuations.

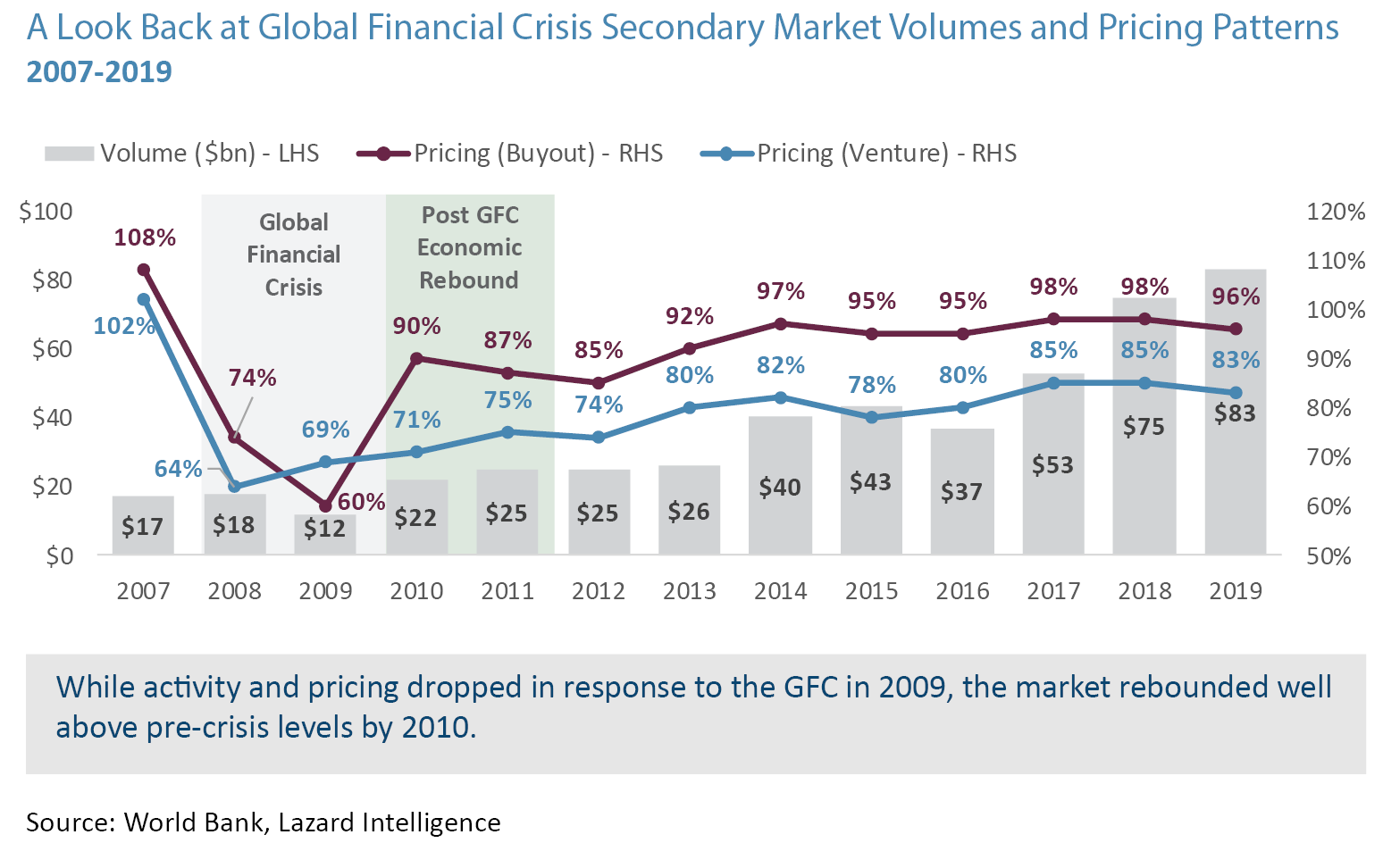

Besides pricing, we believe secondary transaction volumes will initially decline due to the friction caused by the pricing gaps. The pandemic puts entire industries in limbo as the next steps for public health remain in question. When we consider that a typical traditional secondary sale takes 3-6 months to complete in healthy economic environments, a backdrop of medium-term uncertainty is a major execution headwind. Given these factors, we expect traditional secondary sales will decline significantly in the first half of 2020, but are expected to pick up late this year and rebound in 2021-2022, as a result of both deferred and new liquidity considerations just as they did during and following the Global Financial Crisis.

Pressure to Raise Liquidity for GPs and LPs

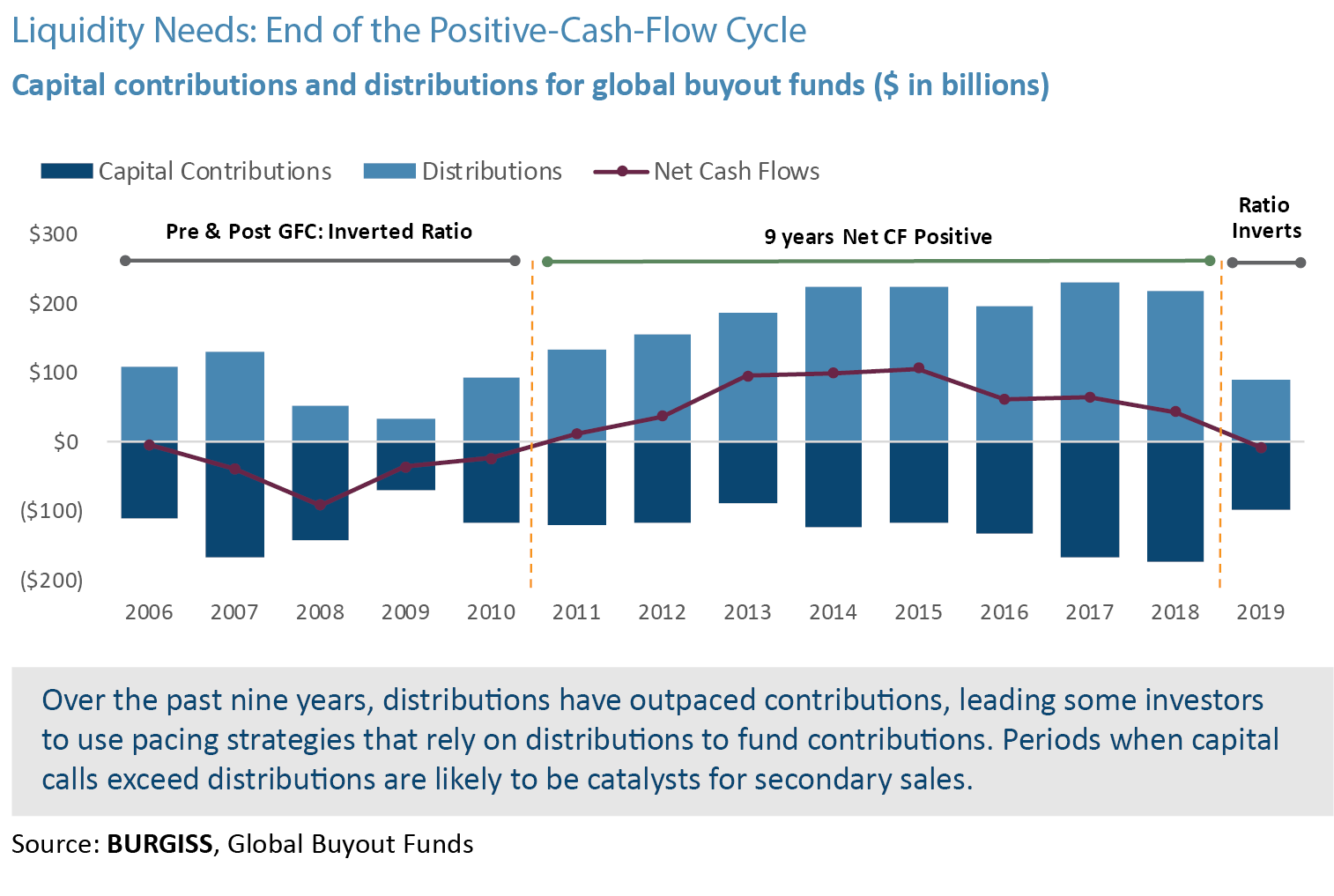

Net cash flows for LPs are expected to plummet in the short-term, and several forces are driving demand for capital at the GP level. GPs may need capital to shore up the balance sheet of portfolio companies under pressure; fund working capital or pay off credit facilities; or execute opportunistic follow-on acquisitions, capturing a rare buying opportunity for coveted investments. Meanwhile, exit opportunities often dry up in downturns, causing distributions to slow substantially.

For LPs, evaporating cash flows are not the only trend. Many investors are likely to face pressure from the denominator effect – as public market values fall, but private holdings stay flat due to the normal valuation lagA, private equity allocations are likely to appear bloated on a relative basis. Even for investment boards that understand the nature of the problem, the appearance is often enough to push investors to trim allocations. This effect could linger for an extended period as investment committees and boards consider their options and revise portfolio allocations and projections.

Opportunistic Viewpoint

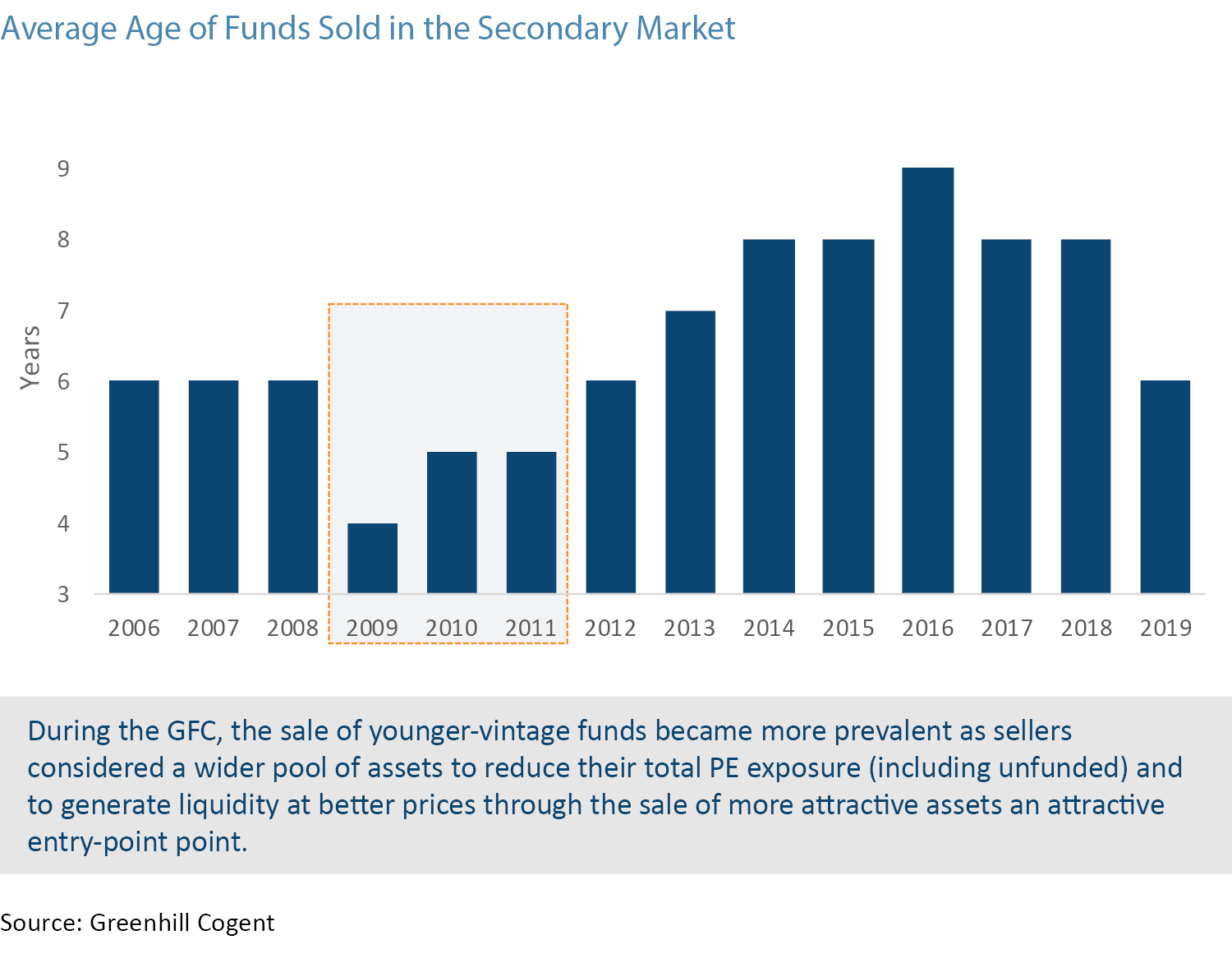

All of the forces described above could create a ‘perfect storm’ and crystallize into specific opportunities – for instance, a limited-time entry point to acquire younger-vintage funds with growth potential. For LPs facing liquidity pressure, the younger-vintage funds are a key stressor, given their significant unfunded capital commitments. At the same time, these assets could be particularly attractive to secondary buyers. Younger-vintage funds have an entry-point advantage in a post-shock world of lower asset valuations, suggesting that buyers could ultimately realize appealing IRRs in the full cycle. But again, such opportunities demand investors with liquidity. Funds with dry powder could be well-positioned to capture such short-term opportunities. Younger vintage funds also potentially offer the secondary buyer with a longer period of time for asset appreciation than tail-end fund interests allowing for higher multiple on invested capita

In this environment, “straight” sales and traditional lending arrangements are prohibitive, both because they depend on transparent valuations and tend to take too long. In contrast, structured solutions can be an appealing substitute. While the cost of capital tends to be marginally higher than a traditional lending solution, there aren’t negative optics for the seller associated with a sale discount, and the speed and flexibility of such arrangements can outweigh the costs. Three examples of these solutions include:

Preferred Equity

Managers. In a preferred equity deal, a GP can accept capital in exchange for preferred equity shares in a diversified fund. The preferred shares are “collateralized” by future distributions from the fund. In a typical arrangement, the fund funnels all or some distributions back to the new preferred shares, paying back the capital infusion plus some pre-determined return – either as a multiple of the investment or as an equivalent IRR. These arrangements can be flexible and allow for the GP to fund portfolio-company balance sheet cures, credit line payoffs, or new acquisitions. Plus, preferred equity solutions may not require LP consent, though we note that it’s still a best practice to make all investors aware of the agreement beforehand, even if formal consent is not required. While some managers may prefer to amend a fund’s recycling provisions to make additional capital available for the remaining portfolio, not every fund will have this as an option.

Institutional investors. The same kind of structured solution is available at the LP level, where the “collateral” is all or part of an LP’s private equity portfolio. Again, this solution provides liquidity to the institution without requiring a headline discount on asset values.

Unfunded Joint Ventures

In some cases, the main demand for capital is to cover unfunded liabilities. For LPs who are comfortable with their existing PE exposure, but would be above their target exposure if there were large capital calls, an unfunded joint venture with a secondary investor would be a way to shift that exposure to a third party. Similar to a preferred equity solution, the secondary investor’s capital injection is repaid with future distributions from the broader portfolio. The terms are customized to each arrangement.

Annex Funds

Managers. In a preferred equity deal, a GP can accept capital in exchange for preferred equity shares in a diversified fund. The preferred shares are “collateralized” by future distributions from the fund. In a typical arrangement, the fund funnels all or some distributions back to the new preferred shares, paying back the capital infusion plus some pre-determined return – either as a multiple of the investment or as an equivalent IRR. These arrangements can be flexible and allow for the GP to fund portfolio-company balance sheet cures, credit line payoffs, or new acquisitions. Plus, preferred equity solutions may not require LP consent, though we note that it’s still a best practice to make all investors aware of the agreement beforehand, even if formal consent is not required. While some managers may prefer to amend a fund’s recycling provisions to make additional capital available for the remaining portfolio, not every fund will have this as an option.

Institutional investors. The same kind of structured solution is available at the LP level, where the “collateral” is all or part of an LP’s private equity portfolio. Again, this solution provides liquidity to the institution without requiring a headline discount on asset values.

With a period of restricted volumes, we believe the secondary market could witness a rebound above 2019 levels in 2021-2022, similar to what we saw after the Global Financial Crisis, fueled by an increase in GP-led deals, as exits are pushed further out, and fund lives lapse. We expect the current crisis will result in a return of deeply discounted secondaries. Post GFC discounts averaged 35-40% over 2008-2009 as equities reset, resulting in the highest returns for the cycle.

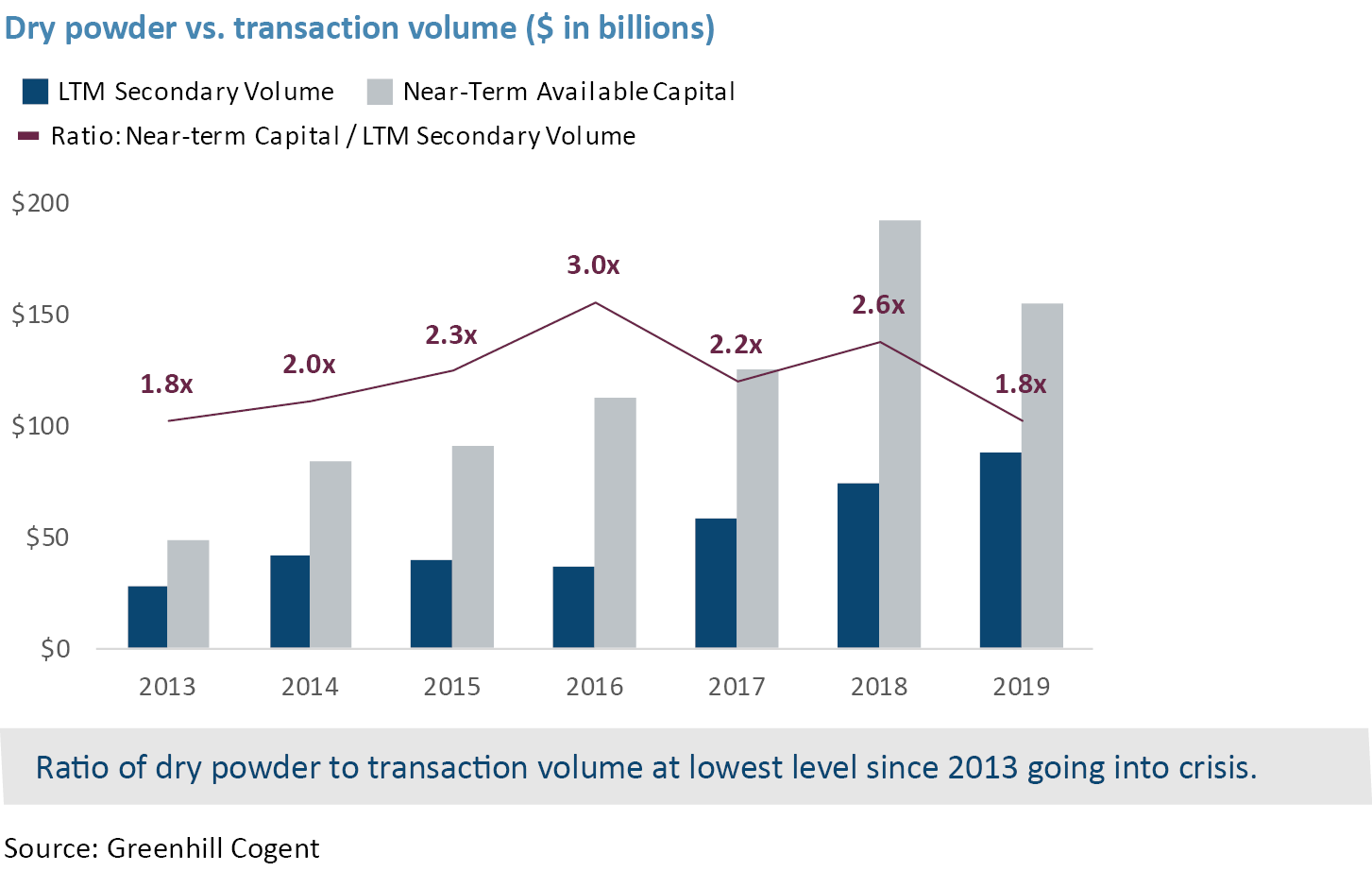

In addition, the dry powder-to-transactions ratio could position buyers even more strongly. Before the pandemic, we saw signs that the market was beginning to favor buyers, as the available dry powder versus annual transaction volume ratio was at its lowest since 2013.

The pandemic is driving a new range of market dynamics distinct from other downturns of the modern era. Importantly, the way that managers and investors navigate the present private equity environment will affect their outcomes for years to come.

With a global platform and expertise across a broad range of investing areas, we believe we are one of the strongest secondary solution partners in the industy."

Fred Pollock, Chief Investment Officer, GCM Grosvenor

GCM Grosvenor’s large and unique primary fund portfolio gives us rare visibility into the GP-led market. It also provides a distinctive secondary-sourcing network, useful across all markets but even more powerful in an atypical, liquidity-demanding market. This access to a broad opportunity set is the foundation that allows us to be selective in our deals. Meanwhile, our firm has robust technology resources, enabling our disciplined and systematic approach across opportunities.

The pandemic is providing conditions typical to a traditional recession, but it’s not exactly like any prior event. As such, a unique set of opportunities is available to secondary investors. As some GPs and LPs face liquidity needs, a structured solution that facilitates a quick liquidity transfer could be the key to unlocking these near-term opportunities.

We delve into the economic factors driving the staggering growth of the secondary market.

We discuss how GP-led secondaries differ from traditional LP-led deals, and why we believe they present a compelling opportunity in the infrastructure space.

Important Disclosures

For illustrative and discussion purposes only. The information contained herein is based on information received from third-parties. GCM Grosvenor has not independently verified third-party information and makes no representation or warranty as to its accuracy or completeness. The information and opinions expressed are as of the date set forth therein and may not be updated to reflect new information.

Past performance is not necessarily indicative of future results. No assurance can be given that any investment will achieve its objectives or avoid losses. Investments in alternatives are speculative and involve substantial risk, including strategy risks, manager risks, market risks, and structural/operational risks, and may result in the possible loss of your entire investment. The views expressed are for informational purposes only and are not intended to serve as a forecast, a guarantee of future results, investment recommendations, or an offer to buy or sell securities by GCM Grosvenor. All expressions of opinion are subject to change without notice in reaction to shifting market, economic, or political conditions. The investment strategies mentioned are not personalized to your financial circumstances or investment objectives, and differences in account size, the timing of transactions, and market conditions prevailing at the time of investment may lead to different results. Certain information included herein may have been provided by parties not affiliated with GCM Grosvenor. GCM Grosvenor has not independently verified such information and makes no representation or warranty as to its accuracy or completeness.

GCM Investments UK LLP (GCMUK) has been made aware of fraudulent schemes targeting members of the public in the United Kingdom.

Unauthorised individuals are falsely claiming to represent GCMUK and are misusing the firm’s name and publicly available information in connection with fake investment opportunities.

These scams are sophisticated and deliberately misleading. They may involve the use of real GCMUK employee names and may imitate the tone, format, and branding of genuine GCMUK communications.

Please note:

GCMUK does not offer financial services or products to retail clients, either directly or through third parties. You can verify GCMUK’s regulatory status and permissions on the Financial Conduct Authority (FCA) Register at register.fca.org.uk.

If you are based in the UK and believe you have been contacted by a fraudster claiming to represent GCMUK, please take the following steps:

Investor Scam Alert

GCM Grosvenor L.P. and its affiliated entities (collectively, “GCMG”) have been made aware of fraudulent schemes currently targeting members of the public in Malaysia and Hong Kong, in which unauthorised individuals are falsely claiming to represent GCMG in connection with purported investment opportunities.

These fraudulent individuals are believed to be actively promoting false investment opportunities, often involving mobile applications, through the unauthorised use of GCMG’s name, brand, corporate logo, and other identifying materials. We have also received reports that these parties may be distributing fabricated business cards, hosting online webinars, creating WhatsApp groups, and arranging personal video calls to simulate legitimacy. These scams are sophisticated and deliberately misleading, frequently involving the use of real GCMG employee names and imitating the style, tone, and presentation of genuine GCMG communications.

GCMG has no presence, operations, or authorised representatives in Malaysia. GCMG does not offer any investment schemes, products, or mobile applications targeted at Malaysian investors, either directly or indirectly.

While GCMG maintains a legitimate presence and employs personnel in Hong Kong, these scams are entirely unauthorised and unrelated to any genuine activities conducted by GCMG or its employees in the region.

Position of GCMG

GCMG has neither authorised nor endorsed any such solicitations and takes this matter seriously. We have reported some of these incidents to the relevant regulatory and enforcement authorities in Malaysia, and are doing the same in Hong Kong, including notifying the Hong Kong Police and the appropriate financial regulators. GCMG will continue to assist with their investigations.

GCMG is actively monitoring these developments and reserves all rights to take legal action against any party found misusing its name, brand, or intellectual property.

While these reports currently centre on activity in Malaysia and Hong Kong, the methods used may be replicated in other jurisdictions. GCMG continues to monitor for similar risks globally.

Unauthorized individuals are impersonating Winston Chow in scams targeting investors, particularly in Malaysia. He does not solicit investments directly in Asia. If you are contacted by someone claiming to be him outside of official channels, please report it to local authorities.

For verification or further information, please contact: [email protected]

Investor Scam Alert

Unauthorized individuals are impersonating Winston Chow in scams targeting investors, particularly in Malaysia. He does not solicit investments directly in Asia. If you are contacted by someone claiming to be him outside of official channels, please report it to local authorities.

For verification or further information, please contact: [email protected]

We offer clients a broad range of tailored solutions across strategies, including multi-strategy, macro, relative value, long/short equity, quantitative strategies, and opportunistic credit. Levaraging our large scale and presence in the industry, we are able to offer clients preferntial exposure to hard-to-access managers and seek to obtain terms that can drive economic and structural advantages.