The Case for Absolute Return Strategies – Part Four

In this fourth and final installment, we look at a variety of opportunities we are seeing across absolute return strategies today.

Past performance is not necessarily indicative of future results. No assurance can be given that any investment will achieve its given objectives or avoid losses. Unless apparent from context, all statements herein represent GCM Grosvenor’s opinion.

Select risks include strategy risks, manager risks, market risks, and structural/operational risks.

In the series, “The Case for Absolute Return Strategies,” we discuss why we believe absolute return investments are particularly important components of a properly diversified portfolio in today’s investment climate. Through charts and succinct commentary, our previous three installments have explored:

In this fourth and final installment, we look at a variety of more specific opportunities we are seeing across absolute return strategies today.

We believe that opportunities to generate attractive returns and alpha in absolute return strategies are as strong as they’ve been in years. The value proposition of these strategies for our clients remains compelling at a time when traditional long-only returns appear historically challenged.

Read more about GCM Grosvenor’s Absolute Return Strategies.

In this fourth and final installment, we look at a variety of opportunities we are seeing across absolute return strategies today.

In this installment, we present our view that top decile hedge fund managers remain among the best available investments globally, without regard to the name “hedge fund.” We also look at how top managers continue to attract talent and capital, while underperforming managers contract, underscoring the importance of manager selection.

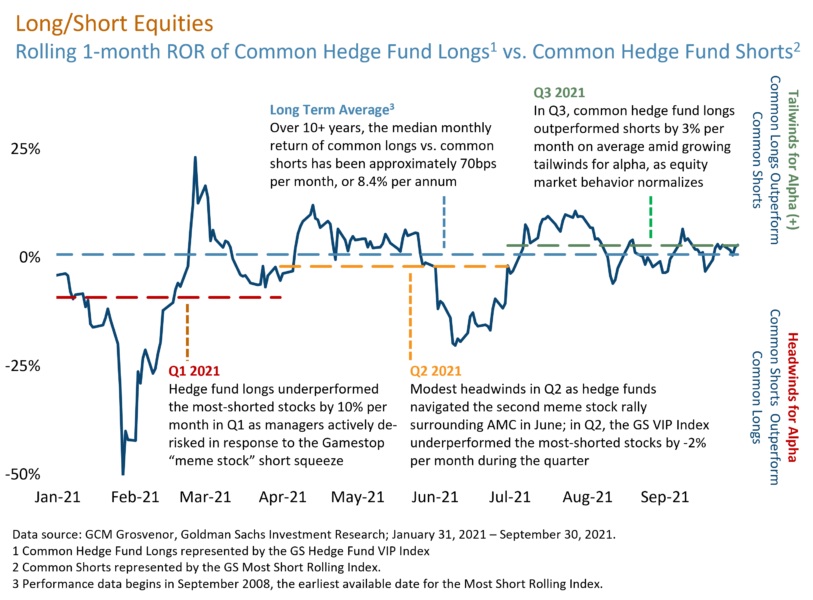

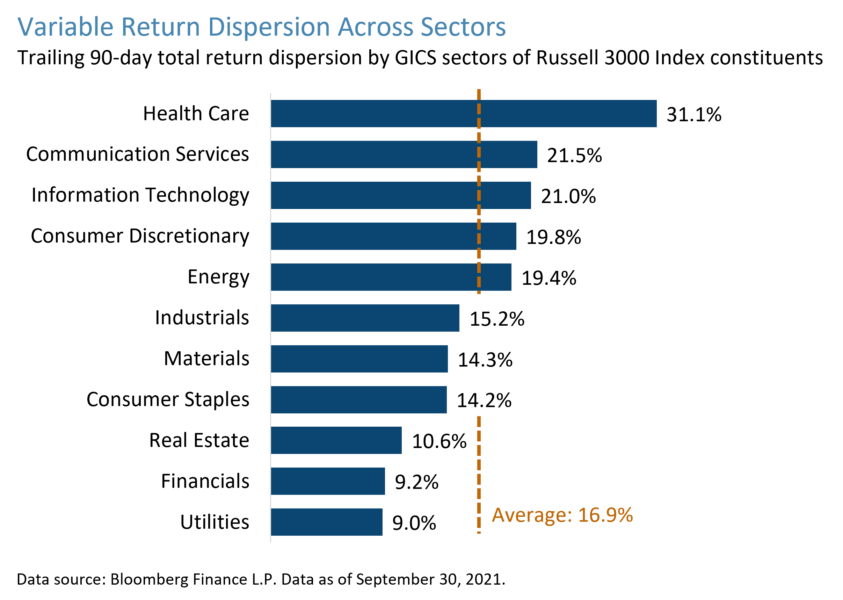

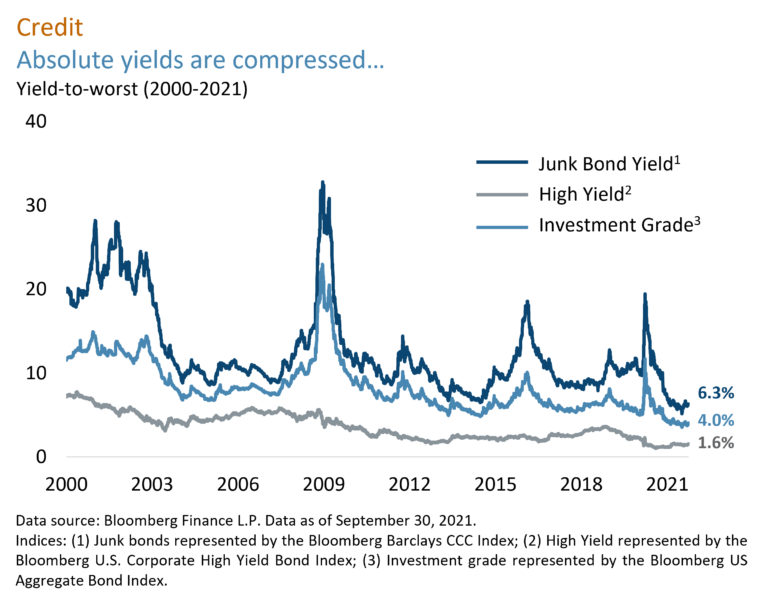

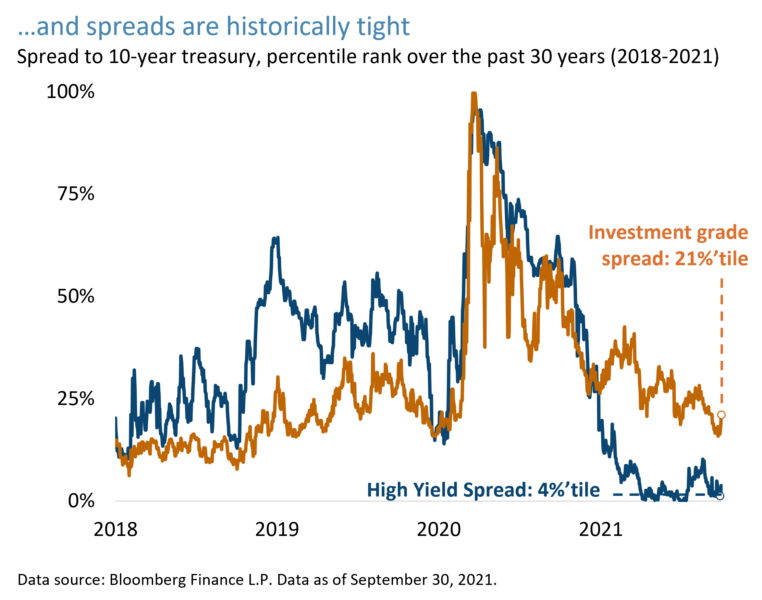

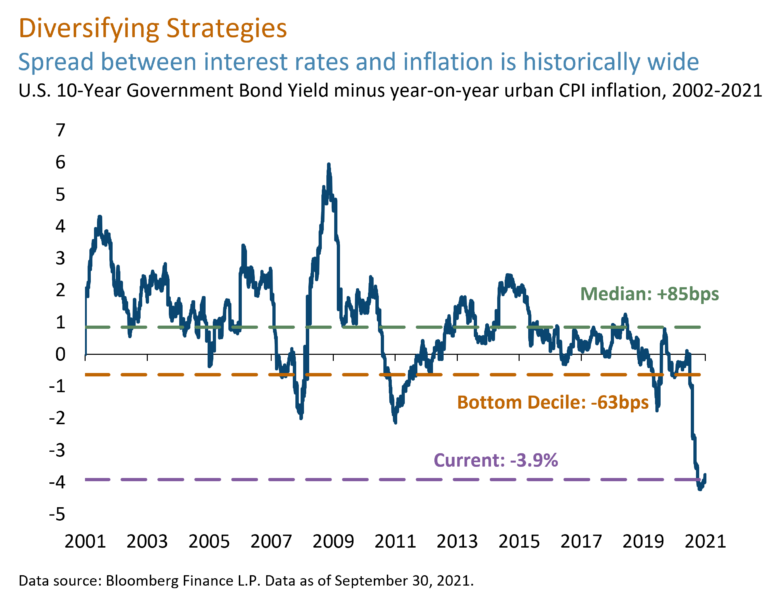

In the first part of the series, we looked at how traditional assets are facing headwinds for future returns from factors such as near-record valuations, historically low interest rates and credit spreads, and elevated risks. In the second part of the series we observe that, despite these challenges for traditional investments, tailwinds exist that we believe can contribute to alpha within absolute return strategies.

Important Disclosures

For illustrative and discussion purposes only. The information contained herein is based on information received from third parties. GCM Grosvenor has not independently verified third-party information and makes no representation or warranty as to its accuracy or completeness. The information and opinions expresses are as of the date set forth therein and may not be updated to reflect new information.

We offer clients a broad range of tailored solutions across strategies, including multi-strategy, macro, relative value, long/short equity, quantitative strategies, and opportunistic credit. Levaraging our large scale and presence in the industry, we are able to offer clients preferntial exposure to hard-to-access managers and seek to obtain terms that can drive economic and structural advantages.