The Case for Absolute Return Strategies – Part Four

In this fourth and final installment, we look at a variety of opportunities we are seeing across absolute return strategies today.

Past performance is not necessarily indicative of future results. No assurance can be given that any investment will achieve its given objectives or avoid losses. Unless apparent from context, all statements herein represent GCM Grosvenor’s opinion.

Select risks include strategy risks, manager risks, market risks, and structural/operational risks.

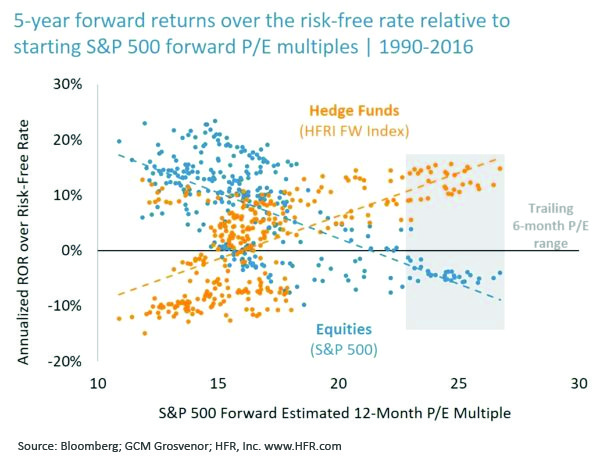

In the first part of the series, we looked at how traditional assets are facing headwinds for future returns from factors such as near-record valuations, historically low interest rates and credit spreads, and elevated risks. In the second part of the series, we observe that despite these challenges for traditional investments, tailwinds exist that we believe can contribute to alpha within absolute return strategies.

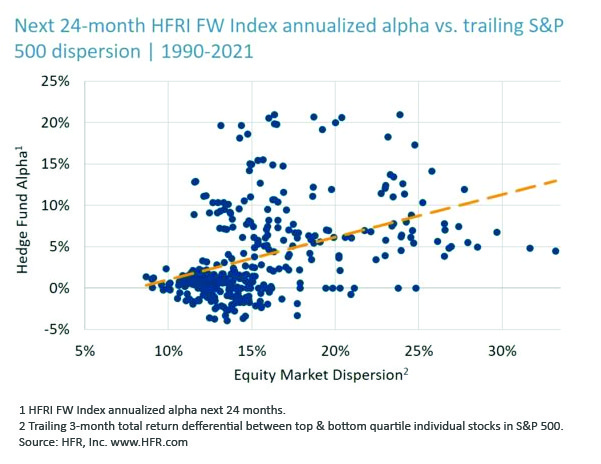

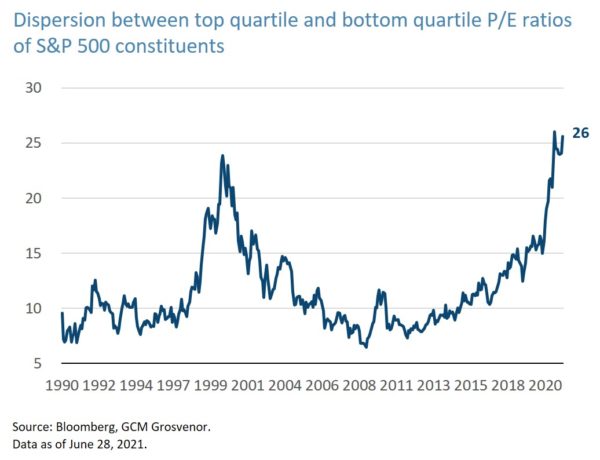

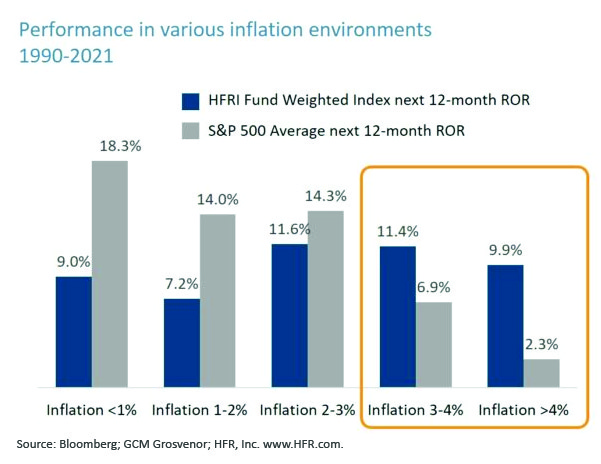

In our view, such tailwinds include higher levels of dispersion, the growing incidence of “two-way” markets, occasional periods of dislocation, as well as the record-high issuance of tradeable securities (both stocks and bonds), and are contributing factors to an improved environment for alpha generation. Additionally, we note the historical resilience of hedge fund alpha through inflationary environments.

In part 3, we’ll discuss the importance of selecting and partnering with the right investment partners at a time when industry AUM is at an all-time high, but the number of hedge fund investors is contracting.

Read more about GCM Grosvenor’s Absolute Return Strategies.

In this fourth and final installment, we look at a variety of opportunities we are seeing across absolute return strategies today.

In this installment, we present our view that top decile hedge fund managers remain among the best available investments globally, without regard to the name “hedge fund.” We also look at how top managers continue to attract talent and capital, while underperforming managers contract, underscoring the importance of manager selection.

In the first part of the series, we looked at how traditional assets are facing headwinds for future returns from factors such as near-record valuations, historically low interest rates and credit spreads, and elevated risks. In the second part of the series we observe that, despite these challenges for traditional investments, tailwinds exist that we believe can contribute to alpha within absolute return strategies.

* X-axis is the P/E ratio for the S&P 500 Index / HFRI FW Index on the first day of that 5-year period. Y-axis represents the annualized return of equities / hedge funds over the risk-free rate for the following 5-year period.

Important Disclosures

For illustrative and discussion purposes only. The information contained herein is based on information received from third parties. GCM Grosvenor has not independently verified third-party information and makes no representation or warranty as to its accuracy or completeness. The information and opinions expresses are as of the date set forth therein and may not be updated to reflect new information.

Investments in alternatives are speculative and involve substantial risk, including strategy risks, manager risks, market risks, and structural/operational risks, and may result in the possible loss of your entire investment. Past performance is not necessarily indicative of future results. The views expressed are for informational purposes only and are not intended to serve as a forecast, a guarantee of future results, investment recommendations or an offer to buy or sell securities by GCM Grosvenor. All expressions of opinion are subject to change without notice in reaction to shifting market, economic, or political conditions. The investment strategies mentioned are not personalized to your financial circumstances or investment objectives, and differences in account size, the timing of transactions and market conditions prevailing at the time of investment may lead to different results. Certain information included herein may have been provided parties not affiliated with GCM Grosvenor. GCM Grosvenor has not independently verified such information and makes no representation or warranty as to its accuracy or completeness.

Data Sources

Bloomberg Finance L.P.

S&P. S&P and its third-party information providers do not accept liability for the information provided and the context from which it is drawn.

We offer clients a broad range of tailored solutions across strategies, including multi-strategy, macro, relative value, long/short equity, quantitative strategies, and opportunistic credit. Levaraging our large scale and presence in the industry, we are able to offer clients preferntial exposure to hard-to-access managers and seek to obtain terms that can drive economic and structural advantages.